Waking up to check the news on January 16, 2026, feels a bit like looking at a weather map where it's sunny in one province and a total blizzard in the next. Honestly, that's exactly what’s happening at the pumps. If you’re living in Halifax this morning, you probably winced when you saw the sign at the station. Prices there just shot up by nearly 5 cents overnight. Meanwhile, drivers in Toronto and Ottawa are seeing basically no change at all. It’s a weirdly fragmented picture for gas prices in canada today, and if you’re trying to make sense of it, you’ve got to look at more than just the number on the LED board.

The national average is sitting around 126.0 cents per litre. That sounds decent compared to the nightmare spikes of a couple of years ago, but it’s a jump from where we were just a week back. We’re in this strange middle ground. Oil is technically in a global "glut," which should make things cheaper, yet local factors like new "hidden" carbon regulations and refinery shifts are keeping things prickly.

What is actually driving gas prices in canada today?

Most people think gas prices are just about the price of a barrel of oil. Sorta, but not really. Right now, West Texas Intermediate (WTI) is hovering around $58 USD. That is actually quite low—historically speaking, it’s a four-year low. In Calgary, some stations have even dipped into the 80-cent range recently.

But then you look at the East Coast.

The Nova Scotia Energy Board just hiked Halifax prices to about 132.4 cents. Why the massive gap? It comes down to regional supply chains and how provincial regulators "catch up" to market shifts.

💡 You might also like: Elimination of H-4 EAD work permits: Why the rumors just won't die

The "Hidden" tax factor

We can't talk about fuel in 2026 without mentioning the policy shift under Prime Minister Mark Carney’s government. While the "consumer" carbon tax was famously rolled back to zero in April 2025 to help with inflation, a new set of federal fuel regulations has filled that void. The Canadian Taxpayers Federation is calling it a "hidden" tax. Basically, producers have to lower the carbon content of their fuel, and if they can't, they buy credits.

Those costs? Yeah, they’re being passed to you. On average, this is adding about 7 cents per litre to gas prices in canada today. By the time 2030 rolls around, experts like the Parliamentary Budget Officer say that could climb to 17 cents.

Global oversupply vs. Local reality

Andrew Botterill, a partner at Deloitte Canada, recently pointed out that we are in a "dramatically oversupplied system." There is just too much oil out there globally. You’d think that would mean 99-cent gas for everyone, but Canada has its own hurdles.

- The Venezuela Factor: With U.S. interests moving back into Venezuelan oil fields, their heavy crude is competing directly with Alberta’s oilsands.

- The Trans Mountain Shift: The expanded pipeline is helping us sell to Asia, which keeps our producers' prices from bottoming out completely, but it also means we aren't just "dumping" cheap oil into the North American market anymore.

- Natural Gas Spike: Interestingly, while your car fuel is relatively stable, your home heating is about to get pricier. With the LNG Canada terminal in Kitimat now fully operational, we're exporting more gas to Asia. High export demand equals higher local prices.

