You’re staring at that little slip of paper, trying to set up a direct deposit or pay a bill online, and the website is demanding a nine-digit code. It’s frustrating. You see a string of weird, computerized numbers at the bottom and honestly, they all look the same at first glance. If you’re asking what is the routing number on my check, you aren't alone. Most of us just ignore those digits until the moment we absolutely can't.

That nine-digit sequence is basically the "address" for your bank. Think of it like a digital zip code that tells the Federal Reserve exactly where to send your money. Without it, the entire U.S. financial system would basically grind to a halt. It’s officially called an ABA Routing Transit Number (RTN), a system dreamed up by the American Bankers Association way back in 1910.

Where Exactly Is the Routing Number on My Check?

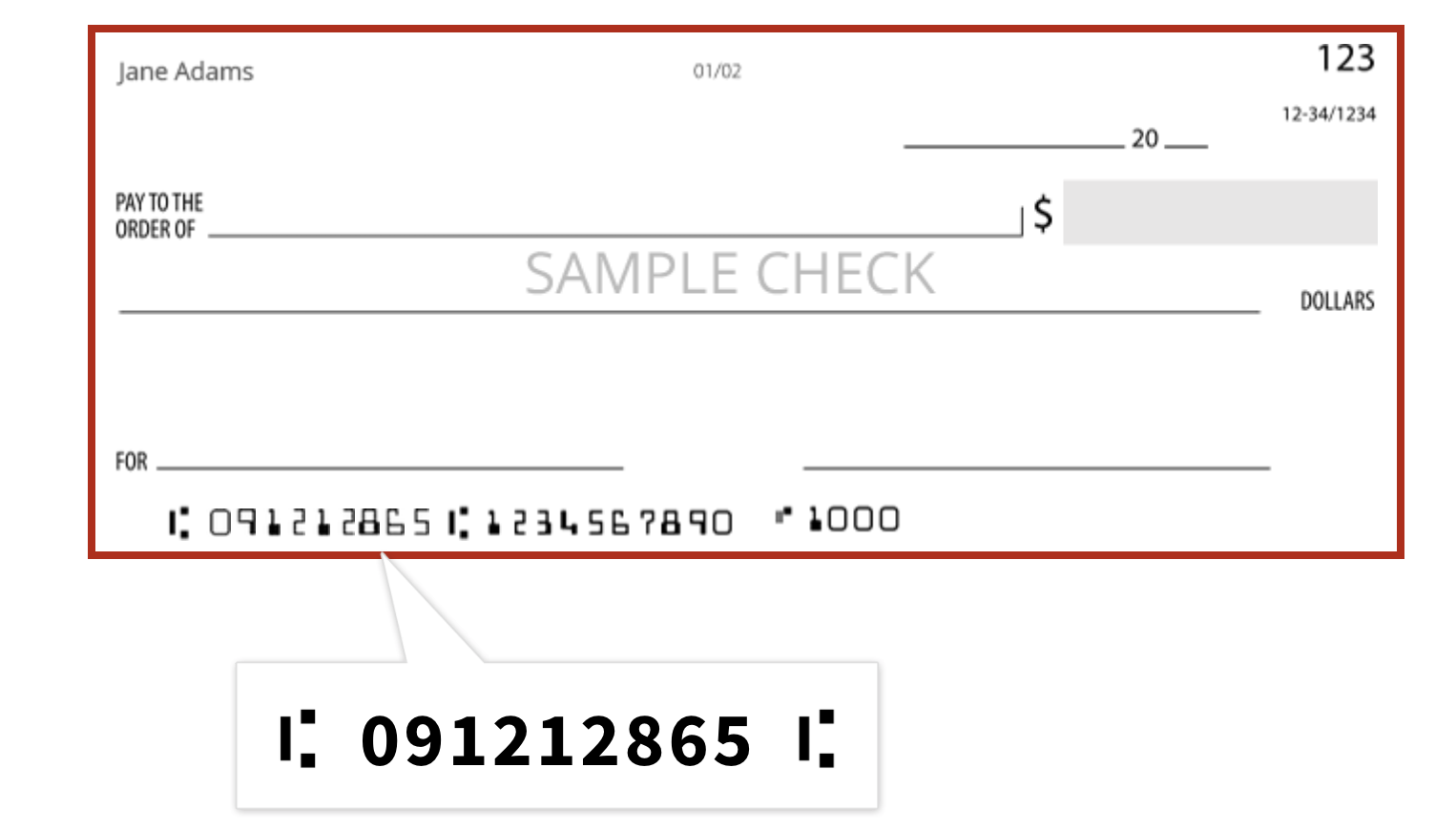

Look at the very bottom left corner. Seriously, go grab a check right now. You’ll see three distinct groups of numbers printed in a strange, blocky font called MICR (Magnetic Ink Character Recognition).

