Tax season is basically the annual marathon nobody actually trained for. You're sitting there, coffee gone cold, staring at a screen, and all you need is that one specific document. The IRS Form 1040 PDF. It sounds simple. It should be simple. But if you’ve ever tried to navigate the official government repository during peak season, you know it feels more like trying to solve a Rubik's cube in the dark.

Tax forms have changed. A lot.

Remember the 1040-A? Or the 1040-EZ? They’re dead. Gone. The IRS nuked them back in 2018 to "simplify" things, which mostly just meant moving all the complexity onto separate schedules. Now, whether you’re a billionaire or a barista, you’re likely using the same base IRS Form 1040 PDF. It’s the "U.S. Individual Income Tax Return," and it’s the sun that every other tax document orbits around.

Where to Grab the Real Deal (And Avoid Scams)

Don't just Google "tax form" and click the first blue link you see. Seriously. Every year, sketchy third-party sites host outdated versions of the IRS Form 1040 PDF just to farm your data or trick you into paying for a "free" download. It’s predatory.

The only place you should be grabbing the blank form is directly from the source: IRS.gov.

If you're looking for the 2025 tax year (the ones we're filing in early 2026), make sure the top right corner actually says 2025. It sounds obvious. You'd be surprised how many people accidentally fill out the previous year's form because they clicked a legacy link. The IRS updates these files frequently to fix typos or adjust for inflation-indexed numbers.

Honestly, the PDF itself is a bit of a relic. It’s a "fillable" form, meaning you can type into the boxes, but it won't do the math for you. If you put $50,000 in line 1z and $5,000 in line 2b, the PDF isn't going to magically calculate your Adjusted Gross Income (AGI) on line 11. You have to do that. With a calculator. Like it’s 1995.

The "Postcard" Lie and the Reality of Schedules

When the IRS redesigned the IRS Form 1040 PDF, they marketed it as being the size of a postcard. That was a bit of a stretch. While the main form is indeed shorter now—only two pages—the reality is that most humans with a job, a house, or a retirement account will need to attach "Schedules."

💡 You might also like: Is Trump Removing Tax on Overtime? What Most People Get Wrong

Think of the 1040 as the cover letter and the Schedules as the actual report.

If you have "additional income" like unemployment, jury duty pay, or prizes, you're looking at Schedule 1. If you owe "additional taxes" like the self-employment tax because you've been crushing it as a freelancer, that’s Schedule 2. Did you pay a lot of student loan interest or have specific tax credits? Schedule 3.

It's a modular system.

The danger here is thinking you’re done after page two of the IRS Form 1040 PDF. You aren't. If you leave out a required schedule, the IRS computer in Martinsburg, West Virginia, is going to flag your return faster than a referee at a high school football game.

Why the 1040-SR Exists

If you’re 65 or older, there’s a specialized version of the IRS Form 1040 PDF called the 1040-SR. It’s essentially the same form, but the font is bigger. No, really. It’s designed for better readability and includes a standard deduction table right on the form so you don't have to go hunting through the instruction booklet. If you qualify, use it. Your eyes will thank you.

The Paper Filing Trap

Most people use software. TurboTax, H&R Block, FreeTaxUSA—they all eventually spit out an IRS Form 1040 PDF at the end. But some people still prefer the tactile feel of paper. Or maybe you're filing a late return from three years ago and the software won't let you e-file.

🔗 Read more: Foreign Cars Built in America: What Most People Get Wrong

Filing paper is risky.

The error rate for paper returns is significantly higher than e-filed returns. Why? Because a human at the IRS has to manually type your handwritten numbers into their system. If your "7" looks like a "1," you've got a problem. Plus, paper returns take forever to process. We're talking months, not weeks. If you’re expecting a refund, filing a physical IRS Form 1040 PDF is basically telling the government, "Hey, keep my money for an extra ninety days, no big deal."

If you absolutely must mail it, do yourself a favor:

- Use a pen with black ink.

- Don't staple your W-2s to the front page; use a paperclip.

- Send it via Certified Mail with a return receipt.

That last bit is non-negotiable. If the IRS claims they never got your IRS Form 1040 PDF, that little white and green receipt is your only shield against late filing penalties.

Common Mistakes That Trigger "The Letter"

Nobody wants a letter from the IRS. It’s never a "thinking of you" card. Usually, it's a CP2000 notice because your IRS Form 1040 PDF didn't match the data their computers have on file.

The biggest culprit? The AGI.

Your Adjusted Gross Income from the previous year is used as a security "password" to verify your identity when you e-file. If you didn't keep a copy of your IRS Form 1040 PDF from last year, you’re going to have a hard time. You’ll have to request a transcript from the IRS website, which is a whole other level of bureaucratic fun.

Another big one: Signing the form.

It sounds stupid. It is stupid. But thousands of people spend hours meticulously filling out their IRS Form 1040 PDF, mail it in, and forget to sign the bottom of page two. An unsigned return is a dead return. The IRS won't process it. They’ll just mail it back to you, and by the time you sign it and send it back, you might be past the April deadline.

Digital Security and Your Data

When you download an IRS Form 1040 PDF, you are handling a document that contains your Social Security Number, your home address, and your total annual earnings. This is a goldmine for identity thieves.

Never email a completed 1040 to your accountant as a standard attachment. Just don't. Email is about as secure as writing your SSN on a postcard and tossing it into the wind. Use a secure portal or an encrypted file-sharing service. If your tax pro asks you to "just email it over," find a new tax pro. They’re being reckless with your life.

