Let’s be real for a second. Whenever you see a headline about the national debt, it’s usually someone screaming about how the "other side" is driving the country into a ditch. It’s a political football. But if you actually sit down and look at the numbers—the cold, hard U.S. Treasury data—the story of federal debt by president is a lot messier, and frankly, more interesting than a 30-second campaign ad.

Money is weird. Government money is even weirder. We just crossed the $38 trillion mark in late 2025. That’s a number so big it basically loses all meaning. To understand how we got here, you have to look at the people who held the pen when the budgets were signed. But there's a catch: a president doesn't just inherit a blank slate. They inherit the previous guy's bills, interest rates they can't control, and sometimes, a global pandemic that eats the economy for lunch.

The Modern Era: From Reagan to the 2020s

If you want to understand the modern trajectory of our debt, you have to start with Ronald Reagan. Before him, the debt-to-GDP ratio was actually falling after the highs of World War II.

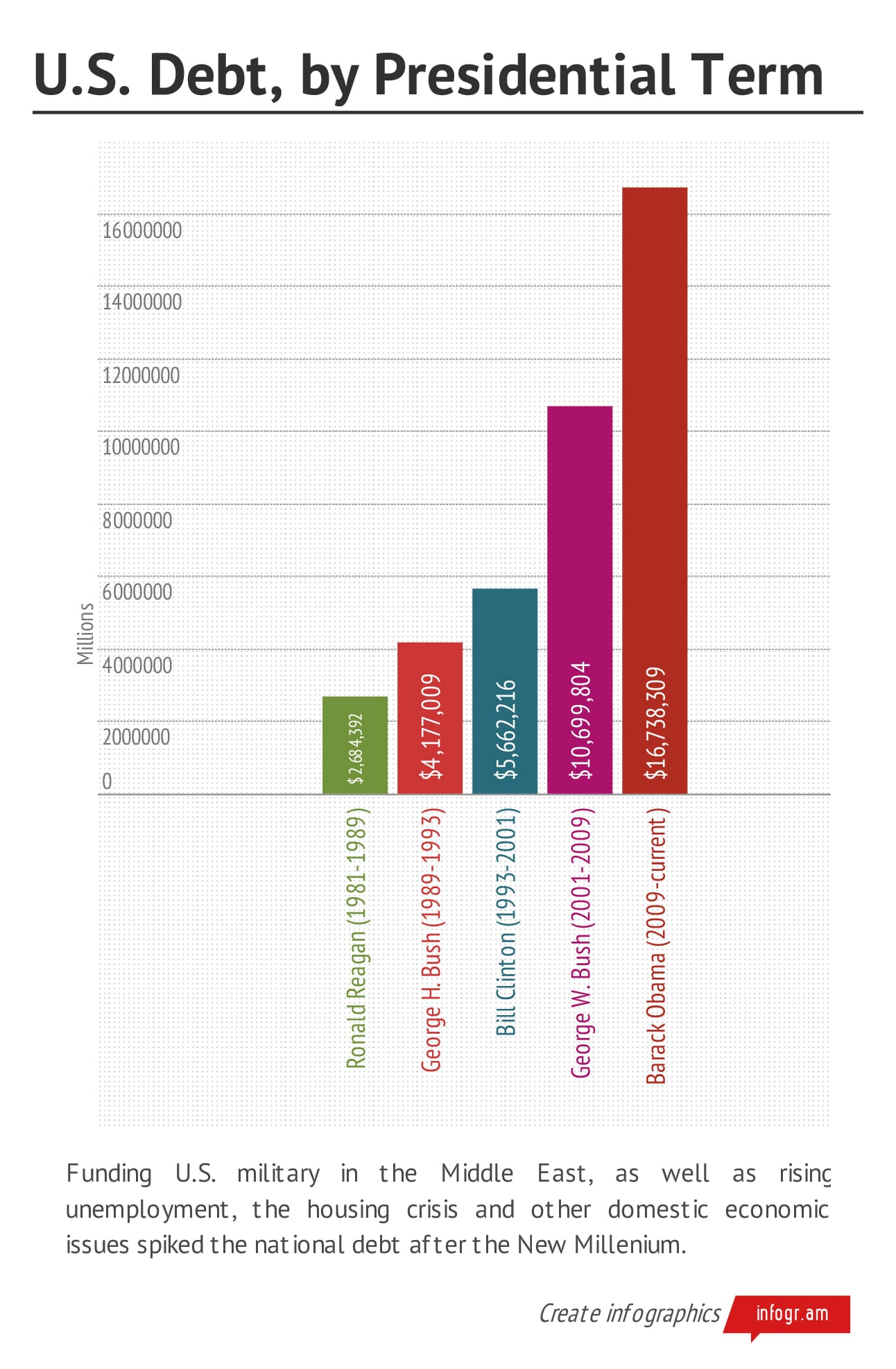

Reagan changed the game. He pushed for massive tax cuts while simultaneously ramping up military spending during the Cold War. It was a "spend now, grow later" strategy. By the time he left in 1989, he had added about $1.86 trillion to the tab. In percentage terms, that was a massive jump—nearly tripling the debt he started with.

