You’re sitting at the kitchen table, looking at a house that’s doubled in value since the 90s, but your bank account isn’t exactly keeping pace. It’s a common spot to be in. You’ve heard about HECMs—Home Equity Conversion Mortgages—and you decide to pull up an fha reverse mortgage calculator to see if you can finally stop worrying about the water heater breaking. You type in your age, your zip code, and your home value. Then, a number pops up.

Is that actually what you get? Probably not.

Reverse mortgages are weird. They don't work like a standard 30-year fixed where you see a balance go down every month. Instead, the math is inverted. Most people think they can just tap into 100% of their equity, but the Federal Housing Administration (FHA) has some very specific ideas about how much of your own money you’re allowed to touch.

How the FHA Reverse Mortgage Calculator Actually Thinks

When you use one of these tools, it isn't just doing simple subtraction. It’s looking at a formula called the Principal Limit Factor (PLF). This is the secret sauce. The FHA—which is part of HUD—sets these tables based on two main things: how old you are and what the current interest rates look like.

The older you are, the more money you get.

The government assumes that if you’re 85, you won’t be living in the house as long as a 62-year-old would. Therefore, they’re willing to let you take out a bigger chunk of the home’s value. If you're 62, the calculator might only show you 40% or 50% of your equity. If you’re 90? That number jumps significantly.

But there’s a catch. Interest rates are the enemy of your initial payout. When rates go up, your "Principal Limit" goes down. This is because the lender has to account for the interest that will accrue over the life of the loan. They need to make sure that, statistically speaking, the loan balance doesn't grow to exceed the home's value too quickly. Even though the HECM is a "non-recourse" loan—meaning you'll never owe more than the house is worth—the FHA still wants to protect the insurance fund.

The Upfront Costs Nobody Mentions

Don't ignore the closing costs. Seriously. If you use a basic fha reverse mortgage calculator, it might show you a "Gross Principal Limit." That looks like a big, beautiful number. But then reality hits.

You’ve got the 2% Initial Mortgage Insurance Premium (IMIP). On a $500,000 home, that’s $10,000 right off the top. Then there are origination fees, which can go up to $6,000. Add in appraisals, title searches, and recording fees, and you might be looking at $15,000 to $20,000 in costs before you even see a dime. Most people roll these costs into the loan, which is fine, but it means your "Net Principal Limit"—the actual cash you can use—is much lower than the headline number.

Why Your Home Value Isn't Always Your Home Value

The FHA has a ceiling. It’s called the Maximum Claim Amount. For 2024, that limit is $1,149,825.

If your home is worth $2 million, the fha reverse mortgage calculator is going to treat it like it’s worth $1,149,825. You won't get any extra "credit" for that surplus million dollars of equity in a standard HECM. In that specific case, you’d actually be better off looking at "Jumbo" or proprietary reverse mortgages, which aren't insured by the FHA but allow for much higher limits.

Also, the appraisal matters more than your Zestimate. If the appraiser finds that your roof is falling apart or there’s significant wood rot, the lender might require a "repair set-aside." They take a portion of your available loan proceeds and lock them away until the repairs are finished. It’s frustrating, but it’s how they protect the collateral.

The Three Ways You Actually Get Paid

Once the calculator spits out your Net Principal Limit, you have to decide how to take the money. This is where people get confused.

💡 You might also like: California Small Business Regulation News: Why Most Owners Are Scrambling Right Now

- The Lump Sum: You take it all at once. This usually forces you into a fixed-rate loan. The downside? You can generally only take about 60% of your available funds in the first year unless you’re using the money to pay off an existing mortgage.

- Tenure Payments: This is a monthly "paycheck" for as long as you live in the home. It’s great for peace of mind, but if you pass away early, you haven't used much of the equity.

