You're standing in a grocery store line or sitting at a desk, staring at a transaction you don't recognize. Panic sets in. You need the pnc bank helpline number and you need it right now. It sounds simple. You Google it. You see a dozen different 800 numbers. Some look legit; others feel... off.

Honestly, finding the right way to talk to a human at a massive institution like PNC shouldn't feel like a digital scavenger hunt. But here we are. Between automated "Virtual Assistants" and third-party sites trying to scrap your data, the path to a real person is surprisingly cluttered.

The Numbers You Actually Need

Let’s get the basics out of the way first. For most personal banking issues, the primary pnc bank helpline number is 1-888-PNC-BANK (1-888-762-2265). This is the "everything" line. If you’re calling from outside the United States, that number changes to 412-803-7711. Be prepared for international rates if you're dialing from a Parisian cafe or a London flat.

Timing matters. They aren't open 24/7 for everything. You can reach them Monday through Friday, 8 a.m. to 9 p.m. ET. On weekends, it's 9 a.m. to 5 p.m. ET. If it's 2 a.m. on a Tuesday and you've lost your debit card, you aren't totally stuck, but you’ll be dealing with an automated system or a specialized fraud department rather than a general representative.

Credit Cards vs. Debit Cards

PNC splits its departments. It’s annoying. If you have a PNC Visa Credit Card, the general line might just transfer you anyway, so you might as well dial 1-800-558-8472 directly. For those with the "PNC Core" or "PNC Cash Rewards" cards, this is your direct line to the people who can actually see your credit limit and reward points.

Why Everyone Hates the Automated Voice

We’ve all been there. You call the pnc bank helpline number, and a cheerful robot asks you to "describe in a few words" why you're calling. You say "representative." The robot says, "I can help with that, but first, tell me..."

It's a loop. It's frustrating.

👉 See also: Arizona State Conference 2024: What Most People Get Wrong

The trick—and this works more often than not—is to stay silent. Or, if the system insists, keep repeating "Agent" or "Operator." If you have your Social Security number or account number ready, inputting it early actually speeds things up. Banks use these inputs to route you to the correct "tier" of support. If you're a PNC "WorkPlace" or "Virtual Wallet" customer, the system recognizes your profile and might drop you into a shorter queue.

The Fraud Reality Check

If you suspect your account has been hacked, do not wait for the general pnc bank helpline number queue. PNC has a specific fraud department. You can reach the identity theft and fraud team at 1-800-762-2035.

Here is something most people get wrong: they think the bank will call them and ask for a one-time passcode (OTP). They won't. Ever. If you receive a call that looks like it’s coming from the PNC helpline, but the person on the other end asks for your PIN or a code texted to your phone, hang up. That is a "spoofing" scam. Use the number on the back of your physical card to call them back. It's the only way to be 100% sure you're talking to a PNC employee and not someone in a basement across the globe.

Specialized Lines for Business and Mortgages

Business owners have it a bit differently. If you’re running a small business account, call 1-877-287-2654. They have different hours and, frankly, usually have shorter wait times because the volume is lower than the retail banking side.

Mortgages? That’s a whole different animal. PNC Mortgage servicing is at 1-800-822-5626. If you're calling about a loan modification or an escrow shortage, don't bother with the general retail line. They literally cannot see your mortgage details in the same system. You'll just waste twenty minutes being transferred.

Avoiding the "Hold Music" Purgatory

Nobody likes the MIDI version of "Clair de Lune" playing for forty minutes.

To avoid the rush, try calling Tuesday through Thursday. Mondays are notoriously bad because everyone is dealing with "weekend drama"—lost cards, failed ATM deposits, or realizing they spent too much at brunch. The lunch hour (12 p.m. to 2 p.m. ET) is also a dead zone for quick service. If you can call at 8:15 a.m. ET, do it. You’ll likely get a human in under five minutes.

