Money changes everything. One minute you're grabbing coffee with a business partner or a cousin, and the next, you're wondering if that $25,000 "investment" was actually a loan they have no intention of paying back. This is where a sample note payable agreement becomes more than just a piece of paper; it’s your legal guardrail.

If you've ever scribbled "I owe you" on a napkin, you're already halfway to a promissory note, but napkins don't hold up well in a courtroom. A note payable is basically a formal promise. One party—the maker—promises in writing to pay a specific sum of money to another party—the payee—at a specific time or on demand. It sounds simple, right? It isn't. People mess this up constantly by forgetting the small stuff, like default triggers or acceleration clauses.

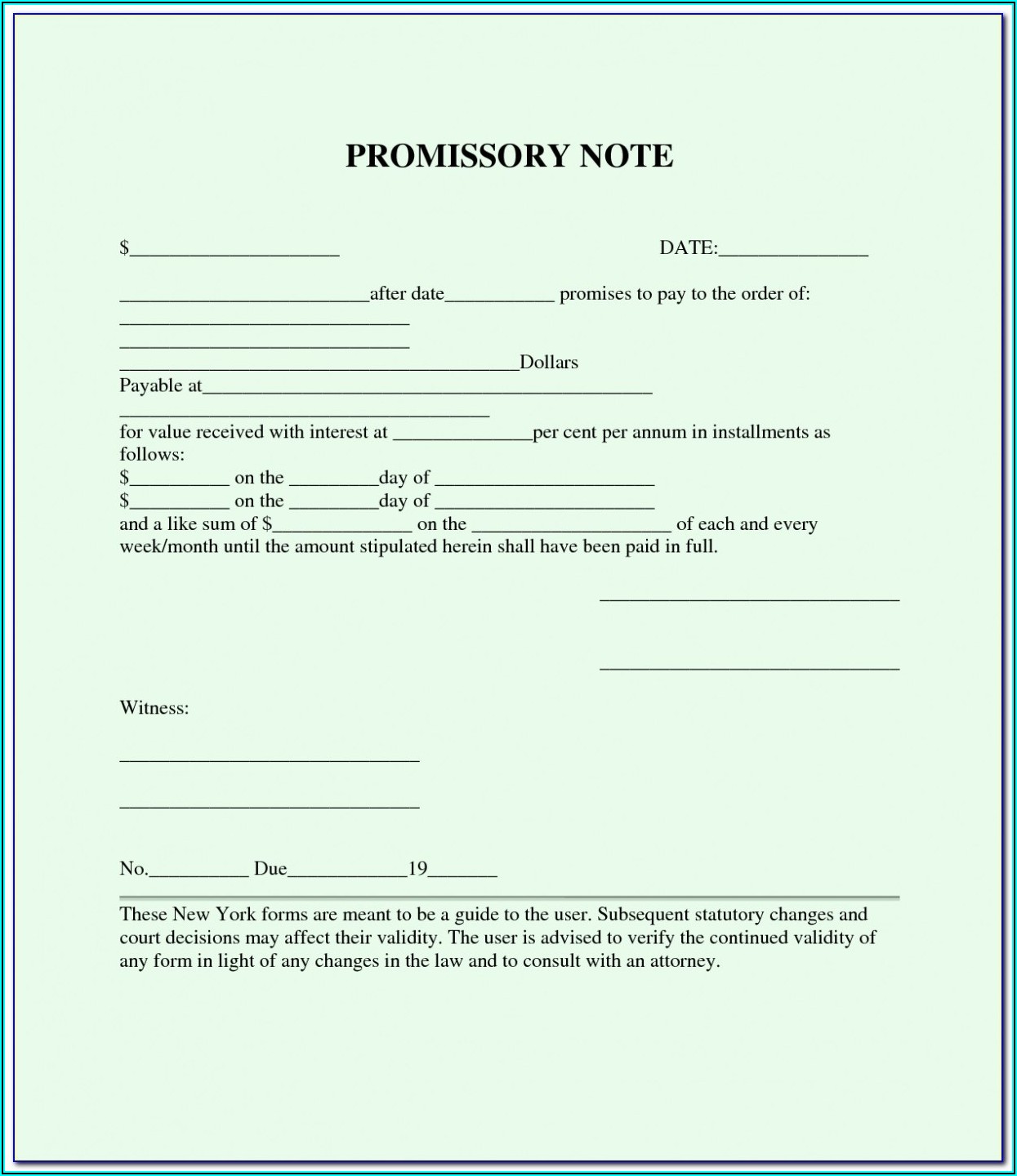

What a Sample Note Payable Agreement Actually Looks Like

Most people think a sample note payable agreement needs to be fifty pages of dense legalese. It doesn’t. In fact, some of the most effective notes are barely two pages long. What matters is what’s inside those pages. You need the names of the parties, the exact principal amount, the interest rate, and the maturity date.

