If you’re looking at the current USD to TRY exchange rate today, January 17, 2026, you’re seeing a number that would have seemed impossible a few years back. The rate is hovering around 43.28, a level that reflects both a massive loss in purchasing power over the long haul and a strange, almost eerie stability in the short term.

Honestly, the Turkish Lira has become one of those currencies where "stability" is a relative term.

For months, we've watched the Lira lose tiny fractions of its value every single day. It’s not a crash; it’s a controlled slide. You check your phone, it's 43.15. You check it the next week, it's 43.27. This isn't an accident. The Central Bank of the Republic of Türkiye (CBRT) is basically managing a "crawling peg," trying to keep the currency from jumping off a cliff while acknowledging that inflation is still too high to keep the rate frozen.

The Reality Behind the 43.28 Level

Why does this matter to you? Well, if you’re an expat living in Kas or a business owner in Istanbul trying to price your exports, that "43" handle is a psychological barrier. Just last week, the USD/TRY hit an all-time high of 43.43, according to market data. It’s a constant reminder that the Lira is still searching for a bottom.

But here’s the weird part. Even though the Lira is at record lows, the mood in the markets is actually... okay? Kinda.

📖 Related: Bed Bath and Beyond Albuquerque: What Actually Happened to the Stores You Knew

Annual inflation in Turkey finally dipped below 31% this January. That’s the lowest it’s been since 2021. When you’ve been living with 60% or 70% inflation, 30.89% feels like a victory lap, even if it would be a national emergency in most other countries. Because inflation is "cooling," the central bank is getting itchy fingers. They want to cut interest rates.

What the Experts are Actually Saying

I was looking at the latest survey from the CBRT, which they just released yesterday. It’s pretty telling.

Market participants—the big banks and economists—are now betting on a 150 basis point rate cut on January 22. They previously thought it would only be 100 points. They see that 30.89% inflation figure and figure, "Hey, the door is open. Let's lower the cost of borrowing."

But there’s a catch.

🔗 Read more: How to Influence People Book: Why Dale Carnegie Still Dominates Your LinkedIn Feed

While the current USD to TRY rate is around 43, the big players don't expect it to stay there. The median forecast for the end of 2026 is sitting at 51.17. That’s a long way up. It suggests that even the professionals expect another 18-20% depreciation over the next twelve months.

- Policy Rate: Currently 38% (but likely dropping to 36.5% next week).

- Inflation Target: The government wants 22.4% by the end of 2026.

- The "Secret" Debt: Recent audits of the Turkey Wealth Fund showed liabilities crossing the 10 trillion Lira mark. That’s a lot of weight on the sovereign balance sheet.

Why the Lira Isn't Spiraling (Yet)

You might wonder why the Lira hasn't just gone to 60 already if everyone knows it's going down.

The answer is "carry trade" and high interest rates. At 38%, Turkish Lira deposits are actually paying out more than the currency is devaluing—at least for now. If you hold Lira, you’re earning a massive interest rate. As long as the USD to TRY doesn't jump by 4% in a single month, you're technically making money in Dollar terms.

Governor Fatih Karahan has been busy lately. He was just in London and New York talking to investors, basically promising that the "tight stance" will continue. He’s trying to convince Wall Street that Turkey is back to "orthodox" economics.

🔗 Read more: Tiffany and Co Founding: What Most People Get Wrong About the Stationery Store That Conquered the World

But it’s a tightrope. If he cuts rates too fast to please the political appetite for growth, the Lira will snap. If he keeps them too high for too long, the economy stalls.

Practical Insights for 2026

If you're dealing with current USD to TRY transactions, don't let the daily "flat line" fool you.

Businesses in Turkey are increasingly pricing in a 50+ exchange rate for their late-2026 contracts. If you’re a tourist, Turkey is still incredibly "cheap" in Dollar terms, but the local prices in Lira are rising faster than the exchange rate in many sectors—especially "services" like hotels and restaurants.

The UN recently projected that Turkey’s growth will hit 3.9% this year. That’s decent. But that growth is fueled by people spending money because they’re afraid it will be worth less tomorrow.

What you should do now:

- Watch the January 22 Meeting: If the CBRT cuts more than 150 points, expect the USD to TRY to break 44 very quickly.

- Hedge Your Bets: If you have Lira-based income, look into "Korumalı Mevduat" (KKM) or similar structures if they are still available, though the government has been trying to phase those out in favor of standard TL deposits.

