You’re sitting at your kitchen table, coffee in hand, ready to finally knock out your tax return. You hit "submit" on your software, expecting that satisfying green checkmark. Instead? A rejection. The IRS says someone already filed using your Social Security number. It’s a gut-punch. Your heart sinks because you know exactly what this means: identity theft. This is the exact moment when IRS Form 14039 online becomes the most important document in your life.

Tax-related identity theft is a massive headache. Honestly, it’s a violation. Someone is out there trying to steal your refund, and the IRS won't process your real return until you prove you are who you say you are. Form 14039, officially known as the Identity Theft Affidavit, is your way of telling the federal government, "Hey, that wasn't me."

What Most People Get Wrong About IRS Form 14039 Online

There is a huge misconception that you have to mail a paper form and wait six months for a guy in a basement in West Virginia to open an envelope. That’s old school. While the paper path still exists, the IRS has significantly modernized. You can actually handle a lot of this through the IRS Identity Theft Central portal.

But wait. You can't always just "fill it out" as a standalone digital document in the way you might sign a PDF for a gym membership. Usually, if you are using tax software like TurboTax, H&R Block, or FreeTaxUSA, and your return gets rejected for a duplicate SSN, the software prompts you to attach a digital version of the 14039 right then and there. This is the "online" path most people actually experience.

If you aren't filing a return but found out your info was compromised in a data breach—like the infamous 2017 Equifax disaster or the more recent National Public Data leak—you might want to file Form 14039 preemptively. In that case, you’re basically flagging your account before the thief even has a chance to strike.

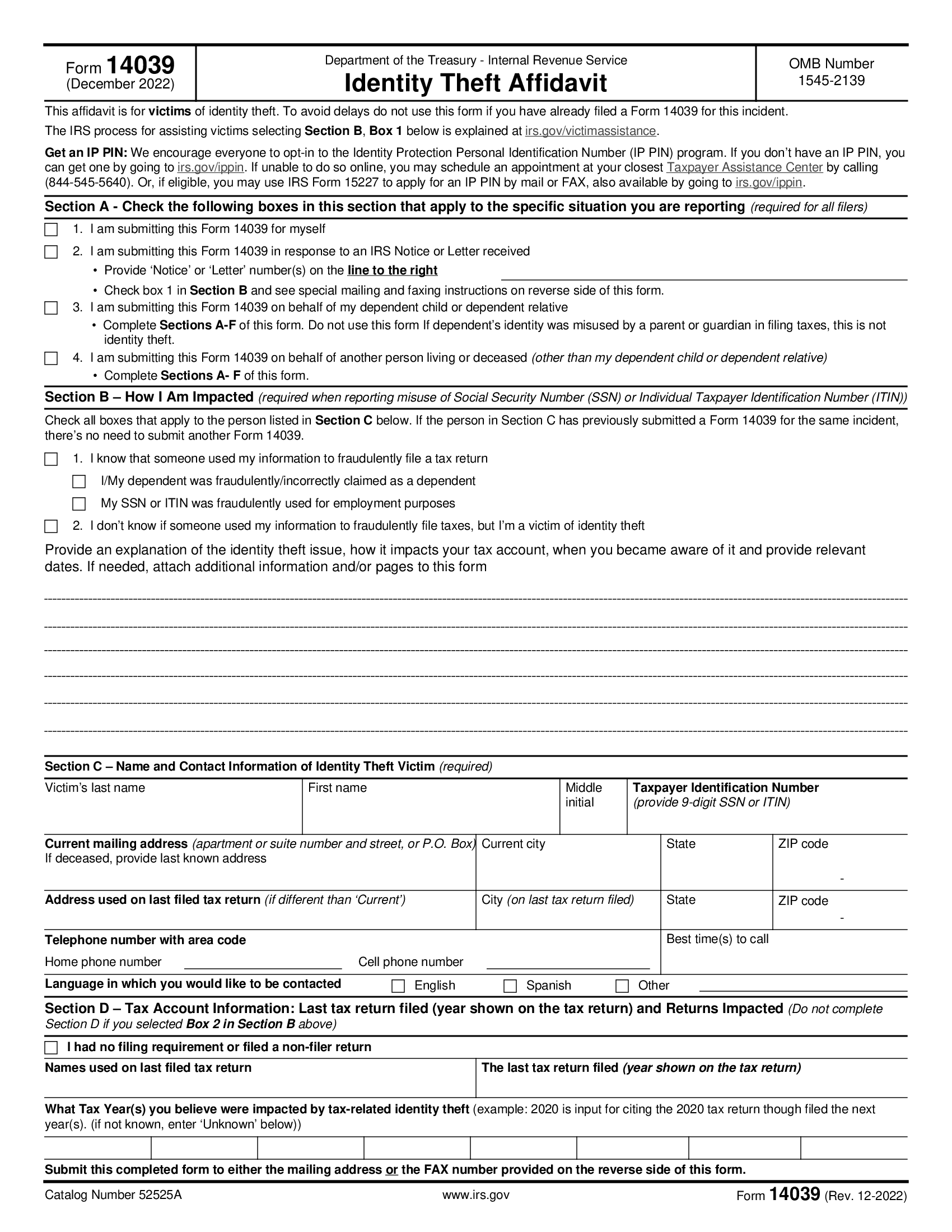

The Nuance of "Section B"

When you look at the form, it asks why you’re filing. This is where people trip up. You have two main choices. One: You’re a victim of actual tax identity theft (your return was rejected). Two: You’ve experienced an "event" that could lead to identity theft (you lost your wallet, or your payroll provider got hacked).