Then came George H.W. Bush. He’s often remembered for "no new taxes," but he ended up raising them anyway to deal with the mounting deficit. He added about $1.5 trillion in a single term. Honestly, he was stuck between a rock and a hard place, dealing with the tail end of the Cold War and a bumpy economy.

Bill Clinton and the Surplus Myth

You’ve probably heard people say Bill Clinton "paid off the debt." Well, not exactly. He did achieve something we haven't seen since: a budget surplus. For a few years in the late 90s, the government actually took in more than it spent.

💡 You might also like: msty etf dividend schedule: How the Payouts Actually Work

He didn't erase the debt, but he slowed the bleeding. The debt-to-GDP ratio actually dropped during his tenure. He left office with the debt at about $5.6 trillion. It’s the last time we really saw the "line go down" in a meaningful way relative to the size of the economy.

The 21st Century Explosion

Then 2001 happened. Between the 9/11 attacks, the wars in Iraq and Afghanistan, and the 2001 recession, the "surplus" vanished almost instantly. George W. Bush signed off on major tax cuts and two wars. By the time the 2008 financial crisis hit, the debt was already on a steep climb. Bush ended up adding roughly $6.1 trillion.

Barack Obama stepped into a literal house on fire. The Great Recession forced massive "stimulus" spending—the American Recovery and Reinvestment Act—to keep the global economy from collapsing. Combine that with the ongoing costs of the wars and the aging Baby Boomer generation hitting Social Security and Medicare, and the numbers exploded. Obama added about $8.3 trillion over eight years.

The Pandemic Pivot: Trump and Biden

Donald Trump’s first term saw a different kind of growth. Early on, it was the 2017 Tax Cuts and Jobs Act. But then 2020 arrived. The COVID-19 response was the single most expensive "event" in modern fiscal history. Bipartisan relief packages like the CARES Act sent the debt vertical. By the time he left office in January 2021, the debt had climbed by about $8.2 trillion in just four years.

💡 You might also like: msft stock price today after hours: Why Investors Are Sweating the Small Stuff

Joe Biden's term continued that trend, though the drivers shifted. While pandemic spending eventually wound down, it was replaced by the Inflation Reduction Act and the CHIPS Act. But the real "silent killer" of the budget under Biden wasn't just new spending—it was interest rates. As the Fed hiked rates to fight inflation, the cost of just holding our existing debt skyrocketed.

By the end of 2024, the U.S. was spending more on interest payments than on its entire defense budget. Let that sink in.

Where We Stand in 2026

As of January 2026, the situation has taken another turn. We are currently seeing the impact of the "One Big Beautiful Bill Act" (OBBBA), which was signed into law recently. This package extended many of the 2017 tax cuts and introduced new tariff structures.

The Congressional Budget Office (CBO) is now projecting that this latest legislative shift could add another $3.4 trillion to the deficit over the next decade. Total federal debt by president metrics are now hitting territories that economists used to call "the danger zone."

- Current Total Debt: ~$38.5 trillion

- Debt-to-GDP Ratio: ~124%

- The "Interest Trap": We are currently paying over $1.1 trillion a year just in interest.

Why the President Isn't a King

It’s easy to blame the person in the Oval Office, but it's sorta unfair. Here’s the reality: most of the budget is "autopilot" spending.

- Mandatory Spending: Social Security, Medicare, and Medicaid make up the lion's share. No president can change these without an act of Congress that would be political suicide.

- The "Inheritance" Factor: A president who enters office during a recession (like Obama or FDR) is basically forced to spend. A president who enters during a boom (like Clinton) has it much easier.

- The Fed: The President doesn't control interest rates. When Jerome Powell moves the dial, the cost of the national debt moves with it, regardless of who is in the White House.

Actionable Insights: What This Means for You

You can't control the national debt, but you can control how it affects your wallet.

Watch interest rates like a hawk. When the federal debt grows this fast, the government has to compete for lenders. This can keep long-term interest rates (like mortgages) higher for longer. If you’re planning to buy a home or refinance, don't wait for a "return to zero" that might never come.

👉 See also: 1111 Stewart Ave Bethpage: What Actually Happens at the Grumman Studios Site

Diversify your currency exposure. If the debt-to-GDP ratio continues to climb toward 150%, the value of the dollar could come under pressure. Many financial advisors are now suggesting holding a mix of assets—international stocks, real estate, or even "hard assets"—to hedge against potential long-term dollar devaluation.

Expect "Fiscal Cliff" volatility. Every time the debt ceiling comes up, the markets get jittery. In 2026, we’re seeing more of these "last minute" deals. Keep a cash cushion (3-6 months of expenses) in a high-yield savings account so a temporary market dip or government shutdown doesn't ruin your life.

The bottom line? The federal debt by president is a reflection of our national priorities, our crises, and our refusal to make hard choices. Whether you lean left or right, the math doesn't care about your politics. It just keeps adding up.

Track the CBO's latest monthly budget reviews to see if the current tariff-heavy revenue model is actually offsetting the new spending, or if the deficit is widening further than projected. Look for the "Monthly Treasury Statement" for the most accurate, non-partisan updates.