You're probably overexposed to the S&P 500. Honestly, most of us are. It’s been the winning bet for over a decade, so why look elsewhere? But if you've ever stared at your portfolio and realized 90% of your net worth is tied to a handful of California tech giants, you've likely stumbled upon the FTSE Global All Cap ex US Index.

It’s a mouthful.

Basically, this index is the "everything else" of the investing world. It tracks thousands of companies across developed and emerging markets, intentionally leaving out the United States. It's the counterweight. When the US dollar wobbles or Silicon Valley has a bad year, this index is what keeps your portfolio from sinking into the basement.

Why the FTSE Global All Cap ex US Index is more than just a backup plan

Most people think of international investing as a "nice to have." They're wrong. The FTSE Global All Cap ex US Index represents about 40% of the investable equity market globally. By ignoring it, you're essentially telling four out of every ten profitable companies on Earth that you don't want their money. That’s a bold—and potentially risky—move.

The index covers over 7,000 stocks. That is a massive number. It ranges from massive conglomerates like Samsung and Nestlé down to tiny "micro-cap" firms in Norway or Taiwan that you’ve never heard of but that are quietly cornering niche markets.

Sentiments change. Cycles turn. In the 2000s, US markets were essentially flat—the "lost decade"—while international markets, especially emerging ones, went on a tear. If you only held US stocks then, you were miserable. If you held a broad basket like the one tracked by this FTSE index, you were doing just fine.

The Mid and Small Cap Secret

Here is the thing about "All Cap" indices. Most international funds focus only on the big names. You get the Toyotas and the Roche Holdgs of the world. But the FTSE Global All Cap ex US Index includes small-cap companies.

Why does that matter?

Small caps are often where the real growth lives. They are more plugged into their local economies. While a giant like Shell is tied to global oil prices, a mid-sized software firm in Germany or a consumer goods company in Indonesia is playing by different rules. They offer a level of "granularity"—a fancy word for variety—that you just don't get with large-cap only funds.

Breaking down the geographic sprawl

This isn't just "Europe and Japan."

The index is a massive tent. It’s roughly split between developed markets (think UK, France, Canada) and emerging markets (China, India, Brazil). This creates a weirdly beautiful balance. You get the stability of Swiss banks and the high-octane, though volatile, growth of Indian tech or Brazilian energy.

- Developed Markets: These usually make up about 75% of the index. They are the "boring" part, providing steady dividends and lower volatility.

- Emerging Markets: The remaining 25% or so. This is where the risk lives. But it's also where you find the next generation of consumers.

Think about the sheer scale. You're holding pieces of the luxury goods market in France (LVMH), the semiconductor backbone in Taiwan (TSMC), and the banking infrastructure of Canada (Royal Bank of Canada).

It's a hedge against American exceptionalism.

We love the US market. It’s innovative. It’s deep. But it’s also expensive. By looking at the FTSE Global All Cap ex US Index, you’re often buying into companies with much lower Price-to-Earnings (P/E) ratios. You’re getting more "earnings" for every dollar you invest compared to the premium prices currently demanded by Wall Street.

The Vanguard Connection (VXSGE and VXUS)

If you've heard of this index, it's probably because of Vanguard. Their Total International Stock ETF (VXUS) tracks the FTSE Global All Cap ex US Index.

It’s one of the cheapest ways to own the world.

With an expense ratio that is essentially pennies, it has become the default choice for the "Boglehead" DIY investor crowd. But don't let the simplicity fool you. Managing a fund that holds 7,000+ securities across 40+ countries is an operational nightmare. The fact that they can do it for such a low fee is a miracle of modern finance.

💡 You might also like: Regeneron Pharmaceuticals Inc Stock: What Most People Get Wrong

