Money is a weird thing in the Caribbean. If you've ever stood in a bank line in Port of Spain only to be told there's a "limit" on how much foreign currency you can buy, you know exactly what I mean. The exchange rate us dollar to trinidad dollar isn't just a number on a screen; for Trinidadians, it’s a daily puzzle of math and patience. Honestly, looking at the official rate is only half the story.

As of early 2026, the official rate is hovering around 6.81 TTD to 1 USD. But that's the "clean" version. In the real world—where people are trying to pay for Amazon shipments or small business owners are trying to restock shelves—things get a lot messier.

The Gap Between the Screen and the Counter

Basically, there’s the rate the Central Bank of Trinidad and Tobago (CBTT) publishes and then there’s the "street" reality. You've probably noticed that the official rate has stayed remarkably stable for years, pinned like a butterfly to a board near the 6.7 to 6.8 mark. This is a managed float. The government keeps it there to prevent runaway inflation, but the side effect is a massive shortage.

If you walk into a commercial bank today, you might see the buying rate at 6.71 and the selling rate at 6.76. Sounds great, right? Try actually buying ten thousand dollars at that price. You’ll likely be met with a "we're out" or a "your limit is $200."

This scarcity has pushed the "informal" or parallel market rate much higher. It’s not uncommon to hear of transactions happening at 7.20 or even 7.50 TTD for a single US dollar. It’s the price of convenience—or rather, the price of necessity.

Why Is It So Hard to Get US Dollars?

It comes down to energy. Trinidad and Tobago’s economy lives and breathes on oil and gas. When production at places like the Atlantic LNG plant dips, or global prices get wonky, the flow of US dollars into the country slows to a trickle.

✨ Don't miss: Thinking about 1.7 billion won: What that money actually buys you in 2026

- Natural Gas Production: It’s been lower than expected lately.

- The "Harding" Effect: People are holding onto their USD.

- Import Obsession: We import almost everything we eat and wear.

- Digital Spending: Everyone is shopping on US websites now.

Governor of the Central Bank has even pointed out a wild statistic recently: for the first time, the general public actually holds more foreign exchange than the Central Bank does. People are "stuffing mattresses" with US cash because they don't know when they'll be able to get more. That’s a huge deal. It’s a trust issue.

How the 2026 Landscape Is Shifting

Things are getting a bit tense on the geopolitical front, too. You might have seen the headlines about T&T’s relationship with the US and the ongoing drama with Venezuela. Kenneth Mohammed, a well-known commentator, recently argued in The Guardian that our alignment with US policy could cost us big if it ruins potential gas deals with our neighbors. If those deals fall through, the supply of USD could shrink even more, putting even more pressure on the exchange rate us dollar to trinidad dollar.

