Honestly, writing a check feels like a lost art. You’re standing at the mechanic’s desk or sitting in your new landlord's office, and suddenly, you realize you haven't touched a checkbook in three years. Your hand shakes a little. Is the date supposed to be in numbers? Does the decimal point go inside the box or outside? It’s a weirdly high-pressure moment for something that’s basically just a piece of paper.

Most people think checks are dead. They aren't. While Venmo and Zelle handle the "pizza money" side of life, paper checks still move trillions of dollars in the B2B world and real estate. If you mess up a filling out check example in your head and translate that error to a real document, you aren’t just being messy. You’re risking a bounced payment, a late fee, or even fraud.

Let's break down how this actually works without the boring textbook vibe.

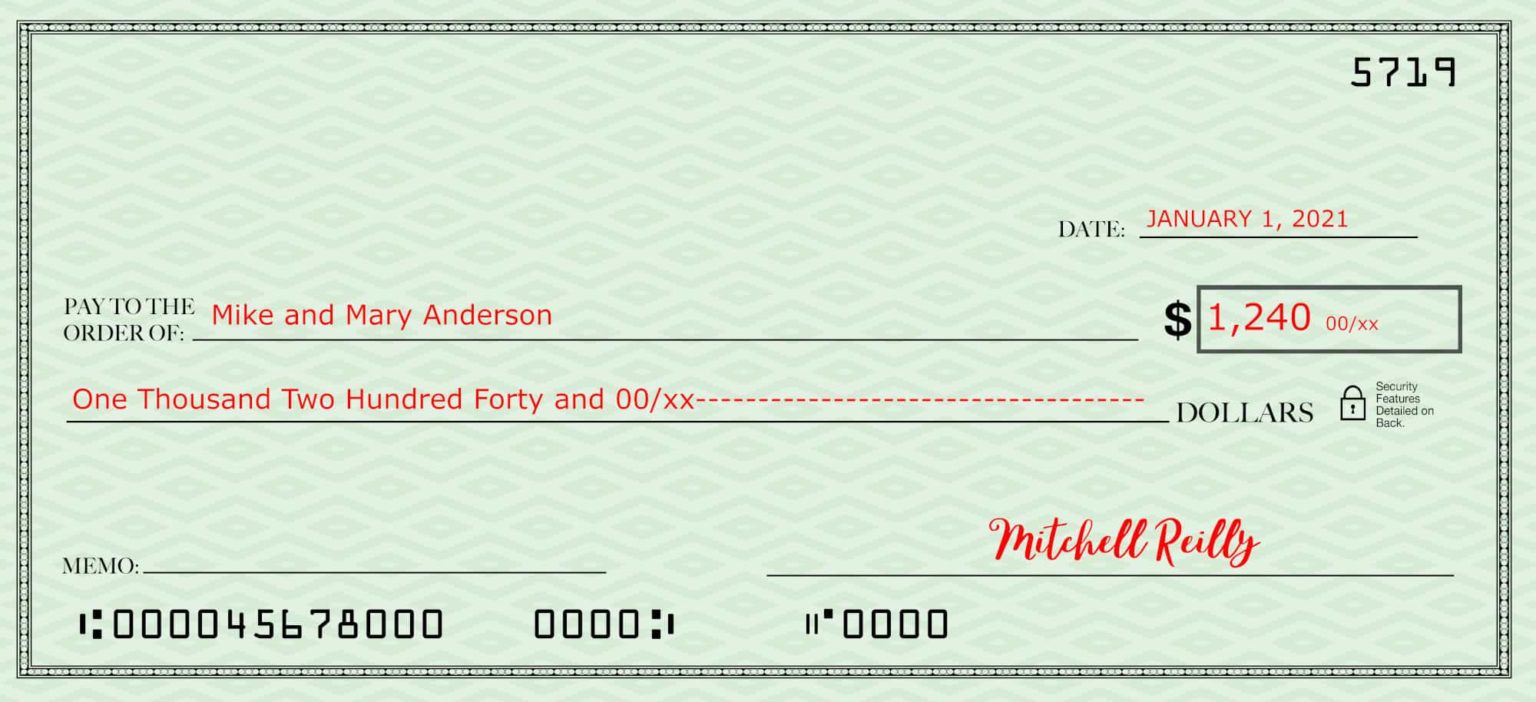

The Anatomy of a Perfect Check

First off, get a pen. Never, ever use a pencil. If you use a pencil, anyone with an eraser and a bad attitude can change your $50 birthday gift into a $5,000 "donation" to their vacation fund. Use blue or black ink. Some experts, like those at the American Bankers Association, even suggest using "gel" pens because the ink soaks into the paper fibers, making it much harder for scammers to "wash" the check.

