Managing payroll is a headache. Honestly, if you’re a small business owner or a freelancer, the last thing you want to do after a ten-hour shift is wrestle with complicated accounting software that costs fifty bucks a month just to tell your employees they got paid. That is exactly why the free pay stub template word remains a staple in the digital junk drawer of many successful startups. It's simple. It works. You don’t need a degree in finance to change a font or update a gross pay figure.

But there is a catch.

Most people treat a pay stub like a receipt for a sandwich. It’s actually a legal document. If you mess up the math or forget a local tax line, you aren't just being disorganized—you’re potentially violating Department of Labor (DOL) requirements or state-specific transparency laws.

🔗 Read more: Why Nobody Wants to Work Anymore is Actually a Century-Old Myth

What Actually Goes on a Pay Stub?

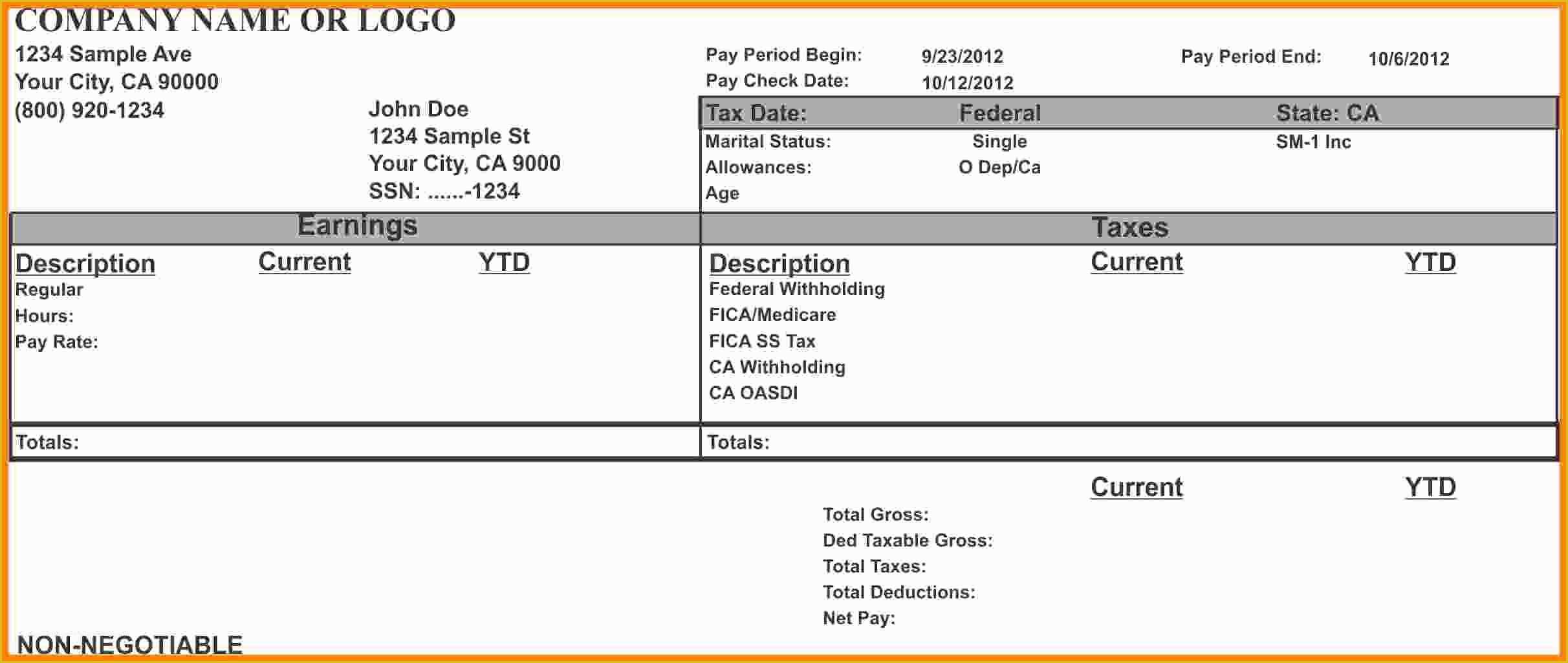

It’s more than just the "big number" at the bottom. You’ve got your basics: company name, address, and the employee’s info. Then it gets granular. You need the pay period dates, not just the pay date itself. There’s a difference. One is when the work happened; the other is when the money hit the bank.

A solid free pay stub template word should have dedicated sections for gross wages, taxes withheld, and those pesky voluntary deductions like health insurance premiums or 401(k) contributions. If you’re in a state like California, you better be showing the available sick leave too. Seriously. Failure to show specific items on a wage statement can lead to "waiting time penalties" or statutory damages under Labor Code section 226. It's not just about the money; it's about the record.