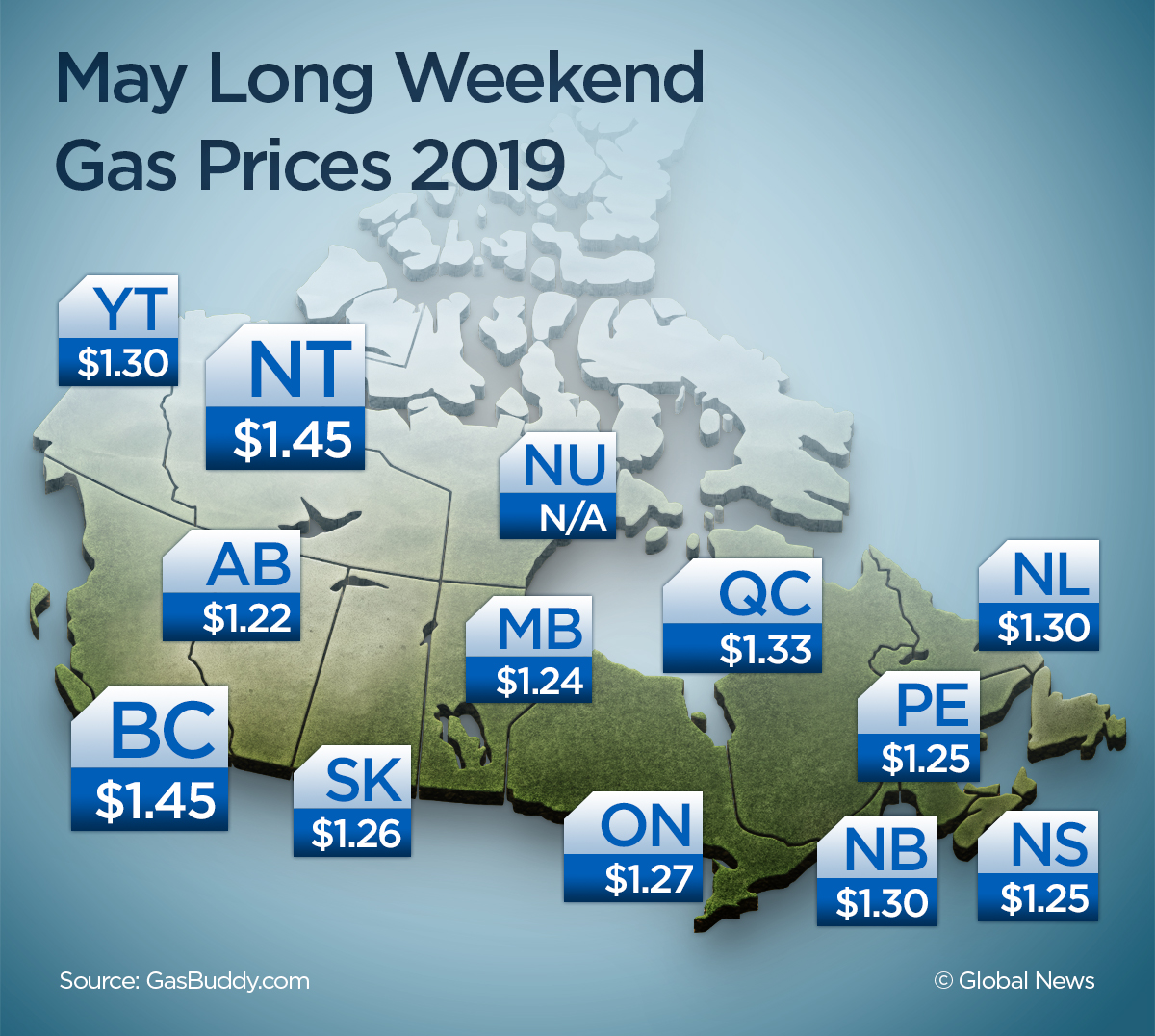

Provincial breakdown: Who's paying what?

It’s almost unfair how much the price varies depending on which side of a provincial border you’re standing on.

✨ Don't miss: Why the South Asian Bar Association Matters More Than Ever

In Ontario, specifically the GTA, prices have held steady at 129.9 cents for the last 48 hours. It’s consistent. Boring, even. But go west to Alberta, and you’re seeing the lowest prices in years. Economists are actually worried about this. While you love the 87-cent fill-up, every $1 drop in the price of oil wipes about $750 million off Alberta’s provincial budget. It’s a double-edged sword: cheap gas today might mean a bigger provincial deficit tomorrow.

Then there’s the Atlantic. Nova Scotia’s Zone 1 is at 132.4, but if you're in Zone 6, you're looking at 134.3. They use a regulated "interrupter" and weekly adjustment system that often leads to these sudden Friday morning shocks.

Is there any relief coming?

If you're waiting for a massive drop, don't hold your breath. Most analysts at ATB Capital Markets expect the global oversupply to peak in the first quarter of 2026. After that, the market is expected to tighten.

What does that mean for your wallet? Basically, enjoy the "lows" while they last. We are currently seeing a "sweet spot" where crude is cheap and the full weight of the 2026 carbon regulations hasn't totally baked into every province's retail price yet.

Misconceptions about the "Cheap" oil

People see $58 oil and wonder why gas isn't $0.70 everywhere. It's important to remember that the "crack spread"—the cost of turning that oil into actual gasoline—has gone up. Labor costs at refineries and transportation via rail and truck have all climbed with inflation.

Also, keep an eye on the U.S. dollar. Since we buy a lot of refined product in USD, a weak loonie makes gas prices in canada today feel much heavier than they would otherwise.

Your move: How to handle the 2026 pump reality

Knowing the "why" doesn't make the bill any smaller, but it helps you plan.

Track the "Cycle"

In Ontario and Quebec, prices usually follow a predictable pattern where they jump on Wednesdays or Thursdays. In the Atlantic, Friday is the day of reckoning. If you see a "No Change" report for Toronto on a Thursday, fill up then, because the weekend usually brings a "convenience" markup.

Watch the Carbon Credits

The 7-cent "hidden" tax is a flat regulatory cost. It doesn't fluctuate with the price of oil. This means even if oil drops to $40, there is a "floor" to how low gas can go. Don't expect to see 2020-era prices ever again.

Leverage Loyalty (For Real)

In 2026, the spread between "brand name" stations and independent ones is narrowing because of those high regulatory costs. The real savings are now in the 3-cent to 5-cent discounts offered by grocery-affiliated pumps or specific credit card pairings. It sounds like small change, but with a 50-litre tank, that’s $2.50 per fill-up—enough for a coffee while you wait in the traffic you just paid to sit in.

Plan for the Spring Hike

Refineries traditionally switch to "summer blends" in April. This blend is more expensive to produce. Combined with the next scheduled tweak in federal fuel regs, you should expect a 10-cent to 15-cent jump across the board by mid-April. If you have any major road trips planned, try to get them in before the spring thaw hits the energy markets.

Monitor the AECO Prices

If you use natural gas for your home, check your fixed-rate options now. With LNG exports to Asia ramping up, the days of "bargain basement" heating bills in Canada are officially over. Forecasters see a 30% to 40% rise in natural gas costs through the remainder of the year.

Stay informed by checking local morning price predictions, as the volatility in the Atlantic provinces right now suggests that regional supply hiccups are the new normal for the early part of the year.