Money is weird. One day you’re looking at a flight to Dubai and the math makes sense, and the next, your bank account is sweating because the EUR to AED rate decided to take a sudden hike. Honestly, if you’ve spent any time staring at currency charts lately, you know it feels a bit like watching a slow-motion rollercoaster.

As of January 18, 2026, the rate is hovering around 4.25. To be precise, a single Euro gets you roughly 4.2495 UAE Dirhams.

That might not sound like a huge deal if you’re just buying a coffee at the Burj Khalifa, but if you’re moving €50,000 for a real estate down payment in Dubai Marina? That decimal point starts to look like a lot of money. The Dirham is pegged to the US Dollar at a fixed rate of $1 = 3.6725$ AED. This means whenever you talk about the Euro-Dirham pair, you’re actually talking about how the Euro is performing against the Dollar.

What is actually moving the EUR to AED rate right now?

The big story this year isn't just about the UAE. It’s actually about Germany and the European Central Bank (ECB). For a long time, the Eurozone was stuck in this "low growth" mud. But lately, things have shifted.

Germany finally ditched its old-school fiscal conservatism. They’ve been pumping money into infrastructure and defense—we’re talking a massive €1 trillion spending package that started making waves late last year. This has given the Euro a bit of "muscle" it didn't have back in 2024. When the Euro gets stronger because the European economy looks healthier, your EUR to AED rate climbs.

On the flip side, the US Dollar has been a bit shaky. Since the AED is tied to the Dollar's hip, any weakness in Washington reflects in Dubai. We’ve seen the Dollar slide about 5% recently, mostly because the Federal Reserve is expected to cut rates a few more times this year while the ECB stands firm.

The French Factor

It’s not all sunshine, though. If you want to know why the rate isn't even higher, look at Paris. Political drama in France has kept investors a bit nervous. There’s been a lot of back-and-forth in their parliament about budget deficits. When France looks unstable, the Euro takes a hit. It’s a tug-of-war between German industrial growth and French political risk.

Real-world impact: From tourists to expats

Let's get practical. If you’re a tourist coming from Berlin to Dubai today, your Euro goes further than it did a year ago. In early 2025, the rate was sitting way lower, down near 3.78.

Think about that.

For every €1,000 you exchanged back then, you got 3,780 AED. Today? You’re getting nearly 4,250 AED for that same thousand Euro. That’s an extra 470 Dirhams. That’s a fancy dinner or a couple of desert safari tickets for free, basically.

Sending money home

For the thousands of European expats living in the UAE, the perspective is different. If you’re earning Dirhams and sending them back to Spain or Italy, you’re actually getting a "worse" deal than last year. Your Dirhams buy fewer Euros now because the Euro has appreciated.

- Sending €1,000 to Europe in early 2025: Cost you about 3,780 AED.

- Sending €1,000 to Europe today: Costs you about 4,250 AED.

It’s a 12% price hike on your remittances. That hurts if you have a mortgage back home to pay.

Why the "peg" matters so much

You’ll hear people say the Dirham is "stable." It is, but only in relation to the Dollar. The Central Bank of the UAE (CBUAE) usually mimics whatever the US Federal Reserve does with interest rates.

If the Fed cuts, the CBUAE usually cuts.

This keeps the 3.6725 peg alive. But because the Euro floats freely, the EUR to AED rate is essentially a mirror of the EUR/USD exchange rate. If you see news that "the Euro is surging against the Dollar," grab your calculator. Your Dirhams are about to get more expensive to buy, or your Euros are about to become more powerful in the Dubai Mall.

Common misconceptions about the rate

People often think oil prices directly dictate the daily EUR to AED rate. Kinda, but not really. While the UAE’s economy is heavily influenced by oil, the currency peg acts as a buffer.

Crude prices can swing 10% in a week, but the Dirham won't move an inch against the Dollar. The real volatility comes from the Euro side of the pair. It’s the ECB's interest rate decisions and European GDP data that cause the "jitters" you see on your currency app.

