You're looking at your phone, checking the red and green flickers of the morning market open, and you see three different numbers. One is up. One is flat. The other is tanking. Honestly, it’s enough to make anyone feel a bit scattered. People talk about "the market" like it’s a single, breathing organism, but that’s just not how it works. When someone says the market is up, they might be looking at the Dow Jones, while your tech-heavy portfolio is actually bleeding because the Nasdaq is having a rough day.

It’s confusing.

The S&P 500 is usually the one the pros care about, yet the evening news still leads with the Dow. Why? Because tradition dies hard, even when the math behind it is kind of weird. If you want to actually understand where your money is going, you have to stop treating these three as interchangeable synonyms for "stocks." They are fundamentally different tools built with different philosophies.

📖 Related: Toronto Dominion Bank Stock: What Most People Get Wrong About the Recovery

The Dow Jones is a weird old relic (that we still love)

Let’s start with the Dow Jones Industrial Average. It’s the oldest of the bunch, founded by Charles Dow back in 1896. Back then, the economy was about railroads and smoke-belching factories. Today, it’s 30 "blue-chip" companies. Think Apple, Goldman Sachs, and Disney.

But here is the kicker: the Dow is price-weighted.

This means the actual share price of a stock determines its influence on the index. If a company has a stock price of $400, it has more "weight" in the Dow than a company with a stock price of $50. It doesn’t matter if the $50 company is actually ten times larger in total market value. It’s a bizarre way to measure things by modern standards. If UnitedHealth (a high-priced stock) has a bad day, the Dow might drop significantly, even if the other 29 companies are doing fine.

Critics like to say the Dow is a narrow, outdated snapshot. They aren't wrong. Yet, it persists because it represents the "establishment." It’s the vibe check for the American corporate giants. When people ask "How did the market do?" they usually want a quick, digestible number, and the Dow provides that psychological shorthand.

Why the S&P 500 is the actual heavyweight champion

If the Dow is a snapshot, the S&P 500 is a wide-angle lens. Most institutional investors and pension funds use this as their primary benchmark. Why? Because it’s market-cap weighted.

Basically, the bigger the company’s total value (shares multiplied by price), the more it moves the needle. Microsoft and Nvidia have a massive impact here because they are trillion-dollar behemoths. A tiny company at the bottom of the 500 list could go bankrupt tomorrow and the index would barely flinch.

It covers about 80% of the available market value in the U.S.

The diversification myth

A lot of people think 500 companies means you're perfectly diversified. That’s not quite true anymore. In recent years, the S&P 500 has become increasingly "top-heavy." A handful of massive tech companies now make up a huge percentage of the index's total movement. We saw this clearly in 2023 and 2024; if the "Magnificent Seven" were up, the whole index looked great, even if the average mid-sized company was struggling to stay afloat.

It’s the most accurate reflection of the U.S. economy’s overall health, but you have to realize you’re mostly betting on the giants at the top.

The Nasdaq is basically a tech fever dream

Then we have the Nasdaq Composite. Or, more specifically, the Nasdaq-100.

📖 Related: 535 Fifth Ave NYC: Why This Midtown Corner Still Commands So Much Attention

If you want to know how people feel about the future, look here. The Nasdaq is where the growth lives. It’s heavily skewed toward technology, biotech, and internet companies. You won’t find many old-school banks or oil companies here.

It’s volatile.

When interest rates go up, the Nasdaq usually gets punched in the mouth. That’s because tech companies often rely on future earnings and borrowing to grow. When money gets expensive, those future profits look less attractive today. But when the AI hype train leaves the station? The Nasdaq leaves the Dow and S&P in the dust.

It’s the home of innovation, but it’s also where bubbles tend to form. Remember the dot-com crash? That was a Nasdaq story.

Comparing the big three in the real world

| Feature | Dow Jones (DJIA) | S&P 500 | Nasdaq Composite |

|---|---|---|---|

| Number of Stocks | 30 | ~500 | 2,500+ |

| Weighting Method | Price-weighted | Market-cap weighted | Market-cap weighted |

| Main Flavor | Blue-chip, "Old Guard" | Broad market, "The Standard" | Tech, Growth, Innovation |

| Volatility | Generally lower | Moderate | Generally higher |

Most people don't realize that these three can move in completely opposite directions on the same day. Imagine a day where oil prices spike and big banks report great earnings, but a major chipmaker misses their forecast. The Dow might be up 1% because it’s full of banks and industrials. The Nasdaq might be down 2% because of the chip news. The S&P 500 would probably sit somewhere in the middle, trying to balance the two.

What most people get wrong about "The Market"

The biggest mistake is thinking these indexes are static. They aren't.

✨ Don't miss: Why PepsiCo Discontinued 30 Beverages (Including 9 Soda Flavors) This Year

Companies get kicked out and added all the time. Being added to the S&P 500 is a massive deal for a company because thousands of "index funds" are then forced to buy their stock. It creates an immediate surge in demand. Conversely, when a company loses its spot in the Dow, it’s a sign of a fading legacy.

Another misconception is that you can "buy" the index directly. You can't. You buy an ETF (Exchange Traded Fund) or a mutual fund that tracks them. Names like SPY (for S&P 500) or QQQ (for Nasdaq-100) are the vehicles people use to actually put their money where these numbers go.

The hidden role of the Federal Reserve

You can't talk about the Dow Jones Nasdaq and S&P without mentioning the Fed. Whether the index is 30 stocks or 3,000, they all react to interest rates. But they react differently.

