You’ve seen the headlines. Everyone is waiting for that magic number. It’s like the whole country is holding its breath, waiting for the Federal Reserve to finally "fix" the housing market.

Honestly, it’s not that simple.

If you’re checking the fed mortgage rate today, you probably noticed the 30-year fixed is hovering right around 6.11%. It’s a weird spot. We are down from those scary 7.5% highs of late 2024, but we aren't exactly back to the "free money" era of 3%.

👉 See also: The Japanese Yen Chinese Yuan Rivalry: Why Asia’s Currency War Is Hitting Your Wallet Now

The Fed Doesn't Actually Set Your Mortgage Rate

Let's clear this up first because it's a huge misconception. Jerome Powell doesn't wake up and decide your interest rate is going to be 6.1%.

The Fed sets the Federal Funds Rate. That’s what banks charge each other for overnight loans. Currently, that sits in the 3.5% to 3.75% range after the cuts we saw in late 2025.

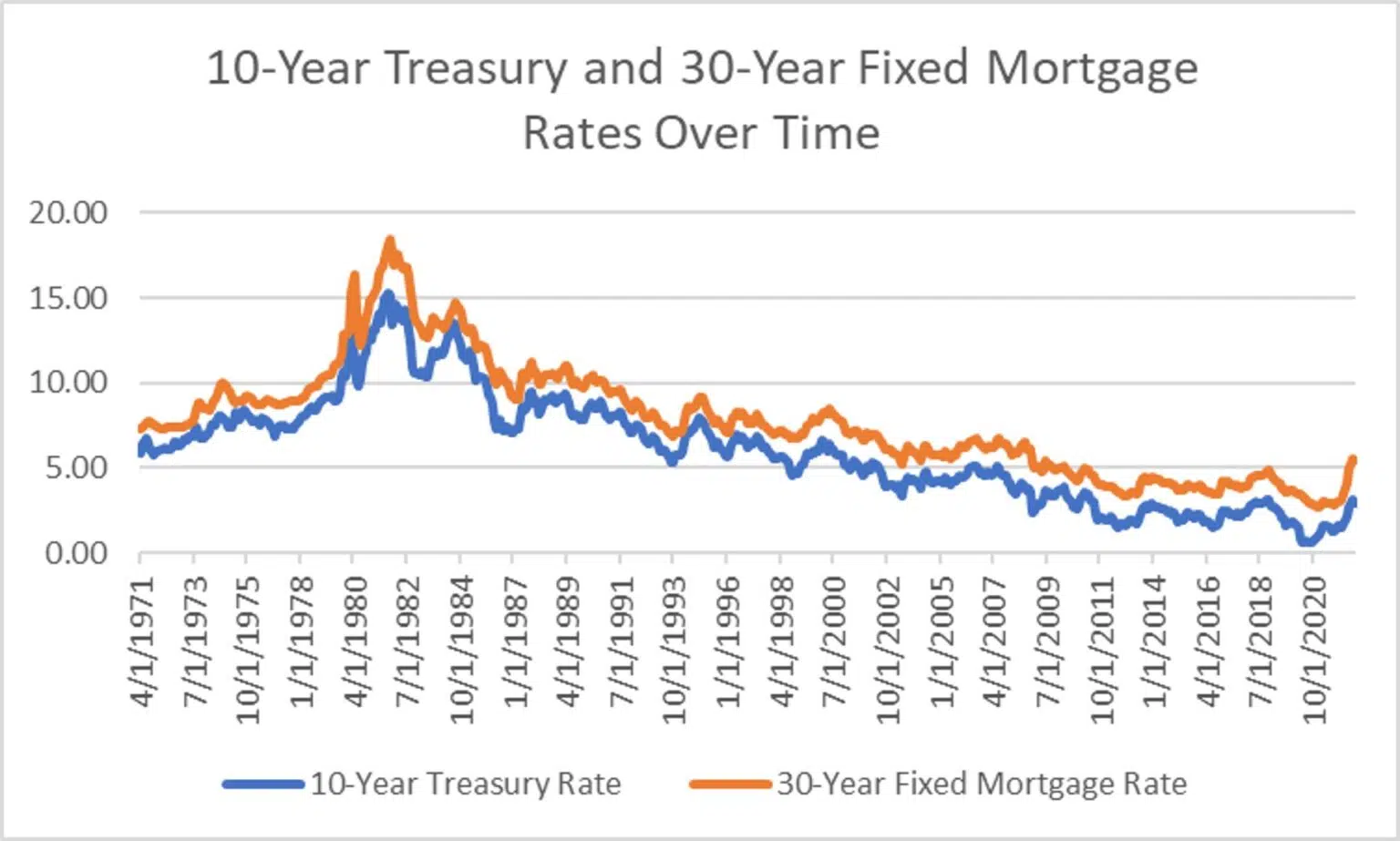

Mortgage rates? They usually follow the 10-year Treasury yield.

It's all about the "spread." Usually, mortgage rates are about 1.5 to 2 percentage points higher than the 10-year yield. But lately, things have been glitchy. The spread has been wider because investors are nervous. When the bond market gets twitchy, you pay for it in your monthly payment.

What’s Happening Right Now?

Today, January 17, 2026, we are in a stalemate.

The Fed is meeting in less than two weeks. Some people, like the folks at Goldman Sachs, think we might see another cut later this year. But others? J.P. Morgan’s Michael Feroli basically said, "Don't count on it." He thinks the Fed might just sit on its hands all through 2026 because inflation is still being a pain.

It’s sticky.

Core inflation is still hanging above 3%. That’s higher than the 2% target the Fed obsesses over. If they cut rates too fast, they risk making everything expensive again. If they don't cut, they risk a recession. It's a tightrope walk with no net.

The Numbers You Need to Know Today

- 30-Year Fixed: Averaging 6.11%.

- 15-Year Fixed: Sitting around 5.47%.

- FHA Loans: Roughly 5.78%.

- Jumbo Loans: Still pricey at 6.40%.

Why 6% is the New 3%

We have to be real here. The days of 2.75% or 3.25% are gone. They were a freak accident of history caused by a global pandemic.

💡 You might also like: Cost of Gold Oz: What Most People Get Wrong About Today's Prices

