Mining stocks are a headache. Seriously. One day you’re looking at a world-class gold deposit, and the next, you’re staring at a decade of red tape and a stock chart that looks like a ski slope.

If you’ve been watching the euro sun mining stock, you know exactly what I’m talking about.

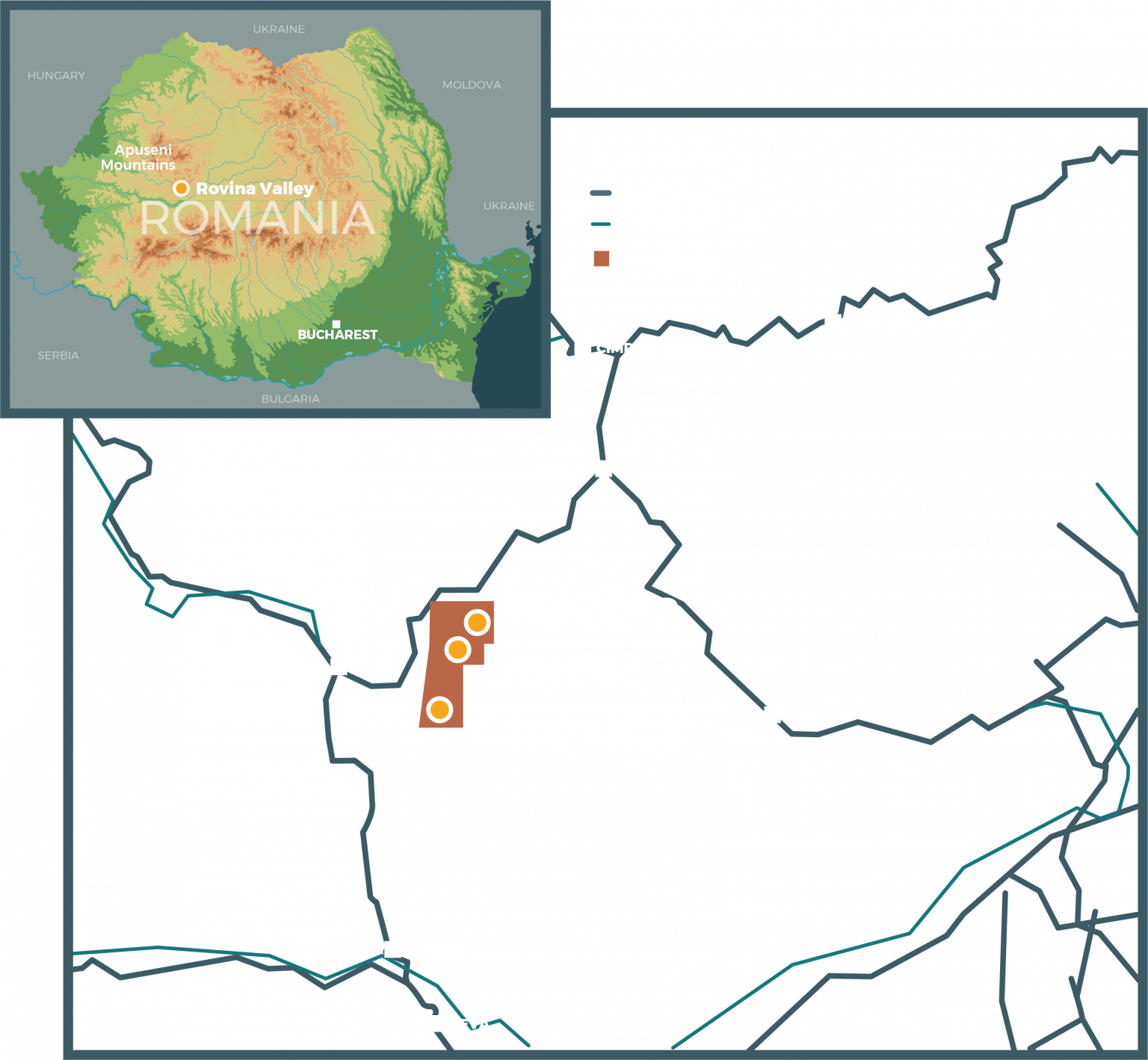

Euro Sun Mining (TSX: ESM) is currently sitting on the Rovina Valley Project in Romania. It is, by all accounts, a monster. We are talking about the second-largest gold and copper resource in all of Europe. Specifically, the site holds roughly 7 million ounces of gold and 1.4 billion pounds of copper. On paper, this thing is a gold mine—literally. But for years, the stock has been stuck in the "permitting purgatory" that swallows junior miners whole.

Honestly, the story has shifted recently. As of early 2026, the vibe around ESM has changed from "hopeful waiting" to "aggressive countdown."

What Actually Matters for the Euro Sun Mining Stock Right Now

The market isn't looking at the gold in the ground anymore; it’s looking at the stamp on the paper. For a long time, the big "if" was the Romanian government. Romania hasn't always been the easiest place to build a mine—just look at the Gabriel Resources / Roșia Montană disaster.

