Tax season is basically the adult version of a scavenger hunt nobody actually signed up for. If you’re freaking out because it’s mid-February and you still haven't seen that piece of paper, you aren't alone. Honestly, how to find my 1099 form is one of those questions that seems like it should have a simple answer, but because the IRS has about a dozen different versions of this form, it gets messy fast.

You might be looking for a 1099-NEC if you did some freelance design work, or maybe a 1099-INT because your high-yield savings account actually earned three dollars this year. It's confusing.

The thing is, companies were technically supposed to mail these out by January 31. If your mailbox is empty, don't panic. Digital is the new paper, and half the time, these forms are buried in an "Account Documents" tab you haven't clicked on since 2022.

Check the Digital Paper Trail First

Before you start calling HR departments or yelling at the post office, go look at your email. Most of the big platforms—think Uber, DoorDash, Upwork, or even your bank—send a "Your tax forms are ready" notification. Search your inbox for "Form 1099" or "Tax Document." You'd be surprised how many people miss these because they look like spam.

Log in to the portal where you actually got paid. If you’re a freelancer using Stripe, they have a specific "Express" dashboard just for tax forms. For investment accounts like Robinhood or Charles Schwab, you usually have to dig into the settings, then "Documents," then "Taxes." It’s rarely on the front page.

Sometimes, the form isn't even a PDF you download. Some platforms just provide the data. That's rare, but it happens. Most of the time, though, you’re looking for a downloadable file. If you’ve changed your email address recently, that’s probably where the disconnect is. Check your old accounts.

What if the Payer Never Sent It?

This is where it gets annoying. If you earned more than $600 from a client or a business, they are legally required to send you a 1099-NEC or 1099-MISC. But businesses are run by humans, and humans forget things. Or they have bad accounting. Or they're just lazy.

Wait until mid-February. Mail is slow.

If it's February 15 and you still have nothing, reach out to the payer directly. A quick, polite email to the accounting department usually fixes it. Just say, "Hey, I'm trying to figure out how to find my 1099 form for the work I did last year, could you send over a digital copy?" Most will just email it to you within an hour.

The IRS "Get Transcript" Secret Weapon

If the company went out of business or they're ghosting you, you can actually go straight to the source. The IRS. I know, dealing with the IRS sounds like a nightmare, but their online portal is actually decent now.

You can request a "Wage and Income Transcript." This document shows a summary of all the tax forms the IRS has received under your Social Security number. If your client filed their copy with the IRS, it’ll be on your transcript.

Go to IRS.gov and create an ID.me account. It takes about ten minutes and some face-scanning, but once you’re in, you can see every 1099 reported to your name. Just keep in mind that the IRS transcript system sometimes lags behind the actual filing date, so if a company filed late, it might not show up until late March.

🔗 Read more: The Man with a Hammer: Why We Keep Getting Charlie Munger’s Best Metaphor Wrong

Different 1099s for Different Folks

Not all 1099s are created equal. You need to know which one you’re hunting for so you don't waste time looking for the wrong info.

The 1099-NEC is the big one for freelancers. It replaced the 1099-MISC for "Non-Employee Compensation" a few years back. If you’re a contractor, this is your lifeblood.

Then there’s the 1099-K. This one is a headache. If you took payments through Venmo, PayPal, or Etsy, you might get one of these. The rules for the 1099-K have been in flux lately—the IRS keeps delaying the $600 threshold, so check the current year’s specific limit. For 2023 and 2024, they've been sticking to a higher "transition" threshold, but don't count on that forever.

The 1099-INT and 1099-DIV are for your money making money. Banks and brokerage firms are usually the best at getting these out on time. Most are available for download by the first week of February.

Real-World Problems: The Wrong Address

Life happens. You moved. You didn't tell your old client. Now your 1099 is sitting in a mailbox three states away.

If you know you moved, don't wait for the mail. Go digital immediately. Almost every major payroll provider—ADP, Gusto, Workday—allows you to log in and update your info. Even if you don't work there anymore, your account usually stays active for tax purposes. If you’re locked out, you’ll have to call their support line. It sucks, but it’s better than guessing your income and getting audited later.

What Happens if You Never Find It?

You still have to report the income. Seriously.

The IRS gets a copy of almost every 1099 issued. If you omit that income because you "couldn't find the form," their automated system will catch the discrepancy. A few months later, you’ll get a CP2000 notice in the mail. That’s a letter saying, "Hey, we think you owe us more money, plus interest."

If you absolutely cannot find the form and the payer won't help, use your own records. Look at your bank deposits. Look at your invoices. Total it up. As long as you report at least what was on the 1099, the IRS usually won't bother you. It's when you report less that the red flags go up.

Correcting Errors on Your 1099

Sometimes you find the form, but it’s wrong. Maybe they said they paid you $10,000 but they really only paid you $8,000.

Do not just ignore this.

