Death is expensive. Dealing with the Social Security Administration after someone passes away is, honestly, the last thing anyone wants to do while they're grieving. But there is a specific piece of paper—the SSA 1724 form PDF—that stands between a family and the money the government still owes a deceased beneficiary. This isn't about the $255 death benefit. That's a different animal entirely. This is about "underpayments." Basically, if your family member was alive for a full month but died before their check arrived, that money belongs to the heirs, not the state.

It’s a weirdly specific rule. Social Security pays in arrears. This means the check you get in July is actually for June. If someone dies on July 2nd, they were alive for the entire month of June. They earned that money. But since the payment cycles take time, the SSA often pulls that money back or never sends it. To get it back, you have to prove who you are and where you sit in the line of succession.

✨ Don't miss: Feast or Famine Meaning: Why Your Income Feels Like a Rollercoaster

Why the SSA 1724 Form PDF is So Frustratingly Necessary

Most people assume the government just knows. They don't. Or rather, the part of the government that knows someone died (the Treasury) doesn't always automatically talk to the part that divvies up the remaining cash. You have to trigger the process.

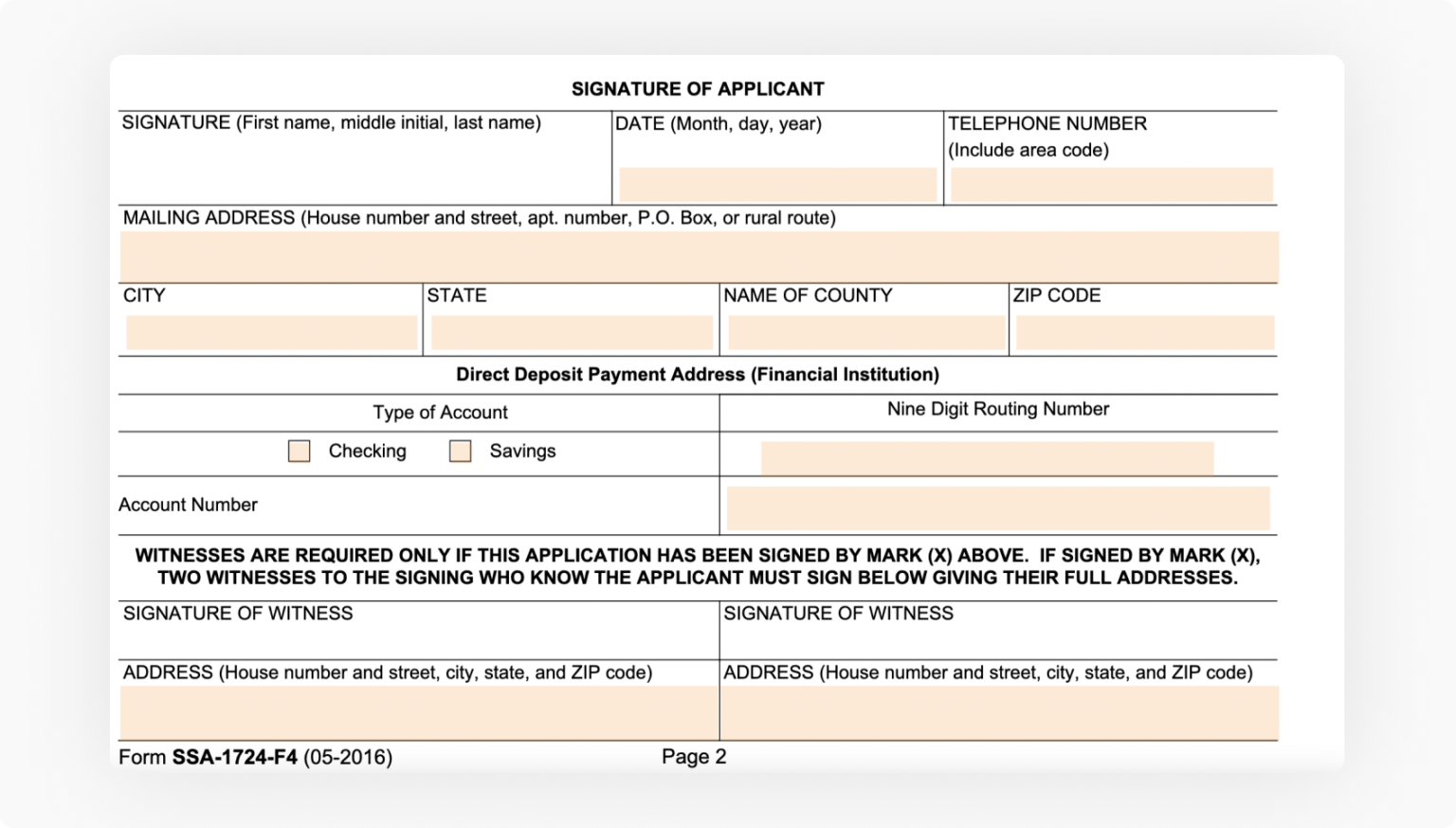

The official title is the "Claim for Amounts Due in the Case of a Deceased Beneficiary." It’s a short form. Only two pages. But if you mess up the order of priority, the SSA will bounce it back faster than a bad check. You aren't just telling them someone died; you’re legally swearing that you are the person entitled to those funds under Section 204(d) of the Social Security Act.

Who actually gets the money?

The government has a very strict "pecking order" for this. It’s not necessarily what says in a will. Social Security isn't an inheritance in the traditional sense; it’s a statutory benefit.

