The national debt is basically the ultimate political football. People love to toss it around. Depending on who you ask, it’s either a looming apocalypse or just a boring accounting entry that doesn't actually matter in the real world. Honestly, both sides are usually exaggerating. If you look at the raw numbers, the story of debt under each president isn't just about who spent more; it’s about what was happening in the world when they held the keys to the Oval Office.

Wars cost money. Recessions cost money. Pandemics? They cost a fortune. You can't just look at a bar chart and say "this guy was bad" without looking at the context. We’ve been borrowing money since the American Revolution, and quite frankly, we’ve gotten really good at it.

The Modern Era: Where the Trillions Started

Let’s talk about Ronald Reagan. Before he took office, the debt was under a trillion dollars. That sounds like a bargain now, doesn’t it? Reagan came in with "Reaganomics," aiming to cut taxes to spur growth. It worked in some ways, but the spending didn't stop. Cold War defense spending skyrocketed. By the time he left, the debt had nearly tripled. It was a massive shift in how the U.S. handled its checkbook.

Then you have George H.W. Bush. He’s the guy who famously said, "Read my lips: no new taxes." Then he raised taxes. Why? Because the deficit was spiraling. He chose fiscal pragmatism over his own campaign promise, which probably cost him the next election, but it set the stage for what happened in the 90s.

✨ Don't miss: TD Bank Warwick NY: What Local Customers Get Wrong

The Clinton Surplus Myth vs. Reality

People talk about Bill Clinton like he was a wizard who waved a wand and made debt vanish. It’s a bit more nuanced. He actually did oversee the last few years of federal budget surpluses. Tax hikes from the Bush and Clinton eras combined with a massive tech boom (the Dot-com era) filled the Treasury's coffers. But here’s the kicker: the national debt didn't actually go away. It just stopped growing as fast. We still owed money; we just weren't adding to the pile for a minute.

Post-9/11 and the Great Recession

Everything changed after 2001. George W. Bush inherited a surplus but ended up with massive deficits. Why? Two wars in the Middle East and a huge tax cut. You can't fight two wars on credit and expect the balance to stay low. Then 2008 hit. The Great Recession was a financial heart attack.

When Barack Obama took over, the house was already on fire. The American Recovery and Reinvestment Act was a massive infusion of cash to keep the economy from collapsing. It worked, but it was expensive. You’ll hear people say Obama "doubled the debt." While technically true in terms of raw dollars, a huge chunk of that was baked in the cake before he even sat down at the Resolute Desk. The CBO (Congressional Budget Office) had already projected trillion-dollar deficits due to the falling tax revenue from the crash.

The Pandemic Pivot

Donald Trump’s term was fascinating from a fiscal standpoint. Before COVID-19, the debt was already rising due to the 2017 Tax Cuts and Jobs Act. Many economists, including those at the Tax Policy Center, argued the cuts didn't "pay for themselves" as promised. But then 2020 happened.

✨ Don't miss: Tania Speaks Shark Tank: What Really Happened to the $400,000 Deal

The CARES Act was a bipartisan spending spree like we’ve never seen. Stimulus checks, PPP loans, enhanced unemployment. It was a "break glass in case of emergency" moment. The debt jumped by trillions in a matter of months.

Joe Biden continued that trend. The American Rescue Plan and the Inflation Reduction Act (which, ironically, has a lot of green energy spending) added more to the tally. We are now sitting at over $34 trillion. It’s a number so big it’s almost meaningless to the average person.

Does the Debt Actually Matter?

