Everything about the Turkish Lira feels like a rollercoaster that only goes in one direction. If you’ve looked at the EUR to TRY current rate today, you’ve probably seen it hovering right around the 50.08 mark. It’s a staggering number. Especially when you think about where we were just a few years ago.

Money is weird.

One day your Euros buy a nice dinner in Istanbul, and the next, it feels like they might buy the whole restaurant. But honestly, the "why" behind this is way more complicated than just a number on a screen. Most folks think it’s just about inflation. It’s not. It is about a high-stakes game of chicken between the Central Bank of the Republic of Turkey (CBRT) and a global market that is, frankly, pretty skeptical.

The Real Story Behind the 50.08 Level

We are sitting at a weird crossroads in January 2026. As of January 18, the EUR to TRY current rate has settled near 50.0765. This isn't just a random dip or spike. It's the result of a very specific, very aggressive strategy by the Turkish central bank.

Back in December 2025, the CBRT actually cut rates. They dropped the policy rate from 39.5% down to 38%. Most analysts at places like KPMG or ING were expecting them to be more cautious, but they went for it anyway. Why? Because inflation finally started to show a tiny bit of mercy. It hit 30.89% in December.

Sure, 31% inflation sounds like a nightmare if you're living in Berlin or Paris. But in Turkey? That’s the lowest it’s been since 2021. It’s all about perspective.

The Lira is breathing. Barely.