But Brussels changed the game.

The European Union's Critical Raw Materials Act (CRMA) basically forced the hand of member states. Europe realized it can’t build EVs and wind turbines if it’s 100% dependent on China for copper. Because Rovina Valley was designated a "Strategic Project" under this act, the Romanian government had to speed things up. In late 2025, they passed an Emergency Ordinance to create a "Single Point of Contact" for these permits.

This is the catalyst everyone is talking about.

The 2026 Timeline

Analysts are currently treating this as a binary play. It’s simple:

- Scenario A: The final construction permit is granted in 2026. The stock likely experiences a violent re-rating. We've seen projections suggesting a 10x potential if they move from "developer" to "producer" status.

- Scenario B: More delays. If the Environmental Impact Assessment (EIA) hits another snag, the cash burn becomes a serious problem.

Grant Sboros, the CEO, has been steering this ship since late 2022. He’s been focused on "de-risking" the project. What does that look like? It means no cyanide. It means dry-stack tailings instead of those massive, scary wet dams. These aren't just "green" PR moves; they are strategic decisions to make the project impossible for the government to reject on environmental grounds.

💡 You might also like: How Much is US Dollar to British Pound: What Actually Drives the Rate in 2026

The Financial Reality Check

Let’s talk numbers because the euro sun mining stock isn't for the faint of heart.

The stock price has been hovering around the CA$0.38 to CA$0.40 range lately. Just a year ago, it was trading at a fraction of that. The technicals look bullish—trading above the 200-day moving average—but you have to remember that this is still a speculative small-cap.

The company recently updated its Definitive Feasibility Study (DFS) in late 2025. The numbers are frankly staggering.

- Post-tax NPV: US$1.47 billion.

- Initial Capex: About US$607 million.

- Project Life: 17 years (just for the first phase).

Compare that US$1.47 billion NPV to the current market cap of around CA$160 million. The gap is huge. That gap exists because investors are still pricing in the risk that the mine never gets built.

Funding is also a major piece of the puzzle. Euro Sun secured a multi-facility agreement with Trafigura and other backers, giving them access to up to US$200 million. This helps, but they’ll still need a massive chunk of change to actually start moving dirt in 2027.

Why People Get This Stock Wrong

Most people think ESM is just another gold junior. It isn't. It’s actually a copper play disguised as a gold company.

📖 Related: Dillard Funeral Home in Pickens SC: What Most People Get Wrong

Copper is the "electric metal." With the Rovina Valley expected to pump out 40,000 to 50,000 tonnes of copper annually once it's at full tilt, it becomes a strategic asset for the European supply chain. This is why the EU stepped in. If this was just a gold mine, it probably wouldn't have received the "Strategic Project" fast-track.

Also, ignore the "zombie company" talk you might see on old message boards. The ESM of 2026 is a different beast than the ESM of 2020. They’ve cleaned up the balance sheet, repaid old debentures, and aligned themselves with Glencore for offtake agreements.

The Risks Nobody Likes to Mention

It’s not all sunshine.

The "Momentum Trap" label is one you'll see from technical analysts. Because the stock has surged so much in the last few months (up over 700% from its 52-week lows in some periods), there’s a lot of "hot money" in there. If the permit news doesn't drop by mid-2026, those traders will vanish, and the price will crater.

Then there’s the local opposition. While the "Single Point of Contact" law makes it harder for small NGOs to block the project, legal challenges are still a possibility in the Romanian courts.

Actionable Insights for Investors

If you’re looking at euro sun mining stock, you’re not "investing" in the traditional sense; you’re placing a bet on European regulatory efficiency.

- Watch the EIA Submission: The submission of the final Environmental Impact Assessment is the next major hurdle. Once that's cleared, the construction permit is the only thing left.

- Copper Prices Matter: While gold provides the floor, the copper price will drive the ceiling. If copper stays above $4.50/lb, the project economics look like a money-printing machine.

- Check the Volume: Look for sustained high trading volume. If the price moves up on low volume, it’s a fake-out. The recent volume of 700k to 1M shares a day suggests institutional eyes are finally starting to watch.

- Position Sizing: This is a "zero or hero" play. Don't put the mortgage money here. It’s the kind of stock that belongs in the speculative 5% of a portfolio.

The Rovina Valley is one of the few projects of this scale left in a Tier-1 jurisdiction (EU). Whether the euro sun mining stock becomes a legend or a cautionary tale depends entirely on the next six months of Romanian bureaucracy.

For those who believe the EU is serious about its Critical Raw Materials Act, the current valuation looks like a massive oversight by the broader market. If you’re waiting for the permit to be signed before you buy, you’ll likely be buying at a price that's already 3x higher than it is today. That is the risk/reward trade-off in a nutshell.