- Nasdaq reacts violently to rate hikes.

- Dow often holds up better because its companies have "fortress balance sheets" and real cash flow.

- S&P sits in the crossfire, usually following the lead of whichever sector is currently dominating the news cycle.

Real world impact: Why does this matter to you?

If you're a casual investor with a 401(k), you probably own a lot of the S&P 500. It’s the default. But if you’re "chasing returns," you might find yourself loading up on Nasdaq-heavy funds without realizing the risk.

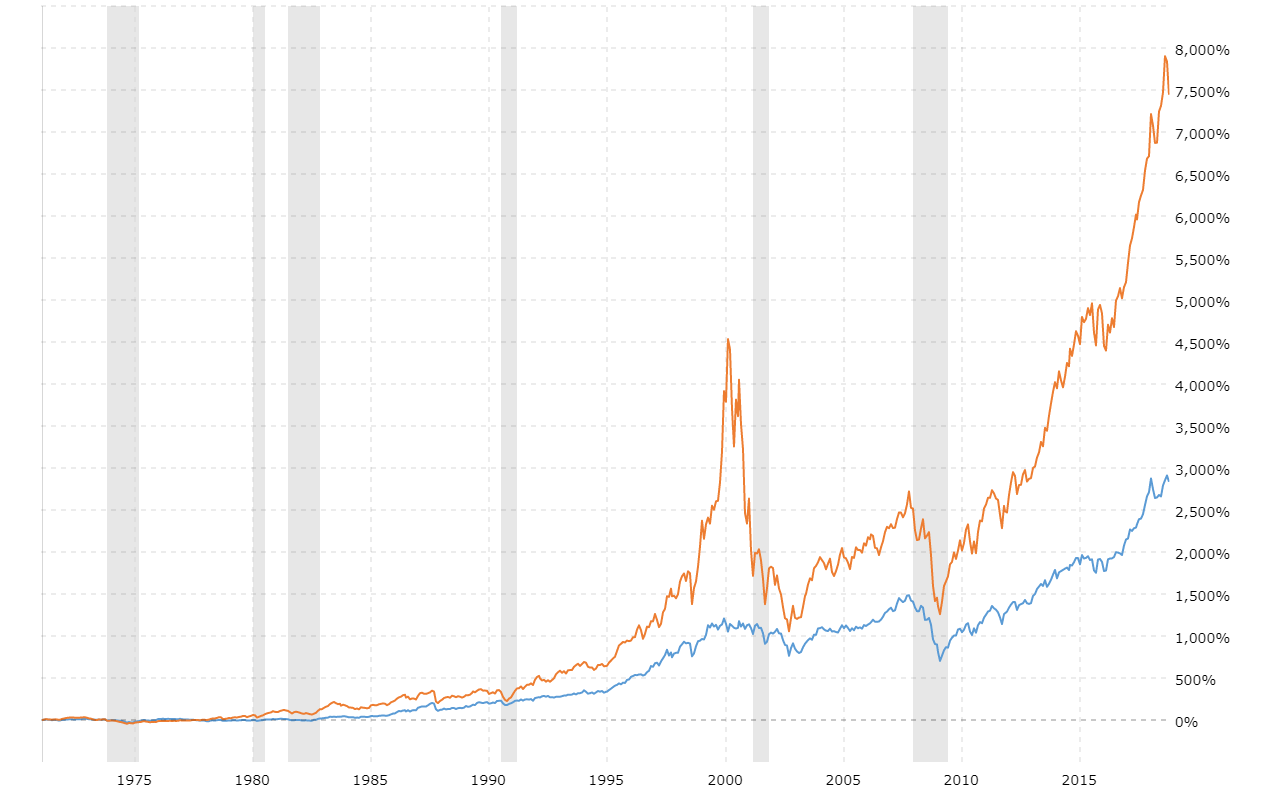

Think back to 2022. The Nasdaq lost about 33% of its value. The Dow only lost about 9%. If you were 100% in the Nasdaq because "tech always wins," that year felt like a catastrophe. If you were balanced across all three, it was just a bad year.

It’s about knowing which "flavor" of the economy you actually believe in. Do you believe in the steady, dividend-paying giants of the Dow? Or the world-changing, high-risk gambles of the Nasdaq?

Actionable steps for the smart investor

Stop checking just "the market." It’s too vague.

First, look at your brokerage account and see what your "benchmark" is. If you own mostly tech stocks, comparing your performance to the Dow is pointless. You should be comparing yourself to the Nasdaq.

Second, watch the S&P 500 Equal Weight Index. This is a version of the S&P where every company—from Microsoft to the smallest clothing retailer—counts the same. If the regular S&P 500 is going up but the Equal Weight version is flat, it means the "real" economy is struggling and only a few giant companies are holding the whole thing up. That’s a huge red flag that a lot of people miss.

Third, pay attention to "rebalancing" dates. Every quarter, these indexes adjust. It creates massive trading volume and can cause weird, short-term price swings that have nothing to do with a company’s actual value.

Understand that the Dow Jones, the Nasdaq, and the S&P 500 are just different ways of telling the same story. One tells it through the lens of history, one through the lens of size, and one through the lens of the future. To get the full picture, you really need to read all three.

Check your exposure. Diversify not just by company, but by index philosophy. That’s how you survive the swings.