The Bare Bones

Imagine you’re looking at a standard template. At the very top, you’ll see the date and the location. This matters because laws regarding interest rates—often called usury laws—vary wildly from New York to Texas. If you're charging 20% interest in a state where the cap is 10%, your entire agreement might be headed for the shredder.

🔗 Read more: How long should a resume be 2024: The Brutal Truth About Why Your Second Page Is Killing Your Chances

Then comes the "Promise to Pay." This is the core. "For value received, [Borrower Name] promises to pay to the order of [Lender Name]..."

You have to specify how the money is paid back. Is it an installment loan? Or a balloon payment? A balloon payment is where the borrower makes small payments (or no payments) for a while and then owes the whole chunk at the end. It's risky. If they don't have the cash on the due date, you're stuck chasing them.

Interest Rates and the IRS Shadow

You can't just give someone a $100,000 loan at 0% interest and expect the IRS to ignore it. They won't. They have something called the Applicable Federal Rate (AFR). If your sample note payable agreement doesn't charge at least that minimum rate, the IRS might decide the "interest" you should have charged is actually a taxable gift.

Honestly, it’s a headache.

When you're drafting the interest section, be specific. Is it simple interest or compound interest? Simple interest is calculated only on the principal. Compound interest is calculated on the principal plus any accumulated interest. Over five years, that difference is huge.

- Simple Interest Example: $10,000 at 5% for 3 years is $1,500 in interest.

- Compound Interest (Annual): That same $10,000 becomes $11,576.25.

See? Details matter.

The Part Everyone Ignores: Default and Acceleration

Nobody likes to talk about what happens when things go south. But you have to. A solid sample note payable agreement must include a "Default" section. This defines exactly when the borrower has officially screwed up. Is it one day late? Ten days? Usually, there's a "cure period"—a few days for the borrower to fix the mistake before the hammer drops.

🔗 Read more: Tootsie Roll Industries Inc Stock: What Most People Get Wrong

Then there’s the "Acceleration Clause." This is your best friend as a lender.

Without an acceleration clause, if a borrower misses a monthly payment, you can technically only sue them for that one payment. With an acceleration clause, a single missed payment can make the entire remaining balance due immediately. It gives you massive leverage.

Secured vs. Unsecured Notes

Are you taking collateral? If you’re lending a buddy money to start a landscaping business, maybe you want a lien on his truck. That’s a "Secured Note." If he doesn't pay, you take the truck.

An "Unsecured Note" is just a signature. It’s a promise. If they don't pay an unsecured note, your only real move is to sue them, get a judgment, and hope they have assets to seize later. It’s a lot harder. Most professional sample note payable agreement templates will have a section for "Security," even if you choose to leave it blank.

Common Pitfalls That Kill Your Agreement

One big mistake is being vague about the "Payee." If you’re lending from your business, the payee should be "ABC Corp," not "John Smith." If you get these names wrong, the tax implications and the ability to collect get messy fast.

Another one? Not witnessing the signature. While not always legally required for every type of note, having a notary public witness the signing makes it much harder for a borrower to claim later that they never signed it. "That's not my handwriting" is a classic, if desperate, defense.

Also, watch out for "Prepayment Penalties." Some lenders want to make sure they get all their expected interest, so they charge a fee if the borrower pays the loan off early. Borrowers hate this. If you’re the borrower, check your sample note payable agreement to make sure you have the "right to prepay without penalty."

Why the "Choice of Law" Clause Matters

I mentioned this earlier, but it deserves its own moment. If you live in California and the borrower lives in Florida, which state’s laws apply? This isn't just a trivia question. It dictates how long you have to sue (Statute of Limitations) and how much interest you can charge.

✨ Don't miss: Brian Thompson CEO United Healthcare: What Really Happened

Always pick a jurisdiction. Usually, it's the state where the lender is located.

Actionable Steps for Your Agreement

Don't just download the first PDF you see and sign it.

- Check the AFR. Go to the IRS website and look up the current Applicable Federal Rate to ensure your interest rate is high enough to avoid gift tax issues.

- Define the Payments. Clearly state if payments are monthly, quarterly, or one lump sum. Include the exact calendar date they are due.

- Include an Acceleration Clause. This ensures you aren't chasing the borrower for pennies every month if they stop paying.

- Decide on Collateral. If the amount is significant, don't do an unsecured note. Get some skin in the game.

- Get it Notarized. It costs ten bucks at a UPS store and saves you a thousand-dollar headache in court.

- Keep the Original. In many jurisdictions, you need the original wet-ink document to prove the debt in court. A photocopy might not cut it if the borrower disputes it.

Drafting a sample note payable agreement is about clarity. It's about making sure that if the relationship sours, the money doesn't disappear with it. Be precise, be firm, and get everything in writing.

Once you have your draft ready, run it by a local attorney. It sounds like a hassle, but it's cheaper than losing the entire principal because you forgot a single paragraph about default notice.