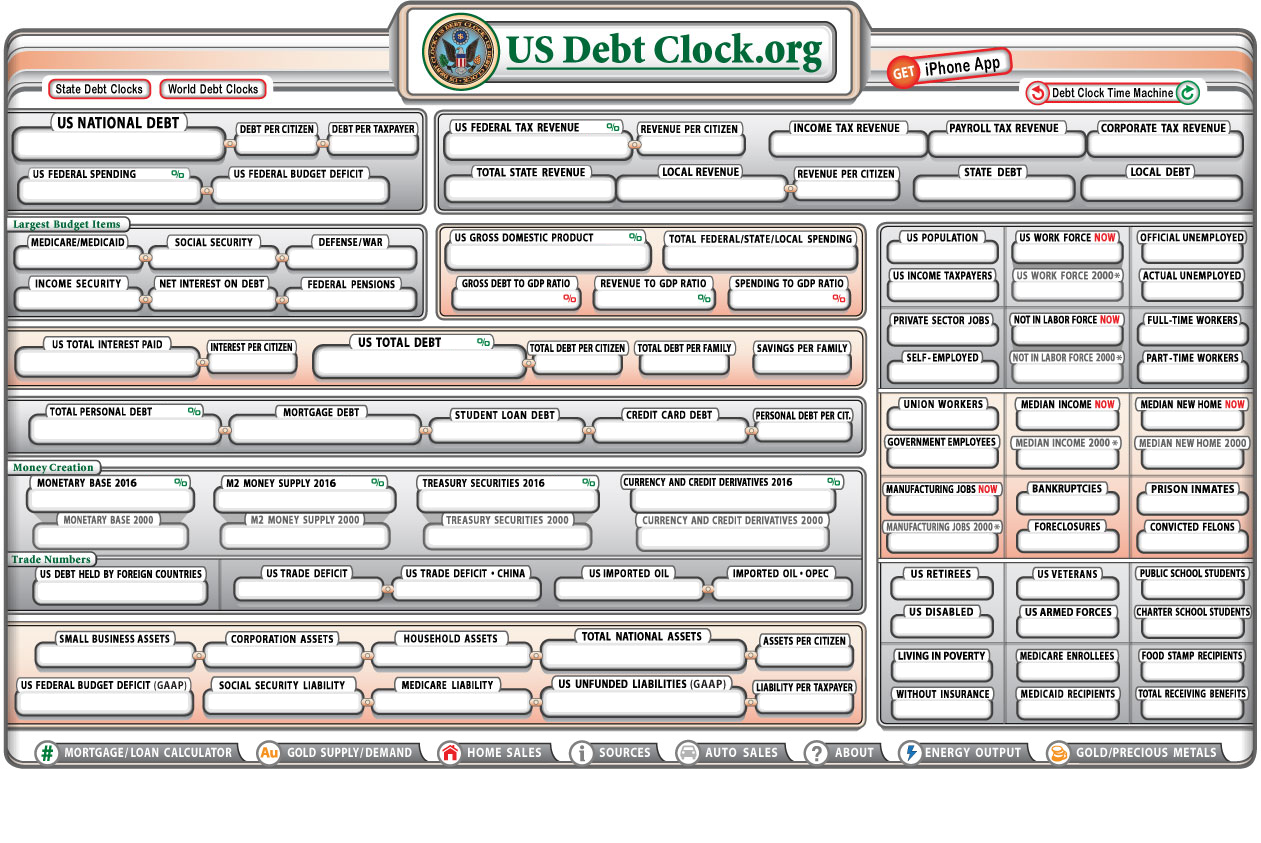

If you’ve ever found yourself staring at the current US debt clock live, you know the feeling. It’s hypnotic. Those digits blur into a neon smear of red and green as they tick upward at a rate of roughly $92,912 every single second. It’s like watching a high-speed car crash where the car is the global economy and nobody is hitting the brakes.

Honestly, it’s a lot to process. As of early 2026, the gross national debt has officially surged past $38.5 trillion. That is not a typo. We are effectively staring down a future where the number "trillion" has become the new "billion."

The scale is hard to wrap your head around. To put it simply, every person in America now technically "owes" about $114,000. If you look at it per household, that number jumps to a staggering $285,127. You didn’t sign for this loan, but your name is on the ledger.

