You’ve just opened that manila envelope. Inside is the annual assessment for your home in Cumming or Alpharetta, and the number is... well, it’s a lot. If you're living in Forsyth County, you probably know we have some of the lowest millage rates in metro Atlanta, but that doesn't make the bill any easier to swallow when your home value has shot up like a rocket.

Property taxes here are basically a math problem with a few moving parts: the fair market value of your home, the 40% assessment rate, and the millage rates set by the Board of Commissioners and the School Board.

Honestly, the "fair market value" the county puts on your home can feel totally disconnected from reality. But before you get too worked up, you've gotta understand that Forsyth County uses a "Mass Appraisal" process. They aren't walking through your front door and looking at your new kitchen. They’re looking at what your neighbors’ houses sold for between January 1 and December 31 of the previous year.

👉 See also: Is Ray Dalio a Liberal? What Most People Get Wrong

The Math Behind Your Forsyth County Georgia Property Tax Bill

In Georgia, you don't pay taxes on the full value of your home.

The county takes your Fair Market Value (FMV) and multiplies it by 40% to get your "Assessed Value." If your house is worth $500,000, your tax bill starts with an assessed value of $200,000.

Then come the millage rates. Think of a "mill" as $1 for every $1,000 of assessed value. In Forsyth, your bill is split between two main bosses: the County Government and the School System. For the 2026 cycle, the county’s combined millage—which covers things like the fire department and general maintenance—is sitting right around 7.896 mills.

The school system is the bigger slice. It usually hovers around 16.626 mills.

When you add it all up, roughly 68% of your check goes to the Board of Education. Only about 32% stays with the county government for things like roads, police, and parks.

Why Your Neighbor Might Be Paying Less (It’s Not a Mistake)

It’s easy to get frustrated when you realize the person next door with the exact same floor plan is paying $1,000 less than you. Usually, the "secret" is the homestead exemption.

Forsyth County is pretty generous with these if you actually live in the house as your primary residence. You have to own the home on January 1st to qualify for that year.

The standard S1 exemption knocks $8,000 off your assessed value for county and fire taxes. It’s not a huge amount, but every bit helps. The deadline to file is April 1st. If you miss that date, you’re stuck with the full bill until next year.

The Senior "Pot of Gold"

If you're 65 or older, Forsyth County is one of the best places in Georgia to live, tax-wise. Why? Because seniors get a 100% exemption on the school portion of their taxes.

Since school taxes make up two-thirds of the bill, this is massive.

💡 You might also like: WPM Stock Price Today: Why This Streaming Giant Is Hitting Record Highs

You don't get this automatically. You have to apply. I've talked to people who lived here for three years after turning 65 before realizing they were still paying for the school bond and operations. That’s thousands of dollars just... gone.

There are also income-based exemptions for those 62 and older, but those are a bit more restrictive. For the 100% school tax break at 65, it’s mostly about your age and residency.

