When people talk about luxury eyewear in Florida, one name usually hits the top of the list pretty fast: Edward Beiner. For decades, this brand was the quintessential independent success story. You’ve probably seen their boutiques in high-end spots like Merrick Park or Worth Avenue. They had this vibe—this very specific, curated aesthetic that felt more like an art gallery than a place to get your eyes checked.

But then, the business world did what it does best. It consolidated. In early 2020, just as the world was about to turn upside down, a massive Canadian player called New Look Vision Group Inc officially stepped in and bought the company.

It wasn't just a minor transaction. It was a pivot. For New Look Vision Group, acquiring Edward Beiner was their "Hello, America" moment. It was the first time the Montreal-based giant crossed the border to plant a flag in the U.S. retail market.

Honestly, if you're a regular customer, you might not have even noticed the paperwork change. The stores still look like Edward Beiner. The frames are still fancy. But behind the scenes? Everything changed.

👉 See also: Trump Tariffs March 1: Why the Next Deadline Could Change Everything

The $15 Million Handshake

Let's look at the numbers because they tell the real story. When the deal was finalized around March 2020, New Look Vision Group Inc paid for substantially all the assets of Coco Lunette Holding LLC (the parent company of Edward Beiner). At the time, the chain had 12 locations across Florida and was pulling in roughly $15.5 million CAD in annual revenue.

Why Florida? Antoine Amiel, the CEO of New Look, basically said it was a no-brainer. Florida has a massive, aging, and—most importantly—wealthy population that values high-end fashion. It’s a goldmine for luxury frames.

The deal wasn't a hostile takeover or some corporate raiding situation. Beiner himself stayed on. He transitioned into a role as Co-Chairman of New Look Vision Group US. It was a "keep the soul, buy the scale" kind of move. New Look gets a foothold in the States; Beiner gets the backing of a company with hundreds of stores and a massive manufacturing infrastructure.

💡 You might also like: Mobile home park images: Why your visual marketing is probably failing

Why This Partnership Actually Matters for Eyewear

Most people think buying glasses is just about picking a frame and waiting a week. In the luxury world, it’s a lot more complicated. Before the New Look acquisition, independent boutiques like Edward Beiner had to fight for every exclusive contract with brands like Cartier, Mykita, or Thierry Lasry.

Once they joined New Look Vision Group Inc, that leverage changed.

- Manufacturing Power: New Look owns state-of-the-art lens labs in Canada. This means Beiner stores could theoretically get high-tech, digital-surfaced lenses faster and with better quality control than a small shop outsourcing to a third-party lab.

- Expansion: Since the Beiner deal, New Look hasn't stopped. They went on to grab other luxury players like Morgenthal Frederics and Robert Marc NYC. They are basically building a luxury eyewear empire that stretches from Miami to Manhattan.

- Technology: They’ve poured money into things like 3D face scanning and bespoke frame manufacturing. It’s a bit futuristic, but it's the direction the industry is heading.

The "New Look" of the Company

It’s worth noting that New Look Vision Group Inc itself isn't a public company anymore. In 2021, they were taken private in an all-cash deal worth about $800 million. They are now backed by heavy hitters like FFL Partners and CDPQ (a massive Quebec pension fund).

What does that mean for your local Edward Beiner boutique? It means there is a lot of private equity money pushing for growth. They aren't just content being a "Florida brand" anymore. They are part of a network that includes over 400 locations across North America.

The Reality of Luxury Optical

Some critics argue that when a big corporation buys a boutique, the "magic" disappears. You've probably heard it before—the service gets colder, the frames get more generic.

