Money isn't just numbers. It’s a story. When you look at the dow jones chart history, you aren't just seeing a zig-zagging line of stock prices; you’re looking at the heartbeat of the American project since 1896. Honestly, most people just glance at the current price and move on. That's a mistake.

Charles Dow didn't have a computer. He had a pencil. He started with just 12 companies—mostly railroads and smokestack industries—and averaged their prices together to see if the "vibe" of the economy was shifting. It was primitive. It was brilliant. Today, that index has survived world wars, the arrival of the internet, and a global pandemic that literally paused the world.

If you want to understand where we're going, you’ve gotta understand the scars on that chart.

The Early Years: When $100 Was a Big Deal

The Dow didn't start at thousands of points. It started at 40.94. Imagine that. You could buy the entire index for less than the cost of a decent dinner today. In the beginning, the dow jones chart history was basically a record of how many trains were moving coal and how much steel was being forged.

The first massive spike peaked in 1929. The Roaring Twenties weren't just about jazz and flappers; they were about a speculative frenzy that pushed the Dow to nearly 400 points. People thought they were geniuses. Then, the floor fell out.

By 1932, the Dow had lost roughly 90% of its value. Think about that for a second. If you had a dollar, you now had a dime. It took until 1954 for the index to return to its 1929 highs. Twenty-five years of waiting just to get back to even. That’s the part of the chart history that people forget when they talk about "buying the dip." Sometimes the dip lasts a generation.

The Long Sideways Grind (1966–1982)

There is a massive "dead zone" in the middle of the dow jones chart history that scares the hell out of historians. Between 1966 and 1982, the Dow basically went nowhere. It would hit 1,000, fall back, hit 1,000 again, and fall back.

Inflation was eating everyone alive.

Even though the "price" of the index stayed somewhat stable, the purchasing power was evaporating. If you look at a chart from that era, it looks like a flat ECG. No heartbeat. It wasn't until the early 80s, when interest rates finally started to cool down and the tech revolution began to stir, that the index finally broke out of that 1,000-point ceiling. Once it broke, it didn't look back.

Black Monday and the Speed of Gravity

October 19, 1987. It’s a day etched into the brain of every veteran floor trader. The Dow dropped 22.6% in a single day. One day.

There was no "reason" in the traditional sense. No war started. No bank failed. It was a failure of the systems themselves—program trading and "portfolio insurance" creating a feedback loop of selling. Looking at the dow jones chart history, 1987 looks like a sharp needle prick. It was terrifying at the time, but if you zoom out, it’s just a tiny blip on the way to the moon.

That’s a huge lesson. The chart proves that the market can be irrational in the short term, but it tends to reflect reality in the long term. By 1989, the market had already recovered all those losses.

The Modern Era: Trillions and Tech

The composition of the index changed. General Electric—the last of the original members—was finally kicked out in 2018. It was replaced by Walgreens, which was later replaced by Amazon. The Dow isn't a museum; it's a living organism.

We saw the Dot-com bubble burst in 2000.

We saw the Great Financial Crisis in 2008.

We saw the COVID-19 crash in 2020.

Each time, the dow jones chart history shows the same pattern: a vertical drop that feels like the end of the world, followed by a slow, agonizing climb, followed by new all-time highs. In 2024 and 2025, we’ve seen the index push past 40,000. It sounds like a big number, and it is, but it’s really just the mathematical result of corporate earnings growing and the dollar losing value over time.

Why the "Price-Weighted" Thing Matters

Here is a weird quirk about the Dow that almost everyone gets wrong: it’s price-weighted. This is kinda dumb, honestly.

Most indexes, like the S&P 500, are market-cap weighted. That means the bigger the company, the more it moves the index. The Dow is different. It’s based on the share price. So, a company with a $500 stock price has more influence on the Dow than a company with a $50 stock price, even if the $50 company is ten times bigger in total value.

👉 See also: Within the Hour Means Exactly This: Navigating Delivery Realities and Deadlines

When you analyze the dow jones chart history, you have to account for stock splits. When a company splits its stock, its influence on the Dow drops. It’s an archaic way to run an index, but we keep using it because it’s the oldest record we have. It’s the "Old Man" of Wall Street.

Actionable Insights for Your Portfolio

Looking at a century of data is useless if you don't do something with it. Here is how to actually use the history of the Dow to make better decisions.

1. Ignore the "Points," Watch the Percentages

When the news screams "Dow Drops 1,000 Points!", it sounds catastrophic. But 1,000 points when the Dow is at 40,000 is only a 2.5% move. In 1929, a 1,000-point drop would have meant the index went into negative territory. Always calculate the percentage.

2. The 200-Day Moving Average is Your Friend

Historians and technical analysts love the 200-day moving average. Throughout the dow jones chart history, when the index stays above this line, we are generally in a healthy bull market. When it stays below it for more than a few weeks? That’s usually a sign that something is fundamentally broken in the economy.

