You're sitting there, receipts scattered everywhere, and you finally finish the math on your adjusted gross income. You feel a brief moment of victory. Then you hit the instruction booklet and see it: the 1040 tax table. For most people, this is where the brain fog sets in because the IRS doesn't exactly make things intuitive. It's just rows and rows of numbers that look like a spreadsheet from 1984. Honestly, if you’re looking at that grid and feeling like you need a drink, you aren’t alone.

Most folks assume that if they make $50,000, they just find that number and look at the percentage. Simple, right? Wrong. That’s the quickest way to overpay or freak out about a bill you don't actually owe. The 1040 tax table is a specific tool for a specific group of people—specifically those making under $100,000—and using it correctly requires a bit of a "taxpayer's touch." If you make more than that, you're bumped into the Tax Computation Worksheet, which is a different beast entirely.

The 1040 Tax Table vs. Tax Brackets

Wait. There's a difference? Yeah, and it’s a big one. People use "tax bracket" and "tax table" interchangeably, but in the eyes of the IRS, they serve different masters.

Brackets are the theoretical percentages. They are the $10%, 12%, 22%$ figures you see politicians arguing about on the news. They tell you the rate at which your last dollar is taxed. But the 1040 tax table is the practical application of those brackets. It does the heavy lifting for you by averaging out the tax for a small range of income.

Think of it like this. Instead of calculating exactly what you owe on $45,342, the table groups everyone making between $45,300 and $45,350 together. It finds the midpoint and calculates the tax based on that. It saves you from doing long-form multiplication, but it also means two people making slightly different amounts might pay the exact same tax to the dollar. It’s a game of "close enough" that the government actually allows.

👉 See also: California Secretary of State in Los Angeles: What Most People Get Wrong

How to actually read the thing without losing your mind

First, look at the columns. You’ll see "At least" and "But less than." This is where people trip up. If you made exactly $50,000, you don't look at the row where $50,000 is in the "At least" column. Wait, actually, you do. If your income is exactly the amount on the line, you go with the "At least" row. It’s a tiny distinction, but if you’re on the edge of a bracket, it can change your liability by a few bucks.

