The national debt is basically the ultimate political football. People love to toss it around. Depending on who you ask, the debt is either a looming apocalypse or just a boring line item on a spreadsheet that doesn't actually matter because we print our own money. Honestly? The truth is somewhere in the messy middle. When you start looking at federal debt by administration, you realize that the raw numbers often lie—or at least, they don't tell the whole story.

It’s huge. We are talking about over $34 trillion as of early 2024. But looking at that massive number doesn't help you understand how we got here. To do that, you have to look at which presidents spent what, why they spent it, and what the economy actually looked like at the time.

💡 You might also like: Hobby Lobby CEO David Green: Why He Really Gave Away His Billion-Dollar Empire

The Raw Data vs. The Reality

Most people look at a chart and say, "President X increased the debt by Y percent, so they are the worst." That’s a bit lazy. It ignores the fact that a president inherits a budget on day one that they didn't write. They also inherit interest payments on debt that was piled up decades ago.

The U.S. Treasury Department keeps the receipts, and if you dig into the historical tables, you see some wild swings. Some presidents are "lucky" enough to govern during a massive tech boom. Others get hit with a once-in-a-century pandemic or a global financial meltdown. You've got to account for that.

Why the Percentage Increase Can Be Deceiving

If you start with $1 and end with $2, you’ve increased the debt by 100%. If you start with $20 trillion and end with $25 trillion, that’s "only" a 25% increase, but you’ve added way more actual cash to the pile. This is why comparing FDR to modern presidents is kinda like comparing apples to spaceships.

The Modern Era: From Reagan to Today

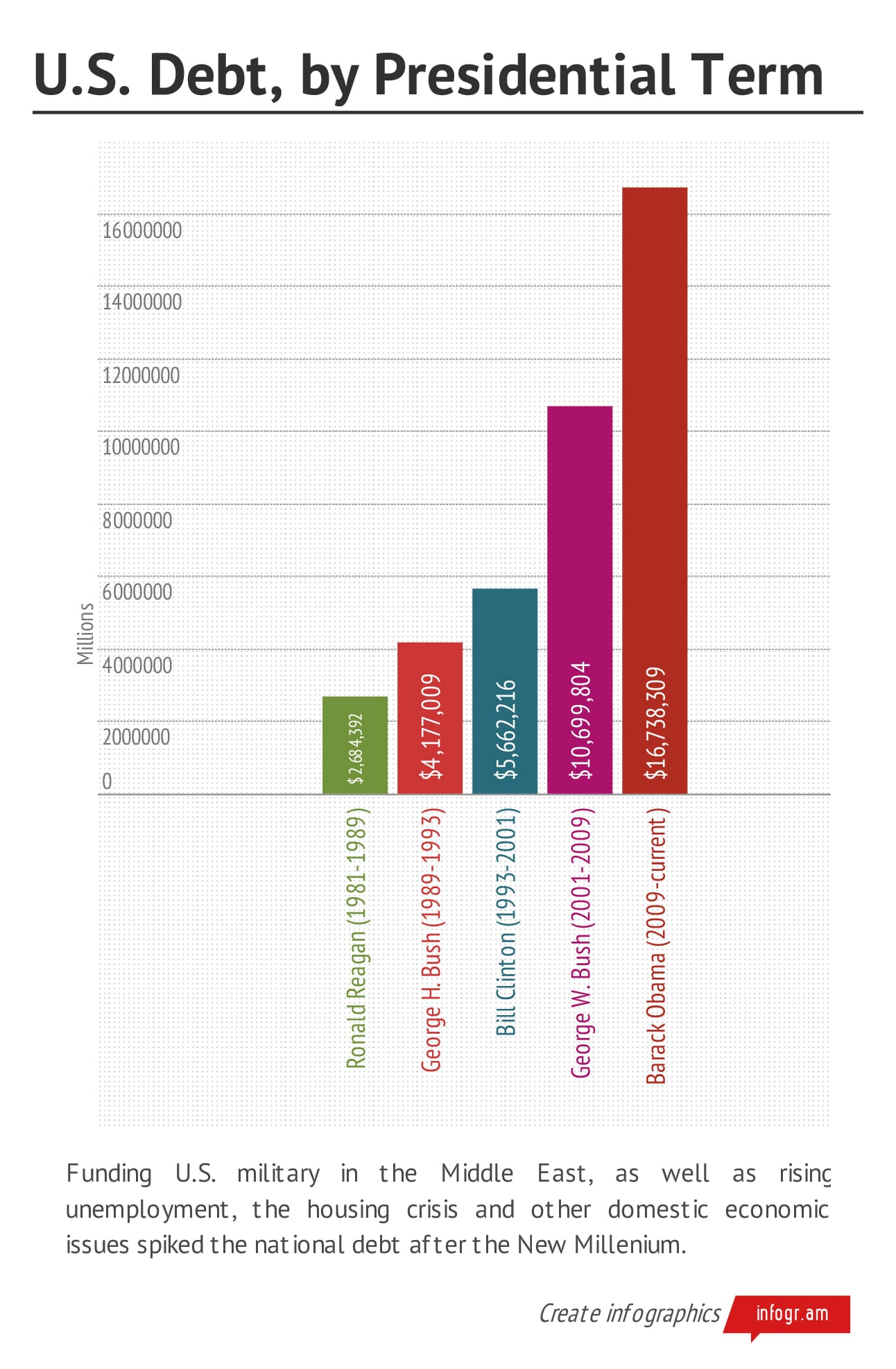

Ronald Reagan is often cited as the father of modern deficit spending. He didn't start the debt, obviously, but his combination of massive tax cuts (ERTA 1981) and a huge buildup in defense spending during the Cold War changed the trajectory. Under Reagan, the national debt nearly tripled. It went from around $900 billion to $2.6 trillion. That’s a massive jump in percentage terms.

