Honestly, if you're looking at the dt midstream stock price right now—sitting around $120.44 as of mid-January 2026—it’s easy to feel a bit "meh." We're coming off a week where it dipped about 1% and the broader market has been a total rollercoaster. But here’s the thing. Most people looking at DTM (that’s the ticker, for the uninitiated) are missing the forest for the (pipeline) trees.

Midstream isn't about the overnight 10x moonshot. It’s about the "toll booth" model. And right now, those toll booths are getting a massive upgrade because of something most people didn't see coming three years ago: AI data centers.

👉 See also: 30 pounds is how much in us dollars: Why the Rate is Shifting Right Now

What’s Actually Moving the DT Midstream Stock Price Today?

Yesterday's close was $120.44. Not bad. But if you look at the 52-week range, we've seen a low of $83.30 and a high of $122.70. We are knocking on the door of all-time highs. Why? Because natural gas has suddenly become the darling of the "reliable energy" crowd.

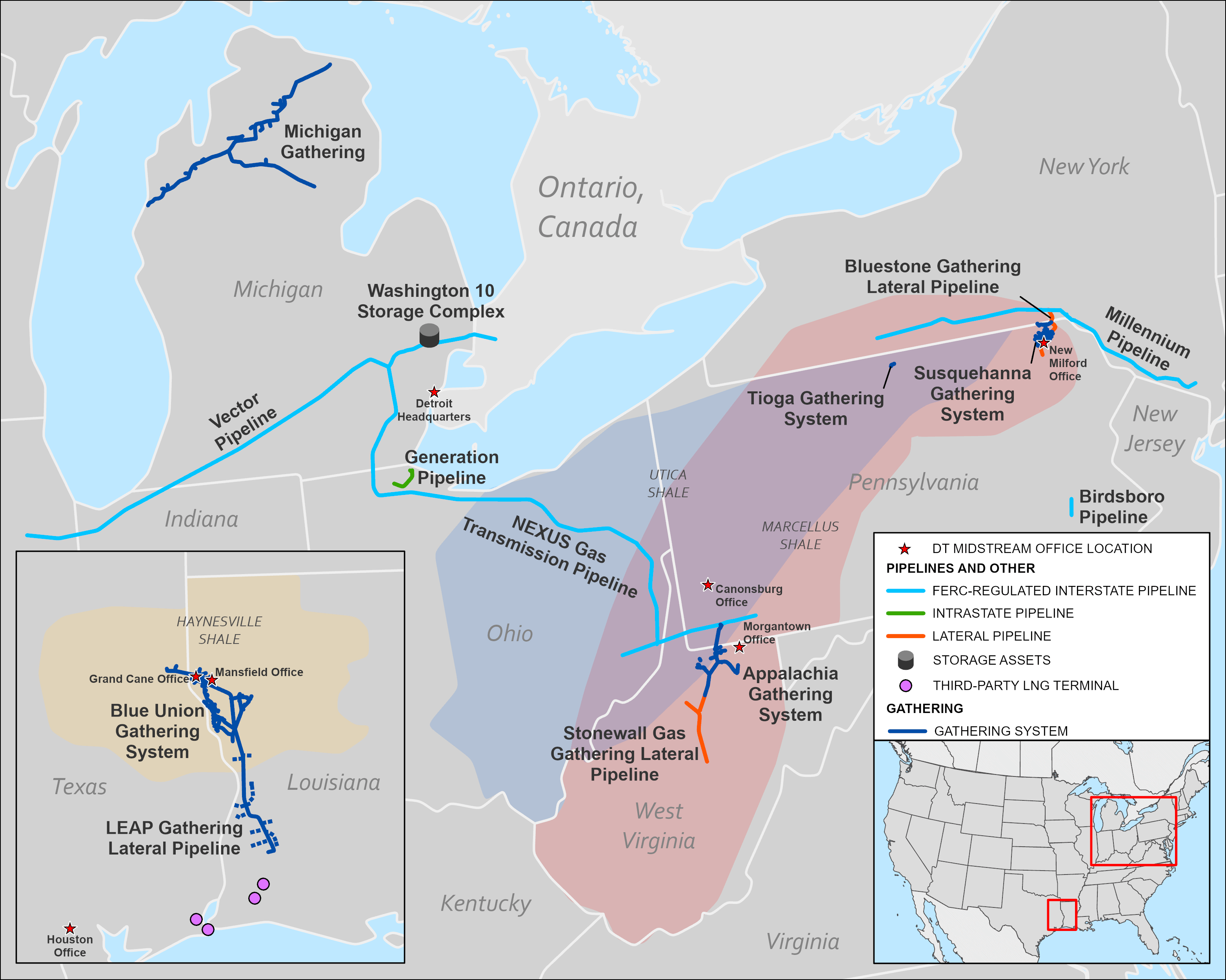

While everyone was obsessed with solar panels, the massive power demands of AI and LLMs (Large Language Models) hit the grid like a freight train. Data centers don't just need "green" energy; they need "always-on" energy. That means natural gas. DT Midstream is sitting right in the middle of this. Literally. Their assets connect the Haynesville shale to the Gulf Coast and the Midwest.

