If you’ve ever looked at a business proposal from Mumbai or a real estate listing in Delhi, you’ve probably hit that mental wall. A "lakh." It sounds substantial. It is. But translating that specific South Asian numerical logic into a clean USD figure isn't just about checking a conversion app. It’s about understanding a different way of counting that dates back centuries.

Most people struggle because the comma moves. In the West, we group things by threes. Thousands, millions, billions. In India, Pakistan, and Bangladesh, the system—the Vedic numbering system—groups by twos after the first thousand. So, when you try to figure out lakh to dollar, you aren't just fighting a fluctuating exchange rate. You're fighting your own brain's hardwiring for where the punctuation belongs.

The Raw Math of Lakh to Dollar Right Now

Let's get the big question out of the way. What is a lakh actually worth in American greenbacks?

A lakh is 100,000. Not a million. Not ten thousand. Just a cool hundred thousand. If the Indian Rupee (INR) is trading at roughly 83 or 84 to the dollar—which has been a common range lately—one lakh rupees is roughly $1,190 to $1,200.

Think about that.

A hundred thousand of "something" sounding like a fortune, only to realize it's about the price of a mid-range laptop or a very cheap used car in the States. That’s the "sticker shock" in reverse. It’s why international HR departments often scramble when hiring remote developers in Bangalore; they see "12 Lakhs per annum" and have to do the quick mental gymnastics to realize they’re paying about $14,400 a year.

📖 Related: Pawn Shops in Simpsonville SC: What Most People Get Wrong

The math is simple: $100,000 / Current Exchange Rate$.

But "simple" is a trap. Exchange rates move while you sleep. If the Federal Reserve raises interest rates in Washington, your lakh buys fewer dollars by breakfast. If the Reserve Bank of India (RBI) intervenes to support the rupee, the math shifts again. You’re shooting at a moving target.

Why the Comma Location Matters More Than You Think

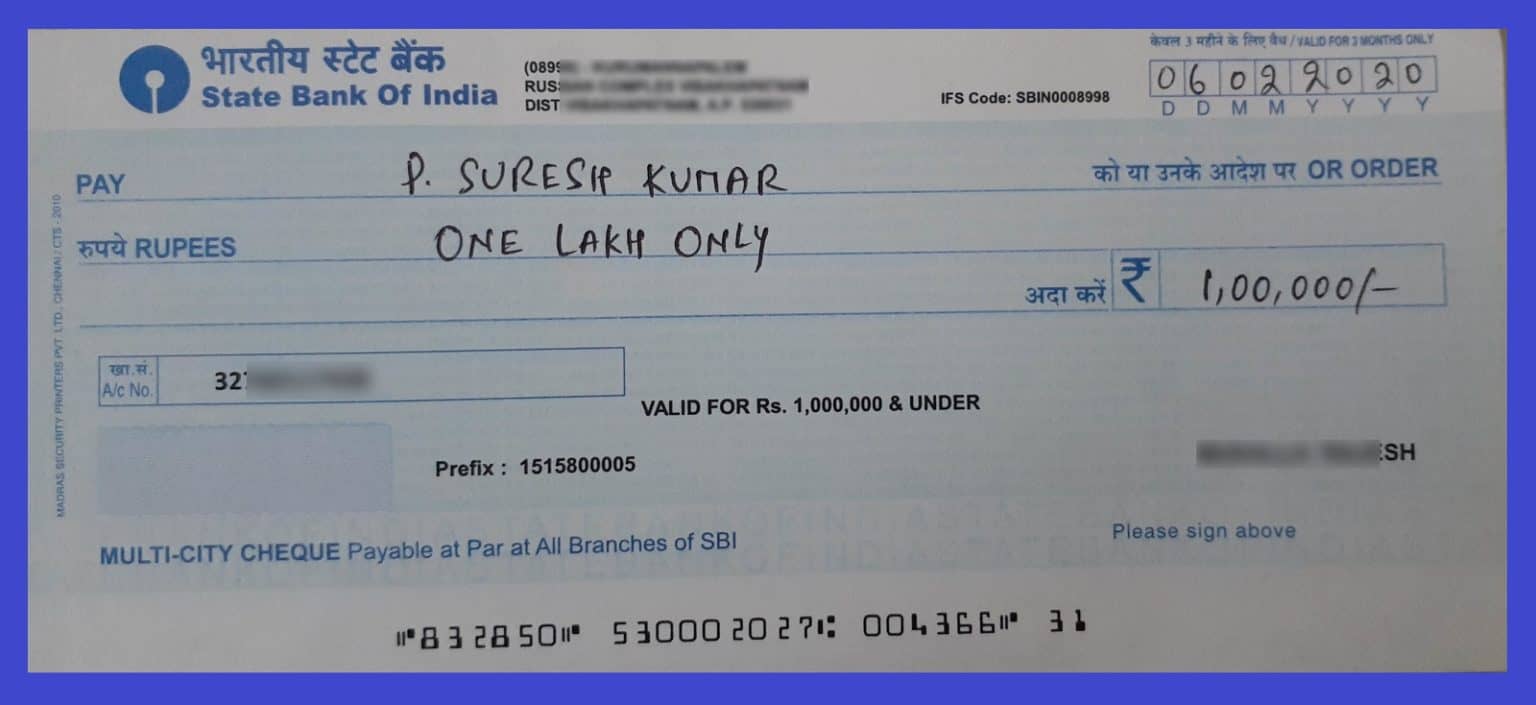

In the US, we write $100,000. In India, they write $1,00,000$.

