Let's be real. Most of us don't even carry a checkbook anymore. You probably have one gathering dust in a kitchen drawer, or maybe you only see a check when your Great Aunt sends you twenty bucks for your birthday. But then, you're suddenly staring at one—maybe a tax refund or a settlement check—and you realize there’s actually a lot of weird data printed on it.

The front and back of check layouts aren't just random design choices. Every tiny string of numbers and every blank line serves a specific legal purpose under the Uniform Commercial Code (UCC). If you mess up the endorsement or misread the routing number, your money basically enters a digital purgatory.

It’s kind of wild how much tech is packed into a piece of paper. Even in 2026, where we’ve got instant transfers and crypto, the "paper" check is still the backbone of the U.S. financial system. Understanding how to read both sides isn't just for bank tellers; it’s about making sure you actually get paid without the headache of a "Return to Sender" stamp.

Breaking Down the Front of the Check

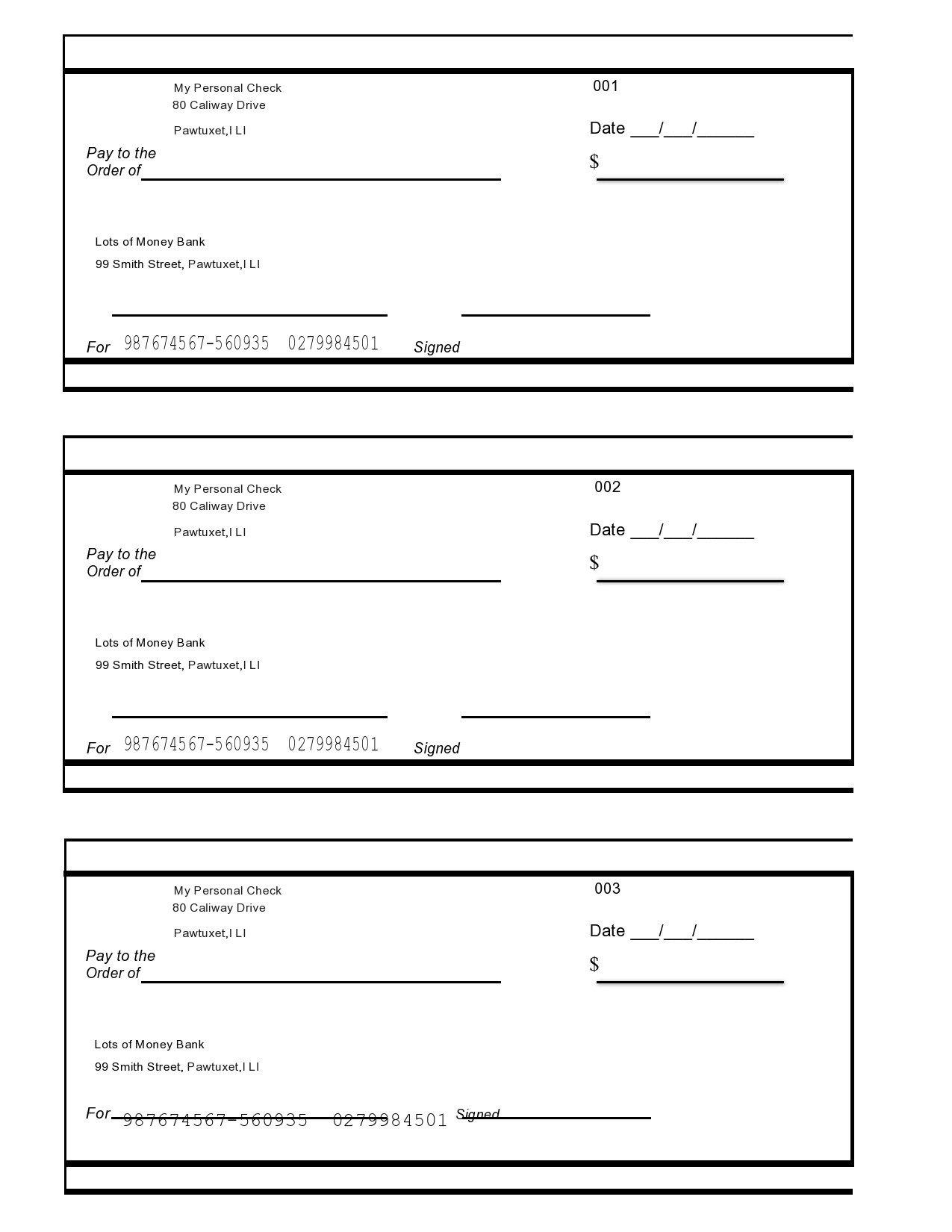

The front is where the action happens. It’s the "instruction manual" for the bank. At the top left, you’ve got the drawer’s information—that’s the person or business paying you. If their address is a P.O. Box, some high-security check-cashing places might give you a side-eye, though it’s perfectly legal.

Look at the top right. You see the check number. It’s there for your own tracking, honestly. But the real meat is the "Pay to the Order of" line. This is the payee. If your name is misspelled here, don't panic. You can usually sign it on the back as it's spelled, then sign your actual name underneath.

