You ever open your banking app on Friday morning, see the deposit, and just... sigh? It's always lower than you thought. You did the mental math on the way to work. You multiplied your hourly rate by 40, or divided your salary by 26, and you felt rich for exactly six minutes. Then the reality of FICA, federal withholding, and that random "ADJ" line item hits. Honestly, it’s annoying. That is exactly why everyone ends up hunting for a free paycheck tax calculator at least once a quarter. We want to know where the money went.

Budgeting on "gross income" is a fantasy. It’s a lie we tell ourselves to feel better about our career choices. If you’re trying to move into a new apartment or finally pay off that credit card, you need the "take-home" number. That’s the only number that pays for groceries.

How a Free Paycheck Tax Calculator Actually Works (And Why It Fails)

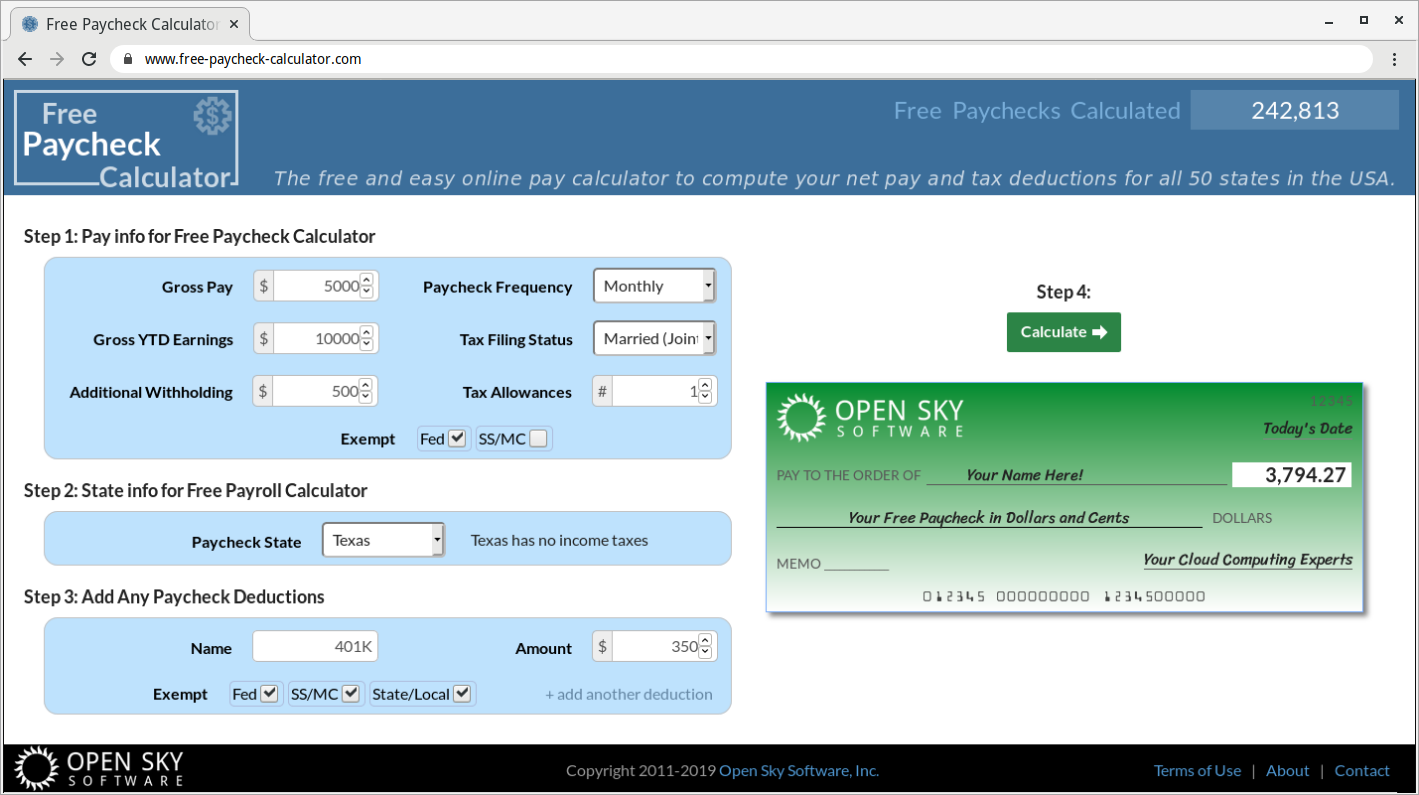

Most people think these tools are just simple calculators. Plug in $60,000, hit enter, get a number. But it's way more granular than that. If a tool doesn't ask for your filing status or your state, close the tab. It's useless.

Federal taxes are progressive. This means your first $11,600 (for 2024/2025 single filers) is taxed at 10%, but the money you earn above that jumps to 12%, then 22%, and so on. A good free paycheck tax calculator has to bake in the current IRS tax brackets. But here is the kicker: the calculator is only as smart as the info you give it regarding your W-4. If you haven't looked at your W-4 since 2019, your "estimated" paycheck is probably going to be wrong. The IRS overhauled the form in 2020, removing "allowances" entirely. Now, it’s all about specific dollar amounts for dependents and other income.

Then there’s FICA. Federal Insurance Contributions Act. Sounds fancy, but it’s just Social Security and Medicare. Social Security takes 6.2% of your gross pay until you hit the wage base limit—which is $168,600 for 2024. Medicare takes another 1.45%. Your employer matches this. If you’re a freelancer using a free paycheck tax calculator, you have to remember you’re both the employee and the employer. That means you're paying the full 15.3% yourself. It hurts.

