Checking your mailbox in January is usually a bore until that windowed envelope arrives. You know the one. It looks official, slightly intimidating, and usually has "Important Tax Document" stamped in aggressive red ink on the front. If you're a freelancer, a side-hustler, or just someone with a high-yield savings account, you're likely staring at a Form 1099.

But here’s the thing: "Form 1099" isn't just one single document. It’s a whole family of forms. Honestly, it’s kinda like a nesting doll of tax headaches. Depending on whether you got paid for a gig, earned interest on your crypto, or won a local raffle, the paper in your hand will look different.

In this guide, we’re going to look at what does form 1099 look like across its most common versions—specifically for the 2025-2026 tax cycle—so you don't feel like you're reading ancient hieroglyphics.

The Basic Anatomy of a 1099

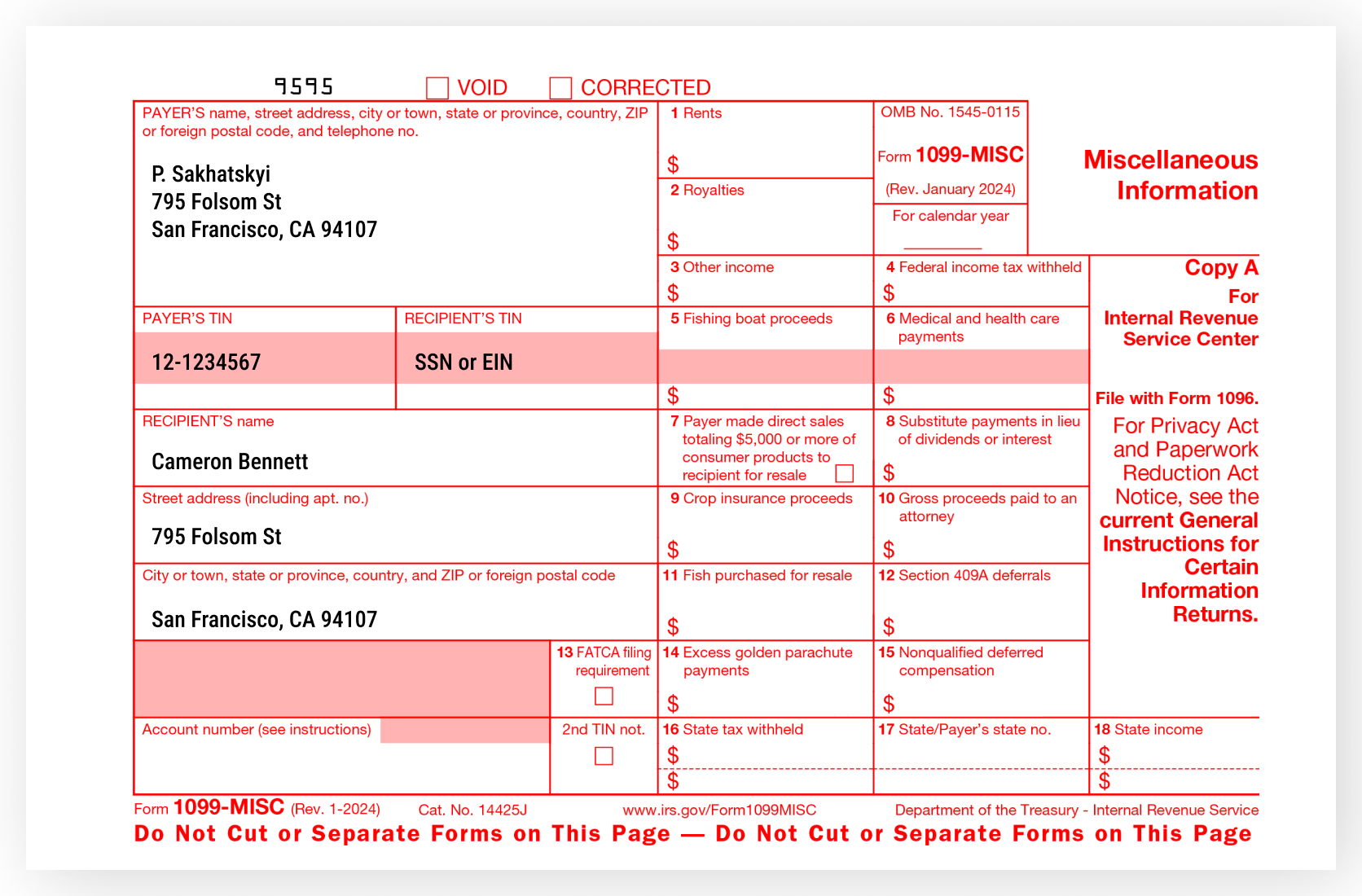

Despite the different versions, almost every 1099 shares a standard "skeleton." If you’re looking at one right now, you’ll notice it’s usually a half-sheet or a full-page with several perforated sections.