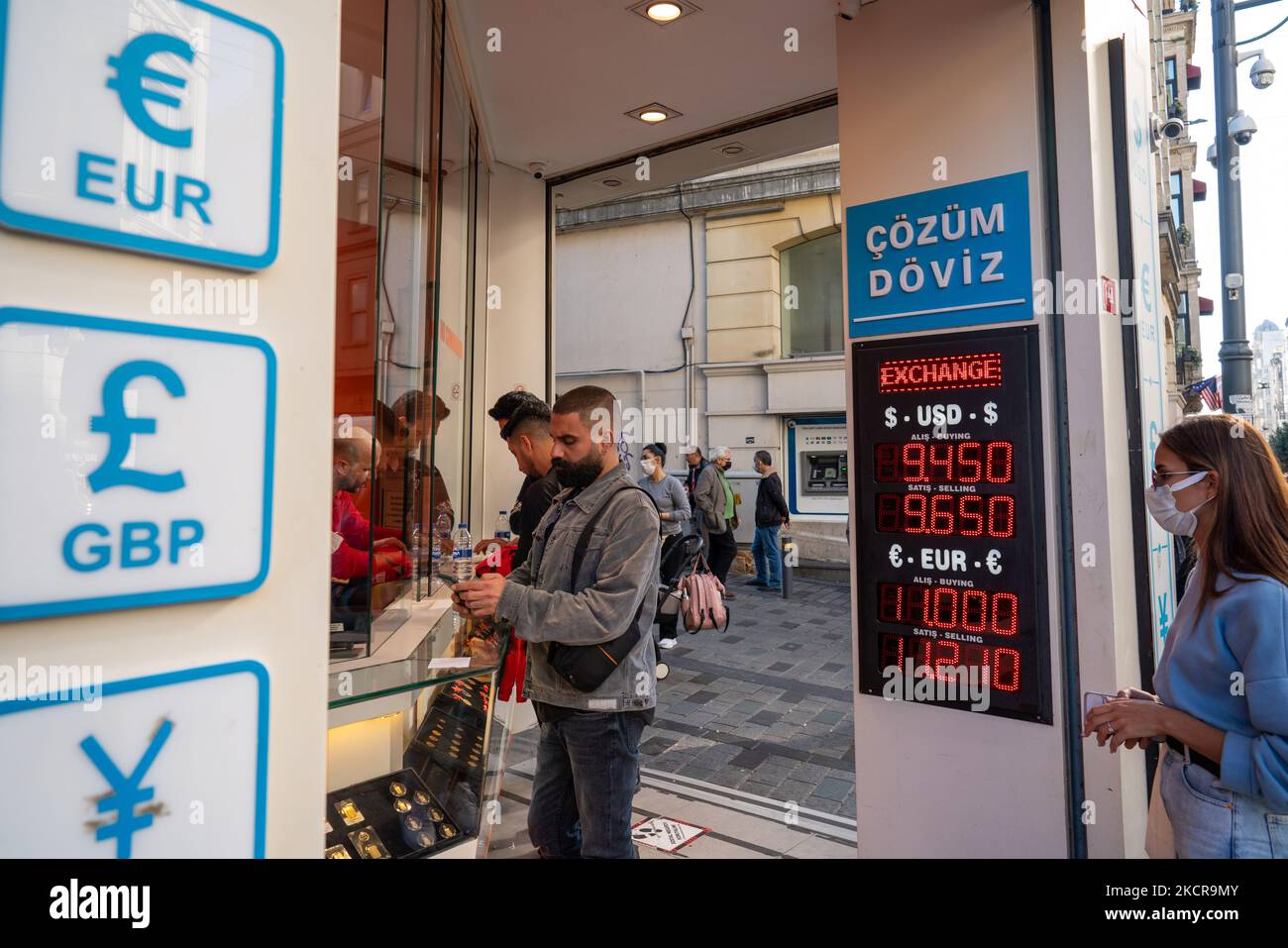

- Check the Spread: Don't just look at the mid-market rate of 43.28. Banks in Turkey often have a 1-2 Lira spread between buying and selling, especially during "thin" market hours or weekends.

The Lira’s story in 2026 isn't one of a sudden explosion. It’s a story of a long, slow grind. Whether that grind leads to a "soft landing" or a sudden correction depends entirely on whether the central bank can keep its nerve while the rest of the world watches that 43.28 ticker.

The next major milestone is the January 22 interest rate decision. If the central bank signals a more aggressive easing cycle than the market expects, the current period of relative stability could vanish. Investors should monitor the gap between the official inflation figures and household inflation expectations, which currently remain higher than the bank’s targets.