Everything is falling. You check your brokerage account, and it’s a sea of red. Your favorite blue-chip stock is down 20%, crypto is cratering, and the talking heads on CNBC are shouting about "capitulation." In moments like these, everyone wants to know one thing: what is the bottom and are we there yet?

It's a scary question. Honestly, it’s a question that has bankrupted plenty of people who thought they were smarter than the tape. Trying to catch a falling knife is the quickest way to get cut, yet the allure of buying at the absolute lowest price is basically the Holy Grail of investing.

The Brutal Reality of Market Bottoms

A market bottom isn't a single point in time. It's not like there’s a bell that rings at the New York Stock Exchange to let everyone know the selling is over. It’s more of a process. Generally, the bottom is the lowest price level reached by an asset or an index during a specific period of decline before a sustained upward trend begins.

But here’s the kicker. You usually only know it was the bottom months after it happened.

Take the 2008 financial crisis. The S&P 500 hit its nadir in March 2009. At the time, the news was horrific. Unemployment was skyrocketing. Banks were failing. If you had suggested to the average person on the street that "the bottom is in," they would have looked at you like you had three heads. That’s because bottoms are born out of maximum pessimism. When everyone has given up hope and sold their shares in a fit of rage or panic, there’s nobody left to sell. That’s when the price stops falling.

Sentiment vs. Fundamentals

There's a massive difference between a fundamental bottom and a sentiment bottom. Sometimes a stock is cheap because the company is actually dying. That’s a value trap. You think you’re finding the bottom, but you’re actually just watching a slow-motion train wreck.

Then there’s the sentiment bottom. This is where the macro environment—inflation, interest rates, war, or global pandemics—forces people to sell everything that isn't nailed down. Even the good stuff gets tossed. High-quality companies with incredible cash flow get sold off just because people need liquidity or are simply too terrified to hold on.

Why Sentiment Matters More Than You Think

Technical analysts love to look at RSI (Relative Strength Index) or moving averages. They’ll point to the 200-day moving average and swear it’s "support." Maybe. But support levels are made of glass when panic sets in.

🔗 Read more: Will Housing Prices Ever Go Down: What Most People Get Wrong

I’ve seen "unbreakable" support levels shattered in minutes during a margin call cascade.

What you’re really looking for is "Capitulation." This is a specific type of market behavior where investors just throw in the towel. It’s characterized by high volume and a sharp, vertical drop in price. It feels like the world is ending. Ironically, that’s usually when the smart money—the institutional buyers and "whales"—starts quietly scooping up shares. They aren't looking for the exact bottom; they’re looking for value.

Signals That a Bottom Might Be Near

While nobody can predict the exact day a market turns, there are classic "bottoming" signs that professional traders look for. It’s never just one thing. It’s a mosaic.

- Extreme Volatility (The VIX): The CBOE Volatility Index, often called the "Fear Gauge," usually spikes to extreme highs. When the VIX hits levels like 40 or 50, it suggests that the panic is reaching a crescendo.

- Breadth Divergence: This is a bit nerdy but vital. It’s when the main index (like the S&P 500) makes a new low, but fewer individual stocks are actually making new lows. It shows the selling pressure is losing steam.

- The "Magical" Pivot: In the current era, the "bottom" is often dictated by the Federal Reserve. If the Fed is hiking rates, the market keeps falling. The moment the market senses a "pivot"—a pause or a hint of a rate cut—that often marks the macro bottom.

Don't Forget the "Dead Cat Bounce"

This is where most beginners lose their shirts.

The market drops 30%. Suddenly, it rallies 10% in two days. You think, "This is it! I found the bottom!" You go all in. Then, three days later, the market rolls over and hits a new low. This is the "Dead Cat Bounce." The name comes from the morbid Wall Street saying that "even a dead cat will bounce if it falls from a high enough ledge."