The Date Line

Top right corner. This seems simple, but it’s where the first mistake happens. You can write it as "January 16, 2026" or "1/16/26." If you’re post-dating the check—meaning you want the person to wait until Friday to deposit it—know that banks usually don’t have to honor that. If they see the check, they might just process it. Don't rely on the date to save your bank balance.

The "Pay to the Order of" Line

This is who gets the money. Write the full name. If it’s a person, use "John Doe." If it’s a business, use their legal registered name, not a nickname. "The Pizza Place" might not be their bank name; it might be "TPH Enterprises LLC." If you aren't sure, ask. If you leave this blank, that check is basically cash. If you drop it on the sidewalk, anyone who finds it can write their own name in and get paid.

The Numeric Box

This is the small box on the right. You write the numbers here, like 125.50. Make sure the numbers are squeezed together. If you leave a gap between the dollar sign and the first number, a thief could easily turn a "50.00" into a "950.00."

Why the Word Line Is Actually the Boss

Here is a weird banking fact: if the numbers in the box and the words on the long line don't match, the words win. Legally, the written-out amount is the "official" amount.

If you write "One hundred dollars" but put "$110" in the box, the bank is technically supposed to pay out $100. It’s based on the Uniform Commercial Code (UCC), which governs commercial transactions in the United States.

When you're looking at a filling out check example, pay attention to the "And" part. You write "One hundred twenty-five and 50/100." The word "and" should only be used to separate the dollars from the cents. Don't say "One hundred and twenty-five." It’s just "One hundred twenty-five." Then draw a line from the end of your words all the way to the end of the printed line. This prevents people from adding words like "thousand" to the end.

The Memo Line and the Signature

The memo line is for you. The bank doesn’t really care what’s there, but your record-keeping does. Write "January Rent" or "Invoice #4502." If you’re paying the IRS, they actually require you to put your Social Security number and the tax year in the memo. It’s one of the few times the memo line is mandatory.

Then there’s the signature.

Don't use a digital stamp unless you're a major corporation. Use your real, messy, human signature. It’s the final "go" signal. Without it, the check is just a piece of scrap paper.

Real-World Risks You Haven't Considered

Check washing is real. In 2026, even with all our tech, mail theft is rampant. Criminals steal envelopes from those blue USPS boxes, use household chemicals to erase your ink, and rewrite the check to themselves.

🔗 Read more: Mark Cuban Explained (Simply): Why the Healthcare System is Broken

How do you stop this?

- Use the right ink (gel ink).

- Don't leave gaps in your writing.

- Drop your mail directly inside the post office instead of the outdoor boxes.

There’s also the issue of "stale-dated" checks. Most banks won't honor a check that’s more than six months old. If you find an old check in a drawer, don't just try to deposit it. Call the person who wrote it first.

Common Mistakes People Make

People get lazy. They leave the cents off. Or they forget to sign. Or they try to use a check from an account they closed three years ago because the paper was still in their desk.

Another big one? Overdrawing. If you write a check for $500 but only have $400, you’re looking at an NSF (Non-Sufficient Funds) fee. In 2026, these fees can be $35 or more per transaction. Some banks have moved away from these, but many smaller credit unions still hit you hard.

✨ Don't miss: Baker Hughes Stock Symbol BKR: What the Energy Tech Shift Means for Your Portfolio

Beyond the Paper: Electronic Checks

When you pay a utility bill online and enter your routing and account numbers, you're essentially creating a "digital" filling out check example. The same rules of accuracy apply. One typo in that account number and your payment bounces, leading to a late fee and a hit to your credit score.

The routing number is always nine digits. It identifies your bank. The account number is unique to you. Usually, on a physical check, the routing number is the first set of weird-looking computer numbers at the bottom left.

Practical Next Steps for Secure Payments

- Audit your checkbook: Look at your remaining checks. If they have an old address, you can usually still use them, but it’s better to get updated ones to avoid red flags at retail stores.

- Get a Gel Pen: Spend the $2 on a Uni-ball Signo or a similar pigmented ink pen. It is the cheapest fraud insurance you will ever buy.

- Draw the Line: Get into the habit of drawing a thick line through any empty space on the "Pay to" and "Amount" lines.

- Balance manually: Don't just trust your banking app. Sometimes checks take days or even weeks to clear. If you see $1,000 in your app but forgot you wrote a $600 check for car insurance yesterday, you’re actually broke. Keep a simple log.

- Destroy Mistakes: If you mess up while writing a check, don't just throw it in the trash. Write "VOID" in huge letters across the front and shred it. A "voided" check is still a goldmine for someone looking for your account and routing numbers.

Writing a check correctly is about more than just moving money; it’s about closing the loopholes that let mistakes and fraud happen. Keep it tight, keep it ink-heavy, and always double-check the words against the numbers.