If you’ve ever stood at a currency exchange counter in Dakar or Douala, you know that heart-sinking feeling of watching the numbers flicker. One day your dollar buys you a decent dinner; the next, you’re looking at the receipt wondering where those extra few thousand francs went. Converting dollar en francs CFA isn't just a simple math problem you solve on your phone. It’s a wild ride through global politics, the ghost of the French Treasury, and the current mood of the Federal Reserve in Washington.

Right now, as we move through January 2026, the rate is hovering around 563 to 565 FCFA for a single US dollar. But that number is a liar. It changes while you’re sleeping. It changes because of a grain shipment in Chicago or a speech in Brussels.

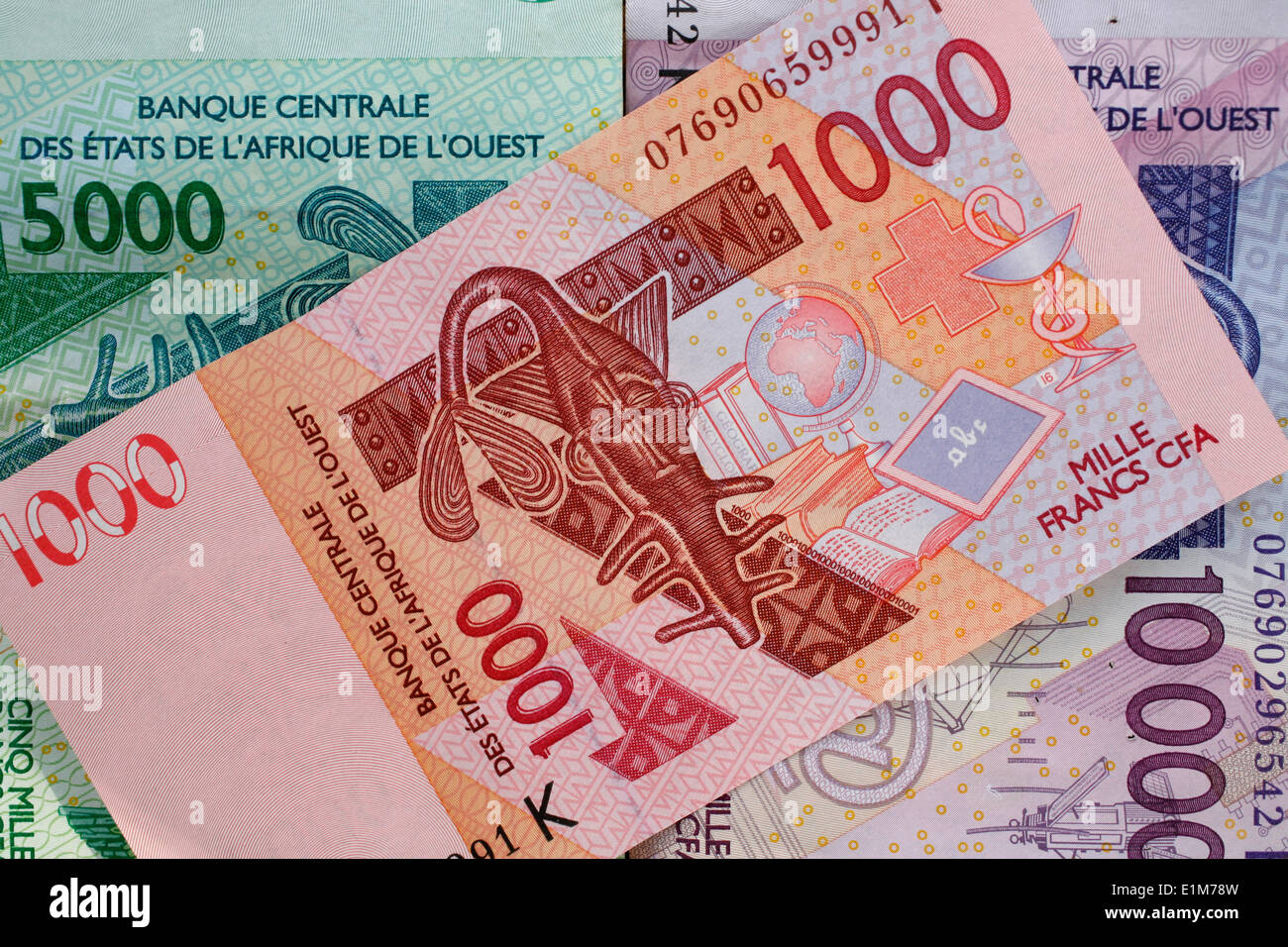

Honestly, most people think the CFA is one single currency. It isn't. You've got the West African CFA (XOF) and the Central African CFA (XAF). They have the same value, sure, but they are managed by different central banks. If you try to spend a Senegalese bill in Gabon, you’re going to have a bad time.

