You’re standing at a kiosk in the Charles de Gaulle airport, or maybe you're just staring at a digital checkout screen, wondering why your EUR 20 to USD conversion looks so pathetic. It should be simple math. You see the "mid-market rate" on Google—that's the real exchange rate banks use to trade with each other—and you expect something close to that. But then the fees hit. Suddenly, your twenty euros feels more like fifteen dollars after the "convenience" charges.

It's annoying.

✨ Don't miss: Why Did the Dow Jones Go Up Today: The Real Story Behind the Rally

The truth is, converting small amounts like 20 euros is actually harder to do efficiently than converting 20,000 euros. Why? Because fixed fees eat small balances alive. If a bank charges a flat $5 wire fee, they just took 25% of your money before the currency even shifted.

The Reality of the EUR 20 to USD Exchange Rate Right Now

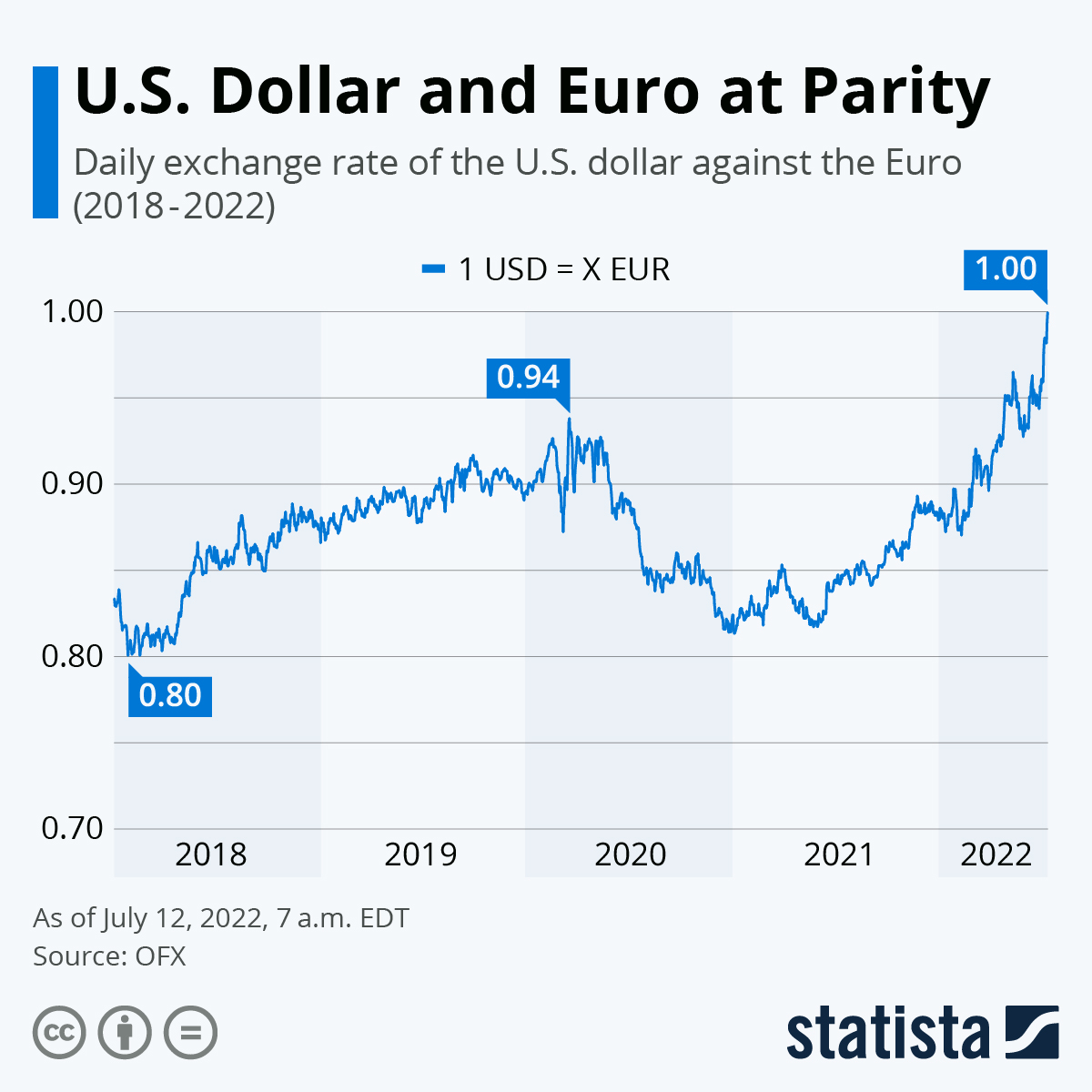

The Euro has been on a wild ride lately. We've seen periods of parity where one Euro equaled exactly one Dollar, and we've seen the Euro soar. When you are looking at EUR 20 to USD, you are basically looking at the pulse of two of the largest economies on earth.