First in line is the surviving spouse who was living in the same household. If there’s no spouse, it goes to the children. Then parents. Then the legal representative of the estate. If none of those exist, it stays in the Social Security Trust Fund. I've seen families get into huge fights over $1,200 because the "responsible" child paid for the funeral but the "estranged" spouse technically had the legal right to the underpayment. It’s messy.

Filling Out the SSA 1724 Without Losing Your Mind

You can find the SSA 1724 form PDF on the official Social Security website (ssa.gov). Don't get it from a third-party "form finder" site that wants to charge you. It’s free.

Once you have the PDF, you’ll notice it asks for the deceased person's Social Security number and your own. It also asks for the date of death. You don’t necessarily need the original death certificate to start the process, but you’ll almost certainly need it to finish it.

The middle section of the form is where people trip up. It asks you to list all surviving relatives in a specific category. If you’re the daughter and you have three brothers, you have to list all of them. You can't just list yourself because you're the one doing the paperwork. The SSA will split the money equally among everyone in that "tier" of the priority list unless those people waive their right to the money.

Dealing with the "Same Household" Rule

The SSA is obsessed with whether a spouse was "living in the same household" at the time of death. If the husband was in a nursing home and the wife was at the family house, does that count? Usually, yes, if it was considered a temporary absence. But if they were legally separated and living in different apartments, that spouse might be skipped over in favor of the children. It’s these small nuances that determine if the claim gets approved or sits in a pile at a regional processing center for six months.

✨ Don't miss: Ohio State Income Tax: What Most People Get Wrong About the New Rates

Realities of the Processing Time

Expect to wait. Seriously.

The SSA is understaffed. They’ve been understaffed for years. Once you mail in the SSA 1724 form PDF, it goes into a black hole. You might get a check in 30 days. It might take 90. If the underpayment is large—say, the person hadn't received their disability backpay yet—it might even take longer because it requires higher-level authorization.

I talked to a clerk once who mentioned that many forms get rejected because people use white-out. Do not use white-out. If you make a mistake, print a new page. The scanners the government uses hate correction tape. It looks like an alteration, and when money is involved, the SSA is paranoid about fraud.

Common Myths About Underpayments

- Myth 1: The funeral home handles this. No, they don't. They report the death so the payments stop, but they don't claim the underpayment for you.

- Myth 2: The will overrides the SSA. Nope. Federal law dictates the priority of payment for Social Security benefits. Your Uncle Bob might have left you everything in his will, but if he has a surviving widow he hasn't seen in twenty years, she likely gets the underpayment.

- Myth 3: You can file this over the phone. Sort of. You can start the report, but they almost always want a signed physical or uploaded copy of the SSA 1724 form PDF to verify the signatures of the claimants.

The "Check in the Mail" Scenario

Sometimes, a check actually arrives after the person dies. If it’s a paper check, do not cash it. If you do, the Treasury will eventually find out and demand it back with interest. You have to return that check and then file the SSA 1724 to have it reissued in your name. If the money was direct deposited, the bank will usually pull it back automatically once they get the death notification. This is why you see people's bank accounts go into the negative right after a funeral—the government took back the "overpayment." The 1724 is how you get the "correct" portion of that money back.

The Nuance of the "Full Month" Rule

This is the hardest part for people to swallow. Social Security has an "all or nothing" rule for the month of death. To be entitled to a payment for a specific month, the person must have lived through every single second of that month. If someone dies at 11:59 PM on the last day of the month, they get the payment. If they die at 1:00 AM on the first day of the following month, they don't.

Wait, let me clarify that because it's confusing.

If someone dies in June, they are not entitled to a payment for June (which would have been paid in July). But they were entitled to the payment for May (which arrives in June). If they died before that June check arrived, that's what the SSA 1724 form PDF is for. It’s for the money they were already entitled to before they passed away.

Practical Steps to Move Forward

First, check the bank statements. See if a payment was pulled back by the SSA (it will usually say "SOC SEC" or "SSA TREAS"). If money was removed that you think belonged to the deceased for the previous month, that's your cue.

Second, download the official form. Make sure it's the most recent version; the SSA updates their forms periodically and using an expired one is a great way to get stuck in bureaucratic limbo.

Third, gather your siblings or other co-heirs. If you want the payment to go to just one person to pay for funeral costs, the others will need to provide statements or signatures. It’s usually easier to just let the SSA split it, even if the checks are small.

Finally, mail it "Certified Mail, Return Receipt Requested." Dealing with the Social Security Administration is 10% paperwork and 90% proving that you actually sent the paperwork. Having that little green receipt card is the only way to get a human on the phone to take you seriously if the claim gets lost.

Once the form is in, your job is basically done. You won't get a "status update" email. You won't get a login. You’ll just get a check in the mail or a letter explaining why you aren't eligible. It’s an old-school process for an old-school agency.

Actionable Next Steps

- Verify the Underpayment: Look at the date of death and the last payment received. If the person died in October, the October check (received in November) must be returned, but the September check (received in October) is theirs. If they never got that September check, move to step two.

- Download the SSA 1724: Get the PDF directly from the SSA.gov forms portal to ensure it's the current version.

- Identify the Highest Priority Claimant: Determine who is first in line (spouse, then children, then parents). Only those in the highest available category should fill out the "Claimant" section.

- Submit with Documentation: Attach a copy of the death certificate unless you have already confirmed the SSA has it on file. Send it via certified mail to your local Social Security field office.

- Monitor the Estate Account: If the money is being paid to the "Estate," ensure you have an EIN and an estate bank account ready to receive the funds, as the bank will not let you cash a check made out to "The Estate of [Name]" into your personal account.