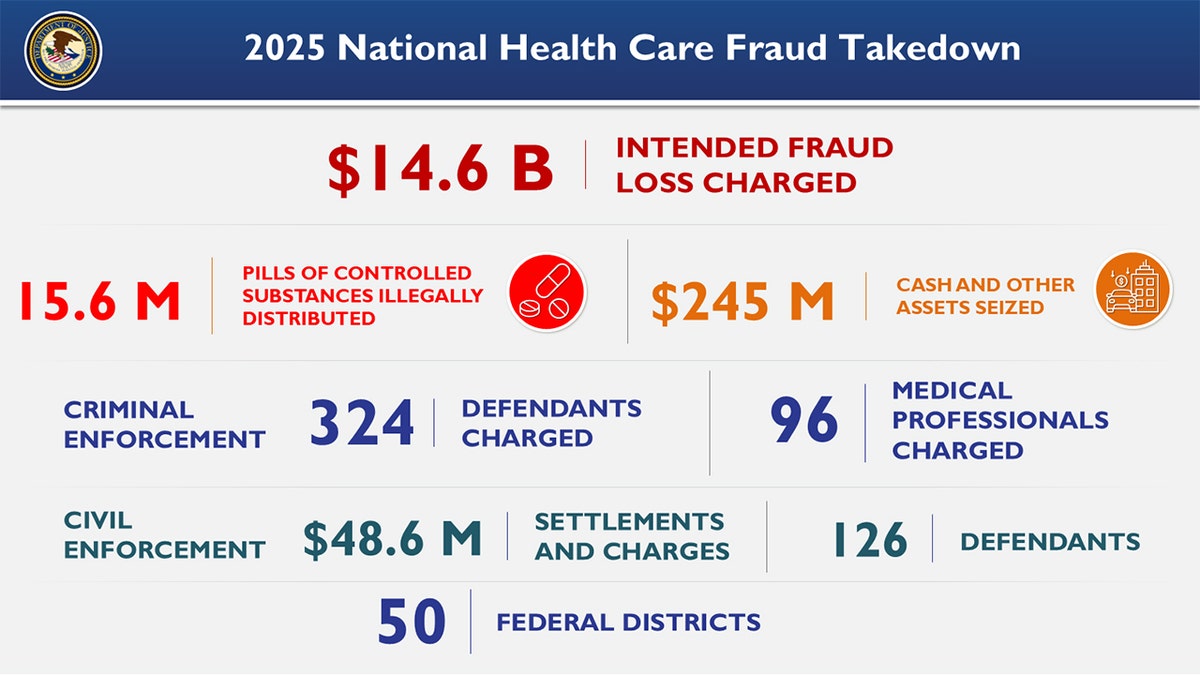

You probably think health care fraud is just some doctor in a dusty office billing for a few extra stitches. That's old school. Honestly, if you're looking at the Department of Justice (DOJ) today, the scale is enough to make your head spin. We aren't talking about "errors" anymore. We are talking about $14.6 billion in alleged losses from a single enforcement sweep.

In June 2025, the DOJ pulled the trigger on its largest-ever national health care fraud takedown. It was massive. 324 defendants. 96 of them were licensed medical professionals. Basically, the feds decided to stop playing whack-a-mole and started using a sledgehammer.

The "Operation Gold Rush" Factor

The center of this storm was something called Operation Gold Rush. It sounds like a movie title, but for the DOJ, it was a strike against a transnational criminal organization that managed to exploit Medicare for billions. This wasn't just a couple of guys in a basement. They had a sophisticated web spanning from the Eastern District of New York all the way to Estonia.

Yes, Estonia.

The DOJ actually worked with Estonian law enforcement to nab four suspects. Seven more were caught at U.S. airports and the Mexican border, literally trying to flee as the indictments came down. When people talk about doj health care fraud, they usually think of local scams. They don't think of international manhunts involving the FBI, HHS-OIG, and the DEA all at once.

👉 See also: Mike Pompeo Net Worth: Why What You See on Google Is Kinda Wrong

The government didn't just walk away with handcuffs, either. They seized $245 million in cold hard cash, luxury cars, and—interestingly—a whole lot of cryptocurrency. It turns out that laundering money from fake hospice claims or unnecessary genetic testing is a lot harder when the DOJ starts tracking the blockchain.