The 45-Day Window: Don't Sleep on It

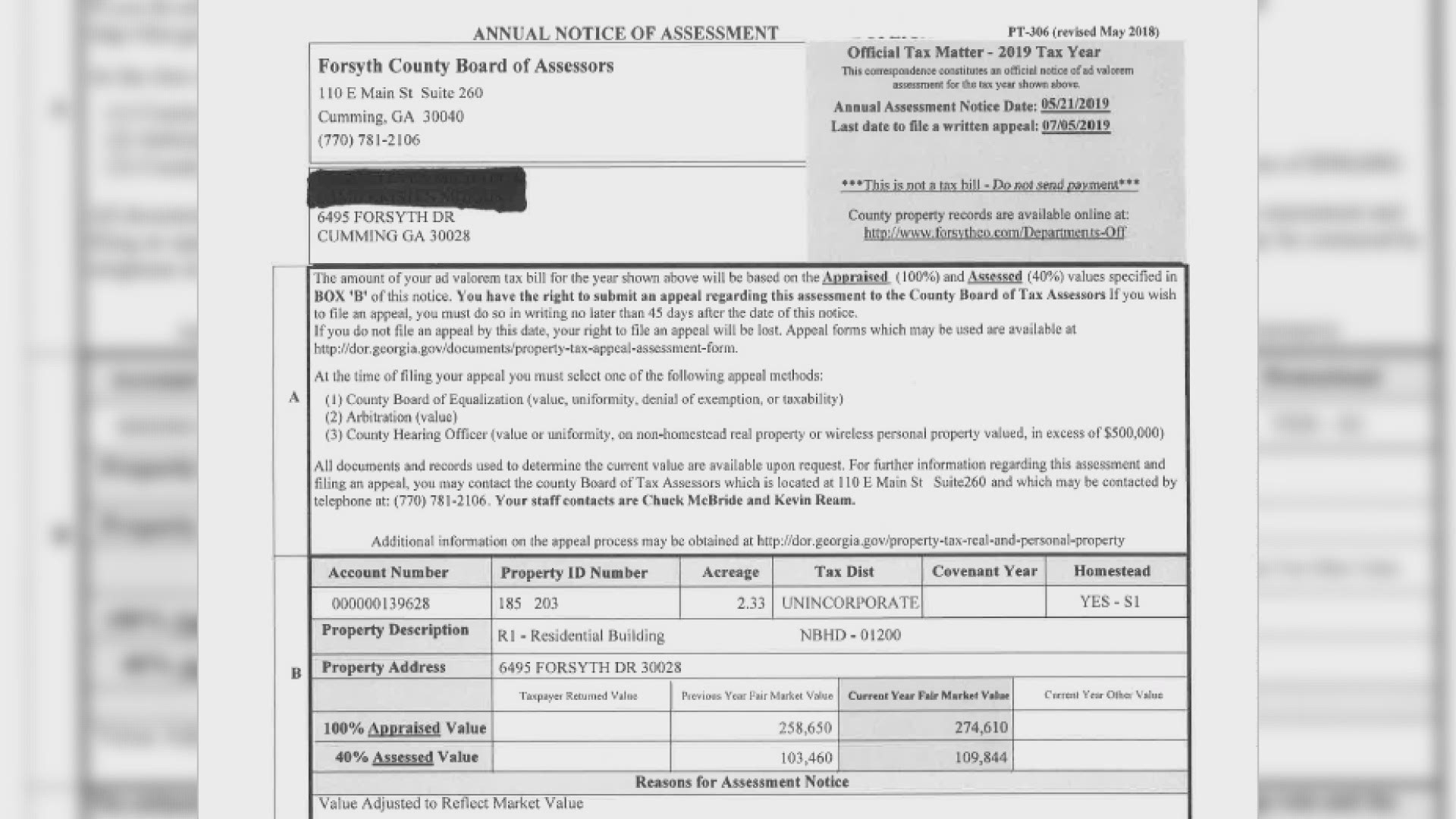

Every year, the Board of Assessors sends out "Annual Notice of Assessment." This is NOT a bill. It’s a notification of what they think your house is worth.

You have exactly 45 days from the date on that notice to appeal.

If you think they’ve got it wrong—maybe they think you have a finished basement when it’s just studs and cobwebs—you have to speak up then. You can’t wait until the actual bill arrives in the fall. By then, it’s too late.

When you appeal, you can choose to go before the Board of Equalization. These are just regular citizens, not county employees. You show up with your evidence—photos of damage, or a list of "comps" (recent sales) that are lower than your assessment—and you make your case.

HB 717 and the Floating Exemption

There’s been a lot of talk lately about Georgia HB 717. Basically, this is a "floating" homestead exemption designed to keep your school taxes from skyrocketing just because your neighborhood got popular.

It creates a "base year" value. If your home value goes up by 10% in one year, your school tax assessment might only be allowed to go up by a small percentage (like 4%) or stay frozen at that base year.

📖 Related: CHTR Stock Price Today: What Most People Get Wrong About Charter Communications

It’s the county’s way of trying to prevent "taxing people out of their homes." It’s complicated, and it applies differently to the "M&O" (Maintenance and Operations) part of the bill versus the "Bond" part, but the gist is: the longer you stay in your house, the more protected you are.

Real-World Action Steps

Don't just grumble about the bill. Take these steps to make sure you aren't overpaying:

- Verify your Homestead Exemption: Go to the Forsyth County Board of Tax Assessors website and look up your property. If it doesn't say "S1" or another exemption code, you're leaving money on the table.

- Mark April 1st on your calendar: This is the hard deadline for all new exemption applications.

- Check your "Grade" and "Square Footage": The county records often have errors. If they have your house listed as 3,000 square feet but it’s actually 2,600, you are being overcharged.

- Watch for the May/June Notice: As soon as that assessment notice hits your mailbox, compare it to Zillow or Redfin. If the county is way higher than the market, start gathering your evidence for an appeal immediately.

- Senior Status: If you or a spouse are turning 65 this year, get your paperwork ready. You'll need your ID and potentially some tax returns if you're aiming for the income-based "Double Homestead," though the standard 65+ school exemption is the big winner for most.

The system isn't perfect, but in Forsyth County, the tools are there to keep your property tax manageable. You just have to be the one to pick them up.