Small cap stocks are a wild ride. Honestly, if you can’t stomach seeing your portfolio drop 20% in a month, you probably shouldn't be looking at the DSP Small Cap Fund at all. It’s one of those funds that people flock to when the market is booming, only to panic-sell when things get messy. But here’s the thing: small caps aren't just about "high risk." They're about finding companies that are currently small but have the DNA to become tomorrow's giants.

Vinit Sambre, the veteran fund manager at DSP, has been navigating this space for a long time. He's known for a very specific style. He doesn't just buy anything that’s growing fast. He looks for "quality" growth. That sounds like marketing fluff, right? It’s not. In the small-cap world, "quality" usually means a company that actually generates cash and doesn't drown in debt. Many small companies look great on paper until a high-interest rate environment hits, and then they crumble. DSP tries to avoid those landmines.

The fund has a massive AUM (Assets Under Management) now. This is a double-edged sword. When a small-cap fund gets too big, it can’t move in and out of stocks easily. If they try to sell a huge stake in a tiny company, the price crashes before they’re even halfway done. This is why you’ll notice the DSP Small Cap Fund occasionally stops accepting lump-sum investments. They do it to protect existing investors from "dilution" and to ensure the manager isn't forced to buy mediocre stocks just because there’s too much cash sitting around.

🔗 Read more: Is Walmart Going To Be Open On Thanksgiving? What You Need To Know Before You Drive

How the DSP Small Cap Fund Actually Picks Stocks

Most people think small-cap investing is like gambling at a casino. It’s not. Well, it shouldn't be. The team at DSP uses a framework that focuses on "Business, Management, and Valuation."

They look for companies with a competitive moat. This is hard to find in small caps. Usually, these are niche players. Maybe a company that makes a specific chemical for the auto industry or a specialized software provider. The goal is to find businesses that can pass on rising costs to their customers. If a company can’t raise prices when inflation hits, it’s a bad small-cap bet. Period.

Management integrity is the second pillar. In large-cap companies like Reliance or HDFC, there’s a lot of institutional oversight. In small caps? Not so much. You’re basically betting on the founder. DSP’s team spends a lot of time doing channel checks—talking to suppliers, customers, and even former employees—to make sure the person running the show is clean.

Then there’s the valuation. This is where most retail investors fail. They buy when the P/E ratio is sky-high because the "story" is good. DSP has a history of being disciplined. They might underperform in a "garbage rally" where every low-quality stock is flying, simply because they refuse to overpay for hype.

The Problem With Chasing Past Returns

If you look at the 3-year or 5-year CAGR (Compound Annual Growth Rate) of the DSP Small Cap Fund, the numbers might look incredible. It’s tempting to project that into the future. Don't.

Small caps move in cycles. There are years where they outperform large caps by 30%, and then there are years—like 2018—where they just bleed value while the rest of the market stays flat. If you’re entering now because the last three years were great, you’re potentially walking into a "mean reversion." This basically means the party might be slowing down.

You have to look at the "Rolling Returns." This is a better metric than "Trailing Returns." Rolling returns show you what the average return would have been if you invested on any random day over the last decade. It smooths out the luck factor. For DSP, the long-term rolling returns are solid, but the standard deviation is high. That’s a fancy way of saying: buckle up.

Why Sector Allocation Matters More Than You Think

The DSP Small Cap Fund doesn't just buy a bit of everything. They take active bets. Lately, we've seen significant allocations to sectors like Chemicals, Healthcare, and Capital Goods.

- Capital Goods: This is a play on India's infrastructure boom. If the government is spending on roads and railways, the small companies supplying the nuts, bolts, and specialized machinery stand to gain.

- Chemicals: This was the darling of the market a few years ago. It’s gone through a rough patch due to global supply chain shifts, but DSP has maintained a presence here, betting on the "China Plus One" strategy.

- Financials: They often avoid the big banks, looking instead at small NBFCs (Non-Banking Financial Companies) or microfinance players that serve the "unbanked" population.

It's important to realize that a small-cap fund is often a reflection of the manager's conviction. If Vinit Sambre likes a sector, he goes overweight. If he's wrong, the fund suffers more than a diversified index fund would. That’s the price of active management.

The Liquidity Risk Nobody Talks About

Let’s get real for a second. In a market crash, everyone wants to sell at the same time. In large-cap stocks, there’s always a buyer. In small caps? The "bid-ask spread" widens like a canyon.

If the DSP Small Cap Fund needs to raise cash to pay back exiting investors during a panic, they might have to sell their best stocks because those are the only ones anyone will buy. This leaves the remaining investors holding the "junk." DSP manages this by keeping a small portion of the fund in cash or large-cap stocks, but it’s still a risk you need to acknowledge.

Small cap funds are "illiquid" by nature. If you need your money back in six months, stay far away from this fund. You need a 7 to 10-year horizon. Anything less is just speculating.

Comparing DSP to Its Peers

You’re probably also looking at Nippon India Small Cap or Quant Small Cap. It’s a crowded field.

Quant is the "math nerd" of the group. They use algorithms and trade frequently. Their turnover ratio is high. DSP is more of a "buy and hold" shop. They want to find a company at a $100 million market cap and hold it until it’s worth $1 billion.

Nippon, on the other hand, is a behemoth. They own hundreds of stocks to manage their massive size. DSP’s portfolio is relatively more concentrated, though still diversified enough to avoid a total meltdown if one company goes bust.

Tax Implications and the "Exit Load"

Don't forget the taxman. Since this is an equity fund, you're looking at Capital Gains Tax.

- STCG (Short Term Capital Gains): If you sell before one year, you’re hit with a 20% tax (as per the latest 2024-2025 budget rules).

