If you’ve checked your savings account lately and felt a little less excited about the interest trickling in, you aren't alone. Money is moving differently now. The current interest rate fed target is sitting at 3.5% to 3.75%, following a string of cuts that finally brought us some relief from those post-pandemic highs. But honestly, just looking at the number doesn't tell the whole story.

The Federal Reserve basically hit the "slow down" button on their cutting spree. After slashing rates by 175 basis points since late 2024, the room is getting smaller. Jerome Powell, whose term as Fed Chair actually expires this coming May, has been walking a tightrope. He’s trying to keep the job market from falling off a cliff while making sure inflation doesn't decide to make a surprise comeback.

It's a weird time for your wallet.

Why the current interest rate fed matters more than you think

Most people think the Fed just picks a number and everyone follows it. Kinda, but not really. The effective federal funds rate—the actual rate banks use to lend to each other overnight—is hovering right around 3.64% as of mid-January 2026. This isn't just some abstract math for Wall Street nerds. It is the invisible hand that decides if your credit card bill feels like a weight on your chest or if that 30-year mortgage is actually doable.

The Federal Open Market Committee (FOMC) delivered their third consecutive 25-basis-point cut back in December 2025. That was a big deal. It signaled that they were more worried about the "maximum employment" part of their job than the "stable prices" part for a minute. However, the mood changed fast. The minutes from that meeting showed a committee that is deeply split. You had folks like Stephen Miran wanting to go deeper with a 50-point cut, while others like Jeffrey Schmid and Austan Goolsbee were literally ready to stop the cuts entirely.

When the leadership is this divided, the market gets jumpy.

The split in the room

- The Doves: They see a cooling labor market and want to keep cutting to prevent a recession.

- The Hawks: They're terrified that core inflation, currently hanging around 2.7% to 3%, is going to get stuck there.

- The "Neutral" Crowd: This is where Powell seems to be landing, suggesting we are close to a "neutral" rate where the economy neither speeds up nor slows down.

Mortgage rates and the 10-year trap

Here is the thing about the current interest rate fed that drives homebuyers crazy: the Fed doesn't set mortgage rates. You’d think if the Fed cuts, your house gets cheaper to finance. Not always. Fixed-rate mortgages are tied more to the 10-year Treasury yield.

Investors are currently demanding a premium because they’re worried about the long-term. Even with the Fed’s recent cuts, the 10-year yield has been stubborn, staying above 4%. That’s why you’re seeing 30-year fixed mortgages still averaging around 6.1% to 6.3%. It’s frustrating. You see the headlines about "Fed Cuts," you call your lender, and they tell you the rate barely budged.

🔗 Read more: Dollar in Dominican Republic Pesos: What Most People Get Wrong

If you are waiting for 3% mortgage rates to come back, you might be waiting forever. Experts at Bankrate and Goldman Sachs suggest a "terminal rate"—the floor where the Fed finally stops—will likely be around 3% to 3.25%. That means mortgage rates might bottom out in the mid-5s later this year, but the days of "free money" are a historical footnote at this point.

What happens when Powell leaves?

Politics is messy, but it’s becoming a huge factor for the current interest rate fed trajectory. Jerome Powell’s term ends on May 15, 2026. There is a lot of talk about who takes the wheel next. The White House has been pretty vocal about wanting lower rates to spur growth, and there’s a real fear in the financial world that the next Chair might be more "political."

Why does that matter to you?

If the Fed loses its independence and starts cutting rates just to make the administration look good, inflation could rip right back through the economy. If investors lose faith in the Fed’s backbone, they’ll demand even higher interest on government bonds. Paradoxically, a Fed that tries too hard to lower rates could end up making long-term borrowing more expensive for you and me.

Real-world impact on your cash

Let’s talk about your "lazy money." For the last couple of years, high-yield savings accounts and CDs were the heroes of the personal finance world. You could get 5% just for letting your cash sit there. Those days are fading.

The top APY on a 1-year CD has already dropped from 6% in mid-2024 to about 4.1% today. Most high-yield savings accounts are starting to slip under the 4% mark. It's still better than the 0.01% we saw for a decade, but the "easy" returns are definitely shrinking.

- Credit Cards: Don't expect a miracle. Even as the Fed cuts, card APRs are staying sticky above 20%. Banks are worried about consumer risk, so they aren't passing the savings on to you very quickly.

- Auto Loans: These are finally starting to ease up. We're seeing some relief in the spring market, but with car prices still high, the monthly payment is still a gut punch for many.

- Bond Ladders: This is the "expert" move right now. Since we're likely near the end of the cutting cycle, locking in current yields on 2-year or 5-year Treasuries isn't a bad idea before the Fed potentially trims another 25 or 50 basis points.

The 2026 forecast: A "Hold" is the new "Cut"

Looking at the data from the St. Louis Fed and major banks like J.P. Morgan, the consensus for the rest of 2026 is actually a bit boring—which is good. After the chaos of the last few years, a period of stability is what the doctor ordered.

J.P. Morgan’s Michael Feroli recently suggested that the Fed might actually be done for the year after one more small move. They see the economy accelerating back to 2.3% GDP growth. If the economy is growing that fast, there’s no reason for the Fed to keep the gas pedal down.