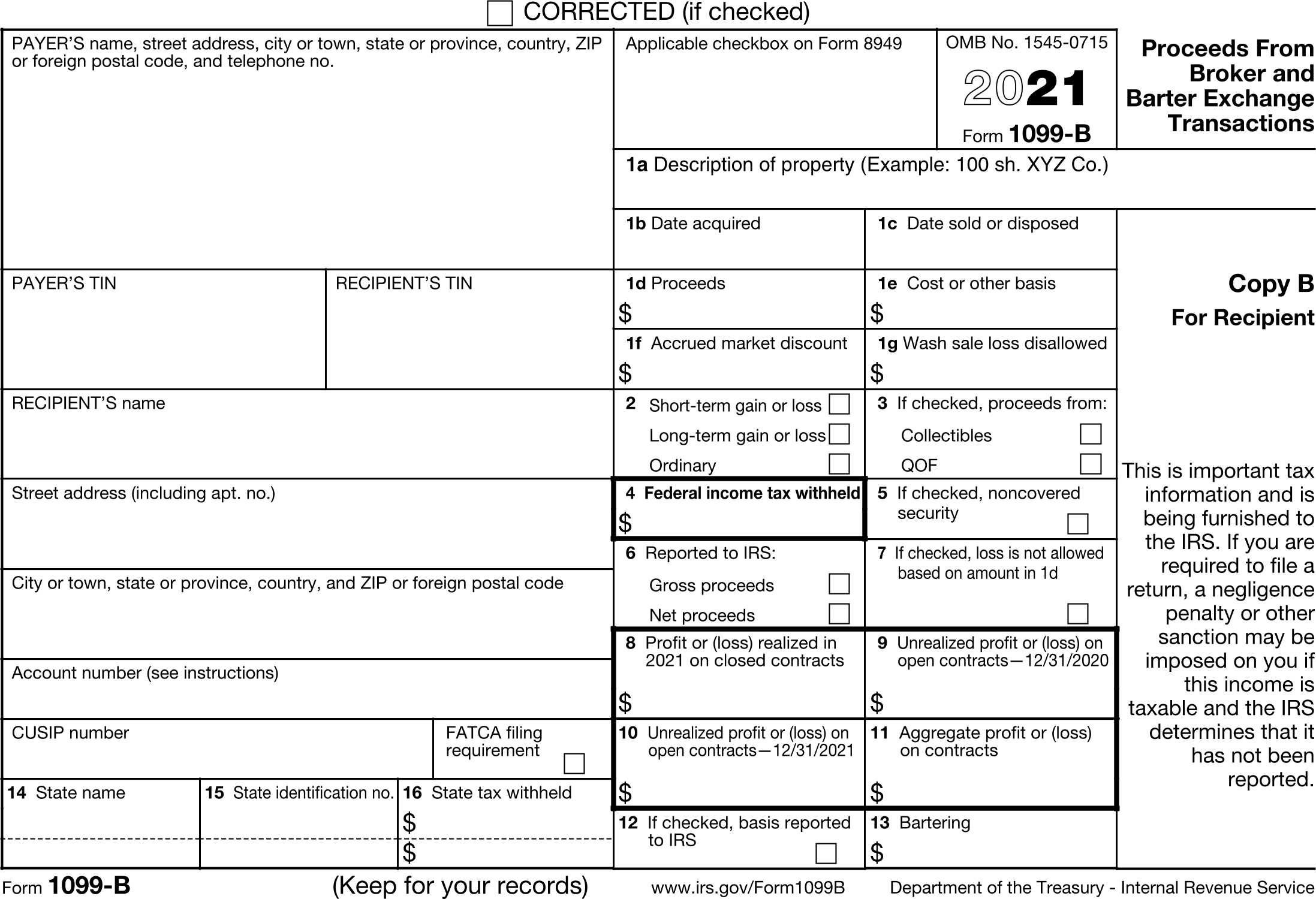

You need to ask the payer for a "corrected" 1099. They have to check a specific box on the form that says "CORRECTED" and re-file it with the IRS. If you just file your taxes with the "correct" number without getting the form fixed, the IRS computers will see a mismatch and send you a bill for the difference.

Actionable Steps to Get Your Taxes Done

- Audit your accounts: Make a list of every bank, client, and payment app you used last year.

- Search your email: Use keywords like "tax," "1099," "form," and "important tax document."

- Log into portals: Check the "Documents" or "Tax" section of every financial app on your phone.

- Download everything: Don't just look at it; save a PDF. Keep a folder on your desktop for the current tax year.

- Check the IRS transcript: If you're missing more than one form, the IRS "Get Transcript" tool is the fastest way to see what they know.

- Verify your totals: Compare your 1099s against your actual bank statements to make sure nobody over-reported what they paid you.

Once you've gathered your documents, keep them in one place. Digital copies are fine, but keep a backup. If you're still stuck, it's probably time to talk to a CPA. They have ways of tracking things down that most of us don't, and they can advise you on how to file a substitute form if a client is totally MIA. Just don't wait until April 14th to start looking. That's a recipe for a very expensive headache.