Tax season usually feels like a giant, looming cloud, but honestly, the real action starts way before you ever file a return. It’s all in the withholding. People tend to treat their paychecks like a fixed reality, something handed down by fate, when it's actually governed by the IRS and their very specific federal tax tables for 2024. If you haven't looked at these numbers lately, you’re basically flying blind. The IRS adjusted these brackets for inflation—quite significantly, actually—because prices for eggs and gas went through the roof.

The system is progressive. This means you don't pay one flat rate on everything you earn, which is a common misconception that drives accountants crazy. You’ve probably heard someone say, "I don't want a raise because it'll put me in a higher tax bracket and I'll take home less money." That is mathematically impossible. Total nonsense. You only pay the higher rate on the dollars that actually fall into that specific bucket.

👉 See also: Converting 100 Dirhams to US Dollars: What You Actually Get After Fees

How the 2024 brackets actually shift your math

For the 2024 tax year, the IRS bumped the brackets up by about 5.4%. That’s a response to the cost-of-living chaos we’ve all been feeling. If your salary stayed exactly the same as it was in 2023, you might actually see a tiny bit more in your take-home pay because more of your income is being taxed at the lower percentage rates. It’s called "bracket creep" prevention. Without these adjustments, inflation would effectively give you a tax hike even if your buying power stayed the same.

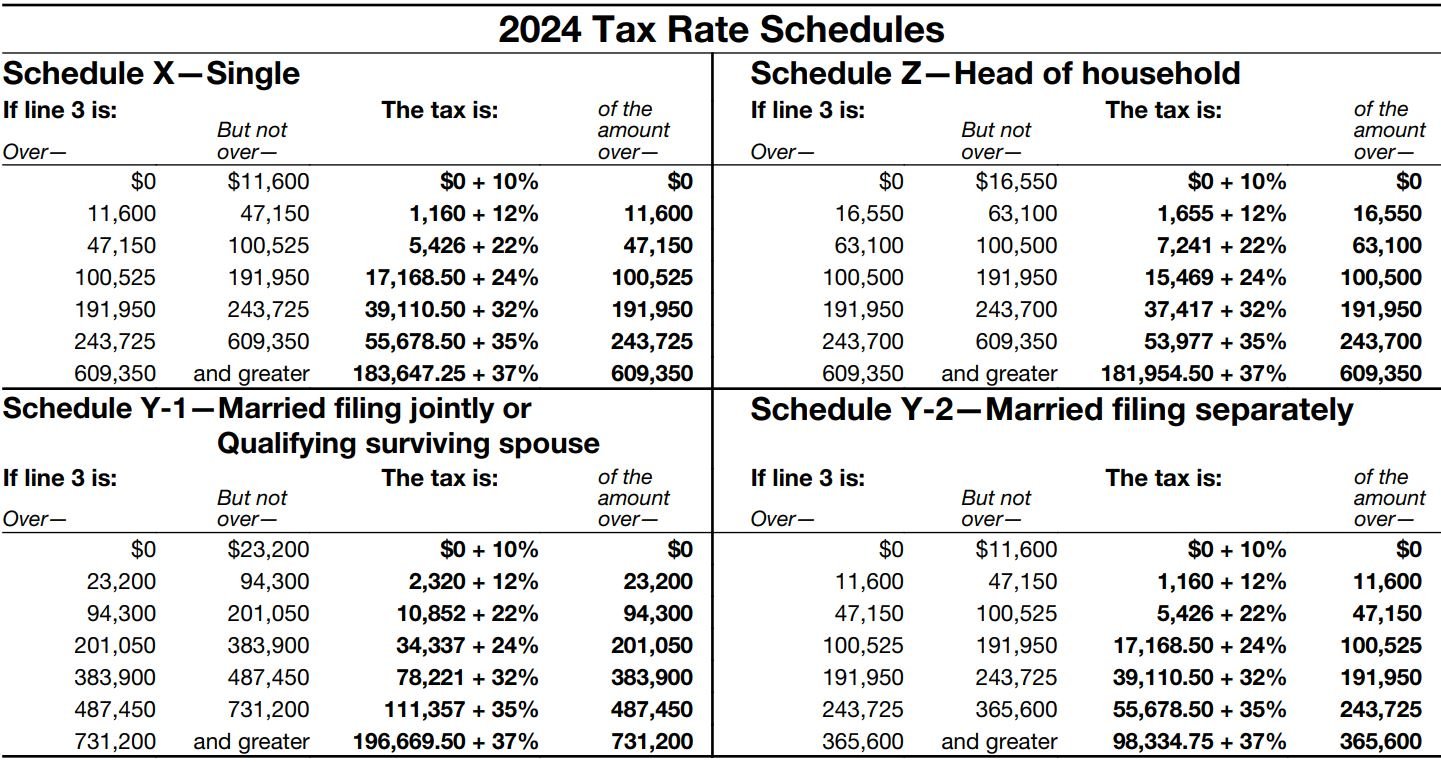

Let's look at the actual chunks. If you are filing as a single individual, that bottom 10% rate applies to your first $11,600 of taxable income. Once you earn dollar number $11,601, that specific dollar is taxed at 12%. This carries on all the way up to $47,150. If you’re lucky enough to be clearing more than that, the 22% bracket kicks in for the income between $47,150 and $95,375. The jumps continue through 24%, 32%, and 35%, until you hit the big one: 37% for anything over $609,350.