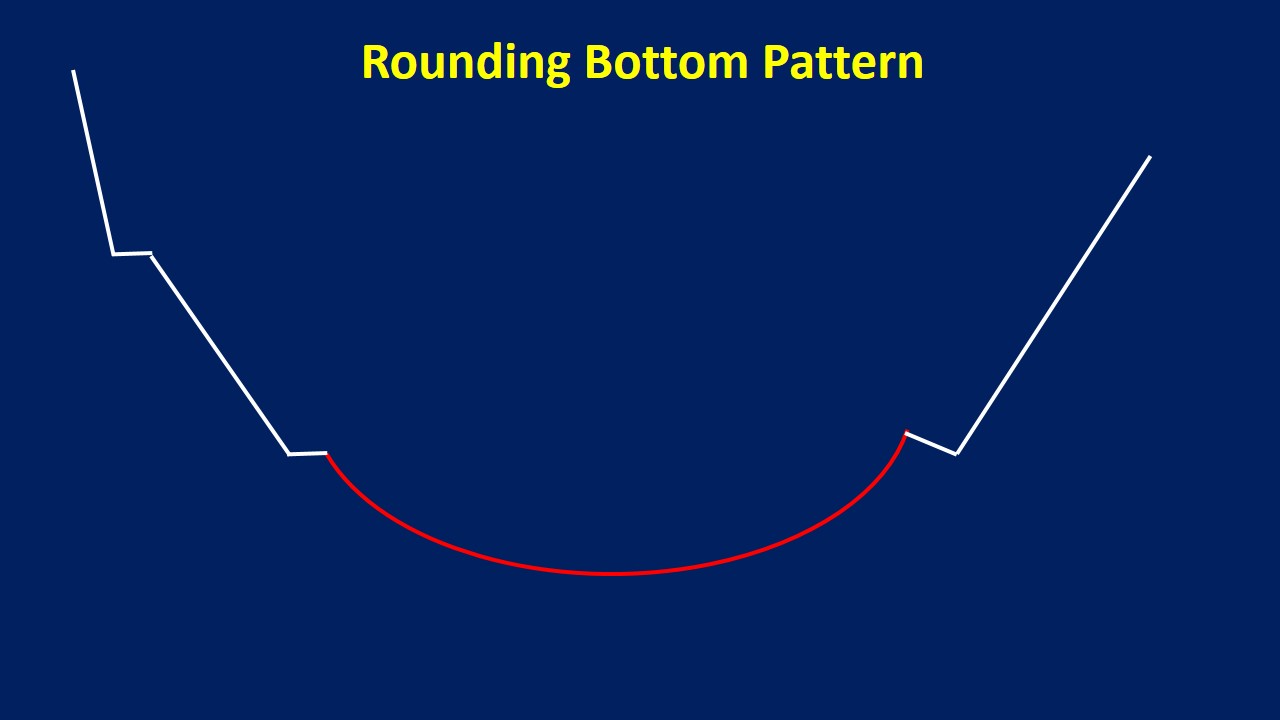

Real bottoms usually involve a "retest." The market hits a low, rallies a bit, then comes back down to check that low again. If it holds, you’ve got a much stronger case for a trend reversal. If it breaks, well, the basement has a sub-basement.

Psychological Warfare

Investing is 10% math and 90% temperament.

When you are looking for the bottom, your own brain is your worst enemy. Evolution programmed us to run away from danger. In the stock market, "danger" looks like a portfolio that is down 40%. Every instinct in your body tells you to sell to protect what’s left.

🔗 Read more: BA Stock Price Today: Why This Rally Feels Different

Successful bottom-fishers do the opposite. They have a plan. They don't try to time the exact bottom; they use a strategy called Dollar Cost Averaging (DCA). They buy a little at -20%, a little more at -30%, and a lot more at -40%. By the time the market actually recovers, their average entry price is low enough that they see massive gains while everyone else is still waiting for "confirmation" that it's safe to buy back in.

Is "The Bottom" Different in Crypto?

Sort of. But also no.

Crypto markets move on liquidations. Because so many people trade with high leverage on exchanges like Binance or Bybit, a small drop can trigger a chain reaction. Long positions get liquidated, which forces more selling, which triggers more liquidations. This creates a "wick" on a chart—a massive, rapid drop followed by a quick partial recovery.

In crypto, the bottom is often a violent, one-day event where billions of dollars in leveraged positions are wiped out. It’s brutal. It’s fast. And if you aren't staring at the screen with a buy order ready, you’ll probably miss it.

Lessons from Famous Bottoms

History is a great teacher. Let's look at a few times the world thought it was over.

- The 1987 Black Monday: The Dow dropped 22.6% in a single day. It felt like the end of capitalism. But guess what? If you bought that day, you were up significantly just a year later. The bottom was a sharp V-shape.

- The Dot-Com Bust (2000-2002): This was a slow grind. It wasn't one day of panic; it was two years of "lower highs" and "lower lows." The bottom only happened when people stopped caring about tech stocks entirely.

- The COVID Crash (2020): This was the fastest bear market in history. The bottom was hit on March 23, 2020, the same day the Fed announced "unlimited" quantitative easing. The lesson? Don't fight the Fed.

Actionable Insights for the Fearful Investor

Stop looking for the "perfect" entry. You won't find it. Even the pros miss it by 5% or 10% all the time. Instead of obsessing over the bottom, focus on these specific steps:

Check Your Liquidity

Never invest money you need for rent or groceries next month. If you are forced to sell because you need cash, you will almost certainly sell at the bottom. That is the definition of a bad time.

👉 See also: Still the Boss Just Hit the Books: Why Education is the New Flex for Modern Leadership

Watch the Volume

True bottoms usually happen on high volume. If the market is drifting lower on low volume, the "big players" haven't stepped in yet. You want to see a big "flush" where millions of shares change hands.

The "Uncle" Point

Define your "Uncle" point. If you’re a trader, this is your stop-loss. If you’re an investor, this is the point where you admit your thesis was wrong. If you’re just buying an index fund, your "Uncle" point should probably be "never," because betting against the total market is a losing game over 20 years.

Ignore the "Gurus"

By the time a famous analyst says "the bottom is in" on Twitter or TV, the price has usually already moved up 15%. They are reactive, not proactive. Trust the data, the price action, and the macro environment.

Finding the bottom is less about being a genius and more about being disciplined when everyone else is losing their minds. It's about recognizing that markets are cyclical. Winter always ends. Spring always comes. The trick is making sure you still have some seeds left to plant when the sun finally comes out.

Next Steps for Navigating Volatility

Start by assessing your current "cash on the sidelines." If you're 100% invested and the market is falling, you can't take advantage of the bottom. If you have cash, set specific price targets for the assets you want to own. Don't wait for a "green day" to buy; professional investors often buy on the bloodiest red days.

Review your portfolio for "junk." In a market crash, speculative stocks with no earnings often go to zero and stay there. They don't have a "bottom" because they have no intrinsic value. Move your capital into "quality"—companies with strong balance sheets and real profits. They are the ones that will lead the recovery when the market finally turns.