The Problem With DIY Math

Computers are better at math than you are. Sorry, but it's true. When you use a Word document, you are the calculator. Word doesn't have the built-in "Sum" functions that Excel has, or the automatic tax table updates that a service like Gusto or QuickBooks provides.

You have to manually calculate Federal Insurance Contributions Act (FICA) taxes. That's $6.2%$ for Social Security and $1.45%$ for Medicare. If you round wrong, or if the employee hits the Social Security wage base limit ($168,600 as of 2024, but check the latest IRS Publication 15), your "free" template just became a very expensive tax audit.

People use Word because it's familiar. It feels safe. You can make it look professional with a nice logo and clean lines. But you have to be vigilant. One typo in the "Year-to-Date" column and the whole year of record-keeping is compromised.

🔗 Read more: Finding Detroit Auto Parts Euclid Ohio: What You Actually Need to Know

Why a free pay stub template word Is Often Better Than a Generator

You’ve seen them. Those websites that promise a "Free Pay Stub" but then ask for your credit card at the very last step. It’s frustrating.

A Word template is truly yours. Once you download it, there are no paywalls. You can customize it to fit your brand. If you want to add a "Great job this week!" note at the bottom, you can. Most automated systems are rigid. They don’t allow for the human touch.

Security and Privacy Concerns

When you use an online generator, you are handing over sensitive data. Names, Social Security numbers (even if masked), and salary info are gold for identity thieves. Keeping your payroll in-house using a free pay stub template word on a password-protected local drive gives you a layer of control that cloud-based "free" tools don't always guarantee.

But don't be lazy with your filing. If you’re printing these out, they need to be stored securely. If you’re emailing them, they should be encrypted PDFs. Sending a raw Word doc via Gmail is a nightmare waiting to happen. Anyone who intercepts that email can see exactly how much your staff makes and where they live.

The Mechanics of Customization

To make a Word-based stub look legitimate, you should use tables. Not the messy "space bar" method. Tables allow you to align the earnings column perfectly with the deductions column.

- Use a 10pt or 12pt font for readability.

- Bold the Net Pay so it stands out.

- Include a "Check Number" or "Reference ID" even if you use direct deposit.

It’s about creating a paper trail. If an employee wants to buy a house or get a car loan, the bank is going to look at these stubs. If they look like they were typed by a toddler in a notepad app, the loan officer is going to have questions. A professional Word template bridges the gap between "small operation" and "legitimate enterprise."

Common Errors to Avoid

- Forgetting the YTD: Your employees need to see their Year-to-Date totals. This helps them track if they are overpaying taxes or if they’re on track for their retirement goals.

- Mixing Up Independent Contractors and Employees: If you're giving a pay stub to a 1099 contractor, stop. They don't get pay stubs in the traditional sense; they get a remittance advice or just a check. Giving them a stub with tax withholdings can actually be used as evidence that they are legally your employee, which opens you up to a world of tax liabilities.

- State-Specific Omissions: States like New York and Washington have very specific "Wage Theft Prevention Act" requirements. You might need to list the hourly rate, the overtime rate, and any allowances taken (like meals or lodging).

Navigating Federal Requirements

The Fair Labor Standards Act (FLSA) doesn't actually require federal pay stubs, which is a weird fact most people miss. However, it does require employers to keep accurate records of hours worked and wages paid. While the feds might not mandate the stub, the state likely does. Most states require some form of written wage statement.

Using a free pay stub template word ensures you are meeting the record-keeping part of the equation. If an auditor walks through your door, you can point to your folder of saved Word docs and show exactly how you arrived at every nickel paid out.

Actionable Steps for Small Business Owners

- Download a reputable template: Look for ones that use a standard "two-column" layout (Earnings on the left, Deductions on the right).

- Verify the Math: Use an external tax calculator (the IRS has a decent one called the Tax Withholding Estimator) to double-check your manual entries for the first few pay cycles.

- Standardize the Filing: Save every stub as a PDF with a consistent naming convention:

YYYY-MM-DD_EmployeeName_PayStub. - Update Annually: Tax rates change. Every January 1st, you need to check if FICA, state disability, or local income tax rates have shifted. Update your "Master Template" immediately.

- Check Local Laws: Contact your state's Department of Labor to see if you are required to include specific information like the employer's FEIN or sick leave accruals on every statement.

The transition from a manual Word template to an automated system usually happens when you hit about five employees. Until then, staying lean with a Word document is a perfectly valid way to run a business, provided you respect the details. Accuracy trumps automation every single time. Keep your records clean, keep your math sharp, and your "free" solution won't cost you a dime in the long run.