State Taxes are the Wild West

Living in Florida or Texas? Lucky you. No state income tax. But if you're in California or New York, the math gets messy fast. California has ten different tax brackets. Ten! Some states, like Pennsylvania, use a flat tax (3.07%), which makes the calculation easier but doesn't necessarily save you money depending on what you earn.

A local tax might even apply. If you work in Philadelphia or New York City, there’s an extra "city tax" sliced right off the top. A basic free paycheck tax calculator might miss these hyper-local nuances. You have to check if the tool asks for your zip code. If it doesn't, take the result with a grain of salt.

The Stealth Killers of Your Take-Home Pay

It isn't just the government taking a cut. Your "voluntary" deductions often eat more of your check than Uncle Sam does.

- Health Insurance Premiums: These are usually pre-tax. That’s good! It lowers your taxable income. But it still means your $2,000 paycheck just became $1,850.

- 401(k) Contributions: Again, pre-tax (unless it's a Roth). If you're putting in 6% to get the company match, your "net pay" looks smaller, even though your net worth is actually growing.

- HSA and FSA: These are the "hidden" accounts. Great for LASIK or dental work, but they are immediate deductions.

- Garnishments: Not common for everyone, but child support or student loan garnishments are post-tax. They don't lower your tax bill; they just disappear from the check.

When you use a free paycheck tax calculator, most people forget to toggle the "deductions" section. They just look at the tax. Then they get their real check and realize they forgot about the $80 a month for the "Premium Dental Plan" they never use.

The Bonus Check Trap

Ever get a $1,000 bonus and only see $600 of it? You aren't being singled out. The IRS treats "supplemental wages" differently. Many employers use the "percentage method," which is a flat 22% withholding for bonuses. Add in FICA and state tax, and you’re basically losing a third of your bonus instantly. Some companies use the "aggregate method," where they add the bonus to your regular pay and tax it as if you make that much money every pay period. This often pushes you into a higher bracket for that one check, leading to a massive over-withholding. You get it back at tax time, sure, but you can't spend a tax refund in October.

Why "Accuracy" is a Moving Target

You have to realize that these calculators are simulators, not legal documents. They rely on the "Circular E" (Employer's Tax Guide) published by the IRS. If the IRS updates a regulation on a Tuesday, the free paycheck tax calculator you're using might not be updated until Friday.

Also, the "Pay Period" matters. Are you paid weekly? Bi-weekly? Semi-monthly? Monthly?

There is a big difference between bi-weekly (26 checks a year) and semi-monthly (24 checks a year). If you select the wrong one in the tool, your monthly budget will be off by hundreds of dollars. Semi-monthly checks are slightly larger because there are fewer of them.

🔗 Read more: Amazon Stock Quote Today: Why Everyone is Watching the 239 Level

Real-World Example: The $50k Salary in Two Different States

Let’s look at how the math shifts. Imagine you earn $50,000 a year, filing single, with no extra deductions.

In Texas, your take-home pay is roughly $41,500. You pay about $4,600 in Federal Income Tax and $3,825 in FICA. That’s it.

In Oregon, for that same $50,000, you’re looking at a take-home pay of roughly $37,800. Why? Because Oregon has a heavy state income tax that will chew up nearly $3,700 of your earnings.

That’s a $300 a month difference just for living in a different zip code. If you’re planning a move, using a free paycheck tax calculator for your new destination is the smartest thing you can do before signing a lease. People move for a "10% raise" all the time, only to realize the state tax and cost of living in the new city actually make them poorer.

Common Mistakes When Calculating Net Pay

- Ignoring the "Head of Household" status. This status has a much higher standard deduction than "Single." If you qualify and don't check that box on the calculator, your estimate will be way too low.

- Forgetting about the "Additional Withholding" line. If you told your HR department to take an extra $50 out of every check to avoid a tax bill in April, no calculator will know that unless you manually add it.

- Assuming 40 hours every week. If you're hourly, your check fluctuates. Most people calculate their "best" week and assume that's their standard. Use an average of your last four paystubs for a realistic number.

- The "Third Paycheck" Month. If you're paid bi-weekly, two months a year you get three paychecks. People often freak out thinking their tax rate changed on these checks, but usually, it's just the timing of benefits deductions.

Moving Toward a Better Budget

If you really want to master your money, stop looking at your gross salary. It’s a vanity metric. It’s what you tell people at parties. Your net pay—the number that actually hits your Chase or SoFi account—is the only number that matters.

Start by finding a reputable free paycheck tax calculator—SmartAsset, ADP, and PaycheckCity are usually the gold standards for being up-to-date.

Run three scenarios. Run one where you contribute 0% to your 401(k). Run one at 6%. Run one at 15%. Seeing the actual "hit" to your weekly cash flow makes it much easier to commit to saving. Often, the tax savings of a 401(k) mean that putting $100 into savings only "costs" you $75 in your paycheck. That’s a win.

🔗 Read more: The Symbol for the Euro Currency: What Most People Get Wrong

Actionable Next Steps

- Locate your most recent paystub. Don't guess. Look at the actual line items for health insurance and retirement.

- Check your W-4 status. If you had a kid, got married, or bought a house recently, your withholding is likely wrong. Use the IRS Tax Withholding Estimator tool for the most "official" check-up.

- Compare two different calculators. Input your data into two different sites. If the numbers vary by more than $10, find out why. One might be using outdated state tax tables.

- Adjust for 2025/2026 changes. Tax brackets shift every year due to inflation. Ensure the free paycheck tax calculator you use is updated for the current tax year.

- Plan for the "Gap." If the calculator says you should be taking home $2,100 but you're only seeing $1,950, call your payroll department. You might be paying for a benefit you forgot you signed up for during open enrollment.

Knowing your numbers isn't just about math; it's about peace of mind. When you know exactly what's coming in, you stop stressing about the "missing" money and start managing what's actually yours.