If you’re in the second camp, the IRS might not actually do anything immediately. They’ll keep the form on file, but they typically don't issue an Identity Protection PIN (IP PIN) until there is a "tax-related" impact. It’s a bit of a bureaucratic catch-22. You want protection now, but the IRS often waits for the fire to start before they hand you the extinguisher.

Why the IP PIN Is the Real Goal

Filing the affidavit is just the first step. What you’re really hunting for is the IP PIN. This is a six-digit code that changes every year. Once you have one, the IRS will automatically reject any return filed under your Social Security number that doesn't include that specific code. It’s basically two-factor authentication for your taxes.

Getting that PIN used to be a nightmare. You had to wait for a CP01A notice in the mail every January. If that letter got lost? Good luck. Now, the IRS allows almost anyone to "opt-in" to the IP PIN program online through their Secure Access identity verification process. If you’ve already filed your IRS Form 14039 online, you’re already on the radar for this.

How the Process Actually Flows

- The Rejection: Your e-file bounces. The error code usually indicates a "Duplicate SSN."

- The Affidavit: You complete Form 14039. You’ll need a clear scan of your driver’s license or passport. Don't skip this. If the scan is blurry, the IRS will toss the application faster than a bad habit.

- The Paper Return: Here is the annoying part. Even if you submit the affidavit online, you often still have to print out your physical tax return and mail it to the IRS with a paper copy of the 14039. Why? Because the electronic system is "locked" for your SSN for the rest of the year.

- The Long Wait: The IRS officially says it takes about 120 to 180 days to process identity theft cases. In reality? I’ve seen it take a year.

It's frustrating. You’re the victim, yet you’re the one doing the legwork. You have to prove your identity to get your own money back.

Crucial Tips for a Smooth Submission

Don't just "wing it" with your documentation. The IRS is a machine. If you give the machine the wrong fuel, it stalls.

Make sure your address on Form 14039 matches the address on your most recently filed tax return. If you've moved, that's fine, but be prepared for an extra layer of verification. Also, specify exactly which tax year was affected. If a thief filed a fake 2023 return in early 2024, your "Tax Year Affected" is 2023.

Another thing: keep a copy of everything. If you are mailing a paper backup, use Certified Mail with a Return Receipt. Honestly, it's worth the $8 just for the peace of mind. If the IRS claims they never got it—and they do that sometimes—you have the receipt to prove otherwise.

🔗 Read more: Am Mex Services Co: How This San Diego Firm Actually Handles Cross-Border Business

The "Paper Trail" Myth

Some "experts" tell you that filing online is always better. Kinda. Online is faster for the initial notification. But the IRS still operates heavily on paper for complex fraud cases. If your situation involves a hijacked bank account where the refund was already sent to a thief, you're going to be talking to a real human being at some point. You can't solve "where did my $4,000 go?" solely through a web portal.

Dealing with the Fallout

Identity theft isn't just a tax issue. It's a life issue. If someone has your SSN for taxes, they probably have it for credit cards, too.

- Check your credit reports at AnnualCreditReport.com.

- Place a "Security Freeze" on your credit files at Equifax, Experian, and TransUnion. This is free and much more effective than a "fraud alert."

- Change your passwords. Especially for your email. Thieves often get your tax info by lurking in your inbox and finding old PDFs of previous returns.

Moving Forward with the IRS

Once your IRS Form 14039 online is processed, you'll eventually receive a letter (usually Letter 4883C or 5071C) asking you to verify your identity. This might involve a phone call or an in-person visit to a Taxpayer Assistance Center. It’s a hassle, but it’s the final hurdle.

Once you are verified, the IRS will clear the fraudulent return from your record and process your actual return. Any refund you were owed will be sent out, usually with a little bit of interest because the IRS was "holding" it. It’s not a lot of interest, but hey, it’s something.

Actionable Next Steps

If you suspect your identity has been stolen for tax purposes, do not wait for the IRS to contact you.

- Go to the official IRS.gov website and search for the Identity Theft Central page. This is the only legitimate place to start your digital journey.

- Download Form 14039 to see what information is required, even if you plan to submit it through your tax software.

- Get your identity documents ready. Find your passport or a valid state ID. Ensure they aren't expired.

- File a report with the FTC at IdentityTheft.gov. This provides you with an "Identity Theft Report," which gives you certain legal rights that just a "police report" doesn't always cover.

- Opt-in for the IP PIN immediately if you can. If the IRS website allows you to verify your identity through ID.me, do it now and get that code. It is the single best way to prevent this from happening again next year.

The process is slow. It’s annoying. But being proactive is the only way to get your tax life back on track.

Practical Resource Checklist

| Action Item | Source |

|---|---|

| Verify Identity Online | IRS.gov (ID.me portal) |

| Official Form 14039 | IRS.gov/pub/irs-pdf/f14039.pdf |

| Credit Freezes | Equifax, Experian, TransUnion |

| FTC Formal Report | IdentityTheft.gov |

Don't let the fear of a long process stop you. Every day you wait is another day a fraudster has a head start. Submit your form, get your confirmation number, and keep your records organized. You'll get through this.