Then you have George H.W. Bush. He’s the guy who famously said "Read my lips: no new taxes," and then... well, he raised taxes. He did it because the deficit was spiraling. Even so, the debt kept climbing.

The Clinton Exception?

People talk about Bill Clinton like he paid off the debt. He didn't. He ran a "budget surplus," which means for a few years, the government took in more than it spent. But the total federal debt still went up because of "off-budget" items and the way Social Security funds are accounted for. Still, compared to everyone else on this list, the Clinton years were a statistical anomaly of restraint.

The Trillion-Dollar Club: Bush, Obama, and Trump

Things got weird after 2000.

George W. Bush inherited a surplus and left with a smoking crater in the economy. Two wars—Afghanistan and Iraq—were funded almost entirely on the credit card. Then the 2008 financial crisis hit. The debt jumped from about $5.7 trillion to over $10 trillion by the time he handed the keys to Barack Obama.

Obama then had to deal with the Great Recession. The American Recovery and Reinvestment Act was a massive infusion of cash. During his eight years, the debt grew by about $9 trillion. Critics point to the raw number. Supporters point to the fact that the economy was in total freefall when he started.

Then came Donald Trump.

Before the pandemic even started, the debt was rising due to the 2017 Tax Cuts and Jobs Act. Then COVID-19 happened. The CARES Act and subsequent relief bills added trillions in a matter of months. By the time Trump left office, the debt had risen by roughly $7.8 trillion. It was a staggering amount of money in a single four-year term.

Biden and the Post-Pandemic Hangover

Joe Biden stepped into a world of high inflation and "sticky" spending. While he’s touted "deficit reduction" in his speeches, the total federal debt by administration metrics show that the pile is still growing fast.

The Inflation Reduction Act and the Infrastructure Investment and Jobs Act are big-ticket items. But the real killer lately? Interest rates. Because the Federal Reserve hiked rates to fight inflation, the cost of just servicing our existing debt has skyrocketed. We are now spending hundreds of billions of dollars just to pay the interest. We aren't even buying anything for it. No roads. No tanks. No schools. Just interest.

The Congressional Factor

We have to be fair here: Presidents don't actually hold the purse strings. Congress does. A president can propose a budget, but the House and Senate are the ones who actually pass the bills. If you have a president from one party and a Congress from another, you usually get a lot of gridlock—but ironically, that’s sometimes when the debt grows the slowest. When one party controls everything, they tend to go on a spending spree.

Does the Debt Actually Matter?

This is where the experts fight.

Some economists, especially those who lean toward Modern Monetary Theory (MMT), argue that as long as we don't have runaway inflation, the debt isn't a huge deal because we owe much of it to ourselves.

Others, like the folks at the Committee for a Responsible Federal Budget (CRFB), are terrified. They argue that we are "crowding out" private investment and heading toward a fiscal crisis where we won't be able to respond to the next big emergency because our credit card is maxed out.

🔗 Read more: How Many Sterling Pounds in a Dollar: Why the Rates Are Moving Right Now

- The "Safety" Argument: The U.S. dollar is the world's reserve currency. People buy our debt (Treasury bonds) because it's the safest place on earth to put money.

- The "Cliff" Argument: If investors lose faith in the U.S. government's ability to pay back that debt, interest rates will explode, and the economy will collapse.

Real Numbers You Should Know

To give you a sense of scale, let's look at the debt-to-GDP ratio. This is basically your debt compared to your income.

After WWII, our debt-to-GDP was over 100%. We paid it down (or rather, outgrew it) over the next few decades. By the 1970s, it was down to about 35%.

Today? We are back over 100%.

That’s the part that worries the pros. It’s not just the dollar amount; it’s that the debt is growing faster than the entire U.S. economy. You can't do that forever. Math eventually catches up to you.

How to Read Between the Lines

When you see a politician post a chart about federal debt by administration, look for these three things:

- Inflation adjustment: Is the chart using "nominal" dollars or "real" (inflation-adjusted) dollars? $1 trillion in 1980 is way different than $1 trillion in 2024.

- External shocks: Did a war start? Did a virus shut down the world? These things aren't "policy," but they drive the debt.

- Mandatory vs. Discretionary spending: Most of our debt isn't driven by "new" laws. It's driven by Social Security and Medicare, which were set up decades ago. As the population gets older, these costs go up automatically. No president has really "fixed" this because it's political suicide to touch it.

Actionable Steps for the Taxpayer

You can't personally balance the federal budget, but you can protect yourself from the fallout of a debt-heavy economy.

Understand your exposure to interest rates. If the government is struggling with debt, interest rates will likely stay higher for longer. This affects your mortgage, your car loan, and your credit card. Refinance when you can, but don't count on 3% rates coming back anytime soon.

Hedge against currency devaluation. Historically, when governments have too much debt, the value of their currency can drop. Diversifying your investments into assets like stocks, real estate, or even a small amount of gold/crypto can be a shield.

Watch the "Primary Deficit." This is the difference between what the government spends and what it takes in, excluding interest payments. If the primary deficit starts shrinking, it's a sign that fiscal sanity might be returning. If it's growing, buckle up.

🔗 Read more: Jimmy Carter Selling Peanut Farm: What Really Happened to the Famous Business

Vote on policy, not just personality. Look at the non-partisan scores from the Congressional Budget Office (CBO) before getting excited about a new spending plan or tax cut. They are the closest thing we have to an objective referee in this game.

The national debt is a massive, slow-moving glacier. It doesn't look like it's moving day to day, but it's reshaping the entire landscape underneath us. Staying informed about the actual drivers of the debt—rather than just the partisan talking points—is the only way to make sense of the noise.