As of early 2026, the European Central Bank (ECB) and the Federal Reserve are playing a constant game of "who blinks first" with interest rates. If the ECB keeps rates high while the Fed cuts them, your 20 euros actually buys more coffee in New York. If the US economy stays "sticky" with inflation, the dollar strengthens, and that 20 euro bill starts looking smaller.

Most people don't realize that the "rate" you see on news tickers isn't the rate you get. That’s the interbank rate. For a small retail transaction of 20 euros, you’re likely getting the "retail rate," which includes a spread. A spread is just a fancy word for a markup. It’s how airport booths stay in business despite claiming "zero commission." They aren't doing it for charity. They just bake the cost into a worse exchange rate.

Why Small Amounts Get Screwed

Let’s look at the math. If the mid-market rate is 1.10, your 20 euros should be 22 dollars.

But a typical high-street bank might give you 1.05. Now you're at $21. Then they add a $3 "service fee." Now you're at $18. You just lost nearly 20% of your value in thirty seconds. This is why understanding the mechanics of EUR 20 to USD is actually more important for travelers and small-scale freelancers than it is for corporate hedge funds who have the leverage to demand better terms.

Where to Actually Exchange 20 Euros Without Losing Your Shirt

Honestly, if you have a physical 20 euro note, your options are kinda limited. Physical cash is expensive to move, guard, and store. That's why the guy at the currency desk gives you such a bad deal.

If you are doing this digitally, you have way better luck.

- Neobanks and Fintechs: Companies like Revolut or Wise (formerly TransferWise) are basically the gold standard here. They usually give you the actual mid-market rate and charge a tiny, transparent fee—often less than 50 cents for a 20 euro transaction.

- Travel Cards: If you're using a card like the Chase Sapphire or a Capital One Venture, they often do the conversion at the Visa/Mastercard rate, which is very close to the real deal, with no added foreign transaction fees.

- PayPal: Avoid this if you can. PayPal is notorious for having some of the worst exchange rates in the industry. They often hide a 3-4% spread in the conversion, which makes a EUR 20 to USD transfer surprisingly expensive.

The Psychology of the Twenty

There’s something specific about the 20 euro note. It’s the most common bill in circulation across the Eurozone. It’s the "walking around money." When people search for EUR 20 to USD, they are usually trying to figure out if they can afford a lunch in Manhattan or a cab ride in Chicago with what’s left in their wallet.

💡 You might also like: Dinero Dolares Fotos Reales: How to Spot a Scam and Why People Search for Them

In 2024 and 2025, we saw the Euro stabilize significantly after the energy shocks of previous years. This means the volatility isn't as crazy as it used to be, but you still need to watch the "Flash PMIs" (Purchasing Managers' Index) from the Eurozone. If German manufacturing looks weak, the Euro drops. If the US jobs report is too "hot," the Dollar climbs. Even a small 20 euro exchange is affected by these macro-economic giants clashing.

Sneaky Fees to Watch Out For

You’ve probably seen "Dynamic Currency Conversion" (DCC). This is the devil of international travel. You’re at a restaurant in Rome, and the card machine asks: "Pay in EUR or USD?"

Always choose the local currency (EUR).

If you choose USD, the merchant's bank chooses the exchange rate for you. They will fleece you. They might charge a 5% to 7% markup for the "convenience" of seeing the price in your home currency. By choosing EUR, you let your own bank handle the conversion, which is almost always cheaper. For a EUR 20 to USD transaction, choosing the wrong button could cost you a couple of dollars. It sounds small, but do that ten times on a trip and you've bought someone else a free dinner.

Actionable Steps for Your Money

Stop using physical exchange desks at landmarks or transit hubs. They are traps.

💡 You might also like: World's Biggest Sovereign Wealth Funds Explained (Simply)

If you need to convert EUR 20 to USD right now:

- Check the real-time rate on a neutral site like XE.com or Google Finance first so you have a baseline.

- Use a multi-currency digital wallet if you are sending the money to a friend or paying for a digital service.

- Keep the physical cash if you plan on visiting Europe again within a year. The loss you take on exchanging it back and forth twice (EUR to USD then back to EUR later) is usually higher than just letting the 20 euros sit in a drawer.

- Check your credit card's "Foreign Transaction Fee" policy. If it’s not 0%, don't use that card for Euro purchases.

The foreign exchange market (Forex) is the largest financial market in the world, topping $7 trillion in daily volume. Your 20 euros is a microscopic drop in that ocean, but that doesn't mean you should let a bank take a huge bite out of it. Be skeptical of "free" and always look at the final amount of dollars hitting the account.