- LTCG (Long Term Capital Gains): If you hold for more than a year, gains above ₹1.25 lakh are taxed at 12.5%.

Also, DSP typically charges an "Exit Load." If you pull your money out within 12 months, they’ll take 1% off the top. This isn't just to make money; it’s to discourage "tourist" investors who jump in and out, which hurts the long-term holders.

Is Now the Right Time to Invest?

Timing the market is a fool's errand, especially with the DSP Small Cap Fund. If you're waiting for a "perfect" dip, you might miss a 50% rally. If you buy everything today, the market might crash tomorrow.

The most sensible way to approach this is through a SIP (Systematic Investment Plan). By investing a fixed amount every month, you buy more units when prices are low and fewer when prices are high. This "Rupee Cost Averaging" is the only way to survive the volatility of the small-cap universe without losing your mind.

You also need to check your "Asset Allocation." If 80% of your money is in small caps, you’re not an investor; you’re a thrill-seeker. Most advisors suggest capping small-cap exposure at 10% to 20% of your total equity portfolio.

The Verdict on DSP Small Cap Fund

This fund has a "Growth at a Reasonable Price" (GARP) philosophy. It’s not the flashiest fund during a speculative bubble, but it tends to be more resilient than the "momentum" funds when the bubble bursts. It’s a fund for the patient. For the person who understands that wealth isn't made in a quarter, but over a decade.

The management team is stable. The process is proven. But the underlying asset class—small caps—is inherently dangerous.

Actionable Next Steps for Investors

If you're considering the DSP Small Cap Fund, don't just click "buy." Follow these steps to ensure it actually fits your life.

- Check your time horizon: If you need the money for a house down payment in 3 years, do not put it here. Small caps require a 7-year minimum commitment to survive a full market cycle.

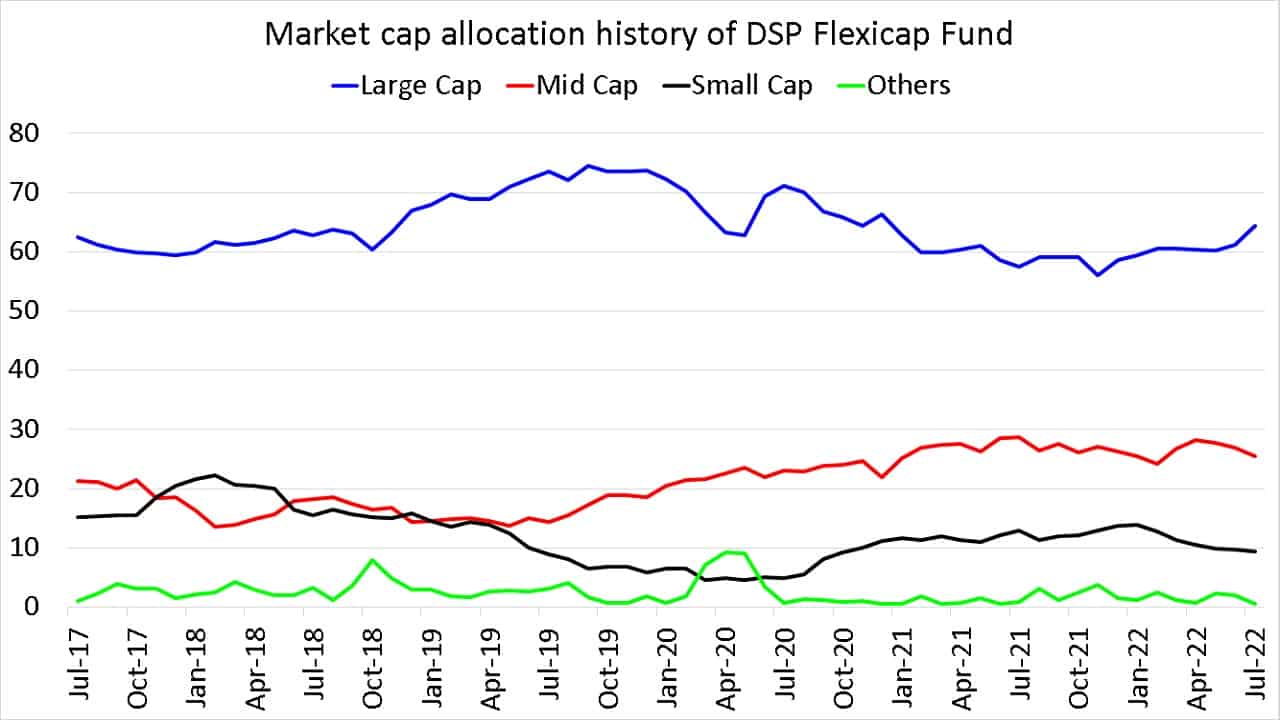

- Review your current portfolio: Look at how much small-cap exposure you already have through "Multi Cap" or "Flexi Cap" funds. You might already own more small caps than you realize.

- Choose the "Direct" Plan: Always go for the Direct Plan instead of the Regular Plan. It has a lower Expense Ratio because you aren't paying a commission to a broker. Over 10 years, that 0.5% to 1% difference can add up to lakhs of rupees.

- Set up a SIP, but keep a "War Chest": Automate your monthly investment, but keep some cash aside. If the small-cap index drops by more than 15% in a month, that’s usually a good time to make a small lump-sum "top-up" to your existing SIP.

- Ignore the daily NAV: Checking the Net Asset Value every day will only lead to emotional decision-making. Set an annual calendar reminder to review the fund's performance against its benchmark (the Nifty Smallcap 250) and leave it alone for the rest of the year.