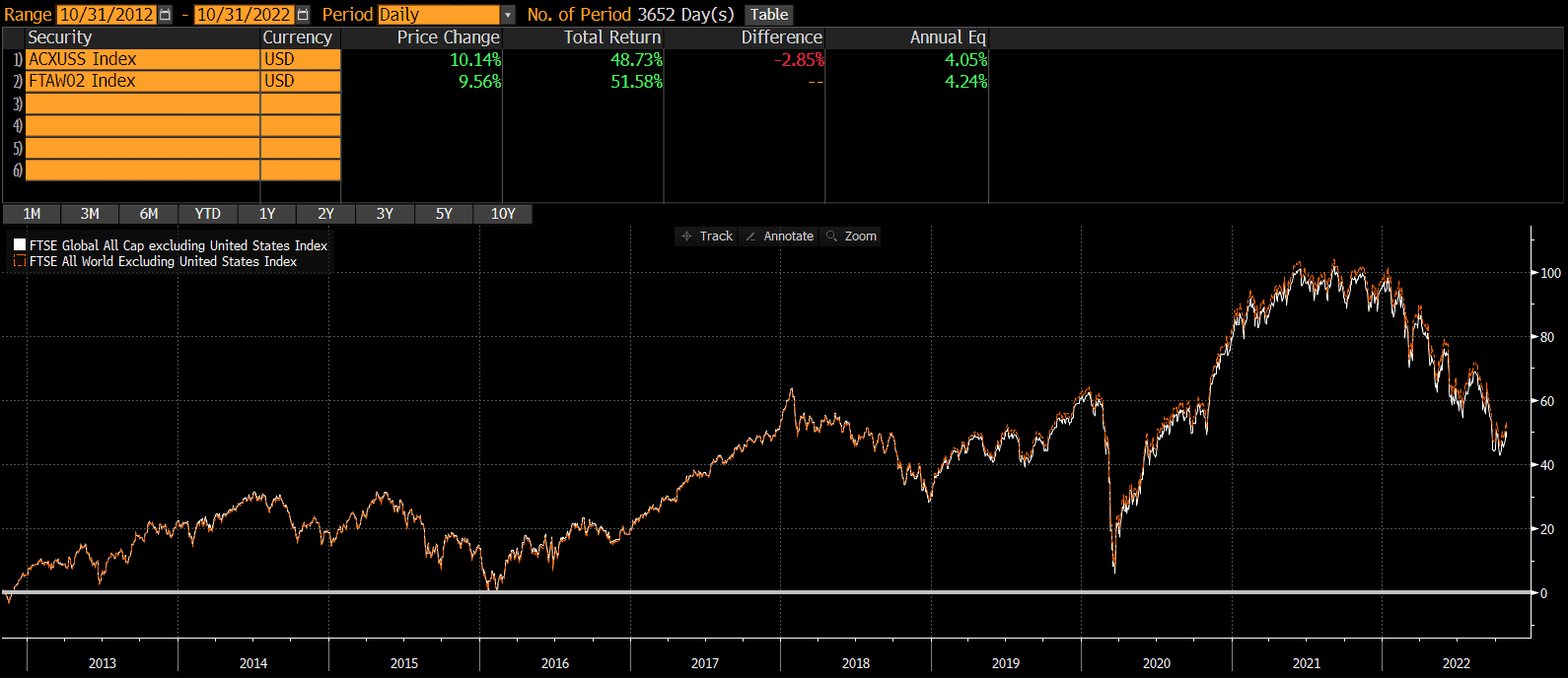

Some investors get confused between this and the MSCI ACWI ex USA Index. They’re siblings, not twins. The FTSE version—the one we're talking about—is generally considered broader because it reaches further down into the "small cap" bucket. If you want the most complete picture of the world outside America, FTSE is usually the winner.

What happens when the Dollar gets strong?

Currency is the ghost in the room.

When you invest in the FTSE Global All Cap ex US Index, you aren't just betting on companies; you're betting against the US Dollar to some extent. If the Euro or Yen gets stronger, your returns go up. If the Dollar stays "King," it eats into your gains.

Lately, the Dollar has been a beast. This has made international returns look "meh" compared to the S&P 500. But currency cycles are just that—cycles. They mean-revert. If you wait until the Dollar is already weak to buy international stocks, you've missed the boat. You buy the insurance before the storm hits, not while your roof is flying away.

The China Question

We have to talk about China. It’s a significant chunk of the emerging markets portion of this index.

For some, this is a dealbreaker.

Geopolitical tensions, regulatory crackdowns, and transparency issues make Chinese equities a "hot stove" for many. Because the FTSE Global All Cap ex US Index is market-cap weighted, it holds China because China is big. If you are deeply uncomfortable with Chinese exposure, this broad index might actually give you more than you want.

However, the index is self-correcting. If the Chinese market shrinks, its weight in the index drops. If India grows, its weight rises. It’s a passive, unemotional way to let the world economy tell you where the value is, rather than trying to guess which country will "win" the next decade.

The reality of "Home Bias"

We all suffer from home bias. It’s comfortable. You recognize the logos in the mall. You use the apps on your phone. But comfort is rarely a good investment strategy.

Professional endowment funds—the ones at Harvard or Yale—don't just buy US stocks. They are global. They understand that the US has outperformed for a long time, but that outperformance has led to high valuations.

The FTSE Global All Cap ex US Index acts as a pressure valve. It’s there for when the US market gets "too hot" and needs to cool down.

Actionable Steps for Your Portfolio

Don't just read about it. Sorta analyze where you stand right now.

First, look at your current "International" exposure. If you only own a "Developed Markets" fund (like an EAFE index), you are missing out on the small caps and the emerging markets. You’re only getting half the story.

Second, check your weighting. A common rule of thumb is the 70/30 or 60/40 split between US and International. If you're at 95/5, you're not diversified; you're just gambling on one country.

Third, look at the tax implications. If you hold a fund tracking the FTSE Global All Cap ex US Index in a taxable brokerage account, you can often claim a Foreign Tax Credit. This helps offset the taxes those foreign companies paid to their own governments. It’s one of the few "free lunches" in the tax code.

📖 Related: Stocks in Dow 30: What Most People Get Wrong

Lastly, stop checking it every day. International stocks can be volatile. They move on different news cycles. They have different holidays. The beauty of an "All Cap" index is that it’s built for the long haul.

Next Steps for the Savvy Investor:

- Audit your "Ex-US" coverage: Ensure you aren't just holding Large Caps. If you don't see "Small Cap" or "Emerging" in your fund's prospectus, you aren't truly diversified.

- Rebalance annually: When the US outperforms, sell a bit of the US and buy more of the FTSE Global All Cap ex US index. It feels wrong to sell winners and buy "laggards," but that is exactly how you buy low and sell high.

- Evaluate your "Home Bias": If you live and work in the US, your salary is in USD and your house is in USD. Having your entire investment portfolio also in USD creates a massive single-point-of-failure risk. Broadening out is simply common sense.

The world is a big place. There are thousands of companies out there making products you use every day—from the tires on your car to the chips in your fridge—that aren't based in the US. The FTSE Global All Cap ex US Index is the easiest way to make sure you get a piece of that action. It isn't flashy. It won't give you "10x returns" overnight. But it will likely be the reason your portfolio survives a decade that looks different from the last one.