Why the Debt Clock is Moving Faster Than Ever

Why is this happening now? Well, it’s a perfect storm of lingering pandemic-era spending, massive interest payments, and a budget that basically refuses to balance. Just in the last 12 months, the national debt climbed by $2.25 trillion. That’s an average of over $8 billion added every single day.

One of the biggest drivers right now is interest. It’s the "silent killer" of the federal budget. Back in 2020, the US paid about $345 billion in interest. Today, those annual payments have nearly tripled, crossing the **$1 trillion mark**. For the first time in modern history, we are spending more on the interest of our old debt than we are on our entire national defense budget.

✨ Don't miss: 8 Howard and the 305: Why This Miami Commercial Real Estate Play Still Makes Waves

Think about that.

We are paying more to the people who lent us money than we are to protect the country. It’s a massive transfer of wealth. Roughly a third of that money is flowing straight to foreign investors in places like Japan, China, and the UK.

The DOGE Factor and Tariffs

There's been a lot of talk about the Department of Government Efficiency (DOGE) and its impact on these numbers. Reports show that DOGE has managed to find about $202 billion in savings since its launch. That sounds huge. It works out to about $1,254 per taxpayer.

But here’s the reality: $202 billion is a drop in the bucket when the total debt is $38.5 trillion. It represents less than 1% of the total mountain. Similarly, tariff revenues have jumped—hitting about **$25 billion** by mid-2026—but again, that’s about 0.07% of the total balance.

Basically, we’re trying to put out a forest fire with a garden hose.

The Reality of the "One Big Beautiful Bill"

In 2025, President Trump signed what he called the "One Big Beautiful Bill." It was a massive package of tax cuts and spending aimed at fueling growth. The White House argues that these "pro-growth" policies are the only way to outrun the debt.

📖 Related: Vanguard Bitcoin ETF: Why Most Investors Get the Story Wrong

Critics, however, point to the $3.4 trillion price tag over ten years. There is a fundamental disagreement here. One side says you have to cut taxes to grow the economy out of the hole; the other says you can’t keep borrowing to pay for those cuts.

Meanwhile, the debt-to-GDP ratio—which is how economists measure if a country can actually afford its debt—is sitting at roughly 123.6%. In plain English: we owe 23% more than the entire value of everything we produce in a year.

What This Means for Your Wallet

You might wonder why the world hasn't ended yet. If a regular person had a debt-to-income ratio like this, they’d be in bankruptcy court. But the US is different. We have the "exorbitant privilege" of the US dollar being the world’s reserve currency. We can, quite literally, print the money we need.

But there’s no such thing as a free lunch. Here is how this actually hits you:

- Inflationary Pressure: When the government pumps more money into the system to cover debt, your dollars buy less.

- Crowding Out: As the government borrows more, there is less capital available for private businesses to expand, which can slow down the "real" economy.

- The Tax Cliff: Eventually, something has to give. Whether it's through higher taxes or reduced services like Social Security (which is already seeing spending hikes due to cost-of-living adjustments), the bill always comes due.

Actionable Next Steps: What Can You Actually Do?

You can’t control the current US debt clock live, but you can control your own exposure to it. If the government is going to keep borrowing and spending, you need a defensive game plan.

🔗 Read more: Calculate North Carolina Income Tax: How to Get it Right Without Losing Your Mind

- Hedge Against Devaluation: Historically, when debt and inflation rise, "hard assets" like real estate, gold, or even certain digital assets tend to hold value better than cash sitting in a savings account.

- Audit Your Own Interest: If the government is struggling with $1 trillion in interest, imagine what high-interest credit card debt is doing to you. Prioritize paying down variable-rate debt before rates climb further.

- Diversify Your Income: Don't rely on a single government-dependent source of income. If future budgets require austerity or cuts to programs, having a private-sector side hustle or diverse investment portfolio is your best safety net.

- Stay Informed, Not Panicked: The US has faced "debt crises" before. While the numbers are bigger now, the economy is also much larger. Watch the debt-to-GDP ratio more than the total dollar amount; that's the real indicator of sustainability.

The clock isn't going to stop ticking anytime soon. The best you can do is make sure your own house is in order while the national one gets sorted out.