Buying a house in Cumming or anywhere else in Forsyth County feels like a win until that first assessment notice hits your mailbox. Suddenly, you're staring at numbers that might not make a lick of sense. Honestly, the way Forsyth County GA property tax records are handled can be a bit of a maze if you don't know where to look or what the jargon actually means.

It’s not just about the money. It's about the data.

Most people think their tax bill is just a "set it and forget it" situation, but that’s a huge mistake. Your property record is a living document. If the county thinks you have a finished basement and you definitely don't, you're paying for air. Checking these records isn't just for nosy neighbors; it's a financial necessity.

Where the Records Actually Live

You've got two main hubs for this stuff. First, the Board of Tax Assessors handles the "what is it worth" side of things. They are the ones who look at your 4-bedroom ranch and decide if the market says it's worth $500,000 or $600,000. They maintain the property record cards. These cards are the holy grail of information, listing everything from your square footage to the year your roof was last "estimated" to be replaced.

Then you have the Tax Commissioner. They are the bill collectors. While the Assessors set the value, the Commissioner’s office applies the millage rate and sends you the bill. If you're looking for payment history or to see if the previous owner actually paid their dues before you closed, this is your stop.

The website for Forsyth County is actually surprisingly decent, though it looks like it was designed a few years back. You can search by owner name, address, or that long string of numbers called a PIN (Parcel Identification Number).

The Math That Bites

Georgia does this weird thing where they don't tax you on 100% of your home's value. Instead, they use a 40% assessment rate. So, if the Board of Assessors says your house is worth $500,000, your "assessed value" for tax purposes is actually $200,000.

Then comes the millage rate.

In 2025, the combined millage rates for Forsyth County sat around 24.5 mills. Think of a "mill" as $1 for every $1,000 of assessed value. It sounds small until you do the math. About $68 of every $100 you pay goes straight to the school system. The rest is split between county operations, fire services, and paying off bonds.

The Homestead Exemption "Trap"

If you live in the house you own, you need a homestead exemption. Period. But here is where people mess up: they think it happens automatically.

It doesn't.

You have to apply by April 1st. If you miss that window, you’re stuck paying the full freight for the entire year. No exceptions. No "oops, I forgot." Forsyth County has a "floating" homestead exemption which is basically a life raft for your wallet. It "freezes" the assessed value of your home for the county and fire portion of your taxes.

So, even if the real estate market in South Forsyth goes absolutely nuclear and your home value doubles, your county tax base stays relatively flat. However, keep in mind this doesn't usually freeze the school tax portion. You’ll still feel the sting of those school bonds as they fluctuate.

👉 See also: John Wood PLC Share Price: What Really Happened with the Takeover

The 65+ School Tax Break

This is the big one. If you are 65 or older, you might be eligible for a 100% exemption from the school tax portion of your bill. Given that the school tax is the biggest chunk of the pie, this is life-changing for retirees. But again, you have to go down to the office at 110 East Main Street in Cumming and show them you're actually 65. They won't just take your word for it over the phone.

How to Fight Back (The Appeal)

Every year, usually around May or June, the county sends out an Annual Notice of Assessment. This is not a bill. It's a "hey, this is what we think your house is worth" letter.

You have 45 days to argue.

If you look at your Forsyth County GA property tax records and see that the county has your square footage wrong, or they’ve listed you as having a "finished attic" when it’s just a crawlspace with some plywood, you need to file an appeal.

Most people lose appeals because they just go in and say, "My taxes are too high!" The Board doesn't care. They only care about value. You have to prove that similar houses in your neighborhood sold for less, or that your house has some "functional obsolescence"—fancy talk for "it's broken."

Common Myths About Forsyth Property Records

I hear people say all the time that if they don't open the mail, the assessment doesn't count. Wrong. The county considers it "served" the moment it hits the post office.

Another weird one? "The tax record is the same as my appraisal."

Hard no. A bank appraisal for a mortgage and a county tax assessment are two different beasts. Usually, the tax assessment lags behind the real market. If the county assessment is higher than what you could actually sell the house for today, you are winning the "I'm being overcharged" lottery and should definitely appeal.

📖 Related: Who Owns The Telegraph Right Now? The Messy Reality Behind Fleet Street’s Biggest Power Struggle

Real-World Steps for Homeowners

Don't just wait for the bill to show up in September or October. Be proactive.