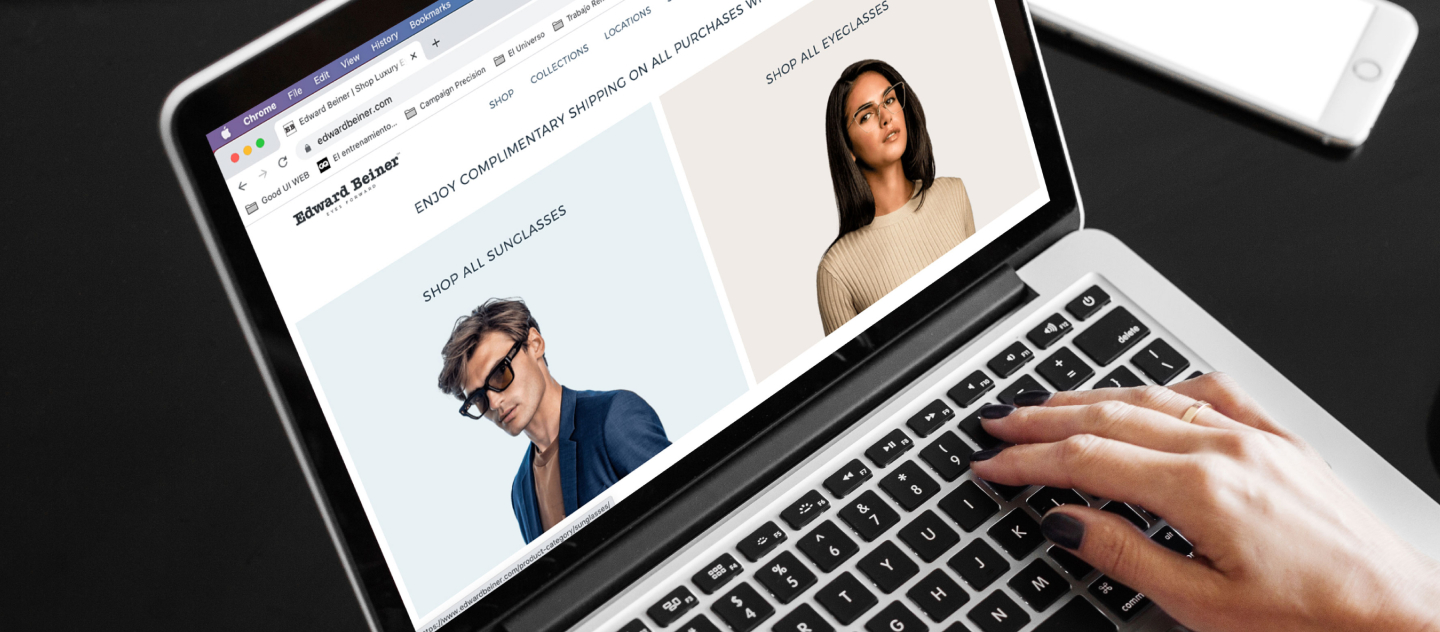

With Edward Beiner, the results have been mixed depending on who you ask. On one hand, the digital integration is way better. Their website actually works now, and you can browse high-end collections online with ease. On the other hand, it’s a larger machine. The "independent" feel is technically a branding strategy now, rather than a business reality.

But here is the thing: the luxury optical market is brutal. Independent shops are being squeezed by online giants and "fast fashion" eyewear brands. By joining New Look Vision Group Inc, Edward Beiner basically ensured its survival. It traded a bit of its independence for a lot of longevity.

Actionable Insights for Consumers and Investors

If you’re following this because you love the brand or you're tracking the industry, here is what you need to keep in mind moving forward.

For the Shopper:

Don't be afraid to ask about the lens origin. Since Beiner is part of the New Look network, they have access to some of the best lens tech in North America. If you're paying $800 for frames, make sure you're getting the high-index, digitally mapped lenses they now have the capacity to produce. Also, check for "trunk shows." Now that they have corporate backing, they tend to host more exclusive events where designers bring their entire collections to the store for a weekend.

For the Business Watcher:

Keep an eye on the "Luxury Group" within New Look. They are clearly positioning themselves to be the high-end alternative to Luxottica (the company that owns LensCrafters and Sunglass Hut). While Luxottica is the "big box" of eyewear, New Look is trying to be the "curated boutique" version. If they continue to acquire high-end U.S. brands, they will become the dominant force in the $500+ frame market.

The partnership between Edward Beiner and New Look Vision Group Inc wasn't just a sale; it was the starting gun for a major shift in how luxury glasses are sold in America. It's less about the local optician and more about the global supply chain, all wrapped up in a beautiful, hand-polished acetate frame.

To see how this affects your next visit, you can look up your nearest location and check if they've integrated the new 3D scanning technology for custom fits—it’s one of the biggest tangible perks of the New Look merger.