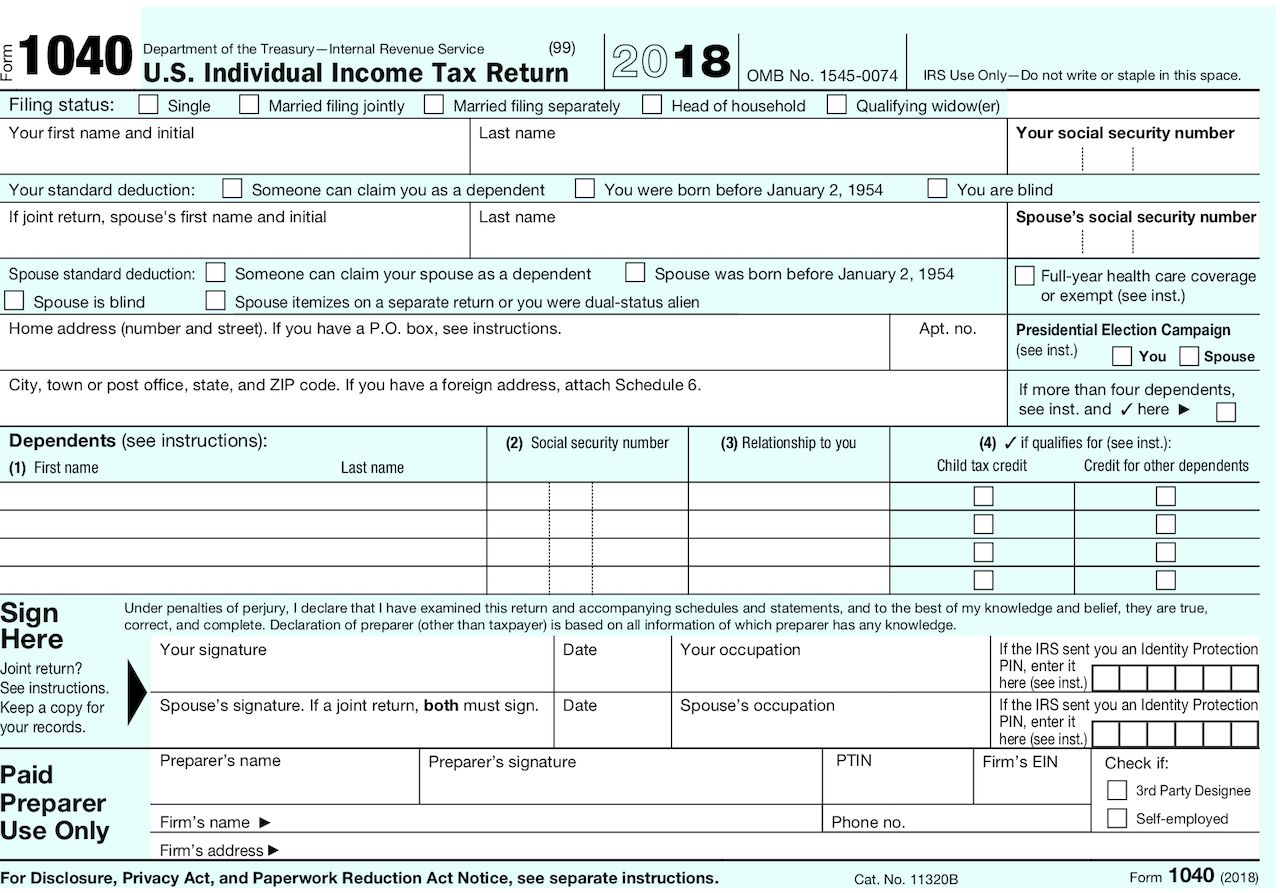

Then you have your filing status. Single, Married Filing Jointly, Married Filing Separately, Head of Household. These columns are everything. A Single person making $60,000 is going to have a much higher number in that table than a Married couple making the same amount. The table is basically a "choose your own adventure" where the ending involves giving the government money.

Why the IRS uses $50 increments

Efficiency. That's the short answer. Back before everyone had high-powered tax software in their pockets, the IRS needed a way for people to file by hand without making a thousand math errors. By creating $50 windows, they reduced the margin for error.

If your taxable income is $99,999, you are at the very end of the 1040 tax table. If you make $100,000? You’re kicked out. You have to use the Tax Rate Schedules. It feels arbitrary because it is. There’s no magical economic shift that happens at the $100k mark; it’s just a legacy cutoff for the physical printing of the tax tables in the instruction booklets.

Common traps that mess up your numbers

People often try to look up their "Gross Income" in the table. Big mistake. Huge. The table is only for Taxable Income.

💡 You might also like: Stock Market Top Gainers: Why Everyone is Looking at These 3 Names Right Now

- Start with your total income (W-2s, 1099s, that side hustle selling vintage clocks).

- Subtract your adjustments (like student loan interest or IRA contributions). This is your Adjusted Gross Income (AGI).

- Subtract your Standard Deduction or Itemized Deductions.

- Then you take that final number to the 1040 tax table.

If you skip those steps and go straight to the table with your salary, you are going to see a tax bill that will make your heart stop. You’d be paying tax on money the government already said you could keep tax-free. For 2024 and 2025, those standard deductions are massive—over $14,000 for singles. Don't donate extra money to the Treasury just because you misread the instructions.

The "Taxable Income" nuance

Taxable income is line 15 on your Form 1040. If that line is zero, you don’t even need the table. You’re done. But if it’s $1 or $99,950, that table is your Bible for the afternoon.

