If you were hoping to see the ticker tape fly this Monday, January 19, 2026, I've got some news that might bum you out: the New York Stock Exchange and the Nasdaq are taking the day off. It’s Martin Luther King Jr. Day, so the physical pits and electronic exchanges in the U.S. will be quiet. But if you’re a seasoned trader, you know the "market" never actually sleeps.

Basically, while Wall Street sleeps, the world keeps spinning. Dow Jones futures for Monday will still be flickering on screens across London, Tokyo, and Singapore. These "overnight" sessions are where the real drama often starts, especially with the way 2026 has kicked off. We’ve seen the Dow flirt with 49,000 recently, but this calm Monday might just be the eye of a very busy storm.

The Ghost Market: How Futures Move When the NYSE is Closed

On Monday, most U.S.-based equity futures—including those tracking the Dow, S&P 500, and Nasdaq—will trade on a shortened schedule. Usually, the CME Group keeps things running until about 11:30 AM or 1:00 PM ET before hitting the pause button for the holiday.

Why does this matter?

Because the "smart money" is watching the IMF's World Economic Outlook Update, which drops precisely on Monday, January 19. While you’re having your morning coffee, Pierre-Olivier Gourinchas and his team at the IMF will be in Brussels laying out the 2026 roadmap. They’ve already signaled that global growth is slowing to around 3.1%. If they paint a darker picture than that, those Dow Jones futures could start bleeding red before the first American trader even wakes up on Tuesday.

What’s Actually Driving the Numbers Right Now?

Honestly, the mood is a bit weird. On one hand, the Dow hit record highs last week. On the other, investors are sweating over President Trump’s proposed 10% cap on credit card interest rates.

That policy hit the big banks hard. JPMorgan Chase, Bank of America, and Wells Fargo all saw their stocks dip mid-January as the market tried to figure out if this was just a "Truth Social" post or a real-world regulation. If you’re watching the Dow Jones futures for Monday, you’re essentially watching a real-time confidence vote on these populist economic shifts.

The Venezuelan Oil Factor

Remember that wild news from early January? The capture of Nicolás Maduro and the subsequent deal to bring 30 to 50 million barrels of Venezuelan oil to the U.S. basically broke the energy market. Crude prices (WTI) have been hovering near $60, which is great for inflation but tricky for the energy-heavy components of the Dow like Chevron.

Lower energy costs usually act like a tax cut for consumers. But in 2026, with a "K-shaped" economy—where AI tech is booming while the rest of the world feels a bit sluggish—those cheaper gas prices might not be enough to save a retail sector that’s been struggling since the 43-day government shutdown ended late last year.

Earnings Fever: The Tuesday Morning Hangover

The real reason to keep an eye on Dow Jones futures for Monday is because of the "Earnings Wall" waiting on Tuesday morning. We are in the thick of Q4 2025 results.

Here is what is hitting the wires as soon as the holiday ends:

- 3M and Johnson & Johnson: Two massive Dow components that will tell us if the "Industrial America" story is still alive.

- Netflix and Intel: These are the sentiment drivers. If Intel misses (again), it drags the whole "chips and tech" narrative down with it.

- Visa: This is the big one. With the talk of credit card rate caps, Visa’s guidance is going to be the most scrutinized document on Wall Street.

If the futures are trading flat or slightly down on Monday, it’s often just "holiday noise." But if they drop more than 0.5%, it means the big hedge funds are front-running a bad Tuesday morning.

💡 You might also like: Why the haves and the have nots is a Gap That’s Only Getting Wider

The Fed’s "Higher for Longer" is Back (Sorta)

There’s this guy, Michael Feroli over at J.P. Morgan, who basically ruined everyone's New Year by predicting the Fed won't cut rates at all in 2026.

The market was pricing in at least two cuts. Now? Everyone is second-guessing. Unemployment is sitting at a healthy 4.4%, and the "Miran-led" FOMC is split. Some want to cut to help the labor market, while others are terrified that inflation is stuck at 3%.