Experts like Ted Rossman at Bankrate think we might dip into the high 5s this year, maybe hitting 5.7% if we're lucky. But for most of 2026, expect to bounce around 6%.

It’s the "new normal."

If you’re waiting for 4% to buy a house, you might be waiting for a decade. Meanwhile, home prices are still climbing because there just aren't enough houses. Even a small drop in the fed mortgage rate today could bring more buyers back into the market. More buyers means more bidding wars. More bidding wars means the house you liked just got $20,000 more expensive.

The Trump Factor and the Fed Chair

There is a lot of noise about the new administration and the Fed’s independence.

President Trump has made it clear he wants lower rates. He’s expected to nominate a new Fed Chair when Powell’s term ends this May. Markets hate uncertainty. If investors think the Fed is becoming political, they might actually push mortgage rates up, not down.

Why? Because a "political" Fed might let inflation run wild. To protect themselves, bond investors demand higher yields. It’s a paradox: pushing for lower rates can sometimes make them higher.

Is Now the Time to Refinance?

If you bought a house in late 2023 or early 2025, you might be sitting on a rate near 7.5% or even 8%.

For you, 6.11% looks like a miracle.

Usually, the rule of thumb is to refinance if you can drop your rate by at least 0.75% to 1%. We are finally in that window for a lot of people. Just remember to factor in the closing costs. If it costs you $5,000 to refinance, but you only save $150 a month, it’ll take you nearly three years just to break even.

💡 You might also like: Kraken News and Rumors Explained: The Truth About the 2026 IPO and What’s Next

Your Next Steps

Don't just watch the news; check the yields.

Keep an eye on the 10-year Treasury yield. If you see it falling toward 3.5%, mortgage rates will likely follow.

Get a "lock-and-shop" agreement. Many lenders will let you lock in today's rate for 60 to 90 days while you look for a house. If rates go up, you’re safe. If they go down, some lenders will let you "float down" to the better rate once.

Check your credit score. A 760 score vs. a 660 score can be the difference between a 6.1% rate and a 7.1% rate. That’s hundreds of dollars a month. In this market, your credit score is the only thing you can actually control.

Stop waiting for a "crash" that might not come. If the numbers work for your budget today, they work. If they don't, no amount of Fed-watching will change the math.