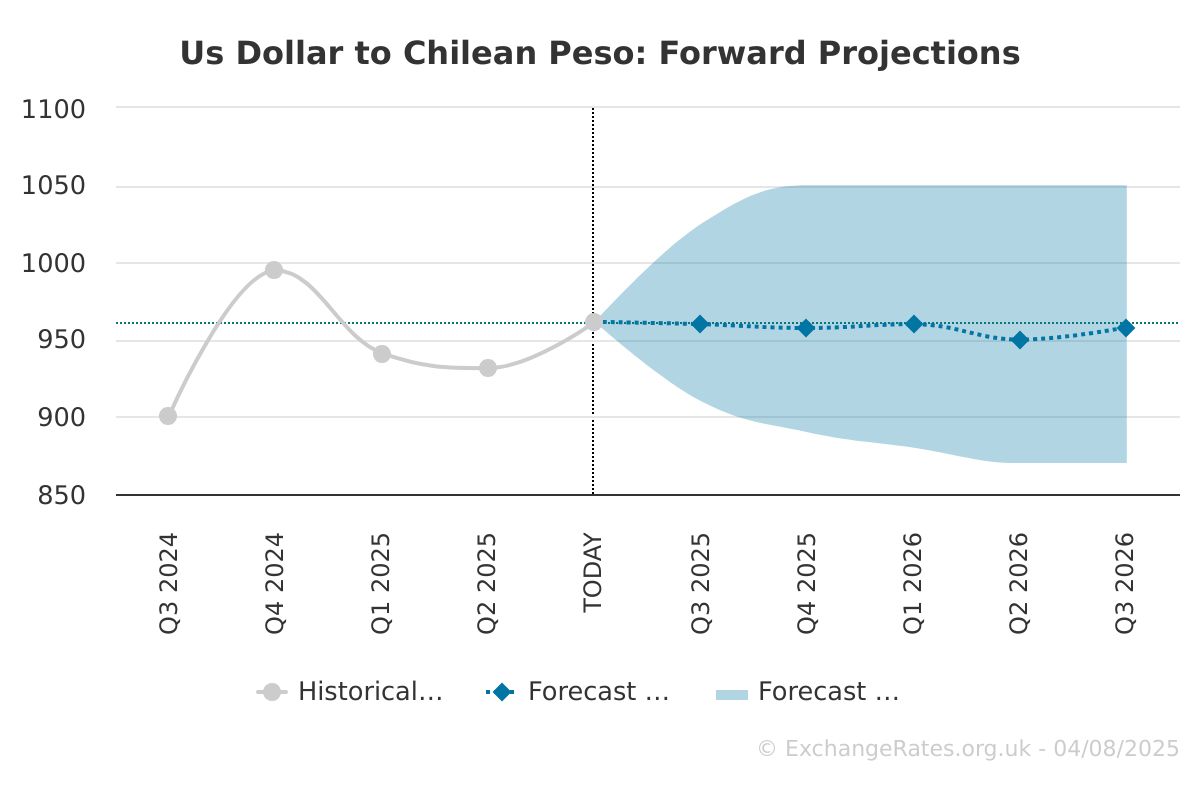

If you’ve looked at the dollar to chilean peso exchange rate lately, you probably noticed something weird. The peso is actually holding its own. Honestly, after the roller coaster of 2024 and 2025, seeing the USD/CLP pair dip back toward the 884.96 mark in January 2026 feels like a fever dream for anyone who was paying 1,000 pesos for a dollar just a year ago.

It’s tempting to think this is just a random market fluke. But it isn't.

The reality of the Chilean economy right now is tied to a "perfect storm" of copper prices and a massive shift in local politics. If you're trying to figure out whether to buy dollars now or wait, you have to look past the ticker tape. The relationship between the "Greenback" and the "Red Metal" has never been more intense than it is right now.

Why the Dollar to Chilean Peso keeps dropping (for now)

Basically, Chile is riding a copper wave that hasn't been seen in decades. As of mid-January 2026, copper is trading at over $5.70 per pound on the London Metal Exchange. Some analysts, like the team at J.P. Morgan, are even whispering about $6.00 before the second quarter ends.

Why does this matter for your wallet?

👉 See also: User Journey Map Examples: Why Your UX Maps are Failing and How to Fix Them

Chile is the world's top copper producer. When the world screams for copper—thanks to AI data centers and the endless push for electric grids—dollars flood into the Chilean treasury. When there are more dollars floating around Santiago, the "price" of those dollars (the exchange rate) naturally drops.