3. Zoom Out to 10 Years

If you look at the Dow on a daily or monthly basis, it looks like chaos. It’s a mess of noise and talking heads. If you look at it in 10-year blocks, it’s almost always an upward diagonal line. History shows that the biggest risk isn't the market falling; it's not being in the market when it's rising.

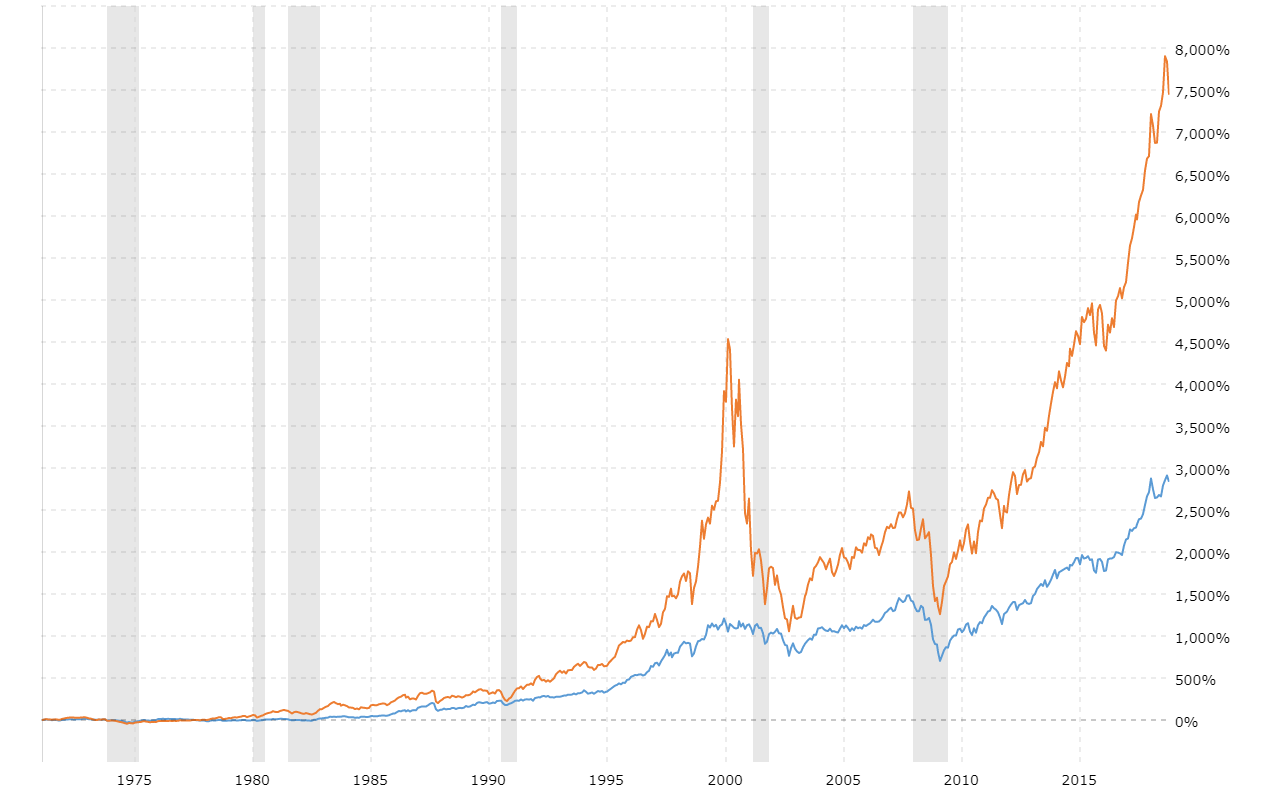

4. Dividends are the Secret Sauce

If you look at a "price-only" chart of the Dow, you’re only seeing half the story. If you look at a "Total Return" chart—which assumes you took the dividends paid by those 30 companies and bought more stock—the growth is staggering. Reinvesting dividends is the only reason the Dow works as a long-term wealth builder.

5. Check the Components Periodically

The Dow changes. It’s not a static list. If you’re tracking the dow jones chart history, keep an eye on when the S&P Dow Jones Indices committee swaps companies out. They usually dump losers and add winners. This "survivorship bias" is why the index tends to go up over long periods; the failures are removed, and the champions are added.

📖 Related: South Africa Currency to PKR: Why the ZAR-Rupee Rate is Shifting Right Now

The chart isn't a crystal ball. It won't tell you what will happen tomorrow at 10:00 AM. But it does tell you that for over 130 years, the collective ingenuity of the largest American companies has managed to overcome every war, recession, and political crisis thrown at it. Betting against that line has historically been a very expensive mistake.

Next Steps for Investors:

- Compare the current Dow price to its 52-week high to gauge "overbought" sentiment.

- Research the "Dogs of the Dow" strategy, which focuses on the highest-yielding members of the index at the start of each year.

- Use a logarithmic scale when viewing long-term charts to better visualize percentage growth rather than raw point increases.