The top left is basically the "Who are you?" section. It contains the Payer’s name and address. This is the company or person who sent you the money. Just below that, you’ll find the Payer’s TIN (Taxpayer Identification Number) and your own Recipient’s TIN. This is the most critical part. If those digits are wrong, the IRS computer systems start screaming.

The right side of the form is where the numbers live. These are the "boxes." Box 1 is usually the "big" number—the total amount of money you were paid.

What Does Form 1099-NEC Look Like?

If you're a contractor, this is your main character. Since 2020, the IRS moved nonemployee compensation from the old "Miscellaneous" form to this dedicated one.

📖 Related: South African Rand INR: Why the 2026 Exchange Rate Is Surprising Everyone

The 1099-NEC is surprisingly sparse. It’s usually a small, horizontal-ish form if it’s the paper version, or a standard portrait page if you printed it from a PDF.

Box 1 (Nonemployee Compensation) is the star of the show. If you made $2,000 or more from a client in 2025 (note that the threshold increased for the 2026 filing season), that total goes here. It’s the raw amount before any expenses.

Box 4 is often empty, but don't ignore it. This is where Federal income tax withheld would appear. Usually, clients don't withhold taxes for contractors, but if you didn't provide a valid W-9, they might have "backup withheld" 24% of your pay. If there's a number here, you actually want it—it means you've already paid some of your tax bill.

The 1099-MISC: Not Just a "Catch-All" Anymore

People used to call the 1099-MISC the junk drawer of tax forms. Now that the NEC took over the contractor pay, the MISC is a bit more specialized.

What does it look like? It has way more boxes than the NEC. It feels crowded.

- Box 1 is for Rents. If you’re a landlord, this is where your tenant’s payments show up.

- Box 2 handles Royalties.

- Box 3 is "Other Income." Think prizes, awards, or even jury duty pay.

- Box 10 is a weirdly specific one: Gross proceeds paid to an attorney.

You’ll also see a section at the bottom for state information. Boxes 16 through 18 deal with state tax withholding and state income. If you live in a state with no income tax, like Florida or Texas, these will probably be blank.

The Digital Newcomer: Form 1099-DA

For the 2026 tax season (reporting on 2025 activity), there’s a new kid on the block: the 1099-DA. This is for Digital Assets.

If you trade crypto, NFTs, or stablecoins, your exchange (like Coinbase or Kraken) is now required to send this. It looks a bit like a 1099-B (the one for stocks), but it includes boxes for "Wallet Address" and "Transaction Hash." It’s the IRS’s way of saying, "We see your blockchain activity."

Common Visual Red Flags to Watch For

Sometimes the form looks right, but something is... off. Tax professionals like those at H&R Block or local CPAs often see the same three mistakes on these forms.

First, check the CORRECTED box at the very top. If that’s checked, it means the payer messed up the first version and this is the "oops, my bad" version. You must use the corrected one.

Second, look at your name. If you recently got married and changed your name, but the 1099 has your old name, it might not match your Social Security records. That’s a recipe for an audit letter.

Third, look for VOID. If there’s a big checkmark in the "VOID" box, that form doesn't exist to the IRS. Payers usually check this if they made a mistake while typing and want the scanner to skip it. If you received a VOID form in the mail, you need to call the sender immediately and get a real one.

Practical Steps for When the 1099 Arrives

Don't just toss it in a drawer.

Step 1: The Math Check. Pull up your bank statements or invoice software (like Quickbooks or FreshBooks). Does Box 1 match what actually hit your bank account? Keep in mind that 1099s usually report gross pay, so if a platform like Upwork took a fee, the 1099 might show a higher number than you actually received. You’ll deduct those fees later on your Schedule C.

🔗 Read more: Why a Photo of Dollar Bill Matters More Than You’d Think

Step 2: Check the SSN. It’s common for companies to truncate your Social Security Number for security (showing only XXX-XX-1234). That’s fine. But if the last four digits are wrong, you have a problem.

Step 3: Organize by Type. Keep your 1099-NECs separate from your 1099-INTs (interest). They go in different places on your tax return. 1099-NEC income is subject to self-employment tax; 1099-INT income usually isn't.

Step 4: Digital or Paper? Many companies have gone paperless. Check your email for "Your Tax Document is Ready" notifications. These digital versions look exactly like the paper ones—just in PDF form. Download them and save them to a "Taxes 2026" folder immediately.

If you get to mid-February and you're missing a 1099 from a company that paid you more than $600 (or $2,000 for certain types in 2026), don't wait. Reach out to their payroll or accounting department. The IRS already has their copy; you want yours so you don't accidentally underreport and face a penalty later.