Tax season is usually a mess of acronyms and anxiety. If you’re a small business owner or a freelancer, you’ve probably spent way too much time staring at the IRS website trying to figure out if you're doing things right. Honestly, looking at a blank document doesn't help. You need a sample completed 1099 form to see where the numbers actually go.

It’s confusing.

💡 You might also like: Capital One Class Action Payment: Why It's Taking Forever and What to Expect

The IRS keeps changing the rules, too. A few years ago, they brought back the 1099-NEC, which stands for Nonemployee Compensation. Before that, everything was just lumped onto the 1099-MISC. Now? If you paid a contractor more than $600, you’re likely looking at the NEC version. If you’re a landlord paying a plumber, or a startup hiring a graphic designer, this is your life now.

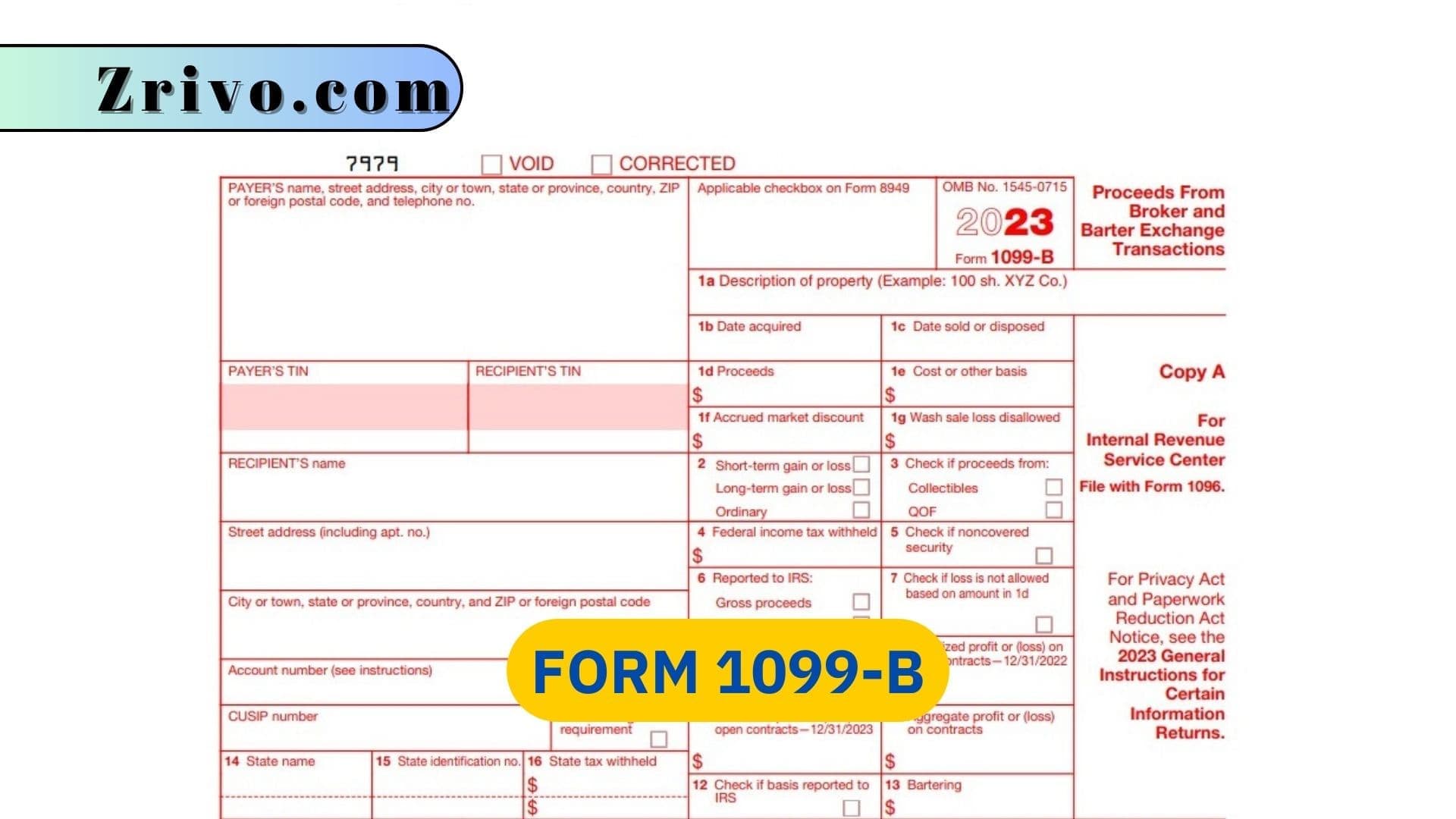

What a Sample Completed 1099 Form Looks Like in the Real World

Let's talk about the 1099-NEC specifically. Imagine you hired a developer named Alex to fix your website. You paid Alex $5,000 over the course of the year.

When you look at a sample completed 1099 form, the first thing you'll notice is the Payer’s information on the left. That’s you. You need your name, address, and your Federal Tax ID (either your SSN if you’re a sole prop or your EIN).

Then comes the Recipient’s information. That’s Alex. You need his TIN (Taxpayer Identification Number).

Here is the kicker: Box 1.