Also, be wary of "Free PDF Editor" websites. If you upload your sensitive IRS Form 1040 PDF to a random website to fill it out because you don't have Adobe Acrobat, you have no idea where that data is being stored. Stick to the fillable forms on the official IRS site or use reputable software.

✨ Don't miss: Australia Dollar to US Dollar Explained: Why the Rules Changed in 2026

Actionable Steps for a Painless Filing

- Verify the Year: Double-check that you have the 2025 version of the IRS Form 1040 PDF for taxes due in 2026.

- Download the Instructions: The 1040 instructions are often 100+ pages long. You don't need to read them all, but keep the PDF open. The "Tax Table" at the end is what you'll need to figure out your actual tax liability based on your taxable income.

- Save Your Work: If you’re filling out the PDF manually, save every ten minutes. The IRS fillable forms are notorious for "timing out" or glitching in certain browsers like Chrome or Safari.

- Print a Copy for Your Records: Always save a finished version of your IRS Form 1040 PDF. You will need it to apply for a mortgage, get a car loan, or even just to file your taxes next year.

- Check the Mailing Address: If you are filing a physical copy, the mailing address depends on two things: where you live and whether or not you are enclosing a payment. Check the "Where Do You File?" section on the IRS website to ensure your IRS Form 1040 PDF goes to the right processing center.

The IRS Form 1040 PDF is more than just a piece of paper; it’s the legal record of your financial year. Treat it with a little bit of respect and a lot of caution, and you'll make it through April with your sanity mostly intact.

Next Steps:

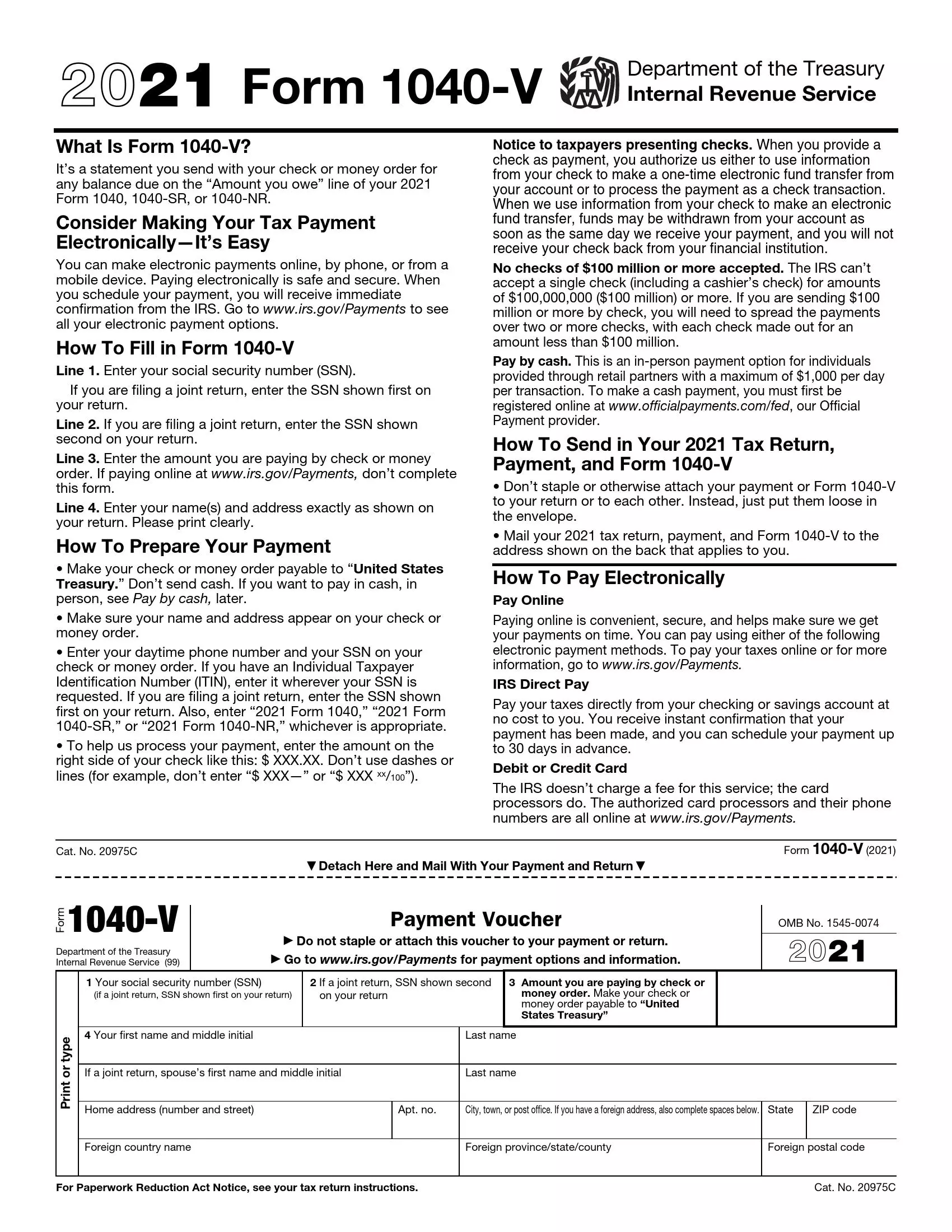

Go to the official IRS "Forms and Instructions" page and download the 1040-V (Payment Voucher) if you know you're going to owe money. This small document ensures your check gets credited to the right account if you aren't paying electronically. Then, gather your 1099s and W-2s into one physical or digital folder before you start typing. It's much easier to fill the form in one sitting than to hunt for missing documents halfway through.