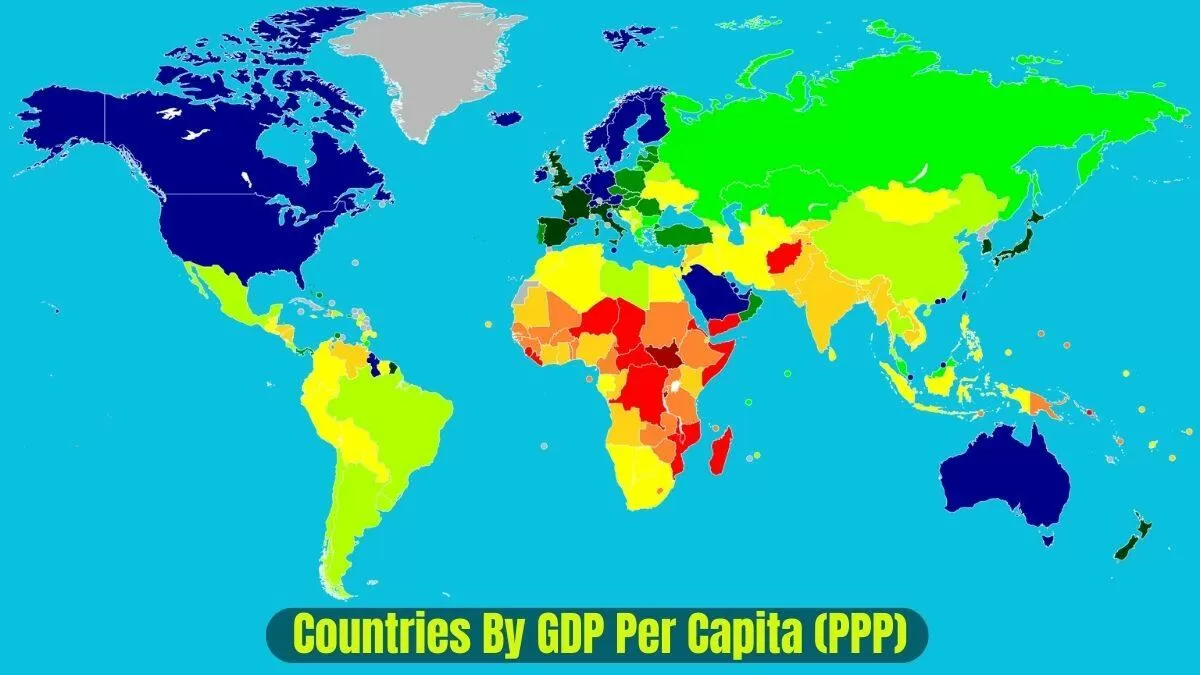

Money is weird. Or, more accurately, how we measure it is weird. You’ve probably seen those lists of the "richest countries" and wondered how on earth a tiny rock in the middle of the ocean or a European microstate is technically "wealthier" than the United States or Germany. Honestly, if you just look at raw GDP, you’re only getting half the story.

To really understand who has the most buying power, you have to look at countries by GDP PPP per capita.

Basically, PPP stands for Purchasing Power Parity. It’s a mouthful, but the concept is simple: it adjusts for the fact that a literal dollar goes much further in some places than others. A cup of coffee in Zurich might cost you $7, while the same caffeine hit in Manila is maybe $1.50. If you don't adjust for those price differences, your data is basically useless for comparing how people actually live.

The Heavy Hitters: Who Actually Tops the List?

If we look at the most recent data from early 2026 and late 2025—pulling from the IMF and World Bank—the top of the leaderboards isn't filled with global superpowers. It's filled with "tax havens," oil giants, and financial hubs.

✨ Don't miss: Cathie Wood Brera Holdings Investment: What Most People Get Wrong

The Top 5 (The Usual Suspects)

- Luxembourg: Usually #1 or #2. Why? It’s tiny. But more importantly, a huge chunk of its workforce lives in France, Belgium, or Germany. They commute in, produce value (GDP), but they aren't counted in the "per capita" population denominator. It’s a statistical loophole that makes them look insanely rich on paper.

- Singapore: The "Little Red Dot" is a productivity machine. No natural resources, just a massive port and a world-class financial sector. Since it's basically just one big city, it doesn't have poor rural provinces to drag its average down.