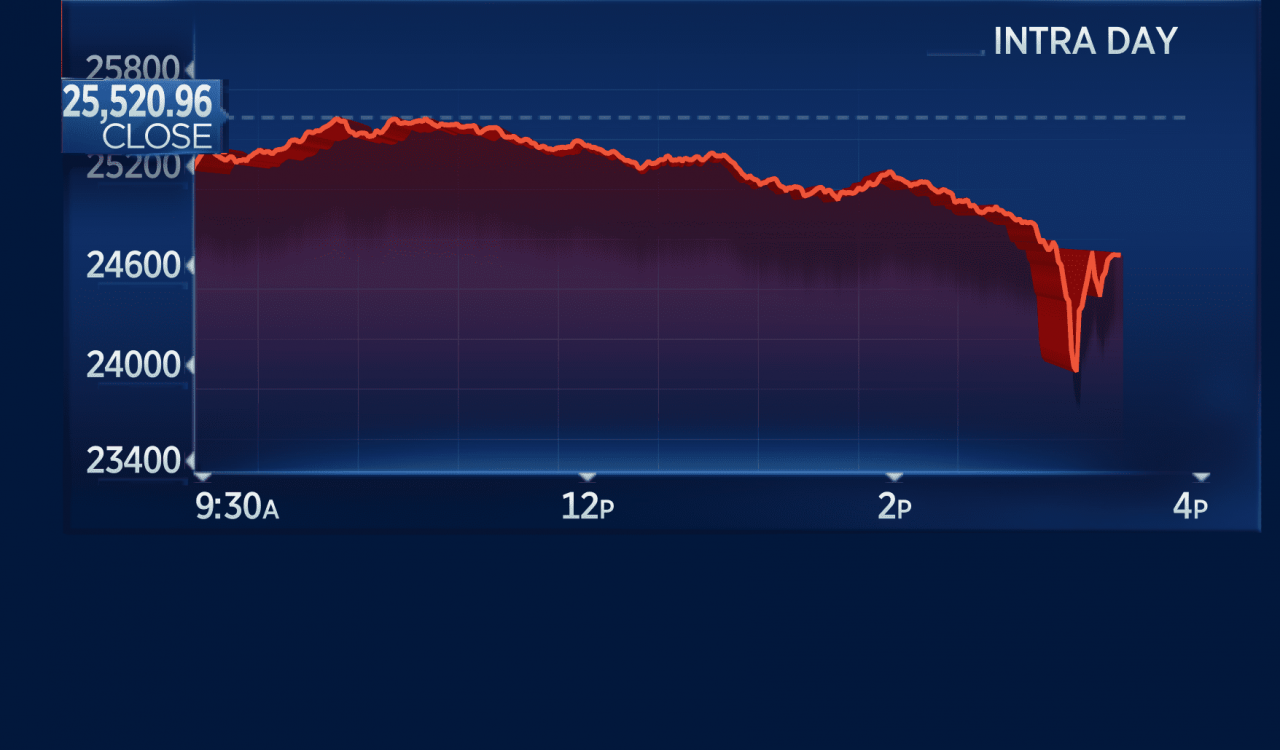

Monday's thin trading volume can exaggerate these fears. A small sell order in a low-liquidity holiday market can move the needle more than it should. Don't panic if you see a 200-point swing; it's often just the lack of buyers on a holiday.

How to Trade the Monday Lull

If you’re looking for actionable moves, don't get chopped up in the intraday futures volatility. Instead, look at the yield curve. 10-year Treasury yields are hovering around 4.15%. If those start creeping toward 4.30% while the Dow futures are stagnant, it tells you the market is bracing for "sticky inflation" news later in the week when the PCE (Personal Consumption Expenditures) data drops.

Strategic Checklist for the Week Ahead:

- Watch the IMF Briefing: It happens at 4:30 AM ET on Monday. If the word "recession" appears more than five times in the transcript, the futures will react.

- Monitor the $50,000 Level: The Dow is close to a massive psychological milestone. If we break it, FOMO (Fear Of Missing Out) will drive the Tuesday open. If we reject it on Monday's thin trade, expect a pullback.

- The "Trump Trade" Pivot: Keep an eye on any news regarding the 10% interest rate cap. Financials make up a huge chunk of the Dow Jones Industrial Average. If that proposal gains steam, the Dow will underperform the Nasdaq.

Basically, Monday is for homework. Use the holiday to look at the blended earnings growth rate, which is currently sitting at 8.2%. If companies start missing that bar on Tuesday, the Dow Jones futures for Monday will look like the high-water mark for the month.

Don't let the "Closed" sign on the NYSE fool you. The most successful traders use these holiday windows to spot the divergence between what the world thinks (global futures) and what America expects (the Tuesday open). Keep your eyes on the data coming out of Brussels and the pre-market moves of the big banks.

Tuesday morning is going to be loud. Use Monday to decide if you're buying the dip or catching a falling knife.