See that? The comma after the "1" changes everything for an automated parser or a tired accountant. If you’re copy-pasting figures into a spreadsheet that isn't formatted for South Asian locales, your Excel sheet might have a stroke. It thinks you’ve made a typo. You haven't.

This isn't just a quirk. It represents a different scale of economy. When you hear about a "Crore," you’re talking about 100 lakhs. That’s 10,000,000 (ten million) in the Western system, but written as 1,00,00,000. Keeping your lakh to dollar conversions straight requires you to physically ignore where you think the commas should be.

Real World Examples: What a Lakh Actually Buys

To understand the value, we have to look at purchasing power parity (PPP).

- The Tech Salary: A junior software engineer in Hyderabad might start at 6 to 8 lakhs a year. In dollars, that’s roughly $7,200 to $9,600. To an American, that sounds like poverty wages. But in India? That’s a solid, middle-class starting salary that covers rent, food, and a decent social life.

- The Luxury Watch: A Rolex Submariner might retail for around 9 to 10 lakhs in India. That’s roughly $11,000. Here, the conversion is almost 1:1 with global pricing because luxury goods are pegged to international markets.

- The Wedding: It’s common to hear about "big fat Indian weddings" costing 50 lakhs. That’s $60,000. In a country where labor is cheap, $60,000 buys a palace, catering for 500 people, and enough gold to make a dragon jealous.

Honestly, if you're looking at lakh to dollar for personal travel, you’ll find that a single lakh goes a long way. You can stay in five-star heritage hotels in Rajasthan for a week and still have change for silk scarves. But if you're looking at it for a corporate acquisition? A lakh is a rounding error.

The Invisible Hand: Factors That Kill Your Conversion Rate

You can’t just use the Google Finance rate. You just can't.

If you’re actually moving money, "the spread" will eat your lunch. Banks like ICICI or HDFC in India, or Chase and Wells Fargo in the US, don't give you the mid-market rate you see on your phone. They take a cut. Usually 1% to 3%. Then there’s the GST (Goods and Services Tax) in India on currency conversion.

Then you have the "Remittance Tax." As of recently, the Indian government implemented a Tax Collected at Source (TCS) on foreign remittances over a certain threshold (usually 7 lakhs). If you’re sending money out of India to the US, the government might take a 20% chunk upfront as a tax advance.

So, 1 lakh isn't really 1 lakh when it crosses the border. It’s 1 lakh minus the bank's ego, minus the government’s "convenience fee," minus the wire transfer cost. You end up with significantly fewer dollars than the calculator promised.

The Influence of Oil and Gold

India imports a massive amount of oil. Since oil is priced in dollars, whenever global crude prices spike, the rupee usually takes a hit. Why? Because India has to sell rupees to buy dollars to pay for the oil. This increases the supply of rupees and the demand for dollars.

Basically, if there’s a conflict in the Middle East, your lakh to dollar conversion rate is probably going to get worse.

Gold is the other factor. Indians love gold. It’s the primary savings vehicle for millions of families. When gold prices rise globally, it often impacts the trade deficit, which in turn pressures the rupee. It's a weird, interconnected web where a wedding season in Kerala can actually influence the exchange rate you get at an ATM in New York.

Common Misconceptions That Cost Money

"I'll just use my US credit card in India."

Don't. Unless you have a "no foreign transaction fee" card, you’re getting hosed. Most cards charge 3%. On a 10 lakh transaction (maybe for a nice carpet or some jewelry), you’re throwing away $360 just for the privilege of swiping.

Another big one? Thinking a "Lakh of Dollars" is a thing. It’s not. While you might occasionally hear someone in the Indian diaspora say "a lakh of dollars" ($100,000), it's grammatically and financially confusing. In the US, we say "a hundred grand." In India, "lakh" is almost exclusively tied to the rupee in common parlance. Mixing the two is a recipe for a very expensive misunderstanding.

How to Get the Best Rate

If you’re actually converting money, stop using the big banks. Use neo-banks or specialized transfer services like Wise (formerly TransferWise) or Revolut. They usually offer the mid-market rate and show you the fee upfront.

- Check the Mid-Market Rate: Use a tool like XE or Reuters to see what the "true" rate is.

- Look for TCS Implications: If you're an Indian resident sending more than 7 lakhs abroad, talk to a CA (Chartered Accountant). That 20% tax hit is real, though you can claim it back during tax filing.

- Timing is Everything: Watch the 10-year Treasury yields in the US. When they go up, the dollar gets stronger. If you’re buying dollars with lakhs, do it when the US yields are cooling off.

Actionable Steps for Your Next Conversion

Converting lakh to dollar doesn't have to be a headache if you follow a specific workflow. First, verify the current spot rate. Don't assume yesterday's price is today's reality. Second, identify if you are dealing with "New" or "Old" currency rules, especially regarding tax laws which change almost every budget cycle in India.

Third, always calculate the "Landed Cost." If you need exactly $10,000 in a US bank account, do not send 8.3 lakhs. Send 8.5 lakhs to cover the inevitable slippage, fees, and intermediary bank charges. It's better to have a few extra dollars in the destination account than to be $40 short on a mortgage payment or a business invoice because a bank in Frankfurt took a "processing fee" mid-transit.

Finally, keep a record of the purpose of the transfer. Both the IRS and the Income Tax Department of India are increasingly picky about "Foreign Inward Remittance Certificates" (FIRC). If you convert a large number of lakhs to dollars, you need to prove where it came from—be it an inheritance, a property sale, or salary. Without that paper trail, you might find your converted dollars frozen in a compliance check that could take weeks to resolve.

Stop thinking in terms of "millions" when dealing with South Asia. Start thinking in groups of two. Once you master the comma, the currency follows.