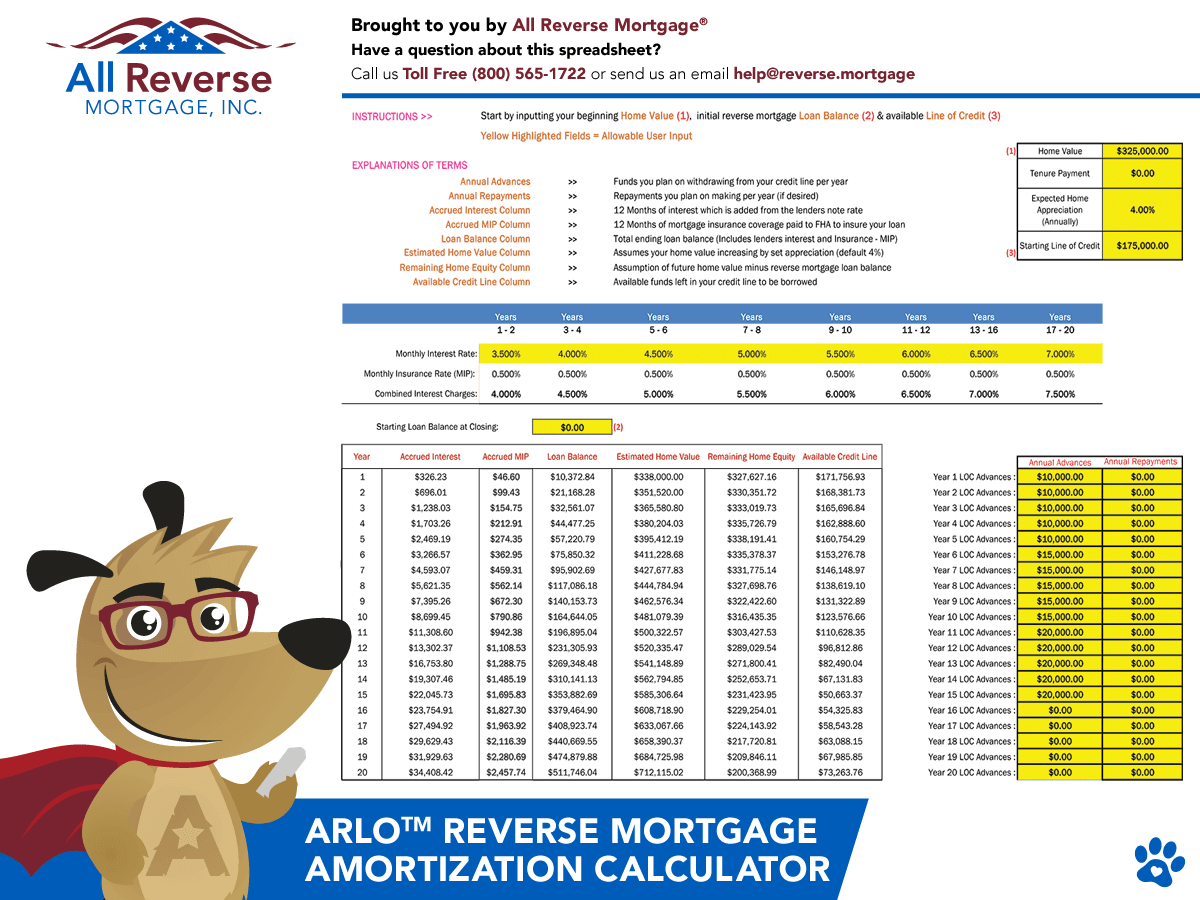

- The Line of Credit: This is arguably the smartest play. The unused portion of your line of credit actually grows over time. It grows at the same interest rate as your loan. Many financial planners, like Wade Pfau, have written extensively about using a HECM line of credit as a "standby" resource to protect your retirement portfolio during a market downturn.

Imagine you have a $100,000 line of credit and you don't touch it. Ten years later, because of that growth feature, it might be worth $160,000. That’s money you can access even if your home value hasn't increased at all.

The Reality Check: Financial Assessment

Since 2015, the FHA has required something called a "Financial Assessment." They aren't just looking at your house anymore; they're looking at you.

If you have a history of not paying your property taxes or your credit score is in the basement, the lender might decide you're a risk. They won't necessarily reject you, but they might create a "Life Expectancy Set-Aside" (LESA). Basically, they take a big chunk of your loan proceeds and put it in a bucket specifically to pay your future property taxes and insurance.

This can drastically reduce the amount of "fun money" or "debt-paying money" you get from the fha reverse mortgage calculator. It's a safety net for the FHA, but a bit of a bummer for the borrower.

Common Myths That Mess Up Your Math

People still think the bank owns the house. They don't. You keep the title. You’re still the owner. But you have to pay your taxes. You have to pay your homeowners insurance. You have to keep the lawn mowed and the roof intact. If you fail to do those three things, the loan can be called due, and that’s how people end up in foreclosure.

Another big one: "My kids will lose the house."

Not necessarily. When you pass away, your heirs have options. They can pay off the loan and keep the house, or they can sell the house and keep whatever equity is left. If the house is worth $500,000 and the loan balance is $300,000, your kids get that $200,000. If the house is worth $500,000 and the loan balance is $600,000, they can just walk away. They aren't liable for the $100,000 gap. The FHA insurance they paid for at the beginning covers that.

Actionable Steps Before You Sign

Don't just trust a random website's numbers. Reverse mortgages are complex financial instruments.

- Get a HUD-approved counseling session. This is mandatory anyway. They’ll give you a certificate, but more importantly, they’ll explain the numbers without trying to sell you a loan.

- Compare the "Expected Interest Rate" vs. "Initial Interest Rate." The calculator might show you a low initial rate, but the "Expected" rate is what determines how much money you can actually borrow.

- Look at the total annual loan cost (TALC). This gives you a better idea of the true cost of the loan over time, including all those fees and interest.

- Check your local property tax rates. Remember, you still have to pay these. If your reverse mortgage takes away your monthly income but doesn't cover your taxes, you're just trading one problem for another.

- Talk to your heirs. It’s an awkward dinner conversation, but it’s better than them finding out after you're gone.

A reverse mortgage is a tool. Like a chainsaw, it’s incredibly useful if you know how to handle it, but it can do some damage if you’re careless. Use the fha reverse mortgage calculator as a starting point, a "napkin sketch" of your potential future. But before you move forward, make sure you understand that the number on the screen is just the beginning of a much longer mathematical story.

Next Steps for Homeowners:

Check the current Maximum Claim Amount for your specific county, as some areas have lower limits than the national ceiling. Gather your latest property tax statement and your current mortgage balance. You'll need these two numbers to get an accurate "net" figure from any reputable lender's calculation. Once you have a preliminary estimate, schedule your HUD counseling appointment early, as there is often a two-week waiting list in many states.