- Check the Clerk of Superior Court for your deed. Ensure the name is spelled exactly right. Any typo there ripples into the tax records.

- Pull your property record card from the Assessors' website. Look at the "Improvements" section. Is the bathroom count right? Is the "Year Built" correct?

- Verify your exemptions. If you’ve lived there for three years and don't see an "L1" or "S1" code on your record, you are leaving money on the table.

- Watch the calendar. April 1st for exemptions. 45 days from the notice date for appeals. These dates are carved in stone.

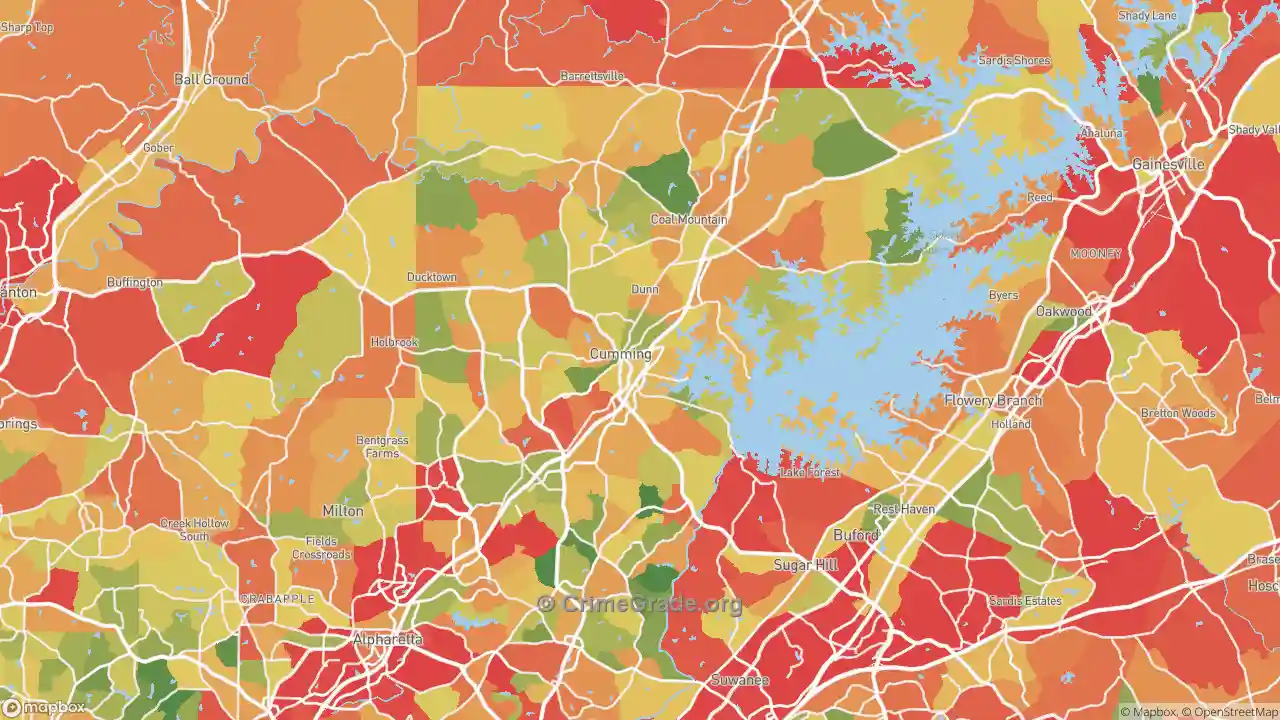

If you’ve recently moved to the area from out of state, the concept of "ad valorem" taxes might feel aggressive. Forsyth County has some of the lowest millage rates in the metro Atlanta area, but because property values here are so high, the dollar amount can still be a shock.

Staying on top of your Forsyth County GA property tax records is the only way to make sure you aren't subsidizing the rest of the county. It takes maybe twenty minutes a year to double-check the data. That’s a pretty good ROI for a few clicks on a government website.

To get started right now, you should navigate to the Forsyth County Tax Assessor’s online portal and search for your property using your Last Name and Street Name to verify that your current assessment reflects the true condition of your home.