- Ireland: This one is controversial. You’ve probably heard of "Leprechaun Economics." Because Ireland has a very low corporate tax rate, tech giants like Apple and Google headquarter their intellectual property there. This inflates the GDP massively, even if that money doesn't always end up in the pockets of the average person in Dublin.

- Norway: This is the "honest" wealth. They have a ton of oil, but unlike many other resource-rich nations, they’ve managed it through a massive sovereign wealth fund.

- Qatar: Another energy titan. With a small citizen population and massive natural gas exports, the math almost always puts them near the top.

Why the US is Never #1 (But Still Wins)

The United States usually sits somewhere around 10th or 11th. In 2025, the US GDP PPP per capita hovered around $92,888.

Now, you might think, "Wait, if we’re the biggest economy, why are we 10th?"

It’s about scale. It is significantly harder to maintain a high average across 330 million people and a massive, diverse geography than it is for a city-state like Singapore. The US has some of the most productive regions on earth (looking at you, Silicon Valley), but it also has rural Appalachia and the Rust Belt. When you average it all out, the "floor" is lower than in a place like Luxembourg.

The Rise of Guyana

One of the wildest things happening in global economics right now is Guyana. Seriously. For decades, it was one of the poorer nations in South America. Then, they found oil. Lots of it.

🔗 Read more: Paul Krugman Latest Column: Why "Drill, Baby, Drill" Is Actually Dead

Their GDP PPP per capita has absolutely rocketed. In just a few years, they've jumped from the middle of the pack to potentially cracking the top 10 globally. It’s an "overnight" success story that’s actually decades in the making, but it shows how quickly these rankings can shift when a small population hits a resource jackpot.

The PPP "Big Mac" Logic

Why do we even use PPP? Because nominal GDP—the kind based on exchange rates—is a liar.

If the Euro gets stronger against the Dollar tomorrow, Europeans don't suddenly become "wealthier" in terms of what they can buy at their local grocery store. Their rent stays the same. Their bread costs the same. PPP fixes this by using a "basket of goods."

Think of it as the Big Mac Index on steroids. It asks: "How many Big Macs can a person in Country A buy compared to Country B?"

What These Rankings Get Wrong

I’ll be real with you: GDP PPP per capita is a flawed metric. It’s a "mean" average, and averages are dangerous.

If Jeff Bezos walks into a dive bar, the average person in that bar is a billionaire. But the guys drinking $3 drafts are still broke.

- Inequality: A country can have a massive GDP PPP per capita (like the UAE or Saudi Arabia) but still have huge gaps between the elite and the migrant workers who actually keep the lights on.

- The "Commuter" Problem: As mentioned with Luxembourg, if people work in a country but don't live there, the "per capita" part of the equation gets skewed.

- Cost of Services: PPP is great for goods (stuff you can ship), but it's harder to measure for services like healthcare or education. Having $100k in a country with free healthcare is very different from having $100k in a country where a broken leg costs $50,000.

The GNI Alternative

Some economists prefer GNI (Gross National Income). This measures what the citizens of a country actually earn, regardless of where they are. For Ireland, the GNI is much lower than the GDP because it strips away all that corporate tech money that's just "passing through."

✨ Don't miss: Musgrove Family Mortuary: What Most People Get Wrong About Eugene’s Legacy Funeral Home

Actionable Insights: How to Use This Info

If you’re looking at these numbers for business or travel, here’s how to actually read between the lines:

- For Digital Nomads: Don't just look for high GDP; look for high PPP versus low local costs. Countries like Taiwan or Malaysia often offer a "first-world" lifestyle at a "third-world" price point because their PPP is strong but local nominal costs are low.

- For Investors: Watch the "movers." Guyana is the current darling, but look at Southeast Asian nations that are steadily climbing the PPP ladder. That’s where the new middle class is being born.

- For Career Planning: High GDP PPP per capita usually correlates with high salaries, but always check the "Modified GNI" for tax-haven countries to see if the wealth actually reaches the workers.

Next Steps for You

If you want a deeper look at your specific neck of the woods, check out the IMF’s World Economic Outlook database. It’s updated twice a year and gives you the raw spreadsheets if you're a data nerd. Alternatively, look up the "Human Development Index" (HDI) for your target country. It combines GDP with life expectancy and education to give a much "realer" picture of what life is actually like on the ground.

Basically, don't let a single number fool you. Economics is as much about the people as it is about the pennies.