Honestly, the trade news lately is enough to give anyone whiplash. One minute we're hearing about a historic "truce" signed at Mar-a-Lago, and the next, there’s a fresh 25% threat over Iran-related business. If you’re trying to figure out the current tariff on china imports as of January 2026, you've likely realized it isn't just one number. It’s a messy, layered cake of taxes that vary depending on whether you’re buying a toaster, a semiconductor, or a bag of chemicals.

Right now, the average U.S. tariff on Chinese goods sits at roughly 47.5%.

That is massive. For context, before the trade wars really kicked off back in 2018, that average was closer to 3%. But while that 47% is the headline, the reality for businesses on the ground is a frantic game of checking exclusion lists and "temporary" suspensions that seem to change every other Tuesday.

👉 See also: Is the AMM Legit? Sorting Out the Truth Behind Automated Market Makers

The Two-Sided Reality of the 2026 Tariff Landscape

We’re currently living in a weird "fragile truce" era. In late 2025, President Trump and President Xi Jinping reached a deal that basically stopped a total trade embargo. Before that deal, tariffs had peaked at a staggering 145% on some items. It was chaos.

Under the current agreement, which is supposedly set to hold until November 10, 2026, the U.S. agreed to:

- Maintain a 10% reciprocal tariff on most goods.

- Lower specific "fentanyl-related" tariffs by 10 percentage points.

- Suspend certain Section 301 hikes on things like ship-to-shore cranes and maritime logistics.

But don't let the word "truce" fool you. Even with these suspensions, the current tariff on china imports remains at historically high levels. Most electronics, furniture, and apparel are still getting hit with rates ranging from 7.5% to 25%. And if you're in the semiconductor or EV space? You’re looking at 50% to 100% duties in many cases, designed specifically to "de-risk" the supply chain.

What’s Actually Happening at the Ports?

Go to Long Beach or Savannah right now and the data tells a story of a world trying to quit China, but failing. U.S. imports from China actually dropped about 28% throughout 2025. That sounds like a win for "decoupling," right?

Kinda.

While direct shipments from Ningbo to Los Angeles are down, imports from Indonesia are up 34% and Thailand is up 28%. A lot of that is just Chinese components being moved to Southeast Asia for final assembly to dodge the current tariff on china imports. It’s basically a global shell game. Marcus Eeman, a director at Flexport, recently noted that while the rhetoric is loud, the administration has actually been surprisingly quiet about enforcing some of the crazier 100% rates because they don’t want to be blamed for $10 eggs or $1,500 iPhones.

💡 You might also like: Will the US Dollar Go Up? What Most People Get Wrong About Greenback Dominance

The "Iran Factor" Curveball

Just this week, things got even more complicated. The administration announced a potential additional 25% tariff on any country doing business with Iran. Since China is Iran's biggest customer for oil, this could effectively push the average tariff on Chinese goods from that 47% mark up to nearly 72% if it’s fully implemented.

The Real Cost to You (The "Hidden Tax")

We have to stop pretending China "pays" these tariffs. That’s not how customs works. When a container lands, the U.S. company—the importer of record—writes a check to U.S. Customs and Border Protection.

The Tax Policy Center estimates that for the 2026 calendar year, these trade policies will cost the average American household about $2,100. If you're in the bottom 20% of earners, your effective federal tax rate just went up by about 1.9% because of this.

It hits hardest on:

- Home Renovations: Tariffs on lumber, kitchen cabinets, and copper wiring have made building a house significantly more expensive.

- Tech and Gadgets: Even with "carve-outs," the components inside your laptop or smart fridge are likely being taxed at 25% or more.