Then there’s the "amount box" and the "legal line." Here’s a fun fact: if the numbers in the box ($100.00) don't match the words written out (One Thousand Dollars), the bank is legally required to honor the words. The words are the "legal amount." It’s a rule designed to prevent people from just adding a zero to a box.

The Magic Numbers at the Bottom

See that weird, blocky font at the bottom? That’s MICR (Magnetic Ink Character Recognition). It’s printed in special ink that contains iron oxide so machines can read it even if you’ve spilled coffee on the check.

- Routing Number: This nine-digit code identifies the specific bank. The first two digits actually tell you which Federal Reserve district the bank belongs to. For example, if it starts with "02," it’s in the New York district.

- Account Number: This is the specific "bucket" where the money lives.

- Check Number: Yes, it’s repeated here so the machine can categorize the transaction.

The Back of the Check: More Than Just a Signature

Flip it over. It looks simpler, right? It’s not. The front and back of check relationship is a legal contract. The back is primarily the "endorsement area."

You’ve probably seen the "Do not sign/write/stamp below this line" warning. They aren't kidding. That space is reserved for the banks that handle the check as it moves through the clearinghouse. If you scribble your grocery list back there, the scanners might fail, and your deposit gets delayed.

Different Ways to Sign (Endorse)

Most people just scrawl their name. That’s a "blank endorsement." It’s also the most dangerous way to do it. If you sign a check in blank and then drop it in the parking lot, anyone who finds it can legally (well, physically) try to cash it. It's essentially "bearer paper" at that point.

If you want to be smart, use a Restrictive Endorsement. Write "For Mobile Deposit Only at [Bank Name]" and then sign. This is huge. Since the rise of mobile banking, fraud has spiked because people were depositing the same check at three different banks via their phones. Now, most banks—like Chase or Wells Fargo—will flat-out reject a mobile deposit if those specific words aren't on the back.

📖 Related: Jon Patton and Zions Bank: What You Should Know About This Finance Leader

Then there’s the "Special Endorsement." This is when you write "Pay to the order of [Someone Else's Name]" and then sign. You’re basically turning the check over to another person. Heads up: many banks won't even accept these anymore because they are a nightmare to verify.

Why the MICR Line Is Still King

You might wonder why we still use paper in a world of Apple Pay. The Federal Reserve still processes millions of checks daily. According to the 2022 Federal Reserve Payments Study (the most recent deep dive into this), while check usage is declining, the value of the checks being written is actually going up. Big businesses still use them for B2B transactions because the "paper trail" is easier for auditors to follow than a series of digital pings.

When you scan a check on your phone, you aren’t just taking a picture. The app is looking for the "Check Digit" in that routing number. It’s a mathematical formula—the ninth digit is calculated based on the first eight. If the math doesn't add up, the app knows the check is a fake before you even hit "submit."

Security Features You Can’t See

The front and back of check are loaded with "covert" security. Hold a check up to the light. You’ll often see a watermark. Look at the signature line on the front. On many business checks, that’s not actually a line—it’s "microprinting." It’s actually the words "Authorized Signature" printed so small that it looks like a solid line to the naked eye. Photocopiers can’t replicate that level of detail; they just turn it into a blurry mess.

On the back, you might see "Original Document" printed in very light ink. If you try to scan or copy it, that text might disappear or change color. This is why "official" checks feel a bit waxy or thick—it’s the chemical reactivity in the paper designed to prevent "check washing," where scammers use chemicals to erase the ink and rewrite the amount.

Common Mistakes That Kill Your Cash Flow

- Signing too early: Never endorse a check until you are literally standing at the ATM or have the app open.

- Using a pencil: Seriously? It’s 2026. Use blue or black ink. Pencil can be erased and changed, and many scanners struggle to pick up the graphite's reflection.

- The "Double Signature" mess: If you're depositing a check made out to you and your spouse, check the word between your names. If it says "John AND Jane," both of you must sign the back. If it says "John OR Jane," either one of you can sign it alone.

Moving Forward: Actionable Steps

Managing a check shouldn't be a guessing game. To keep your money safe and ensure the bank doesn't flag your deposit, follow these steps:

Verify the "Legal Amount" first.

Check the written words on the front. If they don't match the numbers in the box, expect a delay. If you are the one writing the check, make sure the words are clear and start as far to the left as possible so no one can "add" words later.

Use a restrictive endorsement for mobile.

Always write "For mobile deposit at [Your Bank]" on the back. It protects you if the paper check falls into the wrong hands after you've scanned it.

Keep the check for 14 days.

After a mobile deposit, don't shred the check immediately. Stick it in a "Pending" folder for two weeks. Occasionally, the "back end" of the bank's system will find an issue with the MICR line or the endorsement that the initial AI scan missed. Once the funds are fully cleared and the "hold" period is over, shred it.

Check the "Void After" date.

Most personal checks don't have an expiration date, but "stale-dated" checks (usually older than 6 months) can be rejected by banks. Business and government checks often have a "Void after 90 days" notice on the front. If yours is past that, don't even try to deposit it—call the sender for a reissue.