The Dividend Reality Check

You’ve probably seen the dividend yield listed around 2.78%. For a midstream company, that might feel a little low—some of the old-school MLPs (Master Limited Partnerships) boast 6% or 7%. But DTM is a C-Corp. No K-1 forms. No tax headaches.

They just paid out $0.82 per share on January 15, 2026. That’s $3.28 annually.

The payout ratio is about 77%. Is that high? Sorta. But in this industry, where cash flow is king, it's actually fairly stable. They’ve increased that dividend for four consecutive years now. It's the "slow and steady" play that keeps the lights on.

The G3 Expansion: More Than Just Pipes

You can't talk about the dt midstream stock price without mentioning the Guardian Pipeline "G3" expansion. CEO David Slater has been banging this drum for a while.

They upsized this project to 537 MMcf/d. That’s a 40% boost to the existing capacity. Why does this matter to your wallet? Because it’s anchored by 20-year contracts with five major utilities.

20 years.

That is guaranteed cash flow until 2046. When a stock has that kind of visibility, it creates a "floor" for the price. Analysts like the ones at Zacks and Barclays are hovering around an average price target of $121.79, but some outliers are looking at $137. It’s a tug-of-war between the "it’s fairly valued" crowd and the "natural gas supercycle" believers.

Why Everyone Is Talking About Data Centers Near Toledo and Milwaukee

It sounds weird, right? Investing in a pipeline company because Meta or OpenAI wants to build a data center in the Midwest. But that’s the reality. Meta has an $800 million center going up near Toledo. OpenAI and Oracle have plans for a massive 902 MW facility near Milwaukee.

These things are power hogs.

DT Midstream’s Nexus and Vector systems are the "freeways" (Slater’s words, not mine) that bring gas to these regions. If you own the freeway, you collect the toll. The more cars—or in this case, Bcf of gas—the more money.

👉 See also: Images of bull run: What You’re Actually Seeing in Those Market Charts

The Debt Elephant in the Room

Let’s be real for a second. Midstream is capital intensive. DTM has a decent chunk of debt. Total debt to equity is sitting around 76%. Some investors get spooked by that.

But look at the EBITDA. They’re targeting 5% to 7% growth through 2028. If they hit those numbers, the debt becomes a non-issue. It’s the cost of doing business when you’re laying hundreds of miles of steel in the ground.

Analyst Sentiment: A Mixed Bag?

If you look at the ratings from late 2025 into 2026, it’s a bit of a spread:

- BofA Securities: Buy

- Wells Fargo: Overweight

- JP Morgan: Neutral

- Morgan Stanley: Underweight

Why the Underweight? Some analysts think the "AI boost" is already priced in. They see a P/E ratio of 30 and think, "Hey, this is a utility-adjacent company, not a tech stock. Why is it trading like a growth play?"

It’s a fair point. But they might be underestimating the sheer volume of gas needed for the next decade of LNG (Liquefied Natural Gas) exports. The LEAP Phase 4 expansion was placed in service ahead of schedule. That moves gas to the Gulf. The world wants American gas, and DTM has the straw to sip it from the ground.

What Most People Get Wrong

People think dt midstream stock price movements are tied directly to the daily price of natural gas. It’s not. Not really.

✨ Don't miss: Why 300 N Canal Chicago Is Changing the West Loop Skyline Forever

DTM is "volume-based." They don't care if gas is $2 or $8, as long as people are moving it through the pipes. You're betting on the need for gas, not the price of gas. That’s a massive distinction that keeps the stock from being as volatile as the commodities market.

Actionable Insights for the "Wait and See" Crowd

If you're looking at DTM, don't just stare at the daily ticker.

- Watch the Fed: Midstream stocks often act like "bond proxies." If interest rates drop later in 2026, DTM’s 2.7% yield starts looking a lot more attractive than a 3% Treasury bill.

- Monitor the Backlog: They have roughly $2.3 billion in organic projects planned through 2029. Every time a project reaches "FID" (Final Investment Decision), it's a de-risking event for the stock.

- The "Earnings Beat" Pattern: DTM has a habit of "beat and raise." They report Q4 2025 results soon. If they raise the 2026 EBITDA guidance again, expect that $122 resistance level to break.

Honestly, the dt midstream stock price is a play on the boring infrastructure that makes the flashy AI future possible. It's not sexy. It doesn't make headlines on TikTok. But in a world where everyone needs more power, owning the pipes is a pretty good place to be.

Keep an eye on the March 17, 2026, ex-dividend date. If you're looking to capture that next $0.82, you'll need to be in before then. Just remember, this is a long-game stock. If you're looking for a "get rich quick" scheme, you're in the wrong zip code. If you want a company that grows alongside the energy needs of the next decade, DTM is worth a spot on the watchlist.