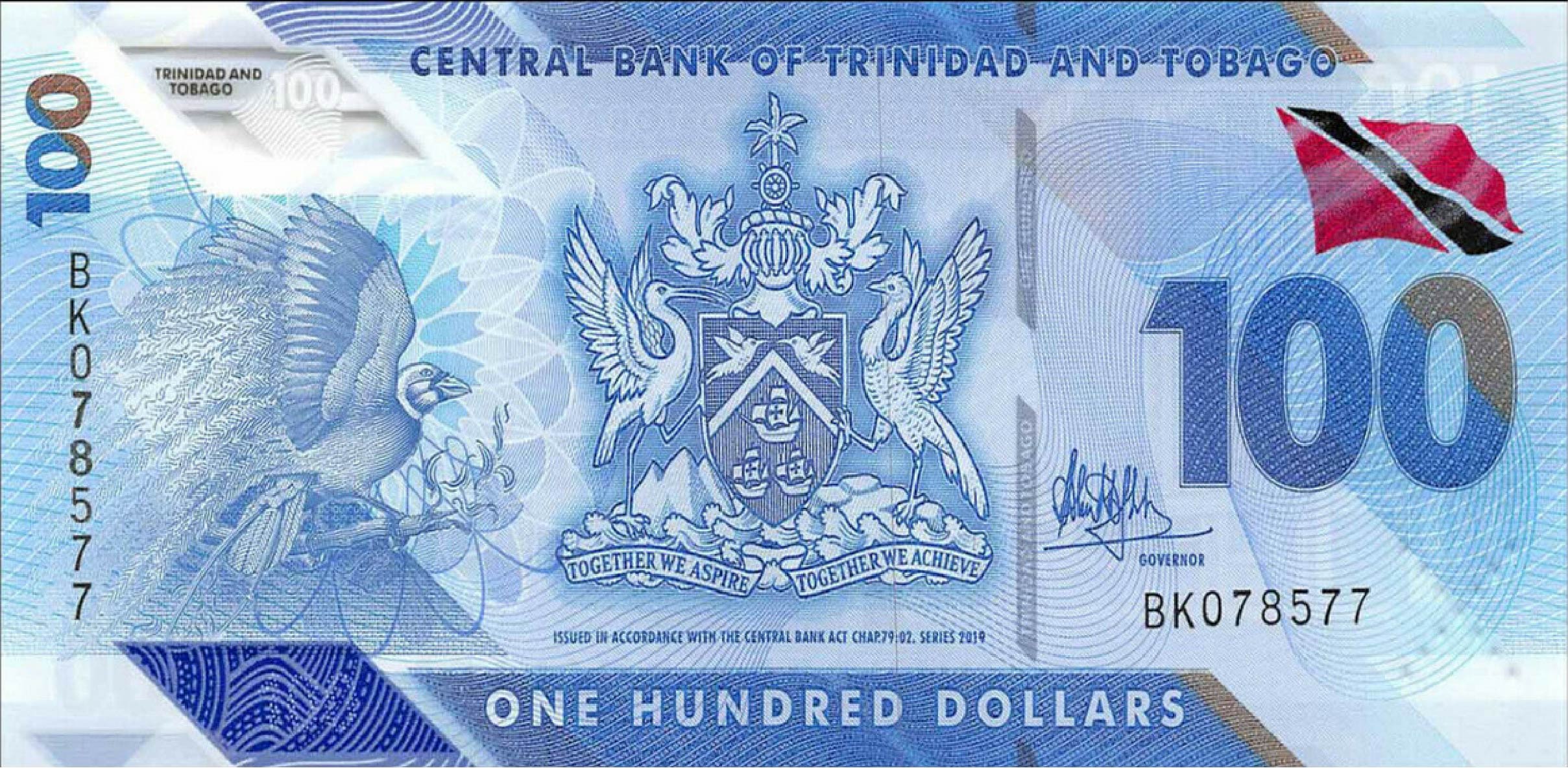

Then there’s the new money. The Central Bank just introduced the Series 2026 $100 banknote with the new Coat of Arms. While it looks fancy, a new bill doesn't change the underlying economics. The bank is trying to manage liquidity by keeping interest rates around 3.50%, but there's a growing "whisper" among economists that rates might have to go up to attract that "hidden" USD back into the formal banking system.

The Survival Guide for TTD Holders

If you're trying to navigate this, you need to be smart. You can't just rely on your local branch's ATM.

First off, understand the priority list. Banks are legally obligated to prioritize:

- Medical emergencies.

- Tuition for students studying abroad.

- Essential business imports (like food and medicine).

If you’re just trying to go on a vacation to Miami, you’re at the bottom of the pile. This is why credit card limits have been slashed. Remember when Republic Bank cut limits from $10,000 to $5,000? Some banks are even tighter now.

What Most People Get Wrong

The biggest misconception is that the TTD is "weak." It’s not necessarily weak in the way a free-falling currency is; it’s restricted.

If the government let the exchange rate us dollar to trinidad dollar float freely tomorrow, the rate would likely jump to 8.00 or 9.00 instantly. The price of bread, gas, and doubles would skyrocket. To prevent that social chaos, the Central Bank intervenes. They "inject" USD into the banks periodically—usually a few times a month—to keep the lights on.

Another mistake? Thinking the rate is the same everywhere. Always check the "Cambios." These are authorized dealers that sometimes have slightly different rates or better availability than the big commercial banks, though they still follow the Central Bank's general lead.

Actionable Steps for Your Money

Stop waiting for the "perfect" time to buy. If you see USD available at the official rate, buy your limit. Even if you don't need it today, you'll need it tomorrow.

Look into USD-denominated investments. Local institutions like the Unit Trust Corporation (UTC) offer funds that are priced in US dollars. This is a way to "hedge" against the local currency. If the TTD ever does devalue significantly, your money in those funds is protected because it’s already "converted" in the eyes of the fund.

Keep an eye on the Monetary Policy Reports. The Central Bank drops these every few months. If they start talking about "tightening liquidity" or "inflationary pressures," it’s a signal that USD is going to get even harder to find.

Use digital wallets where you can. The rise of apps like WiPay and the potential introduction of local versions of Apple Pay are changing how we spend, but they still ultimately rely on that underlying exchange rate.

Honestly, the exchange rate us dollar to trinidad dollar is the pulse of the island's economy. Until the country finds a way to export more than just oil and gas—or until people stop hoarding cash—the "shortage" is the new normal. Plan your travel and your business imports months in advance. Don't leave it for the week you need to fly out, or you'll end up paying those high "street" prices just to get through the airport.

Monitor the Central Bank's official daily rate at their website to ensure you aren't being overcharged by more than the typical 3-5% spread. Diversify your savings into USD-based mutual funds or credit union accounts that offer foreign currency options to protect your purchasing power from future devaluations. Apply for foreign exchange for travel at least four to six weeks before your departure date to allow for bank processing times and "queuing" for available funds.