If you’ve ever watched the news for more than five minutes, you've seen the ticker tape scrolling at the bottom of the screen. Red numbers. Green numbers. Big names like the "Dow," the "S&P," and the "Nasdaq." Most people treat them as interchangeable synonyms for "the stock market."

Honestly? They aren't. Not even close.

🔗 Read more: Web Design Services Law Firm Marketing Strategies: Why Most Firms Waste Their Budget

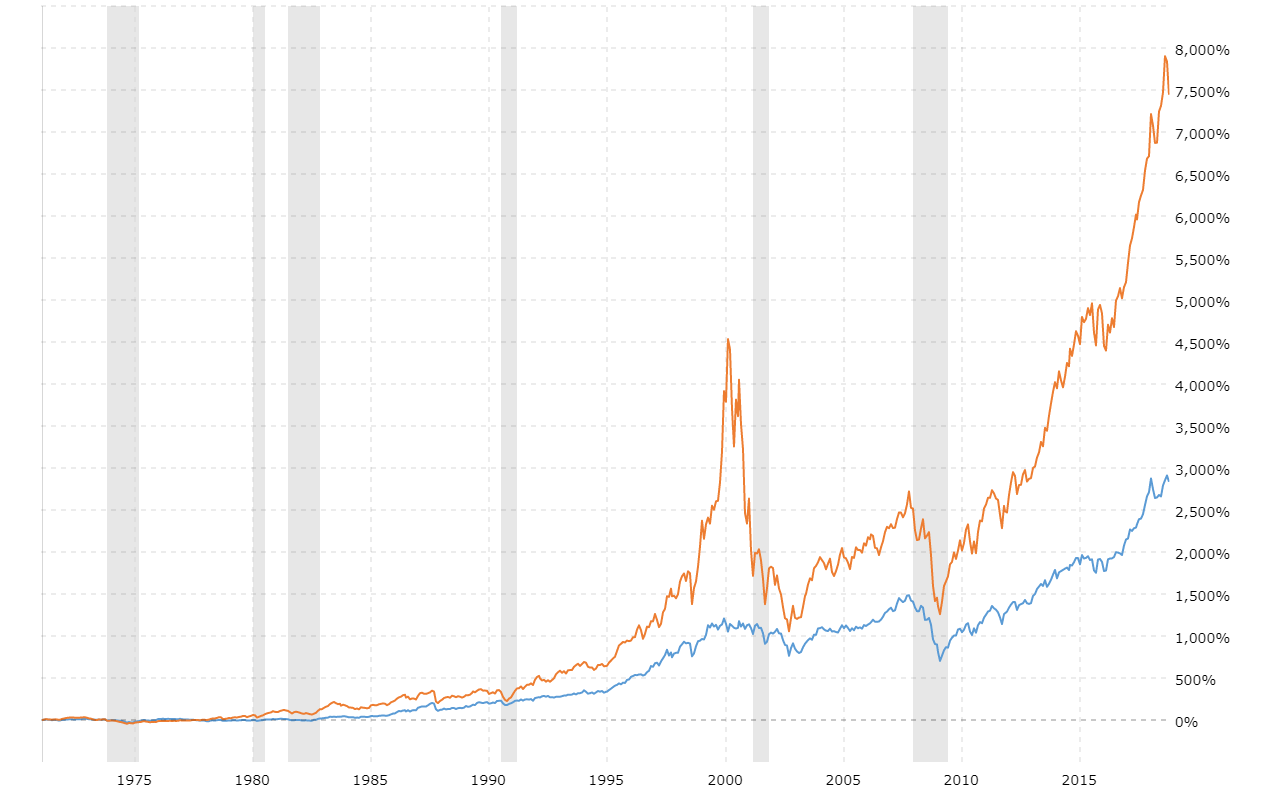

Comparing Dow Jones vs S&P 500 vs Nasdaq is like comparing a luxury sedan, a massive city bus, and a high-speed electric motorcycle. They all get you where you’re going (hopefully), but the ride feels completely different. Right now, in early 2026, the S&P 500 is flirting with the historic 7,000 mark. Meanwhile, the Dow is hovering near 49,000, and the Nasdaq Composite is bouncing around 23,000.

Why the massive price gaps? Why does the Nasdaq crash when the Dow stays flat? Understanding the "why" is basically the difference between "investing" and "gambling on vibes."

The Weird Way the Dow Works (And Why it’s Sorta Dated)

The Dow Jones Industrial Average (DJIA) is the oldest of the bunch. It’s the "Grandpa" index. Started by Charles Dow in 1896, it only tracks 30 companies. Just 30. Think about that. We have thousands of public companies in the U.S., but the media focuses on this tiny, hand-picked club of "Blue Chips."

But here is the truly weird part: the Dow is price-weighted.

In most indexes, the bigger the company, the more it matters. Not the Dow. In the Dow, a company with a $500 stock price has more influence than a company with a $50 stock price, even if the $50 company is actually ten times larger in total value.

- Who's in: Goldman Sachs, UnitedHealth, Microsoft, and (as of 2024) Nvidia and Amazon.

- The Vibe: It’s heavy on "old school" sectors like financials and industrials.