Why the Rate Is Doing What It’s Doing

The CFA franc is "pegged" to the Euro. This means the relationship between the dollar and the CFA is basically just a mirror of the Euro-Dollar relationship. If the Euro gets punched in the gut, the CFA feels the bruise. Currently, the fixed rate is roughly 655.957 FCFA to 1 Euro.

🔗 Read more: What Stocks Will Boom in 2025: Why Most Investors Get the Timing Wrong

So, when you see the dollar strengthening against the Euro—maybe because the US economy is looking "too good" and keeping interest rates high—the cost of buying dollar en francs CFA shoots up. For a business owner in Abidjan importing electronics, this is a nightmare. You pay for your goods in USD, but you sell them in FCFA. If the dollar jumps from 550 to 600, your profit margin just evaporated into thin air.

- The Euro Link: The French Treasury guarantees the convertibility. It's controversial, but it keeps the CFA stable compared to the Nigerian Naira or the Ghanaian Cedi, which sometimes drop like stones.

- The Federal Reserve Factor: If the US keeps rates high to fight inflation, investors flock to the dollar. This makes it more expensive for everyone else.

- Commodity Prices: Oil and cocoa. Africa’s big exports are priced in dollars. When the dollar is strong, those exports bring in more "value," but the cost of imported fuel (also in dollars) cancels it out.

The Hidden Costs of Small Transfers

Let’s talk about the "tourist trap" of exchange. If Google tells you 1 dollar is 564 FCFA, and you go to a local bureau de change, they might offer you 540. That's a huge "spread."

Banks are often worse. They hide their fees in the exchange rate itself. You think you’re getting a deal, but you’re actually paying a 3% or 5% tax just for the privilege of switching currencies. For someone sending $500 home to family, that’s $25 lost to the void. That buys a lot of rice.

📖 Related: Why True Value Quitman TX is Still the Heart of Wood County DIY

Digital platforms like Wise or Revolut have started changing the game in West Africa. They use the mid-market rate—the one you actually see on Google. But even then, you have to watch out for the withdrawal fees at the local ATM. Local banks like Ecobank or Attijariwafa have their own rules.

What Really Happened in 2025

Looking back at the last year, the dollar en francs CFA rate has been surprisingly volatile. We saw it dip toward 555 in late December 2025, only to climb back up toward 565 by mid-January 2026. This isn't random.

The European Central Bank (ECB) has been playing a game of chicken with inflation. Because the CFA is tied to the Euro, West African nations are essentially passengers on a plane they don't fly. When the ECB raises rates, the CFA gets stronger against the dollar. When they cut, the dollar gains ground. It's a weird kind of "monetary colonialism" that economists like Kako Nubukpo have been criticizing for years.

🔗 Read more: Finding Peace at Ourso Funeral Home Donaldsonville Louisiana: What You Need to Know

The ECO Flip: Is the CFA Dying?

You've probably heard the rumors about the "ECO." It’s the proposed replacement for the West African CFA. The idea is to break the tie with France and move toward a more independent currency for the ECOWAS bloc.

But here is the reality: they've been talking about this for decades. The launch date keeps moving. Why? Because the stability of the CFA—as annoying as the French control is—actually prevents the hyperinflation that has wrecked neighboring economies. If the ECO happens and it isn't pegged to the Euro, your dollar en francs CFA calculations will become a lot more stressful. You'll be checking the rate every hour, not every week.

How to Protect Your Money

If you’re dealing with larger sums, don't just "buy and hope."

- Watch the EUR/USD pair: If the Euro is trending down, buy your dollars now. Don't wait.

- Use Multi-Currency Accounts: Platforms like Wise allow you to hold balance in USD and only convert to XOF when the rate is in your favor.

- Avoid Airports: This is common sense, but the exchange rate at the Blaise Diagne International Airport is basically highway robbery. Get just enough for a taxi, then find a bank in the city.

- Negotiate: In many Central African cities, if you have crisp, $100 bills (the new blue ones), you can often negotiate a better rate than the official board says. They want the "hard" currency.

The dollar en francs CFA relationship is a window into how the global economy treats Africa. It’s stable, yes. But that stability comes at the cost of flexibility. As a traveler or a business person, your best tool is timing. Don't let the "official" rate fool you into thinking the price is fixed. It's a moving target.

Keep an eye on the news out of the US Labor Department. When US jobs reports come out strong, the dollar usually flexes its muscles. That means your CFA will buy less. Conversely, if the US economy shows signs of a "soft landing" or a slowdown, you might see the CFA regain some ground.

Actionable Next Steps

To get the most out of your money, stop using traditional bank transfers for small amounts. Check the current mid-market rate on a reliable financial site first. If the "buy" rate offered to you is more than 10 points away from that mid-market rate, you're being overcharged. For business owners, consider hedging your currency risk by keeping a portion of your reserves in a dollar-denominated account. This acts as a buffer when the CFA inevitably fluctuates against the greenback. Consistently monitor the Euro's performance against the dollar, as that is the true engine driving your local currency's value.