So, you’re looking at a EUR to pounds converter on your phone, trying to figure out if that "great deal" at the airport is actually a scam. It usually is. Honestly, the world of currency exchange is intentionally confusing, draped in layers of "mid-market rates" and "hidden margins" that make your head spin. You just want to know how many British Pounds (GBP) you’ll get for your Euros. Simple, right? Not really.

The numbers you see on Google or Reuters aren't what you actually get. That’s the "interbank rate"—the price banks use to trade with each other in massive, multi-million euro blocks. Unless you’re a billionaire or a central bank, you aren’t getting that rate.

Most people use a EUR to pounds converter and think they’ve found the price. Then they go to a bank or a kiosk and suddenly lose 5% of their money. Why? Because the "converter" they used was showing the "real" rate, but the provider they’re using is charging a "spread."

Why Your EUR to Pounds Converter is Probably Lying to You

It’s not a lie, exactly. It’s more like a half-truth. When you search for a EUR to pounds converter, most tools pull data from the global forex market. This is the "wholesale" price. Imagine walking into a bakery and asking for a loaf of bread at the wholesale price of the flour. The baker would laugh at you.

When you exchange Euros for Pounds, you’re paying for the service of the exchange. This shows up in two ways: a flat fee or a markup on the exchange rate. The "no commission" signs you see at tourist traps are the biggest red flags in the industry. If they aren't charging a fee, they are definitely giving you a terrible exchange rate.

Let's look at a real-world scenario. If the mid-market rate on a EUR to pounds converter says 1 EUR is worth 0.85 GBP, a "no commission" booth might offer you 0.81 GBP. On a €1,000 exchange, you just handed them £40 for basically nothing. That’s a fancy dinner in London gone.

The Mid-Market Rate: Your Only True North

If you want to know if you're getting a fair deal, you have to know the mid-market rate. This is the midpoint between the "buy" and "sell" prices of a currency. Professional traders use this. Apps like Wise (formerly TransferWise) or Revolut have built their entire brands on offering this specific rate and then charging a transparent, upfront fee.

It feels better to see exactly what you’re paying. Hidden fees are gross.

The Mechanics of the EUR/GBP Pair

The Euro and the Pound are two of the most traded currencies on the planet. This means the "liquidity" is high. In plain English: it’s very easy to swap them because so many people are doing it. However, the price is constantly twitching.

Political stability in the Eurozone and the UK drives these shifts. When the Bank of England raises interest rates, the Pound often gets stronger. Why? Because investors want to put their money where they’ll get a higher return. More demand for Pounds means the Euro buys less of them.