Box 1 is where that $5,000 goes. In a proper sample completed 1099 form, you won’t see anything in Box 4 (Federal income tax withheld) unless Alex failed to provide a TIN and you had to do "backup withholding." Usually, that box is zero. It feels weird to leave boxes empty, but that’s exactly what most people do.

The form is small. It’s basically a postcard-sized piece of paper that carries a ton of weight with the IRS.

Why the 1099-NEC vs 1099-MISC Distinctions Matter

Most people get these two mixed up. It’s an easy mistake.

The 1099-MISC is now mostly for "other" stuff. Think rent payments, prizes, awards, or maybe even fish purchases (yes, really, Box 10 is for proceeds from sales of fish). If you are looking at a sample completed 1099 form for a landlord, you’d see the rent amount in Box 1 of the 1099-MISC.

But for services? For the work people actually do? That’s almost always the NEC.

According to the IRS instructions for Form 1099-NEC, you must file if you paid someone who is not your employee at least $600 for services in the course of your trade or business. That "trade or business" part is vital. If you paid a guy $800 to paint your personal kitchen at home, you don’t need to issue a 1099. But if he painted your office? You definitely do.

Breaking Down the Boxes on a Sample Completed 1099 Form

Let's get into the weeds.

Payer's TIN and Recipient's TIN: These have to match exactly what the IRS has on file. If Alex’s legal name is Alexander but he wrote Alex on his W-9, you might get a "B-Notice" later. That’s a headache you don’t want.

Box 1: Nonemployee Compensation: This is the big one. It includes fees, commissions, prizes, and awards for services performed as a nonemployee. If you reimbursed Alex for his hosting fees, and those weren't part of an "accountable plan," you might have to include those in Box 1 too.

Box 4: Federal Income Tax Withheld: Most of the time, this is $0.00. Freelancers are responsible for their own taxes. However, if the IRS sent you a notice saying the contractor is subject to backup withholding, you’d be taking 24% off the top and putting it here.

Boxes 5-7: State Information: This is where it gets localized. If your state has income tax, you’ll put the state name, the state ID number, and the amount of state tax withheld (if any). Many people forget these because they focus so much on the federal side.

The W-9: The Secret Ingredient

You can’t finish a sample completed 1099 form without a W-9.

Period.

👉 See also: Who is the 2nd Richest Person in the World: Why Larry Page is Climbing the Ranks

The W-9 is the form the contractor fills out and gives to you. It has their legal name, their address, and their tax ID. If you don't get this before you pay them, you're chasing them in January. Good luck with that. Most freelancers disappear once the check clears.

Experts like those at the AICPA (American Institute of Certified Public Accountants) suggest making the W-9 a prerequisite for payment. No W-9, no check. It sounds harsh, but it’s the only way to ensure your sample completed 1099 form is actually accurate when January 31st rolls around.

Common Blunders When Filling Out the Form

People mess this up all the time.

First, they send a 1099 to a C-Corp. Generally, you don't have to send 1099s to corporations. There are exceptions—like for attorneys (who always get one) or medical payments—but for the most part, if your vendor is a "Inc," you can skip it.

Second, they miss the deadline. The 1099-NEC is due to both the recipient and the IRS by January 31. This is different from many other forms that have a later electronic filing date. The IRS doesn't play around with this. The penalties for late filing can range from $60 to $310 per form, depending on how late you are.

Third, they use the wrong year's form. It sounds silly. But if you download a PDF of a sample completed 1099 form from 2023 and try to use it for 2025, you’re asking for a rejection. Use the current year. Always.

Digital vs. Paper Filing

If you have more than 10 forms to file, the IRS now requires you to file electronically. This was a big change that caught a lot of small businesses off guard recently. Gone are the days of buying the red-ink forms at Staples and mailing a giant stack to the government.

Using software is better anyway. Most accounting platforms like QuickBooks or Gusto will take your data and generate a sample completed 1099 form for you to review before they blast it off to the IRS. It reduces the chance of typos. And typos lead to audits.

Dealing with Corrections

What if you sent the form and then realized you overpaid them by $100?

You have to file a corrected form. You check a little box at the top that says "CORRECTED." You re-enter all the information correctly. You send it again.

It’s a pain.

This is why having a sample completed 1099 form as a reference is so helpful. You can double-check your math and your data entry against a known good example.

Actionable Steps for Your 1099 Filing

Don't wait until January 29th to think about this. Tax compliance is a year-round sport, even if the "game" only happens in the winter.

- Audit your vendors right now. Go through your bookkeeping and flag anyone you’ve paid over $600.

- Collect W-9s immediately. If you don't have one for a vendor, email them today. Tell them their next payment is on hold until you get it.

- Verify corporate status. Look at the W-9s. If they checked the box for "S Corporation" or "C Corporation," you likely don't need to file a 1099 for them, unless they are a lawyer.

- Confirm the TIN. You can use the IRS TIN Matching service if you want to be extra careful. This helps prevent those annoying "does not match" notices later.

- Choose your filing method. Decide if you’re going to use your accounting software or a third-party service like Tax1099 or efile4Biz.

- Review a sample completed 1099 form. Compare your draft to a reliable example to ensure your EIN and the contractor's SSN are in the right boxes.

- Hit "Send" by January 31. Make sure you get a confirmation that the IRS accepted the filing.

Following these steps keeps the IRS away from your door and keeps your contractors happy because they get their tax info on time. Accurate filing is boring, but it's the kind of boring that saves you thousands in penalties.