If you’ve lived in Cumming or anywhere near Lake Lanier for a while, you know the drill. You open the mail, see that white envelope from the county, and your heart sinks a little. It’s the assessment notice. Suddenly, the Forsyth County GA property appraiser says your house is worth way more than you thought—or at least, more than you want to pay taxes on.

People get pretty heated about this. I've heard neighbors at the grocery store swearing the county is just "making up numbers" to pad the budget. Honestly, it's not quite that conspiratorial, but the process is definitely a maze if you don't know which walls to kick.

Understanding how Joel Benton (the Chief Appraiser) and his team actually arrive at these numbers is the only way to keep your tax bill from spiraling. It’s not just about what your neighbor’s house sold for last June. It’s a mix of mass appraisal algorithms, state laws, and—believe it or not—a few opportunities for you to push back and win.

The "Invisible" Math of Mass Appraisal

Most folks think an appraiser walks through their front door, looks at the new granite countertops, and scribbles a number. That’s not what happens here. The Forsyth County GA property appraiser uses something called mass appraisal.

📖 Related: How Much Was Each Stimulus Check? What Really Happened

Basically, they use a computer system (CAMA) to group your home into a "neighborhood" with hundreds of others. They look at sales from the previous year—specifically from January 1 to December 31—and apply those trends across the board.

If three houses on your street sold for a premium because they have finished basements, the system might assume your unfinished basement is worth more too. It's an imperfect science. The county is trying to hit "Fair Market Value," which Georgia law defines as what a willing buyer would pay a willing seller. But computers don't know that your roof is twenty years old or that your backyard floods every time it drizzles.

Why Your Assessment Might Be Out of Whack

Errors happen. Frequently.

🔗 Read more: Exchange Rate Birr to US Dollar: What Most People Get Wrong

I’ve seen property records where the county thinks a house has 3,000 square feet of heated space, but 500 of those "feet" are actually a screened-in porch. Or maybe they have you down for four bathrooms when you only have three and a half. These small data points matter because they are the variables in the tax formula.

Here is the basic formula the county uses:

$$(\text{Fair Market Value} \times 0.40) - \text{Exemptions} = \text{Assessed Value}$$

Then, they multiply that by the millage rate. In Forsyth, the 2026 combined millage rate stays around 7.896 mills for the county side, but the school tax is the real heavy hitter. If your initial Fair Market Value is wrong, every other number in that equation breaks.

The 45-Day Window: Your Only Real Power

Once that notice hits your mailbox, the clock starts. You have exactly 45 days from the date on the notice to file an appeal. If you miss it? You're stuck with that value for the year. No exceptions.

You can file through the Online Appeal portal or mail in the PT-311A form to the Board of Assessors office at 110 East Main Street. When you appeal, don't just say "taxes are too high." The Board doesn't care about your budget. They care about value and uniformity.

- Value Appeal: You argue the house isn't worth what they say. Bring photos of cracks in the foundation or a quote for a new roof.

- Uniformity Appeal: You argue that your house is valued higher than identical houses in your neighborhood. This is often the "secret weapon" for winning an appeal.

If the Board of Assessors doesn't budge, your case goes to the Board of Equalization. These are just three regular citizens (appointed by the Grand Jury) who listen to both sides and make a call. It’s like a mini-courtroom, but without the fancy robes.

Homestead Exemptions: Leaving Money on the Table

It kills me how many people in Forsyth County pay full freight because they forgot to file for a Homestead Exemption. If you own the home and lived in it as of January 1, you qualify.

The standard S1 exemption is great, but the L7 "Floating" Homestead is the real MVP in a rising market. It basically freezes your assessment for the county portion of your taxes. So even if the Forsyth County GA property appraiser says your home value doubled, your county tax base stays flat.

And if you’re 65 or older? You need to be at the office yesterday. Forsyth offers a 100% school tax exemption for seniors (L1). Given that the school system takes about $0.68 of every tax dollar, this exemption can literally cut your bill in half.