Married couples filing jointly get much wider buckets. Basically, they can earn up to $23,200 before they leave that 10% bottom floor. Their 22% bracket doesn't even start until they hit $94,300 in combined taxable income. It's a huge difference.

The Standard Deduction: Your secret shield

Before you even touch those tax tables, you have to talk about the standard deduction. Most people—roughly 90% of filers—don't itemize anymore. Why would you? For 2024, the standard deduction for single filers is $14,600. For married couples filing jointly, it’s a whopping $29,200.

Think about that.

If you and your spouse make $100,000 combined, you aren't actually taxed on $100,000. You subtract that $29,200 immediately. Now you're looking at federal tax tables for 2024 based on $70,800. That’s the "taxable income" line on your Form 1040. If you’re over 65 or blind, you get an even higher deduction. It's an extra $1,550 or $1,950 depending on your filing status. Small wins matter.

Why your W-4 is probably a mess

Most people filled out their W-4 years ago and haven't touched it since. That's a mistake. The IRS redesigned the W-4 a few years back to get rid of "allowances," and it still trips people up. If you have a side hustle, or if both you and your spouse work, the federal tax tables for 2024 might not be applied correctly to your withholding.

If you both work and both check the "Married Filing Jointly" box without ticking the "Two Jobs" box in Step 2, your employers will both assume you have that full $29,200 deduction to work with. They'll under-withhold. Then, come April 2025, you’ll owe a massive bill. It’s a nasty surprise. Use the IRS Tax Withholding Estimator. It’s a clunky tool, but it works.

Capital Gains and the "Hidden" Tables

We can't just talk about ordinary income. If you sold stocks or a property you held for more than a year, you’re looking at long-term capital gains rates. These are much friendlier than the standard tables. Most people pay 15%. If your total taxable income is below $47,025 (for singles), you actually pay 0% on those gains. Zero.

✨ Don't miss: 2024 Earned Income Tax Credit Table: What Most People Get Wrong

But there’s a catch.

If you’re a high-earner, specifically making over $200,000 as a single person, you might get hit with the Net Investment Income Tax (NIIT). That’s an extra 3.8% on top of your capital gains. It was part of the Affordable Care Act and it’s still very much in play. People forget about it until their accountant sends them a "please sit down" email in March.

Credits vs. Deductions: The real heavy hitters

A deduction lowers the income you're taxed on. A credit is a dollar-for-dollar reduction of the tax you actually owe. The Child Tax Credit for 2024 remains at $2,000 per qualifying child under age 17. Up to $1,700 of that is refundable, meaning if your tax bill goes to zero, the government sends you a check for the rest.

Then there’s the Earned Income Tax Credit (EITC). This is specifically for low-to-moderate-income working individuals and families. For the 2024 tax year, the maximum EITC for those with three or more qualifying children is $7,830. That is life-changing money for some households. But you have to meet strict income requirements. For a single filer with no kids, the limit is a modest $18,591.

Self-Employment and the 15.3% trap

If you’re a freelancer or a "1099" worker, the federal tax tables for 2024 are only half the story. You also have to pay self-employment tax. This covers Social Security and Medicare. When you're a W-2 employee, your boss pays half (7.65%) and you pay half. When you are the boss, you pay both halves. 15.3%.

You do get to deduct the "employer" portion of that on your taxes, which helps a little. But you still need to set aside roughly 25-30% of every check for the IRS. If you aren't making quarterly estimated payments, the IRS will tack on underpayment penalties. They want their money as you earn it, not just once a year.

Specific actions to take right now

Don't wait until next year to figure this out. The tax year is happening right now.

First, check your last pay stub. Look at how much federal tax was taken out. Multiply that by the number of pay periods left in the year. Does that total cover what you’ll owe based on the 2024 brackets? If you’re unsure, pull up your 2023 return and see if your income has significantly changed.

Second, maximize your 401(k) or IRA. Contributions to a traditional 401(k) or IRA come right off the top of your gross income. This is the most effective way to drop into a lower bracket. If you’re right on the edge of the 24% bracket, a $5,000 contribution could save you $1,200 in federal taxes immediately. For 2024, the 401(k) contribution limit is $23,000.

👉 See also: Highest Paying Scientific Jobs: What Most People Get Wrong

Third, document your "above-the-line" deductions. These are things like student loan interest (up to $2,500) and educator expenses if you're a teacher. You don't need to itemize to claim these. They lower your Adjusted Gross Income (AGI), which is the number that determines if you qualify for various credits and breaks.

Finally, look at your Flexible Spending Account (FSA) or Health Savings Account (HSA). If your employer offers an HSA and you have a high-deductible health plan, use it. HSA contributions are "triple-tax-advantaged." The money goes in tax-free, grows tax-free, and comes out tax-free for medical expenses. It is arguably the best tax shelter available to the average person in 2024.

Tax laws are dense, but the tables themselves are just a roadmap. If you know where the turns are, you can drive a lot more efficiently.