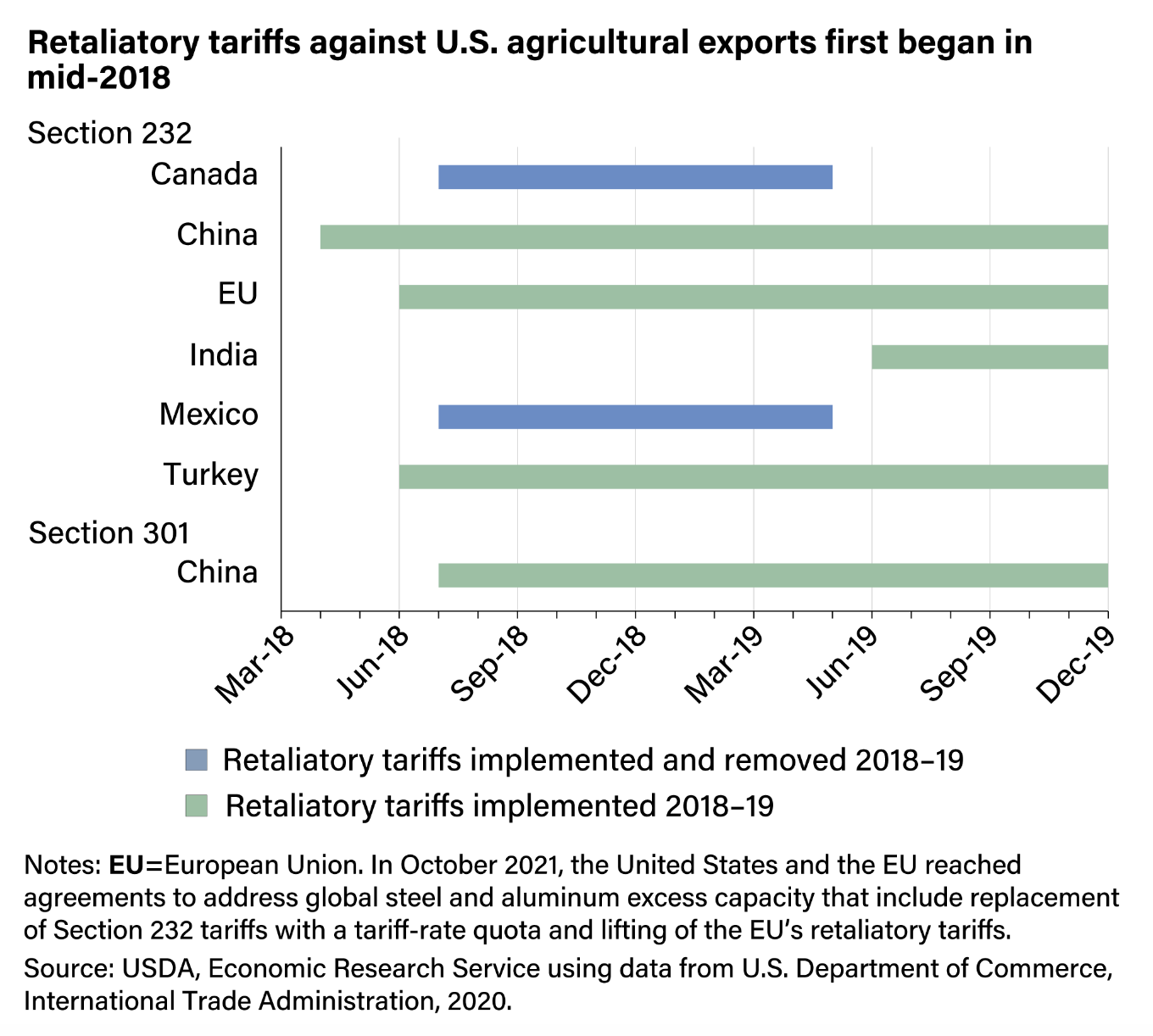

- Agriculture: China retaliated by hitting U.S. soybeans and pork, though they’ve promised to buy 25 million metric tons of soybeans in 2026 as part of the truce.

Moving Forward: Actionable Steps for 2026

If you’re a business owner or just someone trying to time a big purchase, the "wait and see" approach is dead. You have to be proactive.

Audit your HTS codes immediately. Classification is everything. A slight change in how a product is described can be the difference between a 0% duty and a 25% Section 301 hit. Many companies are successfully using "First Sale" valuation to lower their duty burden—basically paying tariffs based on the price the factory charged the middleman, not the price the U.S. company paid.

Monitor the November 2026 Expiration. The current "truce" has a very clear expiration date: November 10, 2026. This lines up almost perfectly with the APEC summit in Shenzhen. Expect massive volatility in the months leading up to that. If you need to stock up on inventory, do it before the Q3 2026 rush when everyone else starts panicking about whether the truce will be extended.

Diversify, but do it for real. Moving production to Vietnam is the standard play, but U.S. Customs is getting way better at "looking through" those shipments. If 90% of your parts still come from China and you just put the screws in at a shop in Hanoi, you’re still going to get hit with the current tariff on china imports. You need a genuine change in the "country of origin," which usually means substantial transformation of the product.

🔗 Read more: Typical Questions Asked in Interviews: Why You’re Probably Over-Preparing the Wrong Way

The bottom line is that these tariffs aren't a temporary "war" anymore. They are the new baseline for global trade. Whether you like the policy or not, the 47.5% average isn't going back to 3% anytime soon.

Actionable Insights for Importers:

- Verify Exclusion Status: Check the USTR website weekly. Exclusions for medical supplies and certain machinery are often granted and revoked with very little lead time.

- Cash Flow Planning: Since tariffs are paid at the time of entry, ensure your credit lines can handle a 25-50% surcharge on your COGS (Cost of Goods Sold).

- Consult a Customs Attorney: The Supreme Court is currently reviewing the legality of using the International Emergency Economic Powers Act (IEEPA) for these tariffs. If they rule against the administration, you might be eligible for massive refunds on duties paid in 2025.