Why the EUR to TRY Current Rate Keeps Everyone Guessing

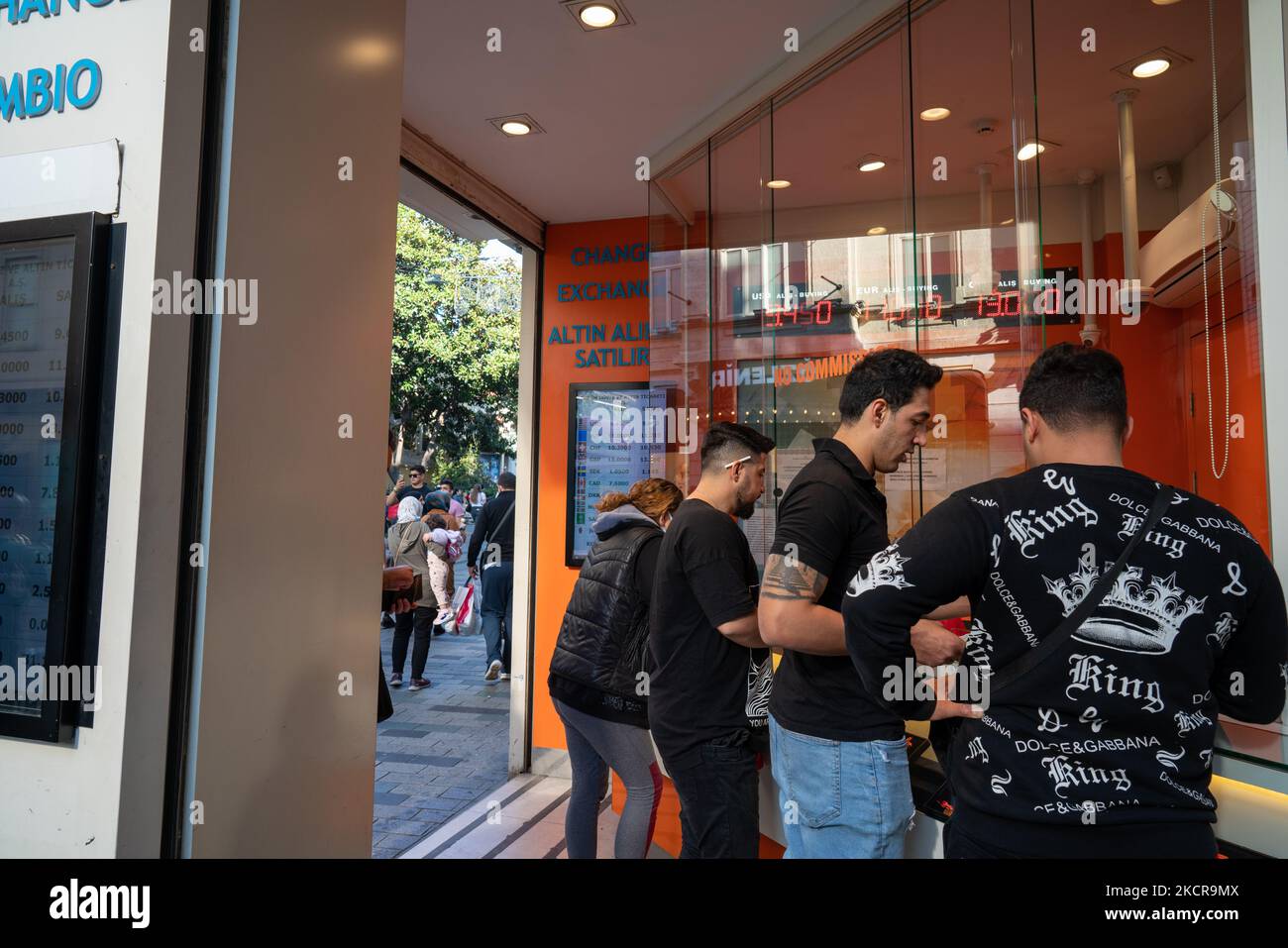

Markets hate surprises. Yet, the Lira is basically a box of surprises. If you are planning to exchange money or you're doing business between the EU and Turkey, you've got to look at the "spread."

The European Central Bank (ECB) is playing a totally different game. While Turkey is cutting rates from 38%, the ECB is sitting steady at 2%. Philip Lane and the rest of the board in Frankfurt are basically saying, "We’re good here." They aren't in a rush to move. This creates a massive "interest rate differential."

Usually, high interest rates protect a currency. But Turkey is cutting theirs while inflation is still way above their 5% target. It's a gamble. They want to jumpstart growth without letting the Lira go into another freefall.

📖 Related: Taxes Late Filing Penalty: Why Waiting Is Way More Expensive Than You Think

- The Minimum Wage Factor: Turkey just bumped the minimum wage by 27% for 2026. That’s a lot of extra money entering the system.

- The "Trump" Effect: Global markets are jittery about U.S. trade policies. If the Dollar gets weird, the Euro follows, and the Lira gets caught in the crossfire.

- Tourist Season Prep: We are in January, but the big players are already looking at summer. Turkey needs those Euro-carrying tourists to bring in hard currency.

Is it Time to Buy or Sell?

There is no "perfect" time, but there are definitely bad times. If you're watching the EUR to TRY current rate for a big move, keep an eye on January 22. That’s when the CBRT meets again.

If they cut rates again—say, down to 36.5%—expect the Euro to flex its muscles. The Lira could easily slide toward 51 or 52. However, if they hold steady because they’re worried about that new minimum wage hiking up prices, the Lira might actually claw back some dignity.

I’ve seen people lose a lot of money trying to time this. They wait for 52, it drops to 48, they panic. Don't be that person.

Practical Steps for Handling Your Euros and Lira

Stop checking the rate every hour. It'll drive you crazy. Instead, think about the "effective rate."

Banks are going to charge you a spread. If the mid-market EUR to TRY current rate is 50.08, your bank might offer you 48.50. That’s a huge chunk of change disappearing into thin air. If you're sending money, use a specialist service that gives you something closer to the real number.

If you're a traveler, honestly, just use your card for big stuff. The "bank rate" on a Visa or Mastercard is usually better than the guy in the booth at the airport who is trying to give you 45 Lira for your Euro.

- Watch the CBRT Calendar: The meeting on January 22, 2026, is the big one.

- Check the "Scissors": The gap between the buying and selling price tells you how volatile the market feels.

- Inflation Reports: These come out monthly. If the next one (due early February) shows inflation heading back toward 35%, the Lira is in trouble.

The Lira isn't just a currency; it's a mood ring for the Turkish economy. Right now, the mood is "cautiously optimistic," but in this part of the world, things change fast. Stay informed, but don't bet the farm on a single day's movement.

For those managing business contracts, consider "forwarding." It basically lets you lock in today's rate for a payment you have to make in three months. If the Euro climbs to 55 by March, you’ll look like a genius for locking in 50 today. If it drops to 45? Well, that's the price of peace of mind.

Everything points to a volatile 2026. The transition from a "high-rate" environment to a "growth" environment is never smooth. You've just got to be ready for the bumps.