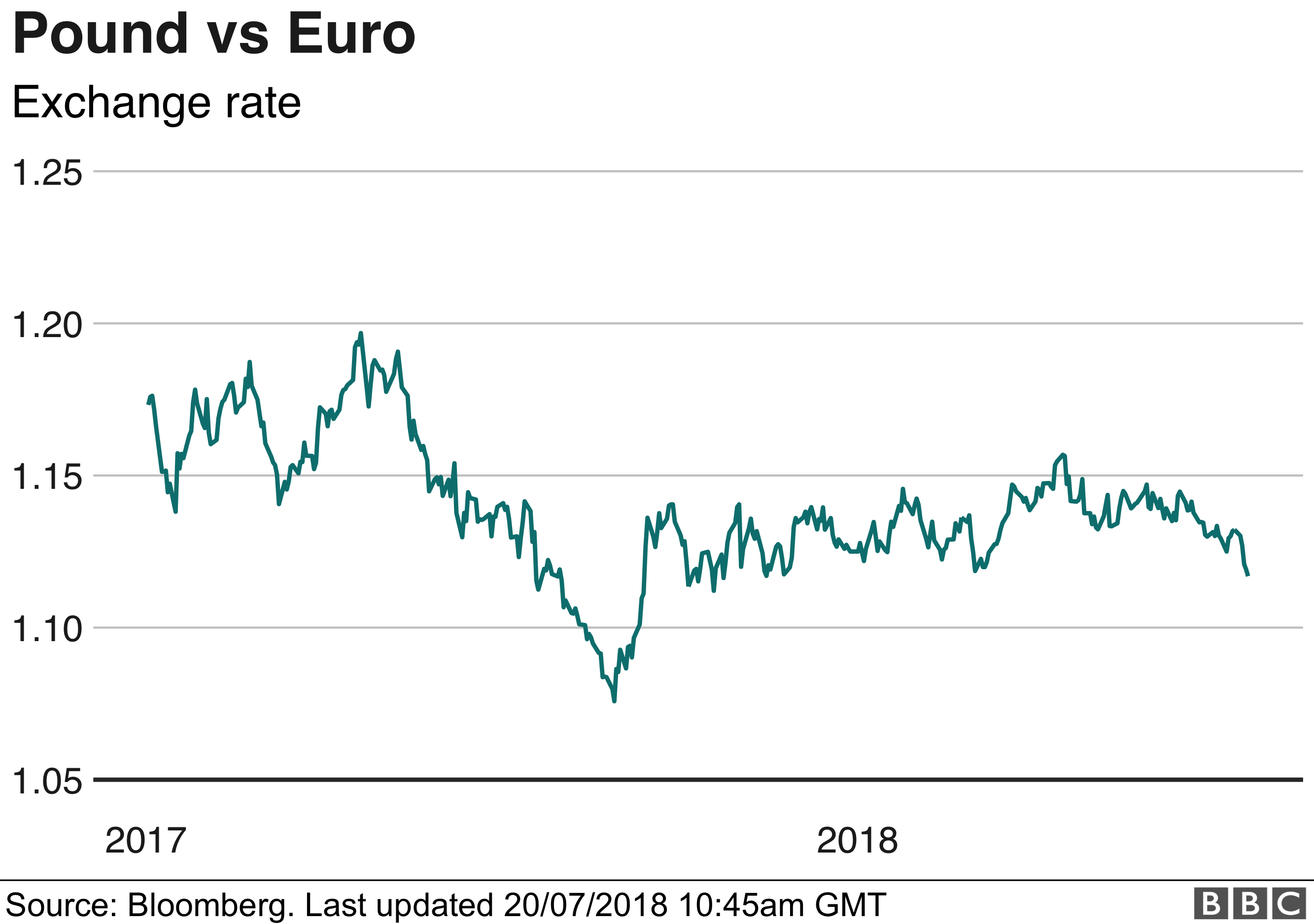

You’ve probably noticed that since 2016, the GBP has been a bit of a roller coaster. Brexit changed the fundamental relationship between these two currencies. It used to be that 1 Euro would get you maybe 0.70 or 0.75 Pounds. Nowadays, we often see it hovering much closer to the 0.85 to 0.90 range.

It makes the UK cheaper for Europeans to visit, but it makes that weekend trip to Paris a lot more expensive for Brits.

Where to Actually Exchange Your Money

Stop using airport kiosks. Just don't do it. They have captive audiences and sky-high rents, so they pass those costs onto you through abysmal rates.

- Digital-first banks: Apps like Starling, Monzo, or Revolut often give you the "real" rate or something very close to it. You just swipe your card and the EUR to pounds converter happens in the background instantly.

- Specialist Transfer Services: If you're moving a lot of money—maybe for a house deposit or a business contract—use something like Atlantic Money or CurrencyFair. They specialize in high-volume transfers with fixed, low fees.

- ATM Withdrawals: This is a gamble. Some ATMs will ask if you want to be charged in your "home currency" or the "local currency." Always choose the local currency. If you choose your home currency, the ATM's bank gets to choose the exchange rate, and they will fleece you.

Understanding "Dynamic Currency Conversion" (DCC)

This is a technical term for a very common trap. You're in a shop in London, you tap your European card, and the terminal asks: "Pay in EUR or GBP?"

It looks helpful. It shows you the total in Euros so you know exactly what’s leaving your account. It is a trap. When you choose to pay in your home currency (EUR), the merchant uses their own EUR to pounds converter rate. It is almost always worse than what your bank would give you. By choosing GBP, you let your own bank handle the conversion. Unless you have a truly ancient, terrible bank account, your bank's rate will beat the merchant's rate every single time.

The Psychology of Exchange Rates

We tend to think in round numbers. When the Euro is "strong," we feel wealthier. But "strong" is relative. A strong Euro is great if you’re buying a flat in Manchester, but it’s terrible if you’re a German car manufacturer trying to sell Volkswagens to British customers.

👉 See also: State of Connecticut Pension: What Most People Get Wrong

The volatility of the EUR/GBP pair affects everything from the price of cheddar cheese in Dublin to the cost of BMWs in Birmingham.

Real Strategies for Using a EUR to Pounds Converter Effectively

Don't just look at the number. Look at the trend. If you have a large sum to move, check the rate over a week. Is it trending up or down? While "timing the market" is usually a fool's errand for retail investors, knowing if the Pound is at a multi-year high can save you thousands.

Most people just Google "1000 eur to gbp" and click the first link. That’s fine for a rough estimate. But for real transactions, you need to look for the "Buy" and "Sell" spread. If the gap between those two numbers is wide, the provider is taking a huge cut.

A Note on Physical Cash

Cash is becoming a relic in the UK. London is practically cashless now. If you’re converting Euros to Pounds to have a thick wallet of notes for a trip to the UK, you might be making a mistake. You'll likely get a worse rate for physical cash than you would for a digital transaction. Plus, you’re stuck with the leftovers.

What are you going to do with 12 Pounds and 40 pence when you fly back to Berlin? You'll put it in a drawer and forget about it. That's wasted money. Digital converters and travel cards allow you to spend exactly what you need.

The Future of EUR/GBP Conversions

With the rise of Central Bank Digital Currencies (CBDCs), the way a EUR to pounds converter works might change entirely in the next decade. Imagine a world where the conversion is instant, peer-to-peer, and costs effectively zero. We aren't there yet, but the "middlemen"—the high street banks and the shady currency booths—are feeling the pressure.

Current fintech solutions have already forced traditional banks to lower their international transfer fees. It used to be standard to pay a £25 "wire fee" plus a 3% markup. Now, many people won't pay more than a fraction of a percent.

Actionable Steps for Your Next Exchange

To get the most out of your money, follow these specific steps:

- Check the Mid-Market Rate: Use a neutral source like Reuters or a dedicated EUR to pounds converter that explicitly states it uses the interbank rate. This is your benchmark.

- Audit Your Bank: Check your bank’s "foreign transaction fee" list. If it’s anything over 0.5%, get a travel-specific card like Revolut or Wise.

- Ignore the "Zero Commission" Bait: Always calculate the "total cost." How many Pounds do I end up with in my hand/account after all fees and the exchange rate are applied? That is the only number that matters.

- Pay in Local Currency: When prompted by a card machine or ATM in the UK, always select GBP. Let your bank do the math, not the merchant.

- Avoid Weekend Exchanges: The forex market closes on weekends. Many apps add a "buffer" or a small surcharge on Saturdays and Sundays to protect themselves against price gaps when the market re-opens on Monday. If you can, do your conversions on a Tuesday or Wednesday.

The goal isn't just to find a EUR to pounds converter; it's to ensure that the value you've earned doesn't disappear into a banker's pocket through lack of transparency. Be cynical about the rates you see and always do the math yourself.