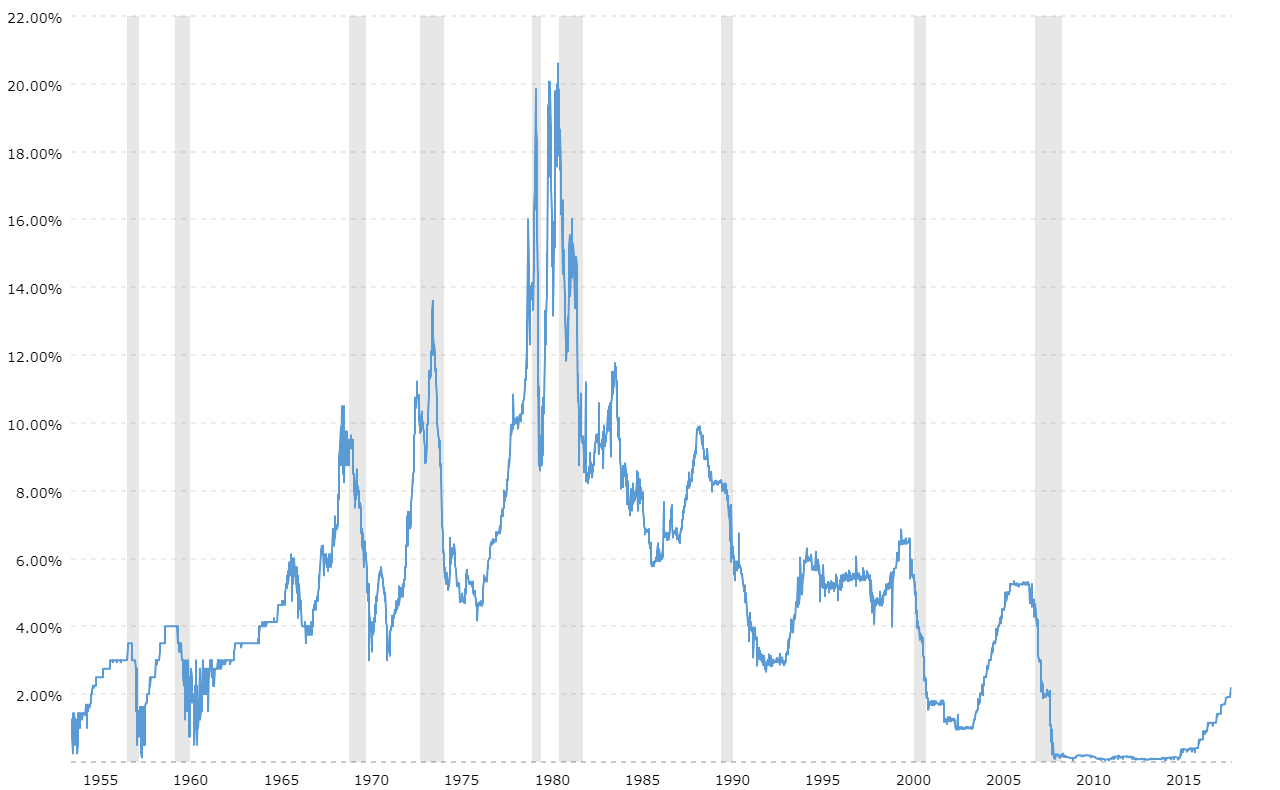

We are basically entering the "Normalization" phase. The current interest rate fed isn't "high" by historical standards (the long-term average is closer to 4.6%), but it feels high because we were spoiled by a decade of near-zero.

Actionable steps for your money right now

Stop waiting for a "big" crash in rates to make your move. It probably isn't coming. If you're looking to refinance, the "window" is likely going to be this spring or summer when the 10-year yield hopefully takes a breather.

Secure your savings yield today. If you have cash sitting in a standard big-bank savings account earning nothing, move it to a 12-month CD or a money market fund now. You want to "lock in" these 4% yields before they drift toward 3%.

Tackle high-interest debt aggressively. The Fed isn't going to save you from a 24% credit card APR. A 0.25% cut in the federal funds rate is a drop in the bucket compared to the interest you're paying. Use a balance transfer card or a personal loan while those rates are relatively stable.

Watch the May transition. Whoever replaces Powell will send a massive signal to the markets. If it’s a known "hawk," expect bond yields to rise. If it’s a "dove," your savings account rate might drop faster than you expect.

The bottom line? The current interest rate fed is finally in a spot where the economy can breathe. It’s not cheap, but it’s not crushing anymore either. We’ve moved from a "crisis" mindset to a "management" mindset. That means the best thing you can do is stop timing the Fed and start managing your own margin. Focus on what you can control: your savings rate, your debt, and your long-term investment strategy. The Fed has done its part; now the rest is up to how you play the hand you're dealt.

Next Steps for You:

- Audit your accounts: Check if your "high-yield" savings account has secretly dropped its rate in the last 30 days.

- Compare 15-year vs. 30-year mortgages: If you're buying, the spread between these two is widening, and the 15-year might offer the only "real" deal left in this rate environment.

- Review bond holdings: If you hold individual bonds, check their duration. Shorter-duration bonds are less risky if the Fed decides to pause longer than expected.