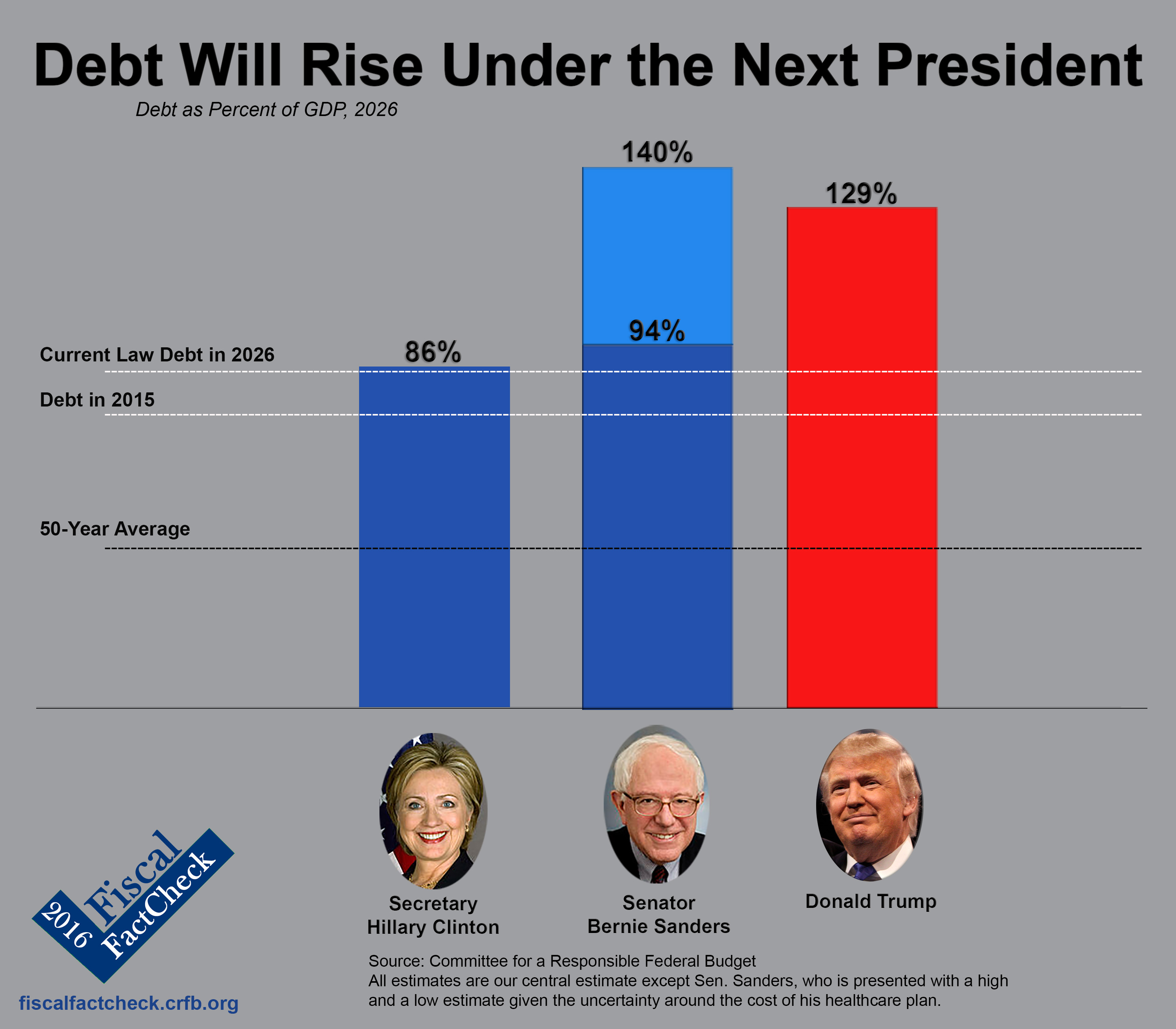

This is where experts like Stephanie Kelton (author of The Deficit Myth) and more traditional hawks like those at the Committee for a Responsible Federal Budget (CRFB) go head-to-head.

Kelton argues for Modern Monetary Theory (MMT). She basically says that since the U.S. prints its own currency, it can't "run out" of money. The only real constraint is inflation. If we spend too much and there aren't enough goods and services to buy, prices go up. Sound familiar?

On the other side, the traditionalists worry about "crowding out." They think if the government borrows too much, interest rates will stay high, making it harder for you to get a mortgage or a car loan. They also worry about the interest payments. Right now, the U.S. spends more on interest than it does on its entire defense budget. That is wild.

How We Compare Internationally

We aren't alone in this. Japan has a debt-to-GDP ratio that makes ours look tiny. However, they also have a very different economy and a population that saves a lot. The U.S. dollar is the world's reserve currency. This is our "exorbitant privilege." As long as the rest of the world wants dollars to trade oil and electronics, we can get away with a lot more debt than, say, Argentina or Greece.

Why Politicians Won't Fix It

Nobody wins an election by saying, "I’m going to cut your Social Security and raise your taxes to pay off a bondholder in China." It’s political suicide. Democrats generally don't want to cut social programs. Republicans generally don't want to raise taxes. Since those are the two biggest levers, we just keep kicking the can down the road.

It’s a cycle.

- Campaign on fiscal responsibility.

- Get into office.

- Realize that spending money makes people happy and cutting it makes them mad.

- Pass a massive spending bill or tax cut.

- Blame the other side for the debt.

Real-World Consequences for You

You might think this is all just numbers on a screen in D.C. It’s not. High national debt often leads to:

💡 You might also like: USD to VND Exchange: What Most People Get Wrong

- Persistent inflation if the money supply grows too fast.

- Higher interest rates for your credit cards and home loans.

- Potential for higher taxes in the future to cover the interest.

- Less "fiscal space" for the government to react to the next big crisis.

If we have another 2008 or another pandemic, will we have the "credit limit" left to borrow another $5 trillion? That’s the real gamble.

Moving Beyond the Talking Points

Stop looking at the debt as a scoreboard for which party is "better." Both parties have overseen massive increases. The debt grew under Reagan, it grew under Obama, and it exploded under Trump and Biden. It’s a systemic issue, not a partisan one.

The real question is what we are getting for the money. If we borrow a trillion dollars to build high-speed rail, educate the workforce, and fix the power grid, that’s an investment. If we borrow it just to keep the lights on because we won't pay our bills, that’s a problem.

Actionable Insights for the Savvy Citizen

Managing your own finances in an era of high national debt requires a bit of strategy. You can't control the Treasury, but you can control your exposure.

- Hedge against inflation: Since high debt often correlates with a devaluing currency over long periods, consider diversifying into "hard assets" like real estate or diversified index funds that own companies with pricing power.

- Watch interest rate trends: The Federal Reserve's reaction to debt and inflation dictates your mortgage rate. If debt-servicing costs force the Fed to keep rates higher for longer, locking in fixed rates becomes a priority.

- Don't count on "status quo" Social Security: If you are under 50, assume the rules will change. The debt pressure will likely lead to higher retirement ages or means-testing. Build your own "personal social security" through a 401(k) or IRA.

- Vote on specifics, not slogans: Next time a candidate talks about the debt, ask how. If they don't mention the "Big Three" (Social Security, Medicare, and Defense), they aren't being serious. Those three make up the vast majority of the budget.

- Educate yourself on the Debt-to-GDP ratio: This is a much better metric than the raw dollar amount. A $34 trillion debt is scary, but if the economy is $50 trillion, it's manageable. If the economy is only $20 trillion, we're in trouble. Watch the ratio, not just the headlines.

The debt under each president is a reflection of our national priorities—and our collective refusal to make hard choices. Understanding the "why" behind the numbers is the first step toward demanding better fiscal policy.