Investing is weird right now. If you look at most portfolios, they’re basically just a giant bet on American tech companies. But there is a massive world out there beyond the S&P 500, and that is exactly where the FTSE Global All Cap Index ex US comes in. Honestly, it is probably the most exhaustive way to own "the rest of the world" without accidentally buying more Apple or Nvidia.

It isn't just a list of big European banks. We are talking about over 10,000 stocks. That is a staggering number of companies that most people couldn't name if you paid them.

Why the FTSE Global All Cap Index ex US is basically the "everything else" button

Most international indexes are kinda lazy. They grab the big names like Toyota, Samsung, and Nestlé, then call it a day. But the FTSE Global All Cap Index ex US is different because it includes small-cap and mid-cap stocks. It covers roughly 98% of the world’s investable market capitalization outside of the United States.

You've got developed markets like Japan and France. You’ve also got emerging markets like India and Brazil. By including small-cap companies, you're getting exposure to the local heroes—businesses that serve their home countries but haven't become global conglomerates yet.

Vanguard’s Total International Stock ETF (VXUS) is the most famous fund tracking this index. As of early 2026, it holds a massive slice of the global pie. People often confuse it with the MSCI ACWI ex USA, but there’s a subtle difference. FTSE includes small caps more aggressively. MSCI’s standard version often leaves those smaller players out unless you're looking at their "IMI" (Investable Market Index) versions.

The Japan and UK factor

If you buy the FTSE Global All Cap Index ex US, you aren't just buying "international." You are buying a lot of Japan. Japan usually makes up about 14% to 15% of the index. It is the heavyweight. Then you have the UK, Canada, and France.

Some people find this annoying. They want high-growth emerging markets. But this index is market-cap weighted. That means the bigger the stock market in a country, the more of it you own. It is a self-cleansing system. If the UK market shrinks and India’s grows, the index automatically shifts. No manager needed.

Breaking down the sectors

It’s not all tech. Unlike the US market, which is dominated by Silicon Valley, the FTSE Global All Cap Index ex US is much more balanced across "old school" industries.

- Financials: Banks and insurance companies are huge here.

- Industrials: Think German engineering and Japanese robotics.

- Consumer Discretionary: Luxury brands in France and car makers in Asia.

- Technology: Still present (hello, ASML and TSMC), but it doesn't suffocate the other sectors.

