If you’ve spent any time looking at midstream energy, you know Enterprise Products Partners (EPD) is basically the "old reliable" of the sector. It’s the tortoise. It doesn’t sprint, it doesn’t do anything particularly flashy, and it certainly doesn’t trade like a tech stock. But as we kick off January 2026, the enterprise products partners stock price is sitting around $32.09, and everyone is asking the same thing: is the yield still worth the wait?

Honestly, the stock has been a bit of a slow burn lately. While the S&P 500 was busy ripping higher in 2025, energy stocks sort of just... hung out. EPD was up about 6% over the last year, which isn't going to set the world on fire, but when you factor in that massive 6.8% dividend yield, the "total return" story starts to look a lot better.

What’s Actually Moving the Enterprise Products Partners Stock Price?

Right now, the market is obsessed with a "pivot." Not the Fed pivot—though that matters—but a pivot in how Enterprise spends its cash. For the last couple of years, they’ve been pouring billions into the ground. We're talking $4.5 billion in 2025 alone. That’s a lot of pipe.

But 2026 is different.

Management has signaled that the heavy lifting is mostly done. Capital expenditures are expected to drop to somewhere between $2.2 billion and $2.5 billion this year. When a company stops spending quite so much on massive construction projects, that "extra" money has to go somewhere.

- More Buybacks: They just bumped their repurchase authorization to $5 billion.

- Dividend Hikes: They’ve raised the payout for 27 years straight. The latest was a 2.8% bump to $0.55 per unit.

- Debt Paydown: With a leverage ratio of 3.3x, they’re already in a good spot, but they might use the extra cash to get even leaner.

The Permian Connection

You can't talk about the enterprise products partners stock price without talking about West Texas. The Permian Basin is still the engine room. Enterprise is expecting about 600 new well connections in the Midland area by the end of 2026. If the oil and gas keep flowing, the tolls keep coming in.

It’s a fee-based model. Think of them as the landlord of the energy world. They don’t really care if oil is $60 or $90 as much as they care about the volume moving through their pipes.

What the "Smart Money" Thinks Right Now

Analysts are surprisingly split for such a stable company. On one hand, you’ve got the bulls at places like Mizuho and Stifel who have price targets as high as $38 to $42. They see the lowered spending as a massive catalyst for free cash flow.

On the other hand, Jefferies recently initiated coverage with a "Hold" and a $33 target. Their argument? The stock is "fairly valued." Basically, they think the good news is already baked into the price.

| Metric | Current Value (Jan 2026) |

|---|---|

| Stock Price | ~$32.09 |

| Dividend Yield | 6.85% |

| P/E Ratio | 12.14 |

| Market Cap | ~$69 Billion |

There’s also a bit of a "show me" attitude regarding their expansion projects. The Mentone West 2 plant and the Athena processing plant are supposed to come online soon. If those hit delays, the stock might tread water. If they launch smoothly, $35 starts to look like a very reasonable floor.

The "Kicker" Most People Miss

People forget that EPD is a Master Limited Partnership (MLP). That means K-1 tax forms. Some investors hate them. They’re a headache at tax time, and they keep most big institutional "passive" funds from buying the stock.

This is actually why the stock often feels undervalued. There is a built-in "annoyance discount." But for the individual investor who doesn't mind a little extra paperwork, you’re getting paid a premium for that hassle.

Is It a Trap or a Treasure?

The biggest risk to the enterprise products partners stock price isn't actually a collapse in oil prices. It’s interest rates.

💡 You might also like: Difference Between a Leader and a Manager: What Most People Get Wrong

MLPs are often treated as "bond proxies." When rates are high, people just buy Treasury bills because they’re safer. But as rates stabilize or start to tick down, that 6.8% yield starts looking like a gold mine again.