Let’s look at a real-world scenario. Imagine Sarah. Sarah is a freelance graphic designer. Her total income was $70,000. After she takes her business expenses and her standard deduction, her taxable income drops to $42,000. She finds the "At least $42,000 but less than $42,050" row. If she’s filing as Single, the table tells her exactly what she owes. She doesn't have to calculate $11,600 at $10%$ and the rest at $12%$. The table did that math back in a basement in West Virginia months ago.

Is the table always accurate?

Mostly. But it’s not "precise." Because it uses the midpoint of that $50$ range, you might technically owe a few cents more or less than what the math would say if you did it manually. But the IRS requires you to use the table if you qualify. You can’t "opt out" and do the long math to save forty cents. They want the table number because it matches their system’s automated checking process.

The jump to the Tax Computation Worksheet

Once you cross that $100,000 threshold, the 1040 tax table disappears. You move to the "Tax Computation Worksheet." This is basically the "adult" version of the table. It involves a bit of algebra—multiplying your income by a percentage and then subtracting a specific dollar amount.

Why the change? Because at higher incomes, the $50$ increments start to result in larger "rounding errors." When you're dealing with higher marginal rates, the government wants precision. Also, the physical table would be 500 pages long if it went up to $500,000. No one wants to carry that home from the library.

✨ Don't miss: Another Word for Pitch: Why Your Choice of Synonyms Changes Everything

Special cases: Capital Gains and Dividends

Here is the "gotcha" that catches even smart people. If you have "Qualified Dividends" or "Capital Gains" (from selling stocks or crypto), the 1040 tax table might actually lie to you.

These types of income are often taxed at lower rates ($0%, 15%,$ or $20%$). If you just look up your total taxable income in the table, you’ll be taxed at the "ordinary" rates, which are higher. In this case, you have to use the "Qualified Dividends and Capital Gains Tax Worksheet." It’s a royal pain, but it can save you thousands. Never blindly use the tax table if you have a 1099-DIV with numbers in box 1b.

Navigating the 2025-2026 Shift

We are seeing some of the largest inflation adjustments in history lately. This means the numbers in the 1040 tax table shift every single year. You cannot use last year's booklet. You just can't. The "breaks" between the $50$ rows stay the same, but the tax amount in the columns changes to reflect the new cost-of-living adjustments.

If you're using software like TurboTax or FreeTaxUSA, you'll never actually "see" the table. The software just pings the database and spits out the number. But understanding where that number comes from is vital. It’s the difference between being a passive participant in your finances and actually knowing why your bank account is lighter in April.

What if you're a "Head of Household"?

This is one of the most beneficial filing statuses in the table. If you're unmarried but provide a home for a kid or a dependent parent, your tax in the table will be significantly lower than the "Single" column. It’s the IRS's way of giving you a break for the cost of maintaining a home. Always double-check if you qualify for this before looking at the Single column. Most people just default to Single because it’s easy, but they leave money on the table.

Actionable Next Steps for Tax Season

Don't just stare at the rows. Do this:

- Confirm your Taxable Income first. Don't even open the table until you have finished Line 15 of your 1040. If you haven't subtracted your standard deduction, you're looking at the wrong part of the table.

- Check for Capital Gains. If you sold stock, put the table down. You need the Qualified Dividends and Capital Gains Worksheet instead. Using the standard table for investment income is basically a voluntary tax hike.

- Verify your Filing Status. One column to the left or right can mean a $2,000 difference in what you owe. Ensure you aren't accidentally looking at "Married Filing Separately" if you're actually "Single."

- Look at the "At Least" rule. If your income is exactly $55,000, remember you belong in the row that starts with $55,000, not the one that ends with it.

- Download the PDF. Don't rely on grainy screenshots from third-party blogs. Go to IRS.gov and search for "Instructions for Form 1040." The official 1040 tax table is always in the back, usually starting around page 60.

Understanding the mechanics of the table won't make paying taxes fun, but it does strip away the mystery. It’s just a lookup tool. Use it like a map—know where you’re starting (taxable income) and where you want to go (filing status), and the table will give you the coordinates for your tax bill. Just make sure you're on the right map for the right year.