- The Catch: If a company does a stock split—cutting its price from $500 to $50—its influence on the Dow instantly vanishes. It’s a mathematical quirk that makes most professional fund managers roll their eyes.

S&P 500: The Real Heavyweight

When professionals talk about "the market," they are almost always talking about the S&P 500.

If the Dow is a tiny club, the S&P 500 is the entire neighborhood. It tracks roughly 500 of the largest U.S. companies. It uses market-cap weighting, which is just a fancy way of saying: "The bigger you are, the more you matter."

Because of this, the "Magnificent Seven" (Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla) basically drive the bus. When Nvidia had its monstrous run in 2025, the S&P 500 soared. If those seven companies have a bad Tuesday, the whole index bleeds, even if the other 493 companies are doing just fine.

As of January 2026, the S&P 500 is the ultimate benchmark. If your portfolio isn't beating the S&P 500, you're technically "underperforming the market." It’s the standard for 401(k)s and pension funds because it captures about 80% of the total value of the U.S. stock market.

Nasdaq: The Tech-Heavy Speedster

Then there’s the Nasdaq.

People usually mean the Nasdaq Composite, which tracks almost every stock listed on the Nasdaq exchange (over 3,000 companies). However, most investors actually trade the Nasdaq-100, which is just the 100 largest non-financial companies on that exchange.

👉 See also: The Bikini Beans Coffee Incident: Why This Arizona Stand Keeps Hitting the News

The Nasdaq is where the "growth" lives. It’s where you find the AI startups, the biotech firms, and the software giants. It has almost zero exposure to traditional banks or oil companies.

- The Highs: When tech is booming, the Nasdaq leaves the Dow in the dust. In 2025, the Nasdaq Composite returned over 21%, while the Dow managed about 15%.

- The Lows: When interest rates rise or tech valuations get "bubbly," the Nasdaq is the first to tank. It’s volatile. It’s the "thrill ride" index.

Dow Jones vs S&P 500 vs Nasdaq: Which One Should You Watch?

You’ve probably noticed that on some days, the Dow is up 200 points but the Nasdaq is down 1%. How?

It usually comes down to Sector Rotation.

Imagine the government announces a new cap on credit card interest rates (something President Trump suggested recently in early 2026). This hammers bank stocks like JPMorgan and Visa. Since banks are a huge chunk of the Dow, the Dow will probably drop. But because the Nasdaq doesn't really care about banks, it might stay green.

Conversely, if there's a "chip shortage" or a pivot in AI spending, the Nasdaq will fall off a cliff while the Dow—full of retailers like Walmart and Home Depot—might actually rise as investors move their money to "safer" spots.

Performance Comparison (Approximate 2025 Totals)

| Index | 2025 Total Return | Key Driver |

|---|---|---|

| Nasdaq Composite | ~21.1% | AI infrastructure and software growth |

| S&P 500 | ~17.9% | Broad participation across Big Tech and Healthcare |

| Dow Jones | ~14.9% | Strong performance in Financials and Industrials |

What Most People Get Wrong About Diversification

I see this all the time. An investor thinks they are "diversified" because they own an S&P 500 fund and a Nasdaq fund.

You aren't.

There is massive overlap. The top holdings in the S&P 500 are almost identical to the top holdings in the Nasdaq-100. You're basically just doubling down on Apple and Microsoft. If you actually want to balance your risk, you'd look at the Dow or even the Russell 2000 (which tracks small companies).

Small-cap stocks are actually starting to outpace the "big guys" in early 2026. The Russell 2000 is up over 4% so far this year, while the S&P 500 is up less than 1%. This suggests that the "money" is moving away from the giant tech monopolies and into smaller, domestic businesses that benefit from lower interest rates.

Actionable Insights for Your Portfolio

So, what do you do with all this? Don't just stare at the numbers. Use them.

- Check your overlap. If you own "The Market," you probably own a lot of tech. If you’re worried about an AI bubble, shifting some weight toward a Dow-tracking ETF (like DIA) can provide a "value" cushion.

- Watch the 10-year Treasury yield. In 2026, this has been the "gravity" for the Nasdaq. When the yield goes up, Nasdaq usually goes down. If you see yields dropping below 4%, that’s usually a green light for tech.

- Don't ignore the Dow's dividends. Because the Dow is full of established "mature" companies, it often pays better dividends than the Nasdaq. In a "sideways" market where prices aren't moving much, those dividends are your best friend.

- Stop obsessing over "points." A 400-point drop in the Dow sounds scary. But with the Dow at 49,000, that’s less than a 1% move. Always look at the percentage, not the raw number.

The "best" index doesn't exist. There's only the index that matches your goals. If you want steady growth and dividends, look at the Dow. If you want to bet on the future of humanity and can stomach the swings, it’s the Nasdaq. If you just want to "set it and forget it," the S&P 500 is still the undisputed king.

Next Step: Review your brokerage account and look at your "Top 10 Holdings." If you see the same five tech names appearing in multiple funds, you might be more exposed to a tech correction than you think. Consider adding a "Value" or "Equal-Weighted" index fund to balance the scales.