Why 2026 Looks Even Tougher

If you’re a provider or a health-tech executive, you’ve probably noticed the vibe shifting. It's getting intense. On July 2, 2025, a new DOJ-HHS False Claims Act (FCA) Working Group was formed. Their sole job? To bridge the gap between "we think something is wrong" and "here is your indictment."

The New Playbook

The DOJ has stopped relying on random audits. Nobody has time for that. Instead, they’ve launched the Health Care Fraud Data Fusion Center.

- Real-time monitoring: They are looking at billing lines as they happen.

- Predictive modeling: If your clinic’s billing for "amniotic wound allografts" suddenly spikes 400% higher than the national average, a red flag pops up on a dashboard in D.C.

- AI Scrutiny: This is the big one for 2026. The DOJ is now looking at how companies use AI for coding. If an algorithm "hallucinates" a more expensive diagnosis and the company keeps the money, the DOJ calls that "reckless disregard."

Honestly, the days of saying "I didn't know the computer did that" are over. Attorney General Pam Bondi and the current leadership have been very clear: if you use AI to boost your revenue, you better have a human-in-the-loop making sure it's legal.

The Amniotic Graft Scandal

You might have missed one of the most heartbreaking parts of the recent cases. In Arizona and Nevada, five medical professionals were charged in an $1.1 billion scheme involving amniotic wound grafts.

These weren't just "unnecessary" procedures. They were targeted at elderly patients, many of whom were in hospice. They were applying expensive grafts to people who were literally in their final days, just to bill the government. It’s that kind of stuff that makes the DOJ move from civil fines to "see you in prison for 20 years."

It’s Not Just "Bad Doctors" Anymore

Large corporations are feeling the heat too. Walgreens recently agreed to a $300 million settlement for filling invalid prescriptions for opioids. Pfizer (through a subsidiary) had to cough up nearly $60 million over kickback allegations involving speaker fees for doctors.

Then you have the CVS/Omnicare case. A court recently held a corporate parent company liable for $164.8 million in penalties even though the jury found no distinct financial loss. Think about that. You can be hit with a massive fine just for participating in a flawed claims process, even if the government didn't technically "lose" money. The law cares about the integrity of the system, not just the balance sheet.

What Most People Miss About the False Claims Act

The FCA is the government's favorite weapon. Why? Because of whistleblowers (or "relators").

In 2024, the DOJ recovered over $2.9 billion through the FCA. A huge chunk of that came from people inside the companies—nurses, billers, even IT guys—who saw something fishy and called a lawyer. In 2025, those numbers are projected to go even higher.

There’s a common misconception that the DOJ only cares if you intended to steal. Not true. Under the "SuperValu" standard (a Supreme Court ruling), if you suspected your billing might be wrong and you didn't check, that's enough for a "knowing" violation. Ignorance isn't a defense; it’s evidence.

Actionable Steps for 2026

If you're in the industry, "compliance" can't just be a dusty binder on a shelf. It has to be active.

👉 See also: Today Gold Rate: Why Everyone is Frantically Checking Prices This Week

- Audit your AI. If you’re using software to suggest CPT codes, you need a "governance memo." Document why you chose that tool and how you’re checking its work.

- Watch the "Outliers." Use the same data the feds use. Check the CMS Provider Utilization and Payment Data. If your billing patterns look like a mountain peak compared to your peers' flat plains, you're a target.

- Hospice and Wound Care. These are the current "hot zones." If you're in these spaces, triple-check your medical necessity documentation.

- Listen to internal complaints. Most DOJ investigations start because a whistleblower felt ignored by their own boss. If an employee says the billing looks "aggressive," don't fire them. Investigate it.

The DOJ isn't slowing down. With the new Data Fusion Center and a massive budget for "Operation Gold Rush" follow-ups, doj health care fraud enforcement is no longer a risk—it's a certainty for those who cut corners.

To protect your organization, your next move should be a "risk-adjustment" audit of any third-party coding vendors you use. Ensure they aren't using "nudge" language to influence clinicians into higher-paying, less-accurate diagnoses.