Performance: The elephant in the room

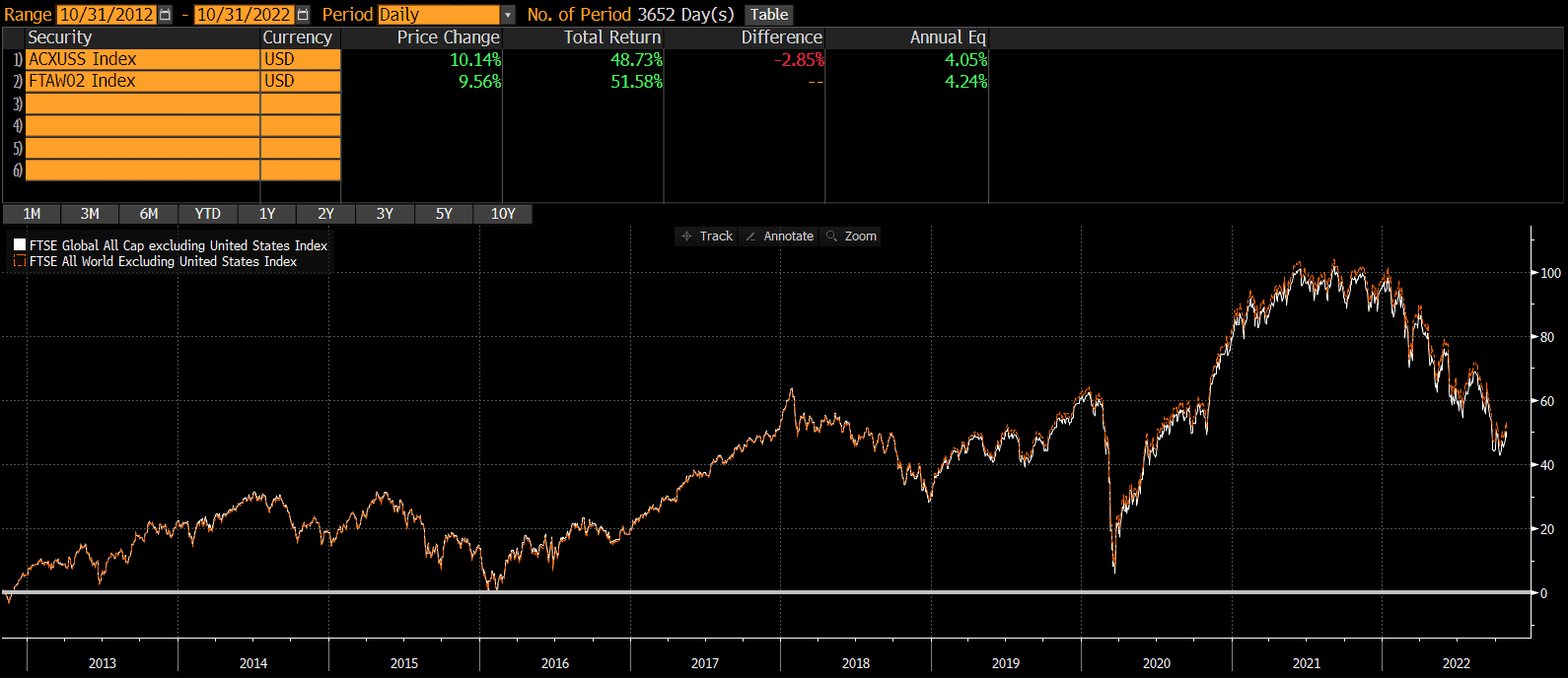

Let’s be real. For the last decade, international stocks have mostly looked like a disappointment compared to the US. While the S&P 500 was mooning, the FTSE Global All Cap Index ex US was just... chugging along.

But 2025 and the start of 2026 have shown some cracks in that narrative. As US valuations hit levels that make even aggressive traders nervous, international markets started looking like a bargain. The price-to-earnings (P/E) ratio for this index is often significantly lower than the US market. You're basically buying earnings at a discount.

Is it a "value trap"? Maybe. But historically, these things move in cycles. There were long periods in the 80s and early 2000s where international stocks absolutely crushed the US. Diversification feels stupid right up until the moment it saves your life.

The risks nobody talks about

Currency is the big one. When you invest in the FTSE Global All Cap Index ex US, you aren't just betting on companies; you're betting against the US Dollar. If the Euro or Yen gets stronger, your returns go up. If the Dollar stays "King," it eats into your gains. It's a double-edged sword that most casual investors forget to check.

Then there’s the geopolitical stuff. Emerging markets in this index (like China) carry risks that you just don't see in a US-only portfolio. Regulatory crackdowns or trade wars can tank 10% of the index overnight. That’s the price you pay for wanting to own the whole world.

How to actually use this information

Don't overcomplicate it. If you want to stop obsessing over whether the US is in a bubble, adding an index like this is the easiest move.

✨ Don't miss: American Heritage Federal Credit Union in King of Prussia: What You Actually Need to Know

- Check your current overlap: Look at your portfolio. If you own "Global" funds, they might already be 60% US. You might need an "ex-US" fund to balance it out.

- Look at the fees: If you're using an ETF to track the FTSE Global All Cap Index ex US, keep the expense ratio low. VXUS, for example, is around 0.07%. Anything over 0.20% for a broad index fund is usually a rip-off.

- Rebalance annually: Because the US has performed so well, your portfolio might have drifted. If you started with 30% international, it might be 20% now. Sell some US winners and buy more of the world.

- Think in decades: This is not a "get rich quick" index. It’s a "stay rich" index.

The FTSE Global All Cap Index ex US is essentially a giant insurance policy against the US eventually having a bad decade. It isn't flashy. It won't give you 100% returns in a year. But it ensures that no matter which country ends up winning the next era of global trade, you've got a seat at their table.

Next Steps for Your Portfolio

Evaluate your current international exposure by checking if your "Total World" funds are too heavily skewed toward the US. If you find your non-US exposure is below 20%, consider a low-cost ETF that specifically tracks the FTSE Global All Cap Index ex US to capture the growth of small and mid-sized international players that large-cap-only funds miss.