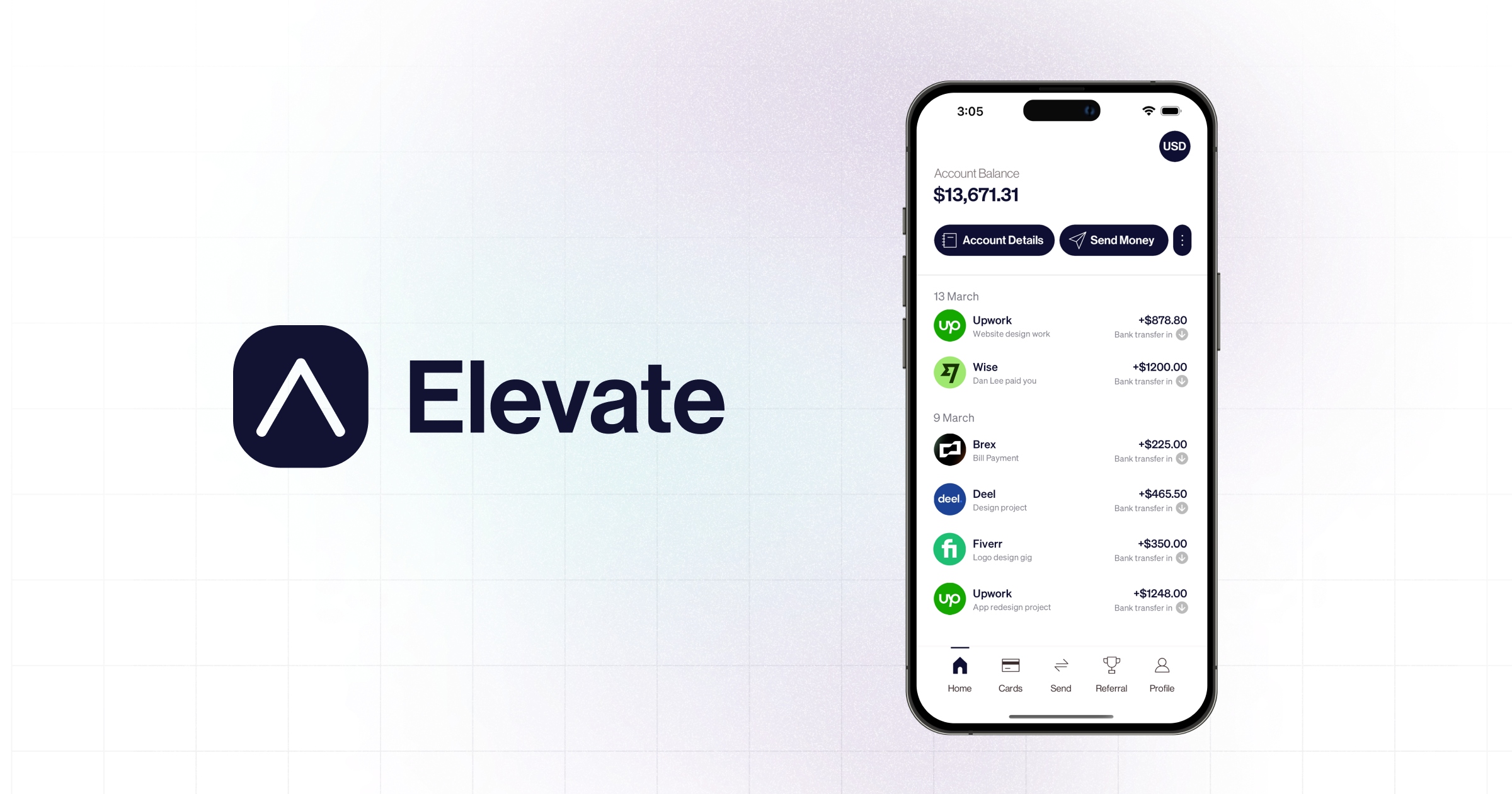

Another mistake? Trusting the "Mid-Market Rate" you see on Google. That 4.25 rate is what banks trade at. If you go to a small exchange booth in a tourist heavy area, they might offer you 4.10. They take a massive cut. Honestly, you're usually better off using a digital transfer service or a neo-bank that gives you something closer to the real interbank rate.

Looking ahead: What to watch for in 2026

We aren't expecting "explosive" movements for the rest of the quarter, but keep an eye on these two things:

- The ECB Pause: Christine Lagarde and the ECB folks seem comfortable with rates at 2.00%. If they keep them there while the US continues to cut, the Euro could break past the 4.30 AED mark.

- Global Trade Deals: There’s talk of a new US-EU trade agreement finally settling some tariff disputes. If that happens, the Euro could get another "confidence boost."

Most analysts, including those from MUFG and ING, suggest the Euro will stay strong through 2026. Some even project it reaching toward a 1.24 USD valuation by the end of the year. If that happens, we could see the EUR to AED rate hitting 4.55.

How to handle your currency exchange now

Stop waiting for the "perfect" moment if you're within 1-2% of your target. Markets are fickle. If you need to convert a large sum, consider "layering" your trades.

Convert half now at 4.25. If the rate moves to 4.28 next week, convert the rest then. It averages out your risk. Also, check the fees! A "zero commission" sign at an exchange house usually just means they've hidden their profit in a terrible exchange rate. Always compare the offered rate against the live mid-market rate you see on a reliable financial site.

👉 See also: Wine & Spirits Market Explained (Simply): Why the Old Rules No Longer Apply

Next Steps for You:

Check your bank's international transfer fees before sending money. Most traditional banks charge a flat fee plus a 3% spread on the EUR to AED rate, which is basically daylight robbery. Compare them against dedicated FX platforms like Revolut, Wise, or Wio if you're in the UAE. If you are planning a trip, avoid airport exchange desks at all costs—they consistently offer the worst rates in the industry.