The routing number on my check is almost always the first set of nine digits on the far left. It’s usually flanked by a specific symbol that looks like a little bracket with a colon.

Don't get it confused with your account number. That comes next. Usually, the account number is the middle set of digits, followed by the check number on the far right. Sometimes banks flip the account and check numbers, but the routing number is a creature of habit—it stays on the left. It is always nine digits. No more, no less. If you count eight or ten, you’re looking at the wrong string of text.

The Anatomy of Those Nine Digits

It isn't just a random serial number. Each part of those nine digits means something to the Federal Reserve.

The first two digits represent the Federal Reserve district where the bank is located. For example, if your bank is in New York, those numbers might start with 02. The third digit tells you which Federal Reserve processing center handles the bank's transactions. The fourth digit is a bit more technical, often identifying the state or a specific city within that district.

Digits five through eight are the unique identifier for your specific bank or credit union. Finally, the ninth digit is a "check digit." This is a mathematical failsafe. Computers use a complex formula to verify that the first eight digits are legitimate, preventing a typo from sending your mortgage payment to a random account in Alaska.

📖 Related: Why Your Choice of Plastic Stand for Paper is Actually More Important Than Your Desk

Why Do Banks Have Multiple Routing Numbers?

Here is where it gets kinda messy.

You might find that the routing number on your physical check doesn't match the one listed on your bank’s website for "wire transfers." That’s because banks often use different "electronic" addresses for different types of money movement.

Paper checks use the routing number printed on the bottom. However, if you are receiving an international wire transfer or a high-value domestic wire, your bank might tell you to use a different set of digits. It’s a common point of confusion. Honestly, it's one of the biggest reasons people have their transfers rejected. Always double-check if the person asking for the number needs it for an ACH transfer (like direct deposit) or a wire transfer. They are often not the same.

Large banks like JPMorgan Chase or Bank of America have dozens of routing numbers. They’ve swallowed up smaller banks over decades, and often, they keep the old routing numbers for those specific regions to avoid forcing everyone to order new checks. If you opened your account in Chicago but moved to Phoenix, you might still be using a Chicago-based routing number. It doesn't matter where you live now; it matters where the account was born.

✨ Don't miss: Stock Market Today October 24 2025: Why the Dow Finally Hit 47,000

Is It Safe to Give Out My Routing Number?

People get nervous about this. They should.

But here’s the reality: your routing number isn't a secret. It’s public information. You can find the routing numbers for major banks with a simple Google search. If someone has your routing number, they can’t do much. They need your account number and your name to actually pull or push funds.

That said, your check has both. When you hand a paper check to a stranger, you are giving them every piece of information they need to potentially draft an unauthorized electronic payment from your account. This is why "positive pay" services exist for businesses and why many people are moving toward apps like Zelle or Venmo that mask this data.

Common Mistakes People Make

Most errors happen because of simple typos. Since the numbers are printed in that weird font, a "7" can sometimes look like a "1" if the ink is faded.

Another big one? Using the "internal" routing number. Some credit unions use a different internal number for bookkeeping that isn't part of the ABA system. If you use that for an external transfer, the money will bounce back like a bad tennis serve.

Sometimes, people try to find the routing number on their debit card. You won't find it there. Debit cards use the 16-digit card number, which is part of the Visa or Mastercard network, not the ABA routing system. Those are two completely different worlds.

How to Verify Your Number Without a Check

Maybe you’re like most people under 40 and you haven't seen your checkbook since 2019. You can still find what you need.

- Mobile App: Log in and look for "Account Details." It’s usually tucked away under a "More" or "Info" tab.

- Monthly Statements: Look at the top right or bottom of the first page of your PDF statement. It’s usually listed right next to your account number.

- The ABA Website: The American Bankers Association has an online lookup tool. You can search by the bank’s name and location to confirm you have the right digits.

The Future of the Routing Number

We are seeing a shift. With the rise of FedNow and real-time payment systems, the old-school routing number is starting to feel like a relic. In Europe, they use IBAN (International Bank Account Number), which is a much longer, more comprehensive code that includes country identifiers.

The U.S. is stubborn, though. We’ve used this system for over a century, and because it works—mostly—it isn't going away anytime soon.

Next Steps for Accuracy

✨ Don't miss: Joe Hummel: The Man Running the Show at Twin Peaks

If you are setting up something high-stakes, like a tax refund or a home down payment, do not guess.

- Log into your online banking portal specifically to look for "Wiring Instructions" or "Direct Deposit Info."

- Verify the type of transfer. Ask the recipient: "Is this for an ACH or a Wire?"

- Confirm the number. If you are using a routing number from a physical check that is more than five years old, call your bank. Mergers happen, and routing numbers do occasionally change, though banks usually provide a long "grace period" for old ones.

- Perform a test. When setting up a new link between two accounts, many banks will send "micro-deposits" of a few cents to make sure the routing number and account number are talking to each other correctly. Do not skip this step.