Actionable Insights for Investors

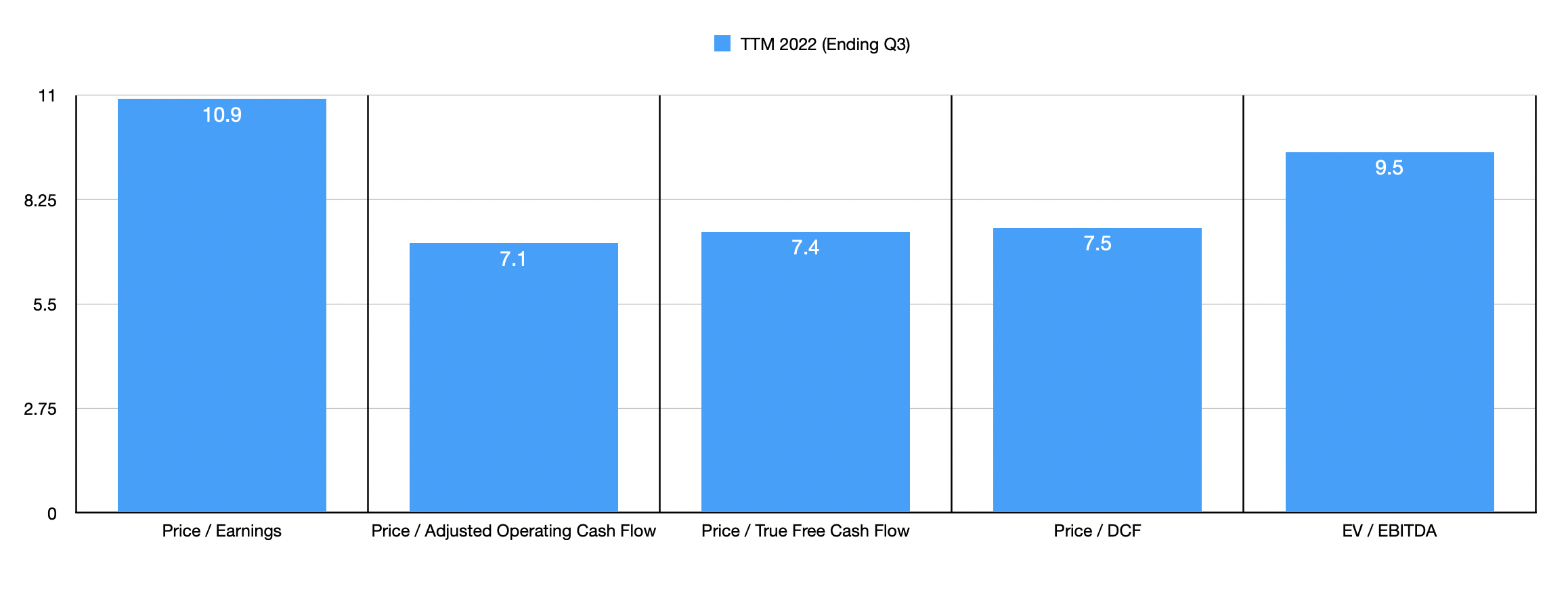

If you're watching the ticker, keep an eye on February 3, 2026. That’s when they drop their Q4 2025 earnings. Look specifically for their "Distributable Cash Flow" (DCF) coverage ratio. Last we checked, it was 1.7x. Anything above 1.5x means your dividend is incredibly safe.

- Check your tax status. Don't buy EPD in an IRA unless you understand the rules around UBIT (Unrelated Business Intermediate Tax). It’s usually better in a taxable brokerage account.

- Watch the CapEx. If management suddenly announces another $5 billion spending spree for 2027, the "buyback story" might take a hit.

- Reinvest the distributions. The secret to making money with EPD isn't the price going from $32 to $40. It’s the compounding. Since their IPO in 1998, the total return with dividends reinvested is over 3,400%. Without them? It's more like 490%.

Bottom line: Don't expect a moonshot. EPD is for the investor who wants to sleep at night while the mailbox money keeps rolling in.

To stay ahead of the next move, you should pull the latest SEC Form 4 filings to see if insiders like Director John Rutherford—who recently bought 15,000 units—are still adding to their positions at these levels. If the people running the company are buying at $32, it’s usually a signal that they think the floor is solid.