Surviving the 2026 Tax Season

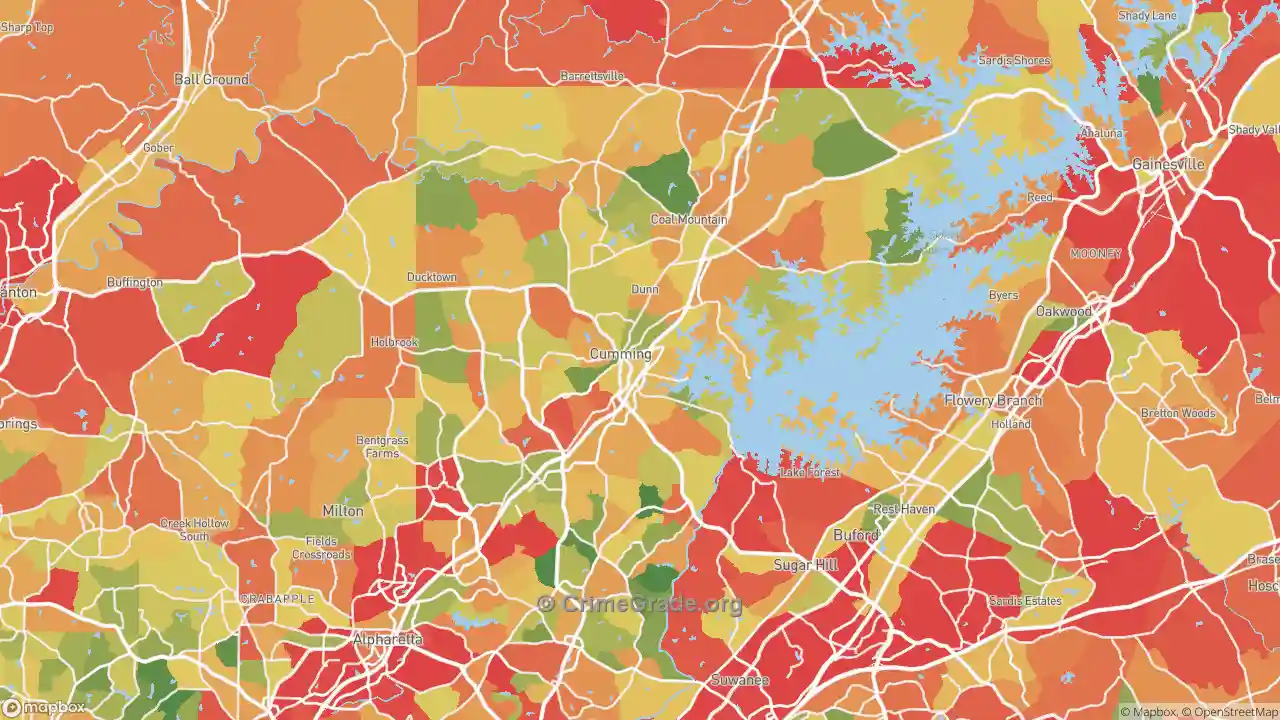

The county growth isn't slowing down. With new developments popping up along GA-400 and near Halcyon, values are naturally climbing. But that doesn't mean you should blindly accept the first number the county sends you.

Check your property record card online. Look for "hidden" errors like incorrect acreage or "finished" space that isn't actually finished. Honestly, the appraisers are overworked. They are managing thousands of parcels. They expect—and sometimes even welcome—homeowners who bring better data to the table.

✨ Don't miss: How Cooks Electrical Services Ltd Solves the Domestic Wiring Crisis

Actionable Steps for Homeowners:

- Audit your data: Go to the Forsyth County Tax Property Portal and search for your address. Check the "Sales Search" to see what homes actually sold for in your specific pocket of the county over the last 12 months.

- Photo Evidence: If you plan to appeal, take time-stamped photos of any property defects (mold, dated interiors, structural issues) before the April filing deadline.

- Apply by April 1: If you haven't filed your Homestead Exemption, do it now. You only have to do it once as long as you live there, but if you moved in last year, the deadline is firm.

- Attend a Board Meeting: The Board of Tax Assessors usually meets at 2:00 p.m. at the Main Street office. Watching one session will take the "mystery" out of how they make decisions.