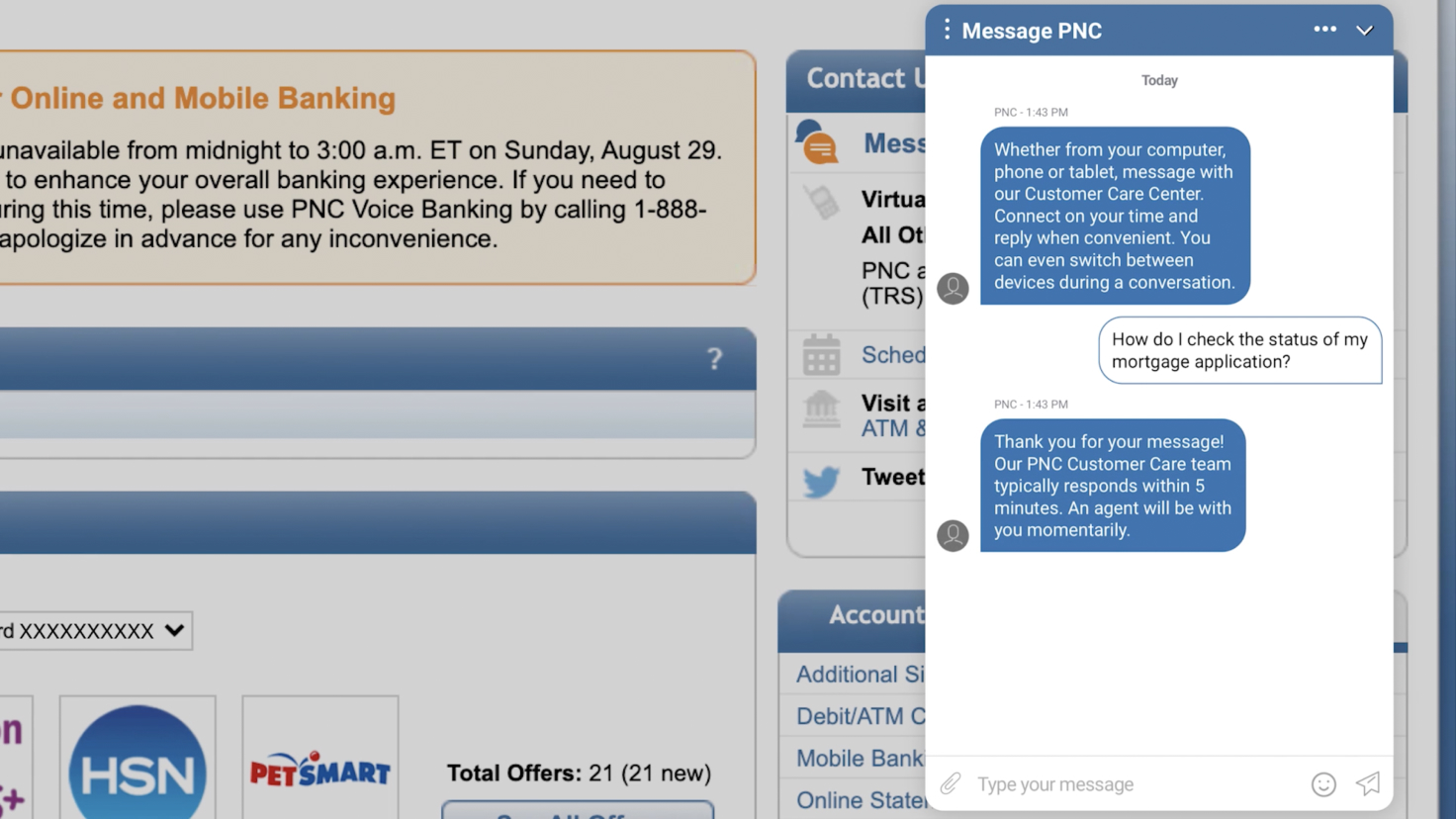

The Virtual Assistant Alternative

PNC pushes their "PNC Voice" and in-app chat hard. Is it worth it? Sorta. If you just need to check a balance or see if a check cleared, the app is faster. If you need to dispute a charge or talk about a complex wire transfer, the chat is usually a waste of time. It’s a chatbot. It has a script.

What to Have Ready Before You Dial

Before you even touch the pnc bank helpline number, grab a pen. Seriously.

- Your account number (the one on your statement, not the one on your debit card).

- The last four digits of your Social Security number.

- A specific date and amount for any transaction you’re calling about.

If you’re calling about a deceased relative’s account—a process that is incredibly stressful—ask for the "Estate Department" immediately. Don't try to explain the whole story to the first person who picks up. They aren't trained for it and will just end up transferring you, making you repeat the painful details twice.

How to Handle a Dispute

Disputing a charge through the pnc bank helpline number is a formal process. The representative will give you a "Claim Number." Write it down. If they don't give you one, the claim hasn't been officially filed.

The Fair Credit Billing Act gives you certain protections, but those protections usually require you to follow up in writing. Calling is the first step, but for large amounts, you should always follow up with a letter sent to the address they provide during the call.

International Travelers Beware

If you're abroad and your card is blocked, the toll-free 1-888 number probably won't work. You must use the collect-call number: 412-803-7711. Pro tip: if you have Wi-Fi, using a VoIP service like Skype or Google Voice to call the US-based 888 number can save you a fortune in roaming fees.

Technical Support for the App

Sometimes the bank is fine, but the app is broken. If you're locked out of your online banking, don't call the fraud line. Call the technical support wing at 1-800-762-2265 and select the option for "Online Banking Support." They can reset your "Device ID" or clear a stuck login session. This is a common issue after an iOS or Android update.

Real-World Advice for PNC Customers

Look, banks are massive bureaucracies. PNC is no different. The people on the other end of the pnc bank helpline number are often dealing with hundreds of frustrated callers a day. Being polite—even when you're fuming—actually gets you further. If an agent likes you, they are much more likely to "waive" that $36 overdraft fee as a "one-time courtesy."

If you aren't getting anywhere, ask for a supervisor. Don't scream it. Just say, "I understand you're following policy, but I’d like to speak with a manager to see if there are any exceptions we can explore."

Beyond the Phone Call

Sometimes the phone isn't the answer. If you have a complex issue involving a power of attorney or a large cash deposit gone wrong, skip the helpline. Go to a physical branch. There is a level of accountability that happens when you are sitting across a desk from a person named "Sarah" who has a business card.

Actionable Steps for Your Next Call

If you need to reach PNC right now, follow this sequence for the fastest results:

- Check the back of your card first. That number is specific to your account type.

- Dial 1-888-762-2265 for general issues.

- Input your info immediately when prompted by the automated system to skip the "guest" queue.

- Request a "Reference Number" for every single call. This is your paper trail.

- Use the Fraud Line (1-800-762-2035) specifically for security breaches to bypass the general billing questions queue.

By keeping these specific numbers and "hacks" in your back pocket, you turn a potentially hour-long ordeal into a ten-minute fix. Banks want to automate everything, but knowing exactly which buttons to push ensures you stay in control of your money.