But there’s a catch.

While the Chilean Peso (CLP) has appreciated recently, the Central Bank of Chile (BCCh) isn't exactly sitting on its hands. They’ve been busy. In December 2025, they cut the interest rate to 4.5%. They are aiming for a "neutral" rate of about 4% later this year because inflation is finally cooling off toward their 3% target.

Here is the weird part: usually, when a country cuts interest rates, its currency gets weaker. Investors move their money elsewhere to find higher returns. Yet, the peso is staying strong. That tells you just how powerful the "Copper Effect" is right now.

The "Kast Factor" and Market Confidence

You can't talk about the dollar to chilean peso without mentioning the December 2025 presidential election. José Antonio Kast’s landslide victory sent a very specific signal to Wall Street: Chile is "open for business" again.

👉 See also: What Bill Is Jackson On? The Surprising Irony Of The $20

Markets hate uncertainty. For the last few years, Chile felt like a question mark. Now, with a pro-growth agenda on the table and plans to slash mining red tape, investors are betting on a massive 10% to 20% jump in copper production over the next two years.

ING analysts recently noted that Chile has basically landed on the "right side" of the geopolitical tracks. While other Latin American currencies are wobbling under the weight of political shifts or US trade tensions, the peso is being treated as a safe haven in the region.

It’s kinda funny. A few years ago, people were moving their savings out of Chile in a panic. Now? Those same people are wondering if they should have kept their money in pesos.

Breaking down the numbers

To give you an idea of the current momentum, look at the first two weeks of January 2026:

- January 2: 906.06 CLP

- January 9: 894.63 CLP

- January 15: 884.96 CLP

That is a 2.3% gain for the peso in just a fortnight. In the world of currency trading, that’s a sprint, not a jog.

What most people get wrong about "The 900 Floor"

There is this psychological barrier at 900 pesos. People think that if the dollar stays below 900, everything is cheap. If it goes above, it's a crisis.

The truth is more nuanced.

A "strong" peso isn't a win for everyone. If you’re a fruit exporter in the Central Valley, a rate of 880 is actually painful. You’re getting fewer pesos for every crate of grapes or cherries you send to China or the US, but your labor costs in Chile are still rising.

On the flip side, if you're a tech nerd in Providencia wanting the new iPhone or a business owner importing industrial machinery, this is your golden era. Your buying power has effectively increased by 10% compared to the start of 2025.

Watch out for the "Reserve Trap"

The Central Bank of Chile is currently in the middle of a massive three-year program to buy $18.5 billion in reserves. They started this in August 2025. Every day, they buy about $25 million.

This is essentially the bank saying, "We don't want the peso to get too strong."

They are stocking up on dollars now so that if copper prices crash in 2027 or 2028, they have a "war chest" to defend the currency. If you see the dollar to chilean peso rate suddenly spike by 10 or 15 pesos for no reason, it might just be the Central Bank stepping in to keep things from getting out of hand.

How to play the current rate

If you are living in Chile or doing business there, the current stability is a gift, but it's a fragile one. Goldman Sachs has warned that while demand for copper is structural (it's not going away), a global surplus of supply could prevent the metal from staying above record highs forever.

📖 Related: Finding the Office Depot Telephone Number Without Getting Stuck in a Loop

If copper dips back to $4.50, the dollar will likely head straight back to 950 CLP.

The "Golden Window" for the dollar to chilean peso exchange rate is likely happening right now, in the first half of 2026. Inflation is hitting that 3% sweet spot, the mining sector is bullish, and the political dust has settled.

What you should do next:

- For Travelers: If you're planning a trip outside Chile, lock in your USD now. Historically, the peso struggles to stay this strong for more than a few months at a time.

- For Investors: Keep a close eye on the "Mantoverde" mine strike and other labor disputes. Chilean labor relations are tense, and one big strike can choke off copper supply, sending the peso into a tailspin regardless of what the Central Bank does.

- For Small Businesses: Use this period of a "cheap" dollar to upgrade your equipment. Importing tech and machinery is significantly more affordable at 885 than it was at 980.

Don't wait for the rate to hit 800. In the current global economy, with US tariffs being a constant "wildcard," waiting for a perfect bottom is a fool's errand. The current stability is as good as it gets for now.

Strategic Move: Set up a "layered" exchange strategy. Instead of converting all your funds at once, do it in 20% increments every two weeks. This protects you from the sudden volatility that usually hits the Chilean market toward the end of the first quarter when